If you own a car, there’s just no way around it. You’re legally required to take out auto insurance before you can operate your vehicle anywhere in the country. But car insurance is also a highly personalized form of coverage. That’s why finding the policy that matches your unique needs often becomes a tall order.

Getting cheap car insurance can be tempting, but there’s a catch. You can end up losing more, especially if your policy provides inadequate protection. To get the most out of your auto coverage, you need to understand the different options available and the type of protection these policies offer.

This is where this guide can prove handy. In this article, Insurance Business lists the best car insurance companies in Canada based on the level of coverage they provide. To come up with the list, we made a side-by-side comparison of the different policy features each insurer offers. These are the companies that made our list.

Car insurance companies evaluate a range of highly individualized parameters to provide each motorist with the right coverage. What may be the best option for you, may not deliver the right kind of protection to another. That’s why there’s no clear-cut number one car insurer in the country. So, what we did instead is arrange the list alphabetically based on what our research has found to be the country’s top auto insurers offering the best value.

Here are the 10 best car insurance companies in Canada based on our research.

Aviva Canada ranks third among the largest car insurance companies in the country based on market share. Clients like that the insurer provides quality auto coverage at a fair price.

The Markham-headquartered firm offers all the features and benefits present in standard car insurance policies, but also provides motorist with a robust list of add-ons, including:

If you’re a Lyft driver in Ontario, Aviva Canada can be a good choice because of its partnership with Lyft Canada. All policyholders can also access a range of discounts by bundling policies, insuring multiple vehicles in one plan, staying claims-free, and being a retiree.

belairdirect is one of the several subsidiaries of Intact, the largest car insurance company in Canada. But the Toronto-based firm stands among the country’s top car insurers in its own right for providing excellent customer service.

Policyholders commend belairdirect for its user-friendly online platform that allows them to manage their policies wherever they are. Customers can also track their claims digitally through the company’s mobile app.

Some of the standout features you can access include accident forgiveness, roadside assistance, and new car protection. The insurer also offers Autocomfort, which provides coverage for replacement and rental vehicles, and Crash Assist, an online feature that detects collision in real-time.

Co-operators is among the most respected names in the industry, mostly because of its unique discounts and good customer service. The Guelph-based company is one of the few car insurers that received a five-star rating the last time J.D. Power conducted a client satisfaction poll in Canada.

Co-operators is a good option for new drivers looking for cheap car insurance as the company offers rewards for those who practice safe driving habits. Bundling discounts and premium reductions for hybrid and electric vehicle owners are also available.

If you’re looking for add-ons, you can access accident forgiveness, loss-of-use, depreciation protection, and rental car coverage, among others.

Desjardins is Canada’s second-largest car insurance company, offering coverage to motorists in Ontario, Alberta, and Québec, where it holds headquarters in Lévis.

Desjardins’ client base is drawn to the insurer because of its affordable premiums and an assortment of add-ons. These include accident forgiveness, new vehicle protection, and zero deductible.

You can also choose from a range of discounts options. You can slash dollars off your premiums by parking in a secure garage or driveway and installing winter tires during the snowy season. If you’re a student, you can access lower premiums by getting good grades.

Desjardins is also one of the largest insurance companies in Canada based on total assets.

Economical is one of the several insurance brands under North American insurer Definity Financial Corporation. The company, which specializes in property and casualty insurance, is based in Waterloo, Ontario.

Economical offers a unique set of coverages, some of which aren’t readily available from other car insurance companies. Its standard policies also include coverage for windshield damage and lost wages. If you’re driving an ATV, moped, motorcycle, snowmobile, or RV, you can also purchase insurance from the company. Policies for campers and motorhomes are available as well.

In terms of discounts, Economical offers perks if you’re conviction-free, just committed your first at-fault accident, or installed anti-theft devices in your vehicle.

Intact is the largest car insurance company in Canada, controlling almost a fifth of the market. Along with its subsidiaries, the Toronto-based insurance giant wrote around $5.5 billion worth of premiums in the last financial year.

A wide selection of discounts and optional coverages are among the benefits of purchasing an auto insurance policy from the company. If you’re a policyholder, you can access Intact’s MyDrive program, which rewards safe driving practices with lower premiums.

Intact also holds a partnership with ridesharing service providers Turo and Uber. Turo drivers in Ontario, Alberta, and Québec can access commercial car insurance through Novex. Uber coverage, however, is only available in Ontario.

Another Definity Financial subsidiary, Sonnet operates as a fully online home and auto insurance company. Being a digital-based insurer, the Waterloo-headquartered insurtech firm has the benefit of fast quoting and underwriting.

Sonnet’s policies come with all the features of a standard auto insurance policy, plus collision and comprehensive coverage. You can also enhance your coverage with a range of optional extras, including accident and ticket forgiveness. You can purchase coverage for rental cars and non-owned vehicles as well.

Sonnet also offers the vroom service bundle, which combines roadside assistance, new vehicle replacement, and hit-and-run deductible waiver.

Toronto-based TD Insurance has among the cheapest car insurance premiums on our list. Still, it offers a decent line-up of premium-reduction perks, including bundling and multi-vehicle discounts. You can also slash premiums by requesting a quote or buying car insurance online, which can be a breeze because of the insurer’s user-friendly website.

