OnePath – Everything you need to know

About OnePath

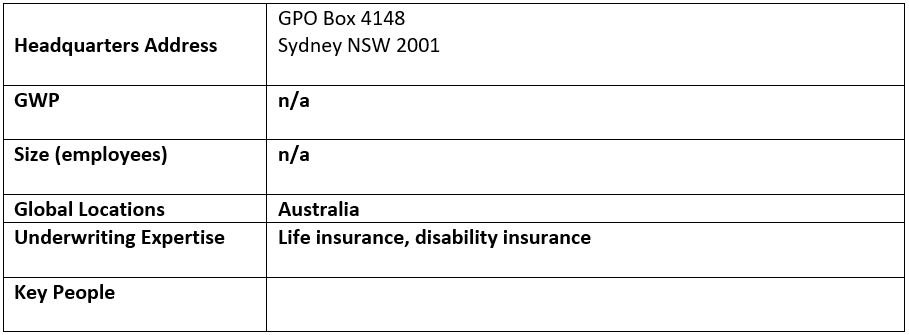

OnePath is an Australian financial services company that provides insurance, superannuation, and investment products. Its life insurance products are provided by OnePath Life Ltd, which is part of global insurance giant Zurich Insurance Group. Zurich Insurance operates in over 210 markets worldwide, employing over 50,000 people.

OnePath offers life insurance, total and permanent disability insurance, trauma cover, income protection insurance, business and living expenses cover, as well as group insurance cover for employers.

OnePath formerly issued general insurance products such as home, motor, and landlord insurance, but they have since been discontinued following the acquisition by Zurich. These covers are still offered under the ANZ brand, issued by QBE.

History of OnePath

OnePath traces its roots to Dutch multinational financial group ING, which opened in Australia in 1999. In 2010, ING Insurance Australia, a joint venture between ING and Australia and New Zealand Banking Group (ANZ), was bought out by ANZ for $1.86 billion. This was part of ING’s recovery efforts following the 2008 Financial Crisis. This led to ING Insurance being rebranded as OnePath.

In 2016, OnePath attracted the attention of Asian insurers Meiji Yasuda of Japan and AIA Group of Hong Kong. ANZ valued the life insurer at $4.5 billion, and, at the time, had a 10% share of the life insurance market in Australia as the sixth-largest player.

The Australian Securities and Investments Commission (ASIC) compelled ANZ to pay a total of $53.5 million in compensation for breaches within the OnePath Group between 2013 and 2016.

In late 2017, ANZ agreed to sell OnePath to Zurich Insurance Group for $2.85 billion, in a transaction that was pegged to complete in 2019. This gave Zurich a share of around 19% in the Australian life insurance market, which CEO Mario Greco said “concludes” its growth plans in Australia, giving Zurich its desired market position.

In 2018, OnePath received a Canstar 2018 Innovation Excellence Award for its Pre-Assessment Wizard (PAW) tool, which helps financial planners estimate costs and cover for clients with specific medical conditions. The company also upgraded its life insurance adviser portal OneView Life with various functionalities.

That same year, ANZ offloaded its OnePath New Zealand business to Cigna Corporation. As part of its transaction with Zurich, ANZ finalised its reinsurance arrangements, receiving around $1 billion of reinsurance proceeds.

OnePath was among the insurers scored by ASIC’s Report 587, which took the life industry to task over sales practices for life insurance. Other insurers included CommInsure, ClearView Life Assurance, NobleOak Life, Suncorp Life & Superannuation, TAL Life, St Andrew’s Life Insurance and its distributor Select AFSL, and Hannover Life Re and its distributors Greenstone Financial Services and Auto & General Services.

In late 2018, an APRA report identified OnePath as the second-largest life insurer in the nation, with 17.8% of market share.

OnePath partnered with national mental health organisation SuperFriend to provide specialised mental health and wellness training to around 200 of its staff, including its claims team. OnePath was shortlisted for the Training and Development Program of the Year award.

In June 2019, Zurich completed OnePath’s acquisition from ANZ, which took 18 months from when it was first announced. It also included a 20-year agreement for the distribution of life insurance through ANZ’s bank channels.

OnePath’s Einstein tool won the Community Innovation Trailblazer Award at the Salesforce Dreamforce 2019 conference. The tool uses data analytics and artificial intelligence to generate visual representations of the claims data. The company is known for utilising technology to make the insurance process simpler and more streamlined for both clients and advisers.

Key people at OnePath

Gerard Kerr – head of life insurance

Within Zurich Australia, Kerr is also head of OnePath propositions and group insurance, life & investments. He joined OnePath in 2008, when it was still known as ING, from Asteron, where he was head of claims. He has over 30 years’ experience in financial services, including underwriting, claims, and product development. He relocated to Australia in 2001, having previously worked in Ireland, the UK, and the USA. Kerr is a member of the FSC Life Board, and was the founding chairman of Lifewise, an FSC working group that seeks to address Australia’s underinsurance gap.

Paul Trigg – manager, group risk market

Trigg joined ING Australia in 1999, and was appointed to his current role in 2001. He has held the role even after the rebranding into OnePath and its acquisition by Zurich. Before joining ING Australia, he was manager of the group risk business unit at Tyndall. Prior to that, he spent over 13 years with Australian Casualty & Life’s group insurance business, holding various senior roles.

John Mirotsos – national sales manager

Mirotsos joined ING Insurance Australia as national sales manager for group risk in 2005. Prior to that, he worked for over a decade with CommInsure, most recently holding the role of business development manager, group risk. He specialises in the superannuation, industry fund, master trust, and multinational pooling segments.

Culture at OnePath

OnePath’s corporate social responsibility efforts centre on mental health. In 2019, it renewed its partnership with Mr Perfect to help expand the organisation’s barbeque programme to more than 300 BBQs. The programme holds informal BBQs across Australia to encourage conversations over mental health. The partnership, which began in 2018, is part of Zurich and OnePath’s MindFIT programme, which seeks to de-stigmatise mental health issues.

The MindFIT programme works to provide customers with resources to help improve mental health. Zurich, along with its mental health partners, works to promote the resources available via its e-wellbeing hub, offered by MindStar, as well as expanding its Tackle Your Feelings mental health programme.

OnePath also partnered with Australian mental health organisation SuperFriend to provide specialised mental health and wellness training to its claims team, to help them understand mental health and process related claims more fairly.

Zurich, Allianz, and more offer financial aid, faster claims, and expanded coverage

Company outlines driving forces behind the new product

Marketing and partnerships team also strengthened

Analysis looks at differences in claims filed between men and women

Corporate watchdog highlights steps insurers must take before avoiding insurance policy