When Adam Moss (pictured above) started his presentation at last Thursday’s Duck Creek Technologies Duck Talk conference, he gave a modest warning. He said that speaking straight after the former NSW Rural Fire Service commissioner, Shane Fitzsimmons, would be a hard act to follow.

He needn’t have worried.

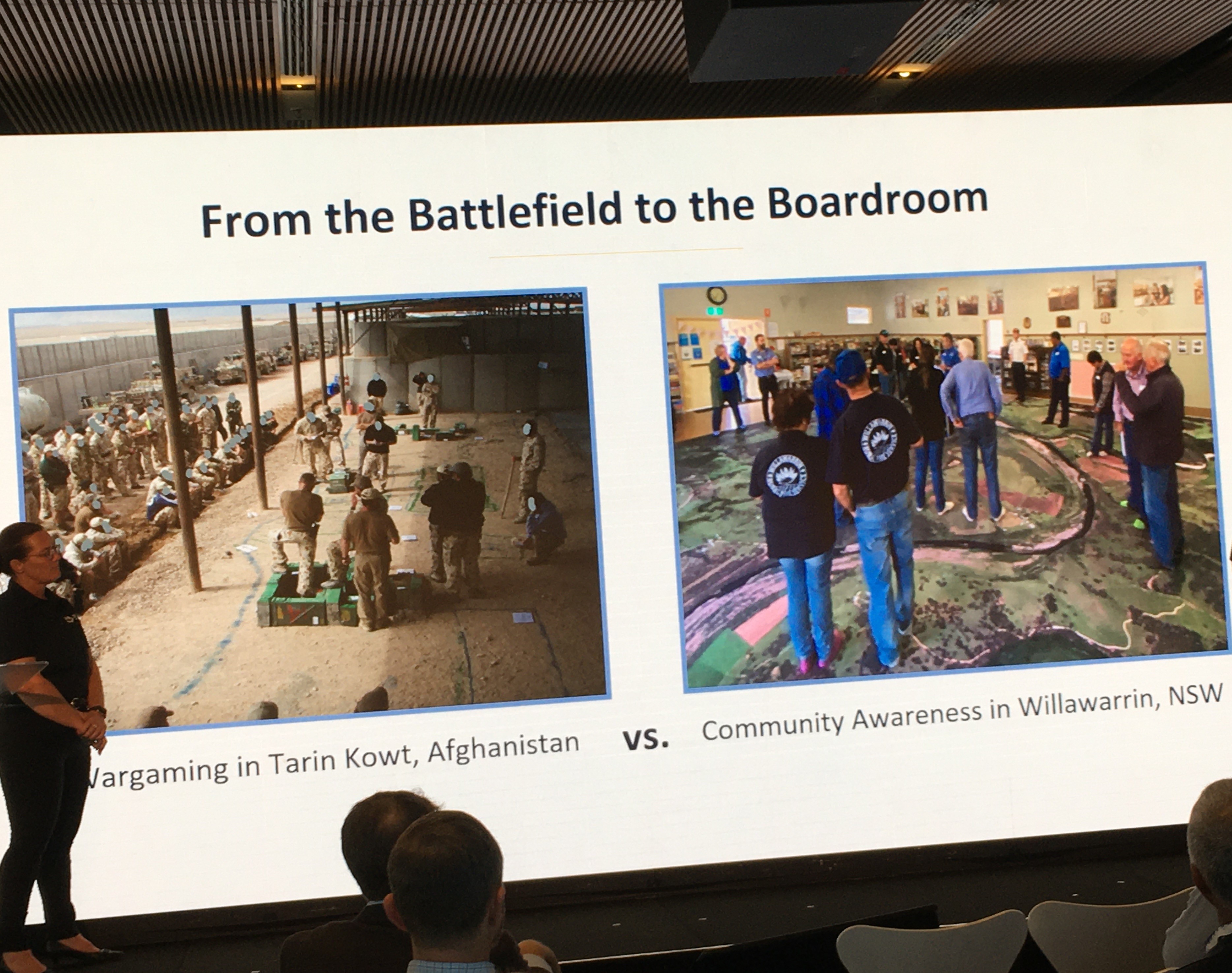

Moss, who is national resilience manager for Disaster Relief Australia (DRA), together with Shari Bent (pictured immediately below), the volunteer organisation’s resilience manager, gave a compelling presentation.

They clearly showed how DRA – now more than 2,500 volunteers across Australia, many of them military veterans – could help insurers and brokers more effectively engage with local communities facing flood and fire risks to help dramatically improve disaster resilience. The result could be more affordable and available insurance.

The basic tool in Moss and Bent’s talk was very old school: giant, physical Big Maps of local areas that can be rolled out and walked on (see Big Map picture below with Shari Bent).

In a partnership with the insurer Allianz, the DRA and a handful of local volunteers have started holding community meetings in the Macleay Valley of NSW. The meetings involve the locals literally standing on top of these maps.

“The Big Map is literally that community where they live,” said Moss. “For a small community like Willawarrin [a small NSW town of 200 people in the Macleay Valley], or a community in a city like Brisbane, or a complete catchment - we actually have that on the floor.”

Moss described how mums and dads behave when they attend the meeting and stand on this map. The first thing they do, he said, is locate their own home.

“Once they find their house, they then work out where June’s place is, then the shop that they pass on their walks,” said Moss. “Then they go: ‘What’s that?’ And they see that they have a state forest near them and realise, for the first time, how close it is.”

After that, he said, they probably spot the river on the map with its flood level marker.

“And once that gets to 9.6 metres, that’s a major flood height and means you’ve got three foot of water through your house,” said Moss.

At this point, the locals walking the Big Map usually ask how they can get more information about these major risks. Moss said this is where a wider conversation about risk management planning can begin.

Moss and Bent said this Big Map tool facilitates the stakeholders in a local community taking ownership of local risks and then developing a plan to deal with them.

Moss said “one of the key things” to come of Big Map meetings so far, is how effectively they can bring together local government with other stakeholders, including insurers, to develop a plan to combat local risks by listening to and then engaging with the locals.

“They [local government and other stakeholders] sat on the sidelines to listen to the community about what the issues are, what the risks are and what the impacts were,” he said. “Through the Big Map, we almost become a speed dating service, literally introducing partners and stakeholders to the community and their customers.”

This was also an opportunity, suggested Moss, for local community members facing issues like unavailable and unaffordable insurance or the need to implement risk management plans they can’t afford, to present these issues to local government and insurers.

“For the first time, the customer was able to look at the stakeholder and say that they don’t have enough money to do what the stakeholder was asking them to do and that based on what they are doing, they are at considerable risk,” he said.

Bent said this Big Map process makes the locals “feel like they’re being listened to.”

When a local disaster plan, for example, is developed from these meetings, she said the locals, because of their “buy in,” will follow it.

“They are taking those actions that they think will benefit them, [so] you will have a plan that works and they will follow it,” said Bent.

She suggested this approach would avoid the “absolute chaos” that can result when the local community isn’t on board and involved in creating their area’s disaster plan.

Are you a broker or insurer. What do you think of the DRA’s Big Map idea? How could it help your risk management work? Please tell us below