TD Insurance’s car policy comes with all the mandatory coverages, but you can purchase add-ons such as collision, comprehensive, specified perils, and all-perils coverage.

The Personal is another car insurance company that got a five-star rating in the last J.D. Power customer satisfaction survey. The Lévis-headquartered auto insurer’s standard policy includes:

You can also pad your coverage with a range of optional add-ons such as:

The Personal is a subsidiary of Canadian insurance giant Desjardins.

10. Wawanesa

Mutual insurer Wawanesa is one of the largest car insurance companies in Canada. It provides motorists with an array of mandatory and optional coverages, which enable the company to customize policies to fit each client’s unique needs.

The Winnipeg-headquartered insurer is also known for offering reasonably priced car insurance plans. You can also access a range of perks, including loyalty rewards, lower premiums for seniors who take safety driving courses, and multi-vehicle discounts.

Wawanesa also provides insurance for private and commercial vehicles, motorcycles, RVs, motorhomes and campers, and utility trailers.

Car insurance is mandatory in all provinces and territories in Canada. It is also among the four types of insurance you need. Getting caught driving without coverage can result in stiff fines and may affect your future eligibility for obtaining coverage.

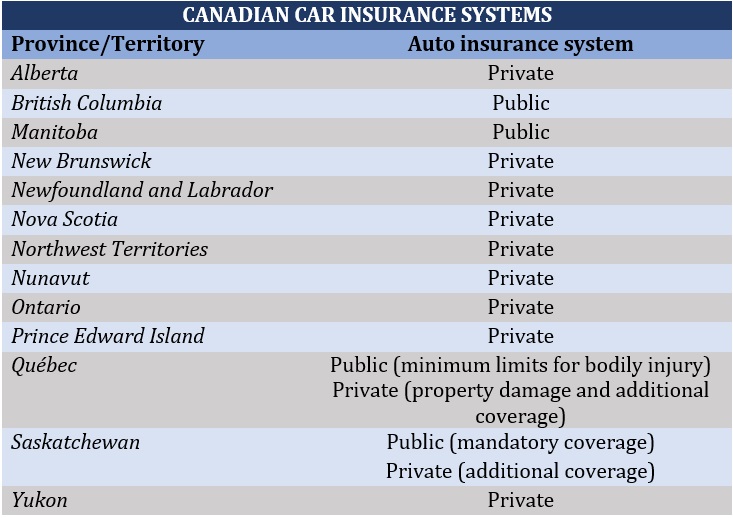

Each province and territory, however, implements different car insurance systems.

Auto insurance in Saskatchewan is also administered by a Crown corporation, the Saskatchewan Government Insurance (SGI). Motorists in the province, however, are allowed to purchase additional coverage through private car insurance companies.

In Québec, the Société de l'assurance automobile du Québec (SAAQ), another public institution, handles minimum limits for bodily injury. Private auto insurers, meanwhile, offer third-party liability, property damage, and additional coverage.

Drivers in the remaining provinces and territories can buy car policies from private car insurance companies.

Here’s a summary of the car insurance systems implemented in all provinces and territories across Canada.

Provinces and territories across the country impose their own rules and regulations when it comes to mandatory coverage. However, there are certain similarities, according to the Financial Consumer Agency of Canada (FCAC):

You can also purchase additional policies to suit your needs, including:

Here's a summary of the minimum coverage requirements in each Canadian province and territory, according to the Insurance Bureau of Canada (IBC). You can also click on the links to learn more about how car insurance works in your area.

|

Province/Territory |

Mandatory coverage |

|

Minimum $200,000 third-party liability Accident benefits |

|

|

Up to $300,000 medical coverage Minimum $200,000 third-party liability Underinsured motorist protection Hit-and-run damage and injuries |

|

|

$50,000 per vehicle all-perils coverage (collision and comprehensive) Minimum $200,000 third-party liability |

|

|

Minimum $200,000 third-party liability Accident benefits Uninsured automobile coverage Direct compensation property damage |

|

|

Minimum $200,000 third-party liability Accident benefits Uninsured motorist coverage |

|

|

Minimum $200,000 third-party liability Accident benefits Uninsured automobile coverage |

|

|

Minimum $500,000 third-party liability Accident benefits Direct compensation property damage Uninsured motorist coverage |

|

|

Minimum $200,000 third-party liability Accident benefits Uninsured automobile coverage |

|

|

Minimum $200,000 third-party liability Accident benefits Uninsured automobile coverage Direct compensation property damage |

|

|

Minimum $50,000 third-party liability Accident benefits Direct compensation property damage Uninsured motorist coverage |

|

|

No-fault coverage for all Minimum $50,000 civil liability coverage, including legal liability for bodily injury and property damage |

|

|

Minimum $200,000 third-party liability Accident benefits All-perils coverage |

|

|

Minimum $200,000 third-party liability Accident benefits Uninsured automobile coverage |

You can keep abreast of the latest developments in Canada’s car insurance market by visiting our Motor & Fleet News section. Here, you can find breaking news and the latest industry updates. Be sure to bookmark this page for easy access.

What do you think of the car insurance companies on our list? Are there auto insurers that you feel were left out? Feel free to comment below.