The National Insurance Brokers Association of Australia, more commonly known as the NIBA, is the main professional organisation representing insurance brokers in Australia. It aims to support brokers while promoting professionalism and high standards in the insurance industry.

The NIBA is a stakeholder in the industry and a vital institution for both aspiring and current insurance professionals. Its members include insurance brokerages across the country, from small independent firms to large companies.

All of these make the NIBA a major player in the country's insurance broking sector.

Founded in 1982, the NIBA has established itself as a peak representative body for the intermediated insurance industry in Australia for more than 40 years.

The organisation represents around 90% of Australia’s insurance brokers. With more than 400 member firms employing around 15,000 individual brokers, the NIBA's membership includes:

These member organisations can be found in cities, towns, and rural regions across Australia.

The NIBA advocates on behalf of its members and their clients across all levels of government. The association makes sure that the voice of its members is heard by decision-makers in Australia’s insurance brokering industry. It also maintains a strong relationship with authorities at a state and national level to discuss the effects of proposed reforms on insurance brokers.

The NIBA is a member of the Council of Asia Pacific Insurance Brokers Associations (CAPIBA) and the World Federation of Insurance Intermediaries (WFII).

Its member firms hold Australian financial services licences issued by the Australian Securities and Investments Commission (ASIC) under the Corporations Act. These licences enable member firms to deal in or advise on risk insurance products.

Overall, this association is a driving force for positive change in the broking industry, supporting financial services reforms and encouraging higher educational standards for brokers. It also created and implemented the Insurance Brokers Code of Practice for its members.

The NIBA’s Insurance Brokers Code of Practice (the Code) aims to build competence in the profession and increase customer confidence. It sets out the minimum service standards that customers can expect from their insurance broker.

The code also outlines how complaints and disputes can be resolved. It explains the benefits of using an insurance broker and what they can expect from the service.

The NIBA's activities fall under four key pillars:

The NIBA is committed to supporting its members by representing the interests of insurance brokers to the Australian government and industry regulators. The organisation does this while promoting high levels of professionalism. It also promotes quality standards for insurance broking in Australia, campaigning for better education and advocating for the Insurance Brokers Code of Practice.

Members can expect that they will be provided with opportunities to network and grow. The NIBA also helps secure the longevity of the profession by promoting insurance broking as a rewarding profession.

Ethics and professionalism are central to the NIBA's values. The association emphasises the importance of integrity in all business dealings and encourages brokers to maintain high standards of conduct. This commitment to ethical practices not only boosts the reputation of the industry but also builds trust with clients—an essential part of dealing with insurance and financing.

Advocacy is an important role of the NIBA. The organisation works to represent the interests of insurance brokers at both the state and federal levels.

By engaging with lawmakers and regulatory bodies, the NIBA ensures that the concerns of brokers are considered in discussions that affect the industry. The NIBA represents the interests of insurance brokers and their clients with integrity to external bodies including:

This representation is important not just for insurance brokers, but also for consumers. It helps create fair rules that protect consumers while allowing insurance brokers to operate effectively.

The NIBA also fosters a strong community among its members. It organises events and networking opportunities that encourage collaboration and knowledge sharing. These gatherings allow brokers to connect with each other and learn from industry leaders, helping to push the industry forward.

For instance, they hold yearly conventions for the benefit of all their members. Check out this video on 2024 the NIBA Convention - Beyond The Status Quo:

The NIBA Convention 2025 happens in October at Gold Coast, Queensland.

To become a member, insurance brokers must meet government requirements and additional conditions implemented by the NIBA. This includes abiding by the NIBA’s membership code and completing the continuing professional development (CPD) requirements.

Those seeking to become a member of the NIBA must pay a fee and apply for one of the six possible membership categories. The application process takes between 8 and 10 weeks.

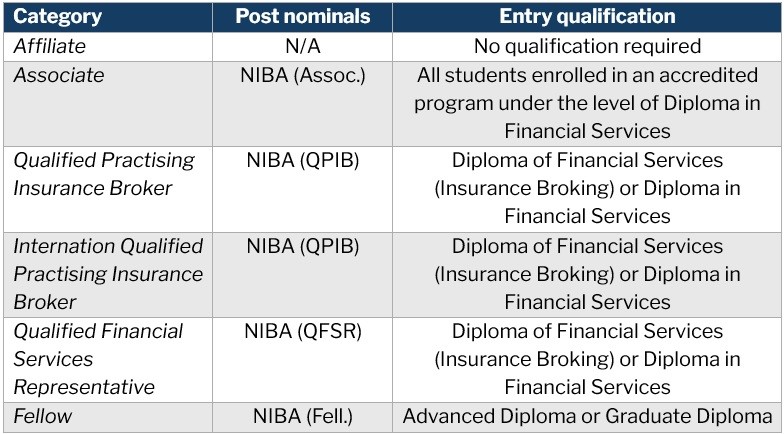

Check out this comparative table of the different membership categories of the NIBA:

