Remember when making a music playlist meant recording from vinyl onto a cassette tape? When you’d pop that little plastic rectangle into your cassette player and hum along or play air guitar until the sad, inevitable day when the tape got mangled mid-song? Perhaps not – because we now live in a streamlined, digitised world where Spotify reigns supreme and even curates your playlists for you.

Insurance, however, has been slow to adapt to the reality of how we live now, say Shaji Sethu, managing director, APAC, and Chris Tandy, lead business architect at Duck Creek Technologies, a software company that provides core system solutions to the general insurance industry as either stand-alone products or a full suite of systems.

It’s not a question of if the industry will catch up because it has to. It’s not even a matter of hoping the right technology will come along, because the tech is already here. What is harder to come by is the right mindset, say Sethu and Tandy. Many insurers are either not responding to the shifting landscape or doing so with something that looks digital but isn’t.

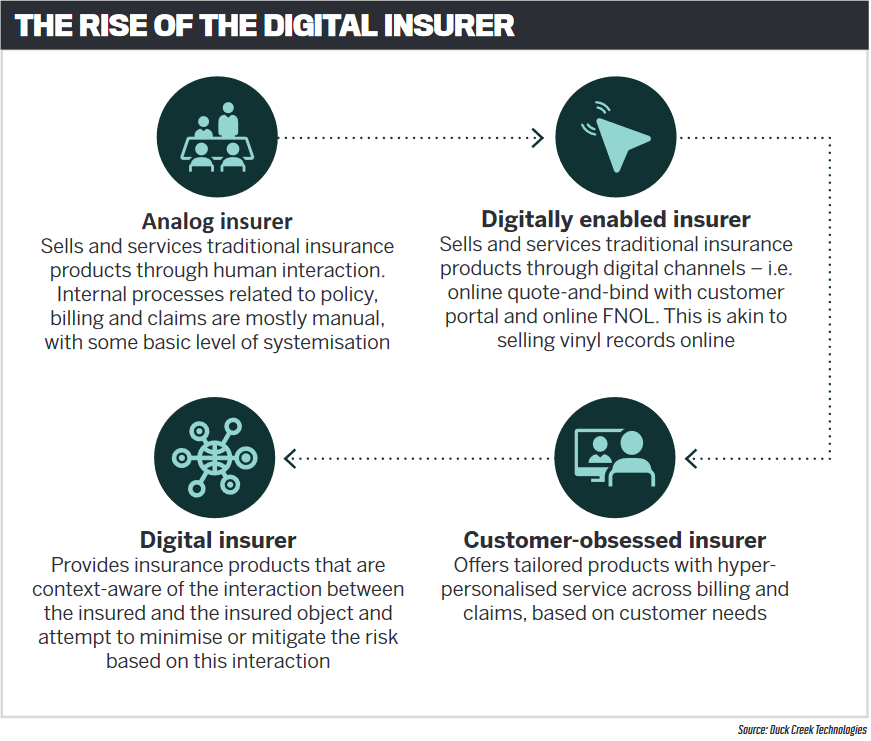

“Many have started to sell traditional risk indemnification products – analogue products – through digital channels,” Sethu says. “This is akin to setting up a digital music business by selling vinyl records through a web front end. It does not allow carriers to achieve the scale of Spotify – a truly global digital music business.”

Tandy adds that “many insurers have infrastructure, systems, governance models and investments in legacy product lines, and this focus can make some traditionally slow to react to market changes and opportunities around what the future will look like. A mentality of gatekeeping the past may hold some insurers back.”

This leads many insurers to innovate in a piecemeal way rather than looking at the problem holistically, he says.

“They will introduce pieces of technology and plug them into their legacy [systems] on the belief that the underlying premise of competition is not going to change substantially. The war [for competition] today is, ‘Here is my product; here is the price in underwriting terms that I will sell it at.’ The war of tomorrow is, ‘How is my product adapting to changing consumer usage and demand patterns?’

“Rather than standardised products, they are more likely to be sold in a far more componentised fashion. It will be, ‘Do you want to cover this risk; do you want to self-insure or self-insure to that level, and then we will pick it up? Right now, it’s, ‘Do you want to buy or not buy?’”

This means most insurers are missing out on the huge benefits that new technology offers to deliver the best possible customer experience – and, in particular, to simplify the process for clients who increasingly demand simplicity.

Since the early days of insurance in London’s coffee shops, little has changed in its core premise: risk indemnification. But the status quo has been disrupted by several factors, Sethu says.

These developments have led to a corresponding change in customer expectations. “E-commerce companies are setting new expectations for insurers due to shifting customer expectations of how, when, why and the way they buy,” Sethu says. “Yesterday’s wow is today’s norm, and consumers expect to buy and use insurance in ever-decreasing time.”

What insurers need to do is create authentically digital products with digital policies, Tandy says. This type of omnichannel insurance model can constantly monitor the inter-action between the insurer and insured objects in real time and, based on the data stream, can help the insurer better manage risk or mitigate emerging risk. A fully digital insurance product is context-aware and changes based on the current state and risks of the insured object rather than what has happened over the past few years.

“They are products that are alive, constantly looking for new ways to prevent risks from eventuating, reduce the severity of the out -come and identify new potential hazards in real time,” Tandy says. “This approach moves carriers’ and insurers’ interaction from selling insurance to consuming insurance.”

He cites the example of the Roost telematics system. “If a homeowner has water damage, the fi rst hour is critical, as from then on, the damage keeