New research from NRMA Insurance has indicated that most Australians preparing for summer holidays are prioritising household cleanliness over protecting their homes from severe weather.

The insurer’s survey found that 67% of Australians plan to clean their homes before heading away on holiday, with women being slightly more likely to do so at 71%.

In contrast, only 45% are focused on weatherproofing their homes against the heightened risks of summer storms, bushfires, and floods.

The data, released in conjunction with NRMA Insurance’s “Wild Weather Tracker,” highlighted the increased weather-related risks during summer.

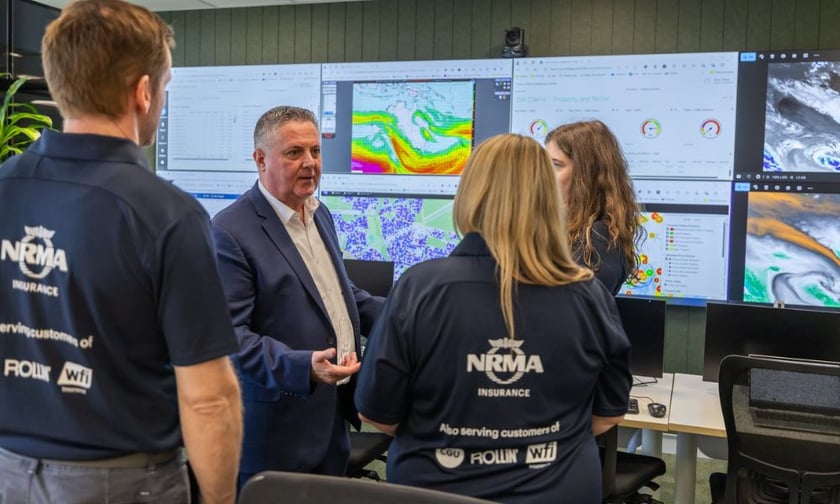

Luke Gallagher (pictured), NRMA Insurance executive general manager of retail claims, said this imbalance is concerning, given the frequency of extreme weather events in recent years.

“An analysis of NRMA Insurance claims data over the past five years since the 2019-20 ‘Black Summer’ has confirmed that 42% of all wild weather claims have occurred during summer,” he said.

He noted that the company sees a significant rise in claims during summer, receiving one in every 4 minutes and 39 seconds on average, which is 60% higher than other seasons.

The research also revealed that 11% of respondents had returned home from holidays to find their properties damaged by events such as severe storms, wild winds, floods, hail, or bushfires.

Gallagher noted that this underscores the importance of preparation before going away.

“The lesson here is that ensuring your home is as well-protected as possible from extreme weather damage is never more important than at this time of year,” he said.

Australians’ weather concerns heading into summer include:

To help mitigate these risks, NRMA Insurance advised homeowners to take practical steps, including:

The Wild Weather Tracker, which monitors seasonal severe weather claims across Australia, aims to encourage property owners to take preventive measures year-round. The data is based on a survey of 3,510 respondents conducted by Pureprofile in November.

NRMA Insurance has also reported a spike in home break-ins during summer, with claims for theft rising by 40% compared to other times of the year.

Between December 2023 and November 2024, the insurer recorded 2,500 claims for home burglaries, with January emerging as the peak month, accounting for 10% of total theft claims.

Survey data showed that 46% of Australians plan to be away from home for at least four days over summer, which Gallagher said can make properties more vulnerable to break-ins. He highlighted that 12% of Australians had experienced a burglary at some point while away on holiday.

The insurer’s data revealed that commonly stolen items include bicycles, small electronics like laptops and smartphones, and outdoor equipment such as power tools. Thieves have also targeted materials like copper piping and hot water systems.

Gallagher said simple oversight can increase vulnerability, with fewer than half of those surveyed arranging for someone to monitor their homes and only 13% pausing mail or deliveries.