The global pendulum is swinging towards data-led insurance solutions, and automotive telematics is leading the way

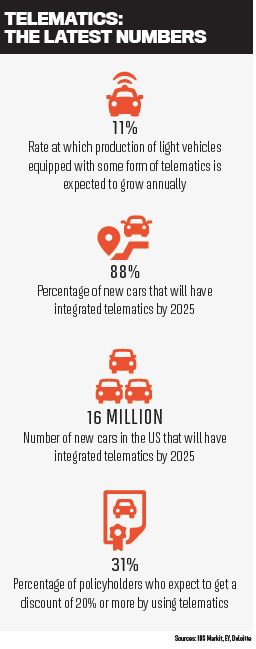

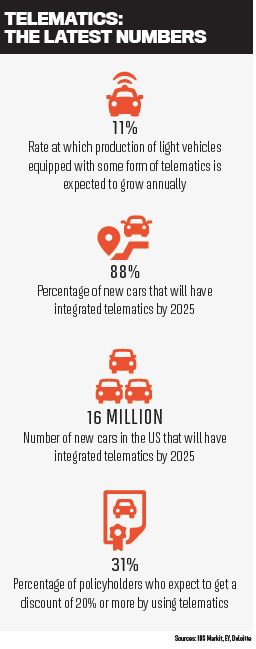

The demand for auto telematics continues to grow. Last year, an estimated 33 million light vehicles equipped with some form of telematics were produced globally, and production of telematics-enabled vehicles is expected to grow by 11% annually, topping more than 66 million automobiles by 2023. Alongside the new breed of connected vehicles, many insurers are also offering their customers telematics solutions via mobile phone apps.

In addition to monitoring driver behaviour, today’s telematics platforms enable insurance companies to provide more accurate pricing, and can even provide safety and security features such as roadside assistance and stolen-vehicle tracking.

For insurers, telematics is also helping to increase the accuracy and efficiency of the claims process. Data that can be instantly transmitted to an insurer includes the date and location of a crash, the speed and direction of travel, and even weather details, allowing adjusters to more easily determine liability and compensation in order to process claims quickly.

It’s clear that telematics is big business: reports suggest that in the next decade nearly every vehicle on the road will be a connected one. By 2025, a whopping 88% of new cars produced globally are expected to be equipped with integrated telematics, and in the race forward, key players are pumping resources into coming up with new usage-based insurance (UBI) solutions.

In October, brokerage giant Willis Towers Watson announced that global telematics provider Octo Telematics was acquiring its UBI division, and the two firms would be partnering on insurance-related products going forward. A number of key personnel from Willis, including global telematics leader Geoff Werner and his team, moved over to Octo as part of the deal.

“Customers’ lives are becoming more convenient … [and] they’re looking for the same thing with their car insurance” - Oliver Baxter, By Miles

“With telematics, it’s very much about how quickly this is going to happen, not if it’s going to happen,” says Jonathan Hewett, chief marketing officer at Octo. “Everything is being used now – from apps to traditional black boxes and connected car platforms, they are all helping to fuel the growth in the market. Frankly, it works because insurers get a better financial result and improve their loss ratios by pricing risk better and being more efficient with claims, and consumers get a better deal.”

Telematics adoption has also surged as a response to a fundamentally unchanged motor insurance market, according to Oliver Baxter, head of brand and communications pay-per-mile start-up By Miles.

“The car insurance industry hasn’t changed for decades, so much like any other sector it’s ripe for disruption,” Baxter says. “People are quite embedded into the way it works. It’s a necessity – people have to pay for it, and they expect to pay for an annual policy. It’s been working for so long – for those businesses it’s working for, why change? And for customers, they don’t know anything else.”

In contrast to traditional motor policies, By Miles offers a pay-per-mile policy that it says is much fairer to customers, the majority of whom are currently subsidising higher-mileage drivers, Baxter points out.

“In the same way that all sorts of other areas of customers’ lives are becoming more convenient, more flexible and more tailored to them,” he says, “they’re looking for the same thing with their car insurance, and they don’t understand why it doesn’t exist yet.”

“Clearly the market of the future is going to be defined by dynamic data, as opposed to the old world of static data” - Jonathan Hewett, Octo Telematics

Hewett agrees that consumers are increasingly demanding a fairer deal, which has spurred new concepts in insurance. “The idea of ‘paying as we consume’ is a broader macro factor that’s driving the market,” he says.

While auto telematics is already in the mainstream, connected devices are now starting to make their way into the home for a similar purpose. Indeed, as part of their partnership, Octo and Willis Towers Watson plan to cast their net wider than just auto.

“The team that we’re acquiring brings increased capability to interpret and analyse ever-increasing amounts of data in all different contexts,” Hewett says, “be it a car, be it a home, anything that can be connected. Big data is one thing, but smart insights and being able to make smart business decisions is quite another. Clearly the market of the future is going to be defined by dynamic data, as opposed to the old world of static data.”

In October, brokerage giant Willis Towers Watson announced that global telematics provider Octo Telematics was acquiring its UBI division, and the two firms would be partnering on insurance-related products going forward. A number of key personnel from Willis, including global telematics leader Geoff Werner and his team, moved over to Octo as part of the deal.

In October, brokerage giant Willis Towers Watson announced that global telematics provider Octo Telematics was acquiring its UBI division, and the two firms would be partnering on insurance-related products going forward. A number of key personnel from Willis, including global telematics leader Geoff Werner and his team, moved over to Octo as part of the deal.