The COVID-19 outbreak has changed, among other things, the way we work, travel, and socialise; in the world of insurance, one aspect that has been stirred quite extensively is the way insurers handle claims.

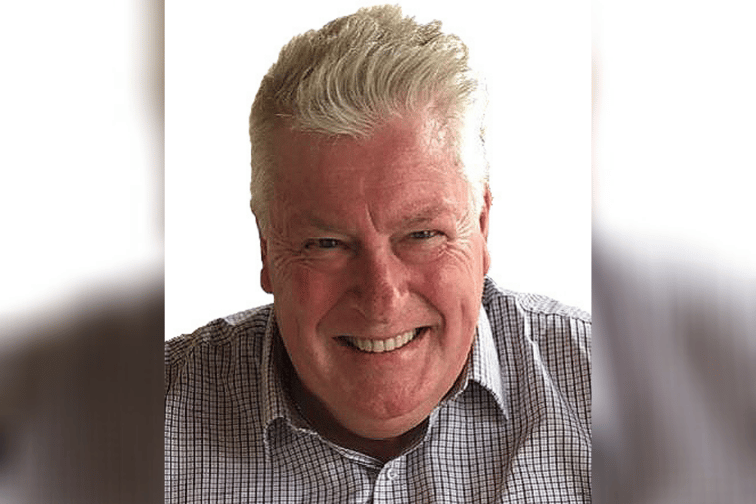

“The pandemic has ironically opened up the entire debate and focus for insurers on their claims operational response to events,” Simpson Strategic Solutions Consulting Services director John Stewart Simpson (pictured) told Insurance Business. “In addition, it has also accelerated the focus on digital technology enabling flexibility in terms of response.”

A high-volume claims expert, Simpson believes that insurance companies will now have to contemplate how they realise cultural alignment and commitment to their unique customer value propositions while dealing with surges and claims demands with a workforce that currently operates remotely and may continue to do so in the future.

He went on to note: “The pandemic has also got insurers thinking about claims validation and assessment in an environment where restrictions exist to movement and access, and utilising interstate resources or even moving resources to affected areas has become difficult. Up until recently these restraints have also applied to having claims fulfilled by trades and builders onsite.”

Meanwhile, on the other side of the equation are customers who have become more confident in using technology to purchase items, access service, and communicate. Simpson cited a growing acceptance – an expectation, even – that digital technology and associated solutions are available as an option for doing business, staying in touch, or remaining safe.

“In short,” he asserted, “the pandemic has accelerated the focus for insurers to think about their entire claims process, their major event capability, and look to alternative strategies such as those relating to digital solutions to deal with these.”

Simpson, whose credentials include forming Coles Insurance and leading large end-to-end claims units for 17 years, added that insurers have generally done an “amazing job” and should be congratulated for employing workarounds and quick response times when providing service to policyholders during this time.

The industry stalwart told Insurance Business: “There is no doubt in mind that the use of digital and technological solutions to handling claims is now at the forefront of thinking for insurers. There are a number of examples where insurers and often insurance builders, repairers, and loss adjusters have utilised technological solutions to enable the processing of claims to be more effective when demand is high.

“Such examples include remote assessment and claims validation remotely using images, footage, and a self-service style approach where the customer actually undertakes to gather key information required for a ‘desktop’ assessment to take place.”

According to Simpson, he has seen hail damage assessed remotely and a vehicle determined as a total loss from submitted photos. He said technology exists today that allows hail damage to be rated by severity, eliminating delays and waiting times for an assessment at a hail centre.

“Other examples include technology that enables the development of detailed building repair scopes of works to be produced by insurance builders and insurance assessors/loss adjustors onsite,” added Simpson. “These detailed scopes, produced by available technology, can then be utilised to either fast-track the repair or even conclude and finalise the claim via a cash settlement.”

In the expert’s view, there is now a greater focus on considering broader end-to-end strategic digital and technological solutions as a critical way forward.