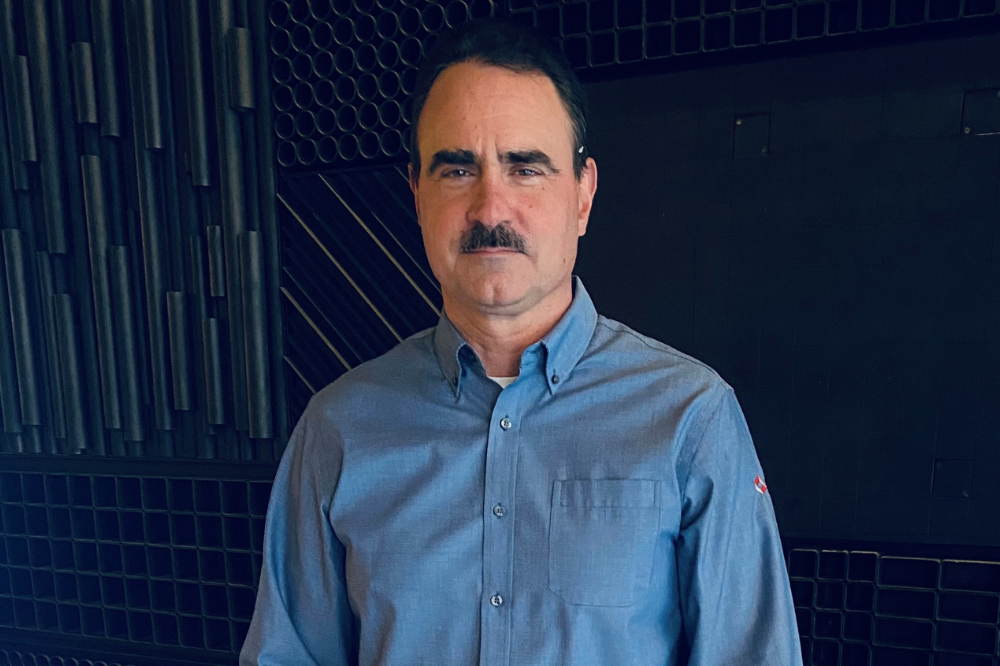

Rob McMullen (pictured below), US-based president of Paragon Risk Engineering was recently in Australia to promote the firm’s growing interest in the region.

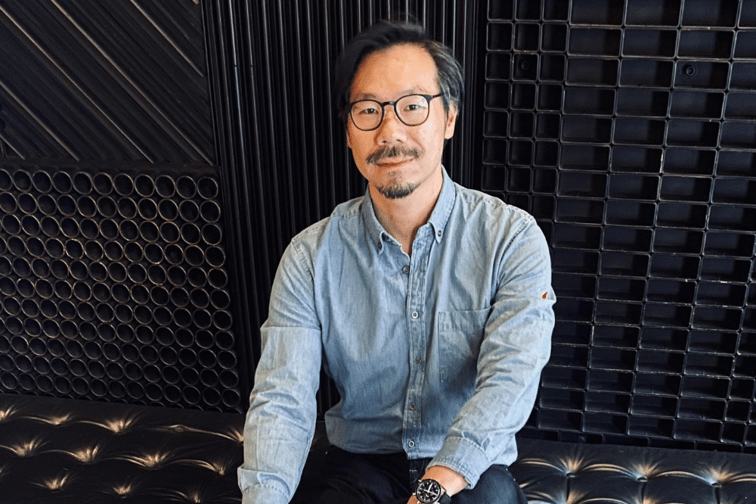

“Australia is one of the most important markets for Paragon and across the Sigma7 family of companies,” said McMullen. “Under the leadership of our regional director for the Australia and New Zealand region, Jason Chua (main picture above), we have steadily grown our market-share of risk engineering services for both insureds and insurers.”

In a media release, Sigma7, which launched in May, described itself as “a new kind of risk services model” with a client base including more than 300 of the “largest and most complex organizations” in the world.

Read more: Is Sigma7 the future of risk services?

“We obviously do a lot of our work with the insurers,” said Chua. “This involves auditing from an insurance risk perspective to help the underwriters be more confident in the underwriting for a particular insurance policy, or what we call an Industrial Special Risks (ISR) policy.”

Chua said his firm can help brokers by using this knowledge learnt from insurers to support the broker becoming a more trusted adviser to their insured clients.

“We can explain to the broker what the insurers are looking out for in terms of the risk assessment of their insured clients’ risk profile and advise their insured client to improve their risks and present an acceptable risk profile to the insurance market,” he said.

Chua gave the example of the risks around EPS (expanded polystyrene) insulated panelling.

“A lot of insurers are very particular about these insulated panels because of recent significant losses, for example, the Thomas Foods abattoir fire [in 2018 near Adelaide] that led to losses of about $400 million,” he said.

He described the role of Paragon as “a conduit between the insurers to the brokers, and insured clients, to better interpret this EPS risk.”

“We guide our food clients by using FM Approved insulated panels plus human element measures to demonstrate that these risks can be mitigated,” he said.

Another Sigma7 company, Strategia Worldwide, is a British business operation with strong links to military veterans and their expertise. The firm recently worked with a large Australian mining company to “scenario test” the impact of the geopolitical risks that continue to rise between China and the West.

“It’s a role-playing scenario with a whole bunch of people in the room, or virtually,” said McMullen. “The scenario is prechosen and then you have the right people involved and it’s a gigantic ‘what if’ scenario.”

McMullen said he and Chua’s role as risk engineers is to turn these scenarios into mathematics.

“It’s a gigantic mathematical formula that’s trying to pick up the reactions in each variable point,” said McMullen. “It’s using the most sophisticated version of anticipated risk response that I’ve come across. It’s very, very fancy.”

He gave the example of a major company losing a pipeline to a power station in the theoretical situation of tensions over Taiwan resulting in war.

“How do you protect the pipeline and the environment, what do you do next?” said McMullen.

In this case, the scenario testing would involve former military leaders.

“Military people who are top in their class, they have that holistic perspective and it’s the nature of their training and experiences which brings a new perspective to the way people think about risk,” said McMullen.

The Paragon company Strategia has also been involved in Ukraine.

“There’s a US company that has thousands of employees in Ukraine,” said McMullen. “Strategia Worldwide, is working with them to identify where are these people? Are they able to be safely evacuated? And to the extent possible, how can those employees continue to work for their employer?”

Chua provided another example closer to home involving a large US insurance company that provides risk engineering services for an Australian ASX listed recycling company.

“On an annual basis, Paragon will conduct a risk audit of the key assets of this ASX company and provide underwriting reports, with risk improvement recommendations, to the insured client, insurance company and broker,” he said.

Chua said this risk audit includes providing details on the number of stockpiles of recycled material the company is managing.

“A lot of the losses come from over-extending,” he said. “So when you get a fire at a particular recycling facility that can only take in, let’s say, 100 tonnes and you’re storing up to 500 tons of recycling waste - that’s a massive risk,” said Chua in a theoretical industry example.

Read next: Geopolitical risk spikes – report

Chua said they also provided this recycling business with merger and acquisition risk reports prior to them acquiring an existing facility. He said this enabled their client to “make a very diligent check and more educated judgement” not just from an economic perspective but also with regard to the risks that it could bring to their portfolio.

“Our trusted risk engineering service provides valuable insight to encourage meaningful conversations within the normal trifecta relationship between the insurance broker, insurance company and the insured client,” said Chua.

Paragon is actively seeking to expand in Australia and Chua said they’re currently seeking new staff.