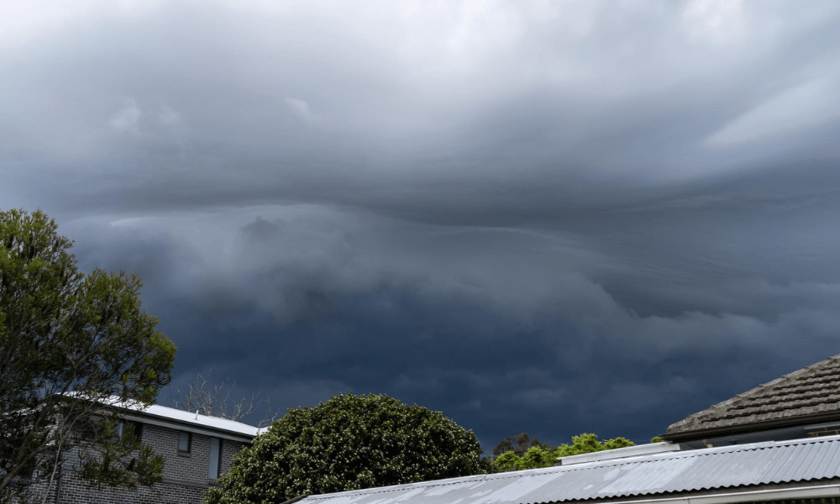

Insurance companies across Australia are actively responding to the aftermath of recent severe weather, including storms and flooding, which have struck Victoria, Tasmania, and surrounding regions.

Between Aug. 29 and Sept. 3, Suncorp received more than 1,400 home insurance claims and around 170 motor insurance claims as a result of the storms.

The company reported significant impacts, particularly in Melbourne, Victoria, and in northern Tasmania’s Launceston and Devonport.

Alli Smith, Suncorp’s executive general manager of home claims customers, said that the storms brought high winds, hail, and heavy rainfall, leading to widespread damage. In response, the company has begun distributing emergency cash payments and has its claims teams ready to assist in the most affected areas as soon as conditions allow.

Customers are encouraged to lodge their claims online through Suncorp’s brands, including AAMI, Apia, Terri Scheer, and Shannons, to facilitate quicker processing. However, safety is still the top priority.

“The most important thing is for people to stay safe and follow the warnings of emergency services,” Smith said.

IAG – which operates NRMA Insurance, CGU, and WFI – has also expanded its response efforts to meet the anticipated increase in claims due to the severe weather.

IAG’s major events response manager, Julia Attard, said that the company is monitoring the situation closely and has deployed assessors and partner builders to assist customers where it is safe to do so.

“We are ready to help our customers lodge their claims and provide immediate assistance,” she said.

The company is advising residents to secure outdoor items, avoid unnecessary travel, and protect vehicles from potential storm-related damage.

The east coast wild weather brought to light a report revealing severe weather events’ rising financial impacts on the Australian insurance industry.

According to the Insurance Council of Australia’s report, the economic costs of such events have tripled over the last three decades.

Insured losses from declared catastrophes have increased from 0.2% of GDP between 1995 and 2000 to 0.7% of GDP over the past five years. Flooding has been a significant contributor to these losses, with insurers paying out an average of $4.5 billion annually over the last five years due to extreme weather events.