The UK has emerged as Europe’s hotbed of insurance innovation, hosting nearly a quarter of the continent’s insurtech companies. Thanks to favourable regulations, collaborative industry initiatives, and a strong focus on digital transformation, the nation’s insurtech space continues to thrive.

In this article, Insurance Business lists the top 20 insurtech companies in the UK. The list contains a mix of startups and unicorns that play a vital role in driving technological innovation within the country’s insurance sector.

If your insurance company is on the lookout for the industry’s leading “disruptors” or “enablers,” this guide can give you plenty of options. Read on and take your pick from our list of the best insurtech companies in the UK.

Insurance Business has compiled a list of startups that are leading digital transformation and technological innovation in the country’s insurance industry. The insurtech companies we have chosen are a combination of unicorns and “futurecorns” – firms capable of crossing the unicorn line – revolutionising how insurance works. Here they are arranged in alphabetical order. Investment data comes from this website.

Total funding: £21.7 million

Number of investors: 4

Artificial Labs provides commercial insurers with a machine learning platform that allows them to perform underwriting and data extraction accurately and efficiently. The London-based software provider partners with insurers and brokers in the UK and overseas to simplify “algorithmic placement” of commercial and specialty risks. The insurtech company offers two platforms: Contract Builder and algorithmic underwriting. Its list of partners includes Apollo, Convex, Chaucer, Lockton, and PPL.

Total funding: £570,000

Number of investors: 6

BirdsEyeView uses artificial intelligence and satellite technology to calculate risks resulting from climate change and natural disasters. Through its “climate and nat-cat risk calculator,” the insurtech company can provide parametric insurance solutions to small and medium-sized businesses. The London-based managing general agent can access research-level weather analytics through its partnership with the European Space Agency.

Total funding: USD24.3 million

Number of acquisitions: 1

Number of investors: 3

Canada-headquartered BOXX Insurance specialises in cyber risk management solutions for families and businesses. Apart from cyber insurance, the global insurtech company offers breach response, data repair and restoration, systems recovery, and other cyber protection services through its Cyberboxx platform. BOXX Insurance has partnered with insurance giants Zurich and AXA to expand its reach in Europe. The futurecorn has offices in Toronto, Miami, Zurich, Dubai, and Mumbai.

Total funding: Unfunded

Stockport-based insurtech firm CDL provides software solutions for high-volume retail businesses. It uses machine learning, AI and big data to offer a range of products and services catering to different types of consumers. Among its offerings are telebroking solutions, price comparison websites, telematics insurance, and online quotations.

CDL is one of the UK-based winners of our Top Insurtech Companies | Global 5-Star Technology and Software Providers awards. Check out the full list of awardees in our special report.

Total funding: £17 million

Number of investors: 16

Cuvva specialises in hourly car insurance policies. Through its user-friendly mobile app, insurance buyers can get instant quotes by providing:

Cuvva has access to various data sources to check driving licence data and protect against fraud. To date, the London-based insurtech company has issued more than 11 million policies and served over 1.3 million customers.

Total funding: USD41.4 million

Number of investors: 15

Cytora’s risk engine technology has become a popular tool for commercial insurers, helping them target and price risks. The platform enables insurance companies to underwrite risks accurately and reduce frictional costs.

The London-headquartered insurtech firm was formed by a team of data engineers and machine learning scientists. That’s why it isn’t surprising that its configurable risk management software is being used by some of the industry’s leading names. These include AXA XL, QBE, and Starr. Cytora is also backed by several leading venture capitalists. The startup holds partnerships with some of the world’s top tech firms.

Total funding: USD71.3 million

Number of investors: 5

Instanda offers insurance professionals a no-code platform to build and launch insurance products. The firm’s software-as-a-service (SaaS) policy administration tool enables insurers and brokers to create, distribute, and manage new products in a fraction of the time it usually takes.

The London-based insurtech company holds partnerships with major insurers in the property and casualty (P&C) and life and health (L&H) lines. It also works with insurance brokers and underwriters across Europe, Australia, and North and South America.

Total funding: USD500 million

Number of investors: 2

Ki Insurance has partnered with Google Cloud to develop a proprietary algorithm that it uses to underwrite risks. The London-based insurtech startup has also collaborated with the University College London on the first “algorithmic underwriting approach” for specialty insurance. This technology assesses policies and provides quotes for businesses through the Ki platform. The platform was designed to cater to the needs of the London brokers. It can underwrite 36 classes of business.

Total funding: USD24.2 million

Number of investors: 16

Laka is a peer-to-peer bicycle insurance platform that offers people-powered insurance subscription to provide coverage that’s “fair and not fixed.” Coverage works by spreading each month’s claims to a collective of cyclists, so the premiums vary up to a guaranteed cap.

The London-based startup’s bicycle insurance protects against damage, theft, vandalism, and loss. The policy also covers bicycle equipment and legal assistance.

Is bicycle insurance worth having in the UK? Find out in this guide.

Total funding: USD483 million

Number of acquisitions: 4

Number of investors: 11

ManyPets is one of the several insurtech unicorns on our list. It offers pet health and insurance products to customers in the UK, Sweden, and the US. The London-based insurtech company uses search and social media data to sell insurance, designing its policies based on over 40,000 customer reviews. Because of this strategy, the insurer’s products boast features that are new to the market. At the same time, the firm was able to avoid adding features that clients don’t like.

ManyPets is the first pet insurer in the country to offer online form-free claims. In 2019, the company gave its clients free access to its FirstVet app – also a first in the UK. This allowed customers to make direct video calls with veterinarians 24/7.

Total funding: USD134.8 million

Number of investors: 10

Another insurtech unicorn, car insurance specialist Marshmallow uses a proprietary pricing algorithm to lower prices for drivers rejected by traditional providers. These include young male motorists, UK residents on temporary visas, and Brits with low credit scores.

The firm’s mission is to help improve the financial health of these individuals by offering affordable car insurance. To achieve this goal, the London-based insurtech company invests in technology to reduce operating costs and passes those savings on to its members. The firm serves more than 100,000 clients.

Find out the cheapest cars to insure for first-time drivers in the UK in this guide.

Total funding: USD4.3 million

Number of investors: 5

OpenCover has emerged as among the leading providers of onchain insurance in the UK. The insurtech firm works with underwriters to help insurance buyers protect themselves financially against onchain risks. These include smart contract exploits, governance attacks, and scams. To date, the London-based startup has covered over USD4 billion worth of cryptocurrency.

Total funding: £5.1 million

Number of investors: 3

PeppercornAI aims to provide a customer-controlled insurance experience. The Cardiff-based insurtech startup offers Pipr, the first conversational AI platform designed for the insurance industry. The platform can integrate seamlessly into an insurer’s existing technology. It is designed to help insurance companies reduce operating costs and improve risk selection.

Total funding: £4.5 million

Number of investors: 5

Previsico provides real-time flood forecasting and risk assessment through its FloodMap platform. The Loughborough-based insurtech company aims to minimise the impact of flooding globally by keeping families and businesses well-prepared. The firm also has offices in London, the US, and Hong Kong. Apart from flood prediction, Previsico offers hydrological monitoring, including drainage performance.

Total funding: Unfunded

SSP provides tech solutions and back-office systems that enable insurance companies to reduce operating costs, boost sales, and improve customer experience. The firm’s insurance broking platform processes more than £5 billion worth of gross written premiums and 1.1 billion online insurance quotes each year.

The West Yorkshire-based insurtech firm caters to insurance professionals in the UK, and across Europe, the US, the Asia-Pacific region, and Africa. It serves more than 160 insurers and over 1,000 brokers worldwide.

Total funding: USD79.2 million

Number of investors: 13

Superscript offers a range of liability and commercial insurance products designed to meet the evolving needs of small to medium-sized businesses. The London-headquartered startup provides custom subscription-based coverage for all types of risks. It is the first UK-based insurtech company to become a Lloyd’s of London broker. The firm also has partnerships with some of the world’s biggest underwriters.

Learn more about how business insurance works in the UK in this guide.

