The role of the underwriter in the insurance industry is forever changing. Emerging technologies within the industry and developing risks throughout the market mean that underwriters need to continue to develop to stay on top of their game.

The second annual Underwriting Agencies CEO Survey, conducted by the Underwriting Agencies Council and

Gratex International, revealed that underwriters are preparing themselves for a competitive future, with broker relationships a key area of concern.

The anonymous survey of senior executives in both Australia and New Zealand saw shifting priorities, said Milan Neklapil, managing director of Gratex.

“For the first time, we can share the shifts in priorities and dynamics that shape our domestic markets. Working on a daily basis with underwriting agencies, I was not surprised to see some of the pressure points that demand proactive action with unprecedented speed and agility under fi ercely increasing competition.”

96 - Number of

UAC members across Australia and New Zealand

58% - Number of respondents that report a GWP of $10m to $200m

$2.5bn - UAC members are responsible for over $2.5bn worth of premiums in Australia

11.9% - The biggest decreasing challenge in this year’s survey was identifying clear opportunities for operational cost reduction

Source: Underwriting Agencies Australia/New Zealand CEO Survey 2015

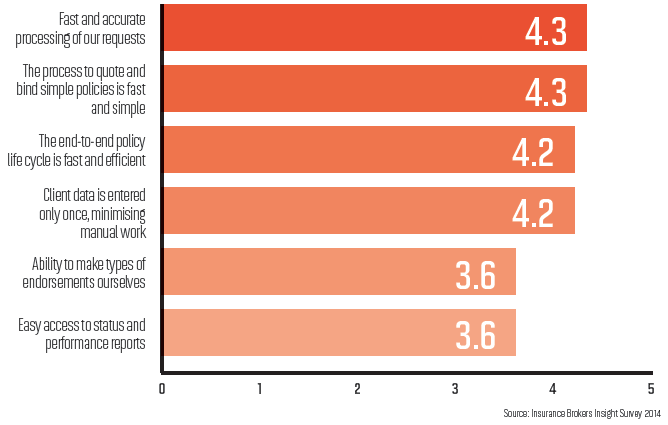

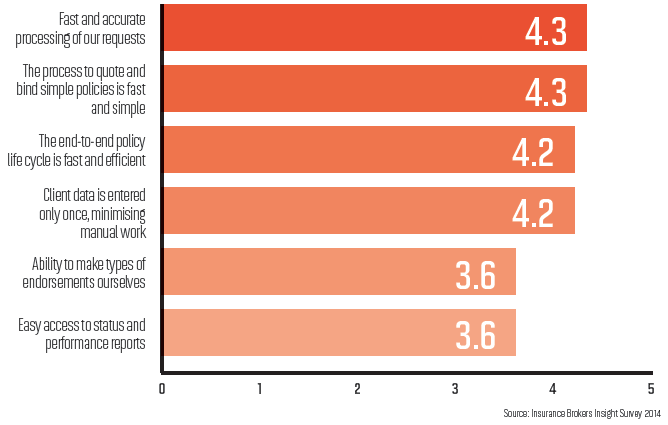

Fast, accurate online experience key for brokers

When asked how important each of the following is in the context of online dealings with underwriting agencies, brokers made it known that speed and accuracy are paramount