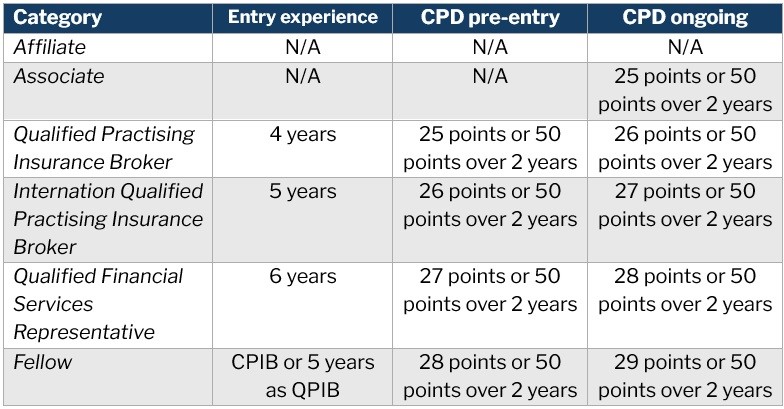

This table outlines the CPD requirements for each category:

There are two levels of the NIBA membership:

Let’s take a closer look at these two NIBA membership categories below:

Any company, trust partnership, or sole trader working as a general, life, or reinsurance broker can apply for principal membership with the NIBA. It is also available to eligible applicants that operate as an underwriting agency.

Corporate Associate membership is available to a subsidiary company of a principal member where there is a common shareholding.

A principal member applicant must have any of these three who is able to qualify as a QPIB, CPIB, QFSR or Fellow:

A Corporate Associate member must also have either a QPIB, CPIB, QFSR or Fellow designation in a responsible position in their office. This designation must be maintained at all times.

The application process for the NIBA Principal membership can take up to 10 weeks. The NIBA Membership Manager will formally contact you once the membership process has been completed.

An application can only be considered once you have completed it online and you have attached the required documents of evidence.

All applicants are subject to a business reputation check prior to joining the NIBA. Potential applicants are presented to the NIBA's membership base and must be able to overcome any written objection.

If no objections are received, the application is referred to the NIBA Divisional Committee in the applicant’s region. Once the Divisional Committee approves the application, it is referred to the NIBA Board for final approval.

NIBA applications for individual members are strictly examined to guarantee that government qualifications are met. Careful deliberation is also done to see if NIBA’s own eligibility criteria are followed by the applicant.

If approved as members, individuals must agree to complete the annual CPD requirements and abide by:

The application process for NIBA membership takes around 8 to 10 weeks.

Just like principal membership, aspiring members need to complete the application form.

Individual membership is also subject to a business reputation check. Aspiring members are also presented to the NIBA's membership base and must be able to overcome any written objection.

The individual membership application is referred to the NIBA Divisional Committee if there are no objections made. However, the referral is done in the applicant’s state, as opposed to principal membership applications that are on the regional level.

The NIBA Board will make the final approval.

Upon confirmation of eligibility for the NIBA membership and satisfying the business reputation check, an offer of membership will be forwarded.

Richard Klipin was appointed CEO of NIBA in March 2024. He officially joined the organisation in May 2024. Prior to this, he served as CEO of the Financial Services Council (FSC) New Zealand. There, he led the development and transformation of the FSC from 29 to 123 members building on the strategic voice helping New Zealanders with their Financial Confidence and wellbeing.

The other members of the NIBA leadership team include:

The NIBA’s executive board for 2025 consists of:

The NIBA publishes annual reports that look at issues facing the NIBA and its members. The annual report also details the organisation’s initiatives and successes over a 12-month period.

As for previous campaigns, one example is limiting the impact of Future of Financial Advice reforms on insurance brokers, especially in relation to general insurance products. In 2023, the NIBA also conducted a seminar on cybersecurity.

During the pandemic, NIBA adjusted its mode of communication by focusing on online programs to reach their members despite the global health crisis. It also conducted free webinars on their social media platforms. Some of these webinars’ titles are:

The NIBA also opposed an excessive regulatory regime in relation to insurance premium funding. Another campaign involved supporting the removal of Fire Services Levies on insurance premiums across Australia.

Recommendations align with insurance industry's response to 2025-26 Federal Budget

Preliminary estimate for losses revealed

2025-26 Federal Budget focused on relief, resilience, and risk plans

Event unites industry to navigate challenges shaping the future of broking