Total funding: USD184.9 million

Number of investors: 19

Tractable develops AI for accident and disaster recovery. Its platform can estimate repair costs just by scanning photos of the damage through deep learning. The insurtech unicorn’s AI Review and AI Estimating solutions help insurers improve their claims processes and produce live, end-to-end estimates of vehicle damage.

The London-based company holds partnerships with some of the world's largest insurers. These include Ageas in the UK, Covéa in France, Talanx-Warta in Poland, The Hartford in the US, and Tokio Marine in Japan.

Total funding: USD16.3 million

Number of investors: 10

Trunomi offers data rights management technology that allows businesses to request, receive, and capture customer consent for the use of their personal data. The London-based insurtech firm uses patented technology that prevents it from seeing or storing a client’s sensitive information. Because of this, Trunomi’s platform isn’t bound by jurisdictional borders surrounding personal data.

Total funding: USD206.6 million

Number of investors: 17

YuLife aims to improve the financial, physical, and mental health and wellbeing of its more than one million clients globally. It offers life, critical illness, income protection, and dental insurance for employees.

The startup is known for gamifying coverage to inspire policyholders to live healthy lifestyles. Through the YuLife app, employees are challenged to complete daily wellness tasks in exchange for YuCoins. They can use these rewards to buy gifts for themselves, family members, or friends. Employees can also donate the YuCoins to charities or use the proceeds for tree-planting projects.

Apart from group wellbeing challenges, YuLife’s platform allows employees to access virtual GPs, and mental health and financial protection services.

Total funding: USD281.7 million

Number of investors: 13

Zego offers simple and flexible policies through its mobile app and website that cover businesses of all types and sizes. The London-based insurtech unicorn provides motor, commercial, and professional insurance. The company began as a provider of flexible motorbike insurance for gig economy workers. It has since expanded with a range of tech-enabled commercial motor insurance products. Currently, Zego insures more than 300,000 vehicles for different types of businesses. These include sole traders, fleets, and multinational companies.

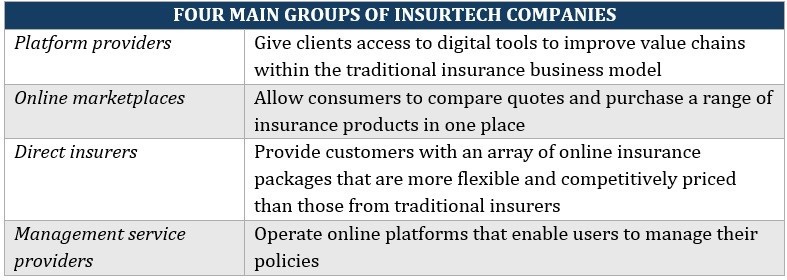

Insurtech is an industry term used to describe a company that takes advantage of technological innovation to make traditional insurance processes more efficient. Insurtech companies use artificial intelligence and data analytics to speed up underwriting and claims processing. They also use these innovations to provide customers with fair and accurate premiums.

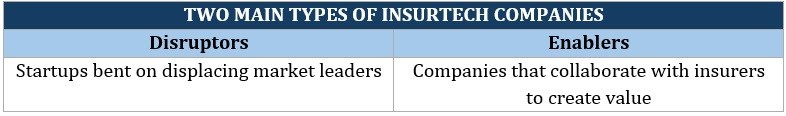

The insurtech sector consists of two main types of companies based on the role they play in the industry:

Additionally, insurtech companies are classified into four groups based on the products and services they provide:

The UK is home to around 280 insurtech companies, according to this report. This figure represents the highest number of insurtech firms per capita among all major world economies. The country trails only the US in the number of insurtech startups and unicorns. London alone has the same number of insurtech unicorns as the rest of Europe combined.

Our Best in Insurance Special Reports page is the place to go if you want to find the best insurtech companies in the UK. The startups featured in our special reports have been nominated by their peers and vetted by our panel of experts as respected and dependable market leaders. By partnering with these “enablers,” you can be sure that your business is well-equipped to navigate the insurance industry.

Have you experienced working with the insurtech companies on our list? Feel free to share your story in the comments.