Tennis is Wimbledon, pizza is Naples, the stock market is New York, beer is Munich – and insurance is Lloyd’s.

For the industry and brokers, the Lloyd’s of London insurance marketplace at 1 Lime Street is comparable to their version of Mecca or the Holy Grail.

But if an insurance broker visits Lloyd’s on business, how can they get a head start on navigating this complex behemoth?

Gallagher Bassett’s chief client officer, Pete Diskin (pictured above), can lay claim to being his firm’s Lloyd’s go to man. He’s dealt with Lloyd’s since joining GB in 2000 and, he said, is now in the senior role for GB facing this market.

“I would probably say that my area of expertise is Lloyd’s,” said Diskin. “My first foray was working in a sports claims environment and then I’ve maintained contact [with the Lloyd’s market] through operational roles and then senior leadership roles all the way through.”

In 2017 he moved with his family to the UK specifically to expand GB’s Lloyd’s footprint into its UK business.

“We’d already established a Lloyd’s market here in Australia for the claims that we do but our UK operation had not yet started working with Lloyd’s, despite being on its doorstep,” said Diskin. “My principal role in going overseas was to actually help them [GB’s UK operation] get into to Lloyd’s.”

He said he’s always been fascinated by this famed London insurance market. He first got to know it from Australia, servicing clients at the backend of it.

“My first interactions over there [at Lloyd’s’] really cemented my picture of it as a market rather than an insurance company,” said Diskin.

Insurance Business asked him what it’s actually like inside the building during business hours?

“It trades as a market, so much like any other weekend market you might see on a Saturday or Sunday, when you walk down there are individual syndicates that are actually syndicating together,” said Diskin.

This collaboration between the different syndicates to share risk in a market style set-up was the first thing that struck him.

The building was finished in 1986 and designed by famed Italian born British architect Richard Rogers. One striking feature is the huge central atrium surrounded by towers containing many of the important functional elements, including elevators and toilets (see picture immediately below courtesy of Stephen Richards).

“It’s a very iconic building and if you Google pictures of it you’ll see that all of the air conditioning, for example, is on the outside to create space for a gallery on the inside,” said Diskin.

The way individual syndicates occupy the space is also unusual.

“I had imagined it would look like any other typical stock exchange type of building but what you typically see in the four floors of underwriting is that each syndicate has its own, what they call a box,” he said. “The box is where the underwriter sits and the broker goes in with the business to actually sit with the underwriter and do a deal to place that business.”

Insurance Business asked Diskin if he meant business is literally conducted in box?

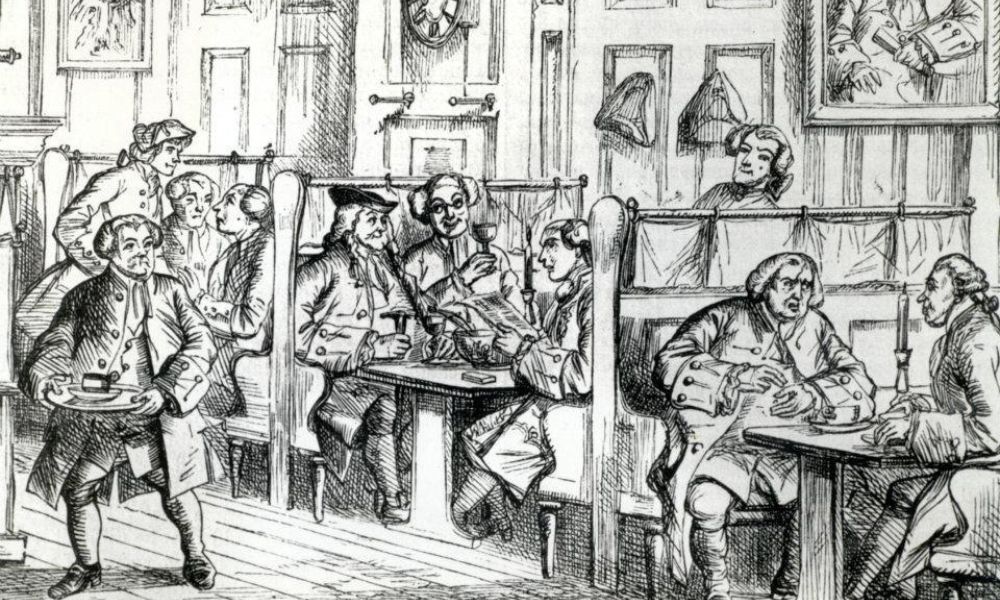

“Yes, literally in a box,” he said. “They’ve just revamped the bottom floor of Lloyd’s - I was only over there recently - and that notion around a box actually emanates from Edward Lloyd’s Coffee Shop.”

He said the coffee shop had booths like boxes where the shipping merchants would sit and trade (see Edward Lloyd’s Coffee Shop picture immediately below, courtesy of Lloyd’s website).

“If you go into Lloyd’s you’ll see four floors of underwriting and the underwriters sitting at a box with about four desks,” said Diskin. “These days, they’ve got computers on them but in the old days it would have been paper and quills I imagine.”

He said there are two seats at one end for the brokers who come in with their slip. The underwriter then decides, said Diskin, what percentage of the slip, if any, they’d like to take. Then the broker moves around the building to other underwriters until his or her slip is filled 100%.

“The broker really does the job of actually securing insurers if you like,” he said.

IB asked how insurance brokers become authorised to enter the building and trade in this way with the underwriters inside?

“A broker needs to be approved by Lloyd’s to go in there and not at a broker level but an organisation level,” said Diskin. “I think, last count, there are 308 brokers in London representing different organizations.”

He said the underwriters at Lloyd’s aren’t actually there all day.

“It is interesting in that the underwriters will sit there for part of their day, but not all of the day,” said Diskin. “So they’ll go back and actually prepare business and slips in their own offices.”

He gave a working example of how a broker and an underwriter would do business at Lloyd’s.

“So if you’re the underwriter and I’m the broker, I would come in with a couple of slips that might be of interest because you write Australian liability,” said Diskin. “I’d ask if you want to put a line down on this? Would this be something you’d want to insure? You might say, ‘Yes, I would and here’s the line percentage that I would want to write.’”

If the broker knows other underwriters who work with this first underwriter, he or she could approach them, he said, and together they’d form what’s known as the follow market.

“So at number one, you’re the lead market and then we’re filling up the slip in a following capacity,” said Diskin. “That’s how it works.”

Have you had the opportunity to do business at Lloyd’s? What was it like? Please tell us below.