To operate a vehicle in Australia, you need to have at least one type of coverage – compulsory third party (CTP) insurance. But with the market for auto policies being extremely competitive, finding the best car insurance companies to partner with can be an overwhelming task.

An insurer offering cheaper coverage can be an enticing option, but there’s a catch. You can end up losing more, especially if the protection the company provides isn’t enough.

To help you better understand what choices are available, Insurance Business analysed data from one of the nation’s largest consumer opinion platforms. We looked at thousands of product reviews from actual policyholders to find out which car insurance companies provide the best coverage.

If you’re on the lookout for a reliable auto insurer, this guide can prove handy. Insurance professionals can also share this article with clients to help them make an informed decision.

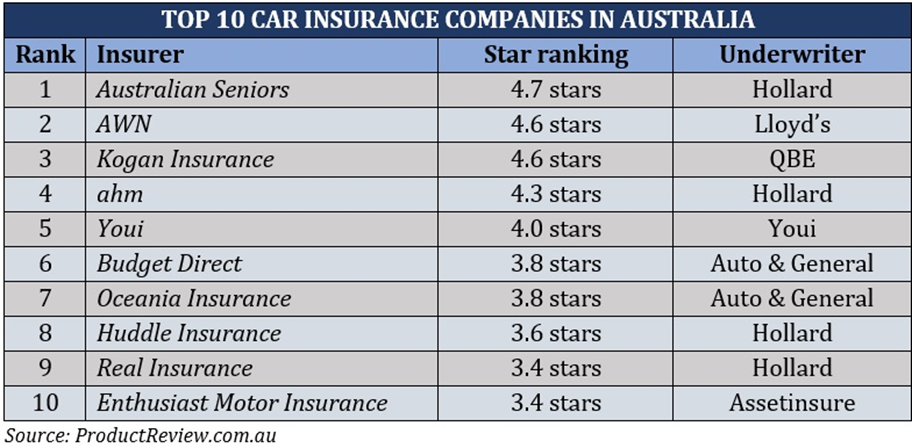

Here are the 10 best car insurance companies in Australia, according to customers who have experienced working with them.

To find out which car insurance providers ranked highly among motorists, we looked at data from customer opinion website ProductReview.com.au. Here are the insurers that got the highest star rankings (with five stars being the highest) based on thousands of client feedback.

4.7 stars from 3,300+ reviews

Australian Seniors scored near perfect scores in value for money, transparency, and customer service. Policyholders like the Norwest-based insurer’s competitive rates and “helpful and attentive” customer service, especially when contacted through phone. Clients also commend the company’s smooth claims processing, which on average lasts less than a week to four weeks.

Australian Seniors specialises in insurance for the over 50s age bracket. It offers all the standard types of car insurance, along with several optional extras, including roadside assistance and hire car coverage. The company’s policies are underwritten by Hollard.

Learn more about how car insurance works for seniors and pensioners in this guide.

4.6 stars from 1,300+ reviews

Australian Warranty Network (AWN) is an add-on insurance specialist. It focuses on providing mechanical breakdown coverage to enhance standard car policies. Still, the company received high marks for its “prompt and professional” customer services. Policyholders also like the insurer’s straightforward and fast claims process.

AWN operates as a wholesale insurance broker. This means that the company provides policies to insurance agents who then offer its products and services to the public. The Queensland-based insurer’s policies are underwritten by Lloyd’s.

4.6 stars from 50+ reviews

Apart from car insurance, Kogan offers a range of home, pet, life, and travel policies. The Melbourne-based general insurer is considered one of the best car insurance companies in Australia when it comes to customer experience.

Kogan received high scores in terms of pricing and transparency. Policyholders also like the company’s generous discount options. The insurer offers all types of standard coverage. Its policies are underwritten by insurance giant QBE.

4.3 stars from 120+ reviews

Although known as one of Australia’s largest health insurance companies, Medibank-backed ahm is also popular among motorists who want customisable coverage. Policyholders like the insurer’s flexible policies, as well as its excellent customer service and efficient claims process. The company also offers affordable rates.

Melbourne-headquartered ahm offers third party and comprehensive car insurance. It’s known for offering instant cover and a year of free roadside assistance when you take out a new policy.

4.0 stars from 7,000+ reviews

Queensland-based Youi is one of the country’s largest car insurance companies. It offers comprehensive, TPPD, and TPFT policies. The insurer also provides roadside assistance and hire car coverage.

Many policyholders like that their policies were set up quickly and efficiently by “friendly and informative” staff. They also appreciated the company’s timeliness in responding to claims.