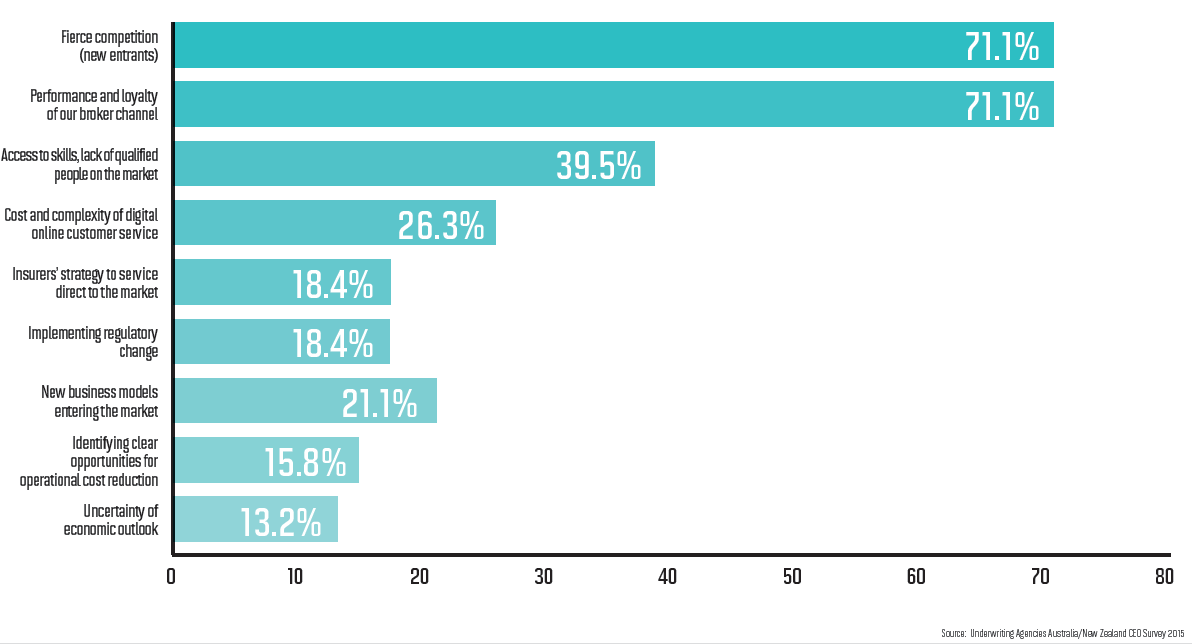

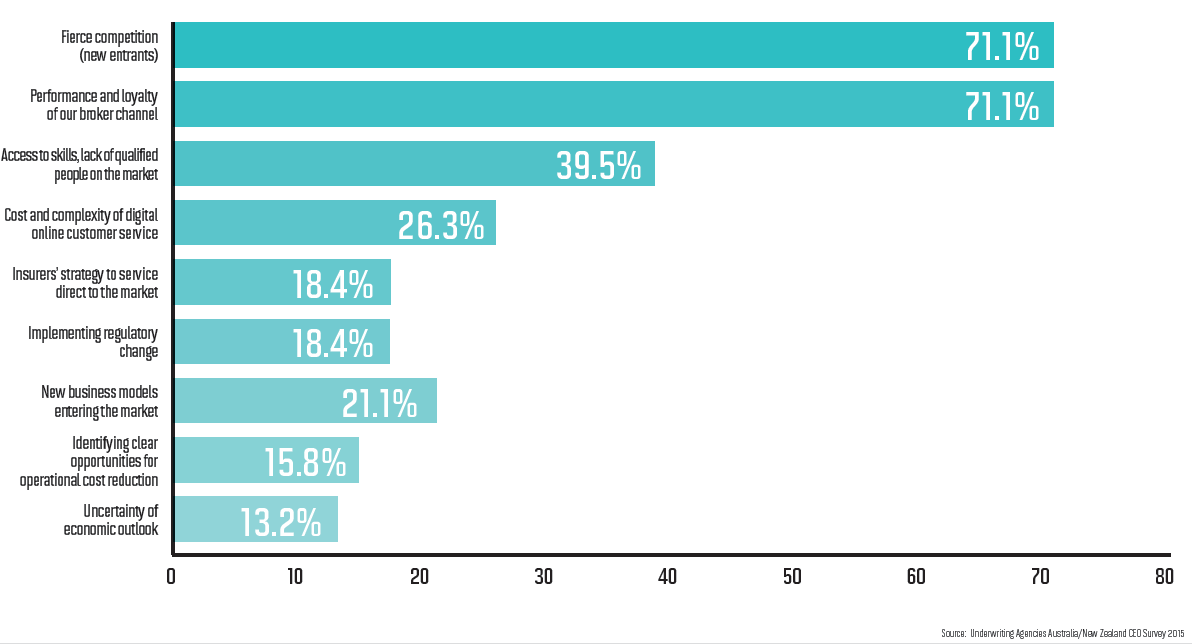

Broker loyalty, competition key challenges

Broker loyalty, competition key challenges

Underwriters see the broker channel as one of their key challenges for success in the future as fierce competition in the industry is also turning heads

What are the key challenges that impact on your business today, or might do so in the future?

The underwriter of the future?

The underwriter of the future?

The survey finds three major emerging trends for the underwriting industry, which could help shape the future of businesses

- Speed – of service and time to market

- Collaboration – with broker channel and insurance partners

- New markets –diversification targeting new segments with new products

Claims handling in insurer shift

Underwriters are handling their own claims less and less, with a big rise in the number of organisations using a third-party claims service instead of their insurers

–2.1%

We process claims internally

–0.9%

We use our insurer’s claims facility

+3.9%

We use a third-party administrator