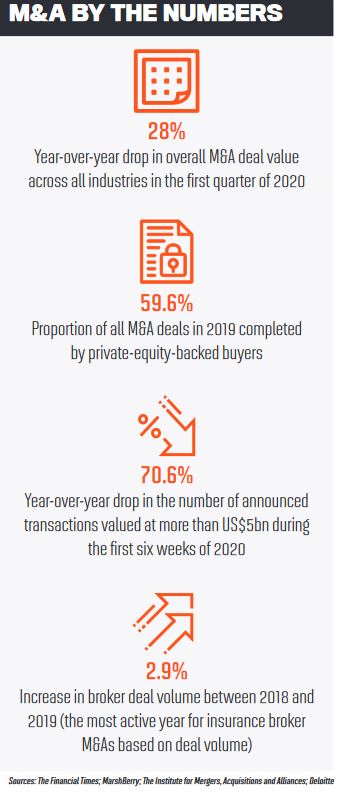

When the merger between brokerage giants Aon and Willis Towers Watson, with its implied combined equity value of nearly US$80bn, was announced on March 9, it seemed that the insurance M&A market was kicking off 2020 with the energy that has been its trademark for several consecutive years. According to Deloitte, 2019 was the most active year on record for M&A deal volume in the brokerage sector, and MarshBerry had predicted a record-setting number of transactions for 2020.

However, the COVID-19 outbreak and the resulting global lockdown have led to a rapid slowdown in the M&A market. Data from Refinitiv indicates that the total number of transactions across all industries has fallen sharply since the pandemic.

“[Business continuity] is certainly going to be a consistent imperative, especially with the potential market opportunities coming out of the pandemic recovery cycle” Mark Purowitz, Deloitte Consulting

In terms of deal numbers, M&As in insurance are, by nature, very episodic, says Mark Purowitz, a principal with Deloitte Consulting, who highlights several specific trends that will likely shape the M&A strategies implemented this year. A core trend he hopes to see flourishing is the development of powerful business continuity programs that companies can use once a deal has occurred. The coronavirus has likely forced most of the corporate world to implement such business continuity programs, Purowitz says, but these strategies are currently not often part of M&As.

“We don’t see that people are prepared in general to do a transaction,” he says, “and ... we’ve been encouraging our clients to get ready to do this. That’s certainly going to be a consistent imperative, especially with the potential market opportunities coming out of the pandemic recovery cycle.”

Phil Trem, president of financial advisory at MarshBerry, says COVID-19 will undoubtedly dampen the amount of deal activity in the market following the strong first quarter of 2020. While the rapid pace at which the pandemic is unfolding will continue to inval-idate any forecasts regarding the outlook of the 2020 M&A market, Trem says the funda-mental tenets of the insurance industry won’t change, even as the situation progresses.

“We still think that the insurance industry is very durable,” he says. “We believe that investors see the insurance distribution marketplace as a safe place to invest their money during a down economy and that it can still generate good returns when the economy returns to a more positive form.”

Although it’s too early to say how deeply the pandemic will hit the industry and what downstream impact it will have on M&A activity, Trem points out that several of the key factors that have led to recent record-setting quarters for the M&A market still exist within insurance. The fragmented supply of brokers that exists today will still exist following the pandemic, he says. This, combined with robust demand that will exist as long as the financial sources supplying it don’t dry up, is a key driver of M&A activity.

“The key is that we’ll come out of this at some point, so firms that are strong fundamentally will still be able to command high valuations” Phil Trem, MarshBerry

“Those of the kinds of things buyers are going to be looking at,” Trem says. “And the key is that we’ll come out of this at some point, so firms that are strong fundamentally and have historically had good track records of running good businesses will still be able to command high valuations.”

Purowitz also highlights how port-folio optimisation might be impacted by COVID-19. The pandemic is testing portfolio structures, he says, to see if assets put together under different conditions still stand in today’s environment or if divesting is a way to free up capital that’s not offering needed returns to reinvest in something else.

Purowitz says he wouldn’t be surprised to see additional portfolio optimisation and restructuring activities throughout the year as businesses revisit their strategies. Depending on their expectations, operating models and corresponding cost structures, businesses might see significant changes as a result of the COVID-19 pandemic, he says, and the crisis could potentially be a catalyst for unintended M&A.

Though a pause in the M&A market is inevitable, Trem says deals are still getting done, and buyers are taking still taking new meetings – albeit virtually. It’s not business as usual, but the market hasn’t frozen, he says. Though this could potentially change depending on the impact of the pandemic on the industry overall, right now, M&As are suspended in a game of ‘wait and see’.