3.8 stars from 8,300+ reviews

Many policyholders commend Budget Direct for offering competitive premiums and good customer service. The Brisbane-based insurer’s policies are underwritten by Auto & General Services.

Budget Direct provides third party and comprehensive car insurance. You can limit your policy’s coverage to motorists over a certain age. The company also offers a lifetime guarantee on authorised repairs while your car is in your possession.

3.8 stars from 20+ reviews

Digital car insurer Oceania Insurance offers comprehensive, TPPD, and TFPT coverage. It’s backed by Auto & General.

Most policyholders like the company’s competitive rates and good customer service. It also scored well in terms of transparency.

3.6 stars from 400+ reviews

Insurtech Huddle allows you to receive quotes and sign up for a policy in 15 minutes. It got high marks in pricing, customer service, and transparency. Policyholders also like the company’s efficient handling of claims.

Huddle is backed by Hollard. It offers comprehensive and TPPD insurance. Motorists can also add roadside assistance to their policies.

3.4 stars from 620+ reviews

Real Insurance is the trading name of Greenstone Financial, which is the retail arm of industry giant Hollard. Apart from auto coverage, Real Insurance offers home, life, and pet insurance.

The Baulkham Hills-headquartered firm is considered one of the best car insurance companies in Australia when it comes to customer satisfaction. Policyholders like its affordable premiums and efficient claims process. Motorists can access all types of standard and optional coverage from the company.

3.4 stars from 30+ reviews

Sydney-based Enthusiast Motor Insurance specialises in auto coverage. It offers TPPD and comprehensive policies for all types of vehicles, including classic, show, modified, and imported cars. These policies are underwritten by Assetinsure.

Enthusiast is known in the industry for providing competitively priced car insurance. It also scored high in transparency and customer service.

Here’s a summary of the best car insurance companies in Australia based on consumer feedback.

There are four main types of general motor vehicle insurance in Australia:

CTP coverage is mandatory in each state and territory. It is also known as green slip insurance in New South Wales and transport accident charge (TAC) in Victoria. This type of policy covers you financially if you’ve been found liable for an accident that leads to another person’s injury or death.

CTP insurance, however, doesn’t cover the injuries you and your passengers sustain. It also won’t pay for damages to any vehicle or property. This form of coverage is paid upon the renewal of your vehicle registration.

Although this is often the most expensive form of coverage, comprehensive car insurance offers the broadest protection. It covers damages to your car, as well as to other people’s vehicles and property, regardless of who caused the accident. It also provides protection against theft, vandalism, and damage caused by storms or hail, and accidental losses.

This type of insurance covers the cost to repair another person’s property, including their vehicle, in case of an accident. However, it doesn’t provide coverage for damage sustained by your vehicle. If the accident involves an uninsured motorist, some car insurance companies pay only up to a certain amount.

TPFT offers the same protection as TPPD but extends coverage to include repair and replacement costs if your vehicle is stolen or damaged by fire, up to a specified limit.

When calculating premiums, car insurance companies consider a range of factors, making it difficult to come up with a one-size-fits-all estimate. Motor insurers use different variables that typically include:

Insurers determine your car’s market value by looking at its age, make, model, condition, and distance travelled. Your car’s market value is often the biggest factor influencing your premiums. Some car insurance companies provide an allowance for accessories under market value coverage, but this is subject to limits.

Apart from the four main types of motor vehicle insurance, you can add optional extras to enhance the level of protection. Common add-ons include roadside assistance, widescreen excess, and rental car cover, which have a corresponding impact on premiums. Some of these policies, however, may be included in comprehensive car insurance.

Young motorists are often considered riskier to insure and face higher premiums than older drivers. If you’re a parent and considering adding your teenage children to your policy, bear in mind that doing so can raise premiums depending on your kids’ driving history.

Men are statistically more likely to get involved in accidents and other risky driving practices than women. This why car insurance rates for male motorists are also higher compared to their female counterparts.

Past accidents and claims raise a driver’s risk, increasing car insurance rates. But you don’t have to worry about this if you’re a safe driver. Insurers often reward motorists with a clean driving record and claims history with discounted premiums.

Car insurance companies calculate premiums based on a person’s overall risk level. But because each driver’s profile and situation vary, there isn’t a straightforward answer to this question. An auto insurer that can offer you affordable coverage, for instance, may be the most expensive option for another motorist.

However, there are several ways for drivers to access cheap car insurance. Here are some of them:

If you’re looking for more ways to save on motor insurance, you can get practical tips in our guide to finding cheap car insurance in Australia.

Do you have experience with the insurers in our best car insurance companies list? How was it? We’d love to see your story in the comments section below.