The pace of innovation in insurance and the inevitable question this gives rise to – whether insurance is innovating fast enough – were two topics very much under the microscope at Insurtech Insights Europe 2023.

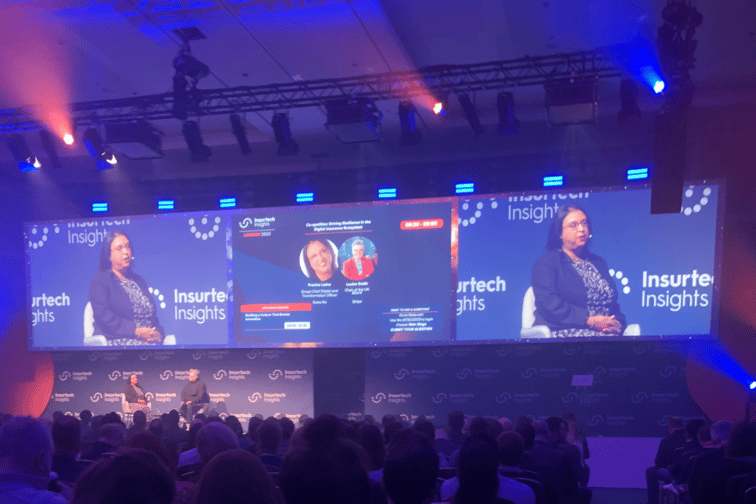

Offering a deep-dive perspective into the complexities of these topics during a keynote discussion on ‘Co-operation: Driving resilience in the digital insurance ecosystem’, was Swiss Re’s group chief digital and transformation officer, Pravina Ladva (pictured). And during her address, she highlighted how the answer to this question has shifted in the last five years, propelled by changes in our wider societies.

“When I reflect on what’s changed, I think, really, there are three things,” she said. ”The first thing is that our customers and clients demand something different from us as an industry. And people want to interact with us, how they interact with other things in their lives - whether it’s buying stuff online, or whether it’s communicating with their bank. So, I think there is a push from our customers.”

The second major change is that internal organisations across the insurance ecosystem appear to now have a greater willingness to adapt to technological change, Ladva said. She identified how quickly the industry shifted to online meetings during COVID as an example. Previously, that scale of change would have taken six months of training and workshops, etc. but almost overnight, entire workforces moved online – reflecting the lower barrier to entry and reduced resistance to technological change within organisations.

“And finally,” she said, “I think the things that technology can do now have changed. I think all those three things in the last five years have made a difference. But we haven’t quite caught up yet…. And to catch up, I would say we really need to focus and we need to execute. I think our Achilles heel as an industry is our ability to get stuff done and get stuff done quickly.”

During Ladva’s keynote address, host Louise Smith, chair of the UK board of the global financial services software firm Stripe, identified how the rest of the financial services sector generally views insurance as behind the technology curve, albeit with the ability to outstrip them in the future. But what are the barriers preventing insurance from making that leap? And what transitions will be required to accelerate insurance into the next generation?

For Ladva, the answer really comes down to having a “relentless focus on the customer or the client.” Different stakeholders across insurance will define that in very different ways, she said, but the industry is primed to overcome that barrier due to the bright, clever and incredibly forward-thinking individuals that make up the sector. She emphasised, however, how important it is for the insurance sector to celebrate its inherent creativity as well as its strong data and tech proficiencies.

People outside of the insurance industry don’t seem to recognise that creativity, she said, but it’s, “a fascinating part of what we do.” So, insurance should look to utilise and amplify that creativity to truly ensure that the customer is at the heart of everything it does and all the solutions it creates.

“Secondly,” she said, “I think the other barrier and challenge that we face - and it’s not unique to us, but I think it has a greater challenge for us – is talent. Everybody in the world is after the same talent.”

Another company with a bigger brand name which is operating in a different industry probably has an easier time attracting great talent, Ladva said, and so the question for the insurance market is how can it encourage the best people to join the sector. And the answer starts with understanding why individuals are not currently attracted to the insurance market which goes back to importance of advertising the creativity to be found in insurance – but it’s also about finding creative solutions to plug that talent gap.

“The way I think about solving that is that first of all you have to look at who you already have,” she said. “Think about how do you repurpose, how do you retrain, and how do you create a real learning culture?... I think that’s the first thing. And then the second thing is how do we make what we do in insurance attractive for people to want to come and join us?

“And there, the thing I’ve realised is purpose. We have a real purpose in what we do in this industry. We talk about making the world more resilient but what does that actually mean? So when you explain to younger talent about how by using satellite imagery, you can predict supply chain risks they’re like, ‘really? Is that what you can do?’ So, it’s about creating a purpose out of our industry which attracts talent that sometimes would go elsewhere. I think those things are probably, as well as a focus for execution, things that concern me.”

What are your thoughts on the pace of innovation in insurance? Please feel free to share your comments below.