Residents in Far North Queensland are in disputes with insurance companies, alleging pressure to accept inadequate settlements for their flood-damaged homes, seven months after Cyclone Jasper.

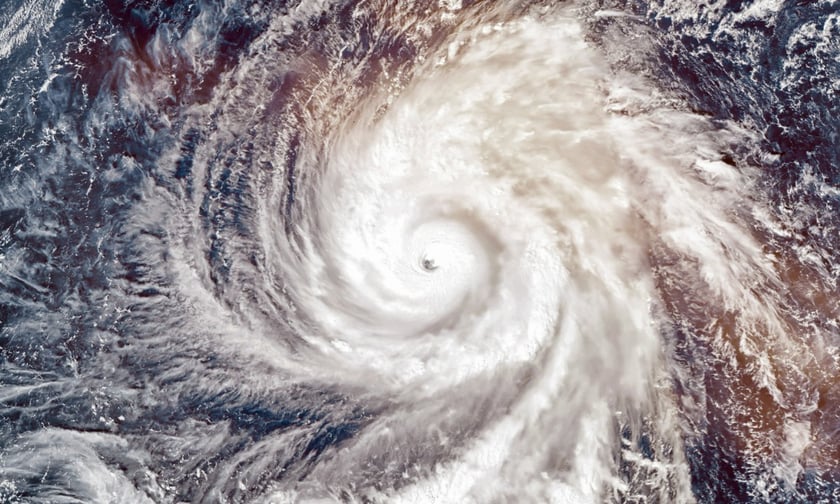

The Queensland Reconstruction Authority reported that 1,863 properties were affected in Cairns and surrounding areas due to flooding and heavy rains from Cyclone Jasper in December.

In an interview with ABC, Erin Easton, a family support worker in Port Douglas, said she has been advocating for flood victims while facing insurance struggles.

Easton and her family have been living in a caravan on their property in Wonga Beach, north of Cairns, after their home flooded before Christmas. Although her house was insured for $700,000, she accepted a payout of less than $200,000.

“To get to where we got to have been mentally draining, exhausting, and has worn me down to literally nothing,” she told ABC.

She testified before the federal parliamentary economics committee’s inquiry into insurance responses to major floods, which convened in Cairns last week. She described the difficulties in agreeing on the scope of work with the insurance company’s preferred builders.

“We have had clients finding a scope of works that is $40,000 under the rebuild cost of their home,” Easton said, adding that she secured a payout of $60,000 higher than the initial offer after challenging her scope of works six times.

Meanwhile, Mossman resident Danielle Morache claimed she has spent about five hours weekly managing her insurance claim and that of an elderly neighbour since the flooding.

Morache, her husband, and their daughter have had to move rental properties five times since their home was flooded. She told ABC that dealing with two insurance, securing higher payouts, and managing temporary accommodation have consumed much of her time. She has also been coordinating with tradespeople and builders for repairs.

“I wanted the insurance to pay, and I didn’t want the stress, but the reality is I’ve ended up project managing my own job,” she said, as reported by ABC.

An Insurance Council of Australia (ICA) spokesperson reported that 57% of Cyclone Jasper claims had been closed. However, the time required to resolve a claim depends on the claim type, necessary assessments, and the complexity of repairs or settlements.

“The time required to settle or resolve a claim depends on the type of claim, the assessment, and analysis that’s required to make a claim decision, and the complexity of the repair or settlement,” the spokesperson said, as reported by ABC. “The ICA will continue to work with government and industry partners to help improve the insurance outcomes for customers.”

Research by Australian property marketplace Domain revealed that nearly half of all Australian homes face risks from natural disasters, exacerbated by rising insurance premiums.

The study examined the impact of extreme weather events, including bushfires, floods, and coastal erosion, threatening millions of homes nationwide.

Domain’s report found that 5.6 million homes, valued at $4.66 trillion, are at risk of bushfires. Additionally, 953,000 homes face flood risks, valued at $768.5 billion, and 160,000 homes near coastlines face erosion threats, amounting to $26.41 billion worth of properties at risk.