The Insurance Council of Australia (ICA) and the California Department of Insurance, supported by the American Chamber of Commerce in Australia (AmCham), convened a Wildfire and Flood Summit in Sacramento, California, on July 25.

The event aimed to foster collaboration in disaster management, climate risk, and clean energy.

Australia and California, with their shared natural hazards, economic similarities, and regulatory environments, have experienced significant extreme weather events over the past decade. These events – coupled with the increasing value of assets, urban expansion, and inflation – have pressured the insurance sectors in both regions, impacting insurance availability in high-risk areas.

As climate change drives longer and more intense fire seasons and increases flooding, both regions face further community impacts and a widening insurance protection gap. The ICA said these challenges necessitate unique partnerships.

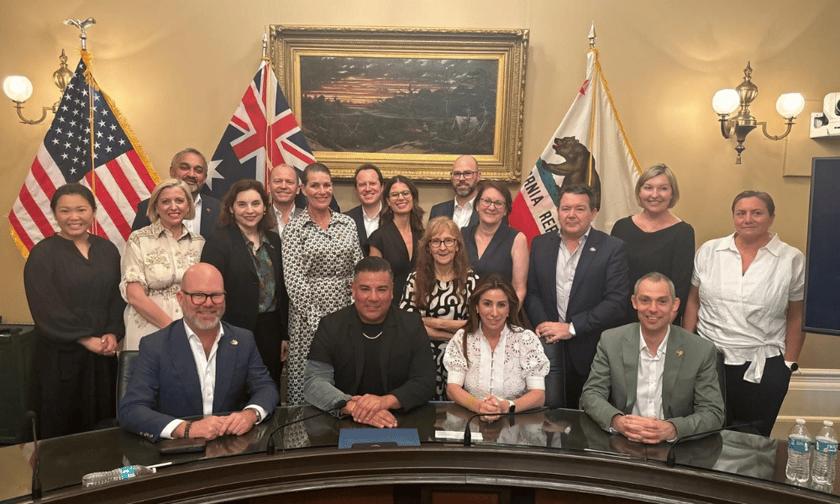

The summit brought together insurance industry leaders, catastrophe management experts, climate scientists, government agencies, and elected representatives from both regions to develop a collaborative blueprint.

Key findings from the summit include the following:

The summit highlighted methods for preparing for, responding to, and mitigating fires and floods.

The participants agreed that shared firefighting resources across hemispheres are crucial, though increasingly strained as disaster seasons overlap. Investments in mitigation and resilience, alongside changes to building standards and land use planning, are essential for improving long-term insurance availability.

The summit underscored the need for collaboration between insurance sectors and governments to close the protection gap and improve insurance availability.

The ICA said combining industry and government expertise can enhance understanding of current and future hazard risks and foster collaborative opportunities.

The ICA and California Department of Insurance committed to a climate and resilience partnership to build a shared view of growing risks and solutions. This partnership builds on the ICA’s global engagement with markets worldwide.

The Australian insurance watchdog will host international leaders at a National Conference in Brisbane in October.

The summit addressed the global phenomenon of a worsening protection gap and rising pressure on premiums. Both US and Australian markets are seeing an increasing gap between those who can afford insurance in high-risk areas and those who cannot.

The participants agreed that a comprehensive approach is needed to reduce premiums and manage risks.

The delegation included senior executives from IAG, Youi, Suncorp, Auto & General, QBE, Allianz, and Hollard, along with representatives from the ICA.

Bipartisan members from the Australian and New South Wales parliaments, the Department of Prime Minister and Cabinet, and the National Emergency Management Agency also participated.

Commenting on the summit, ICA CEO Andrew Hall highlighted the shared insurance challenges facing Australians and North Americans.

“The Australian and North American insurance markets are facing strikingly similar challenges around affordable and available home insurance,” he said. “Rapidly growing populations, growing asset values all in areas that are vulnerable to extreme weather is testing the overall durability of the insurance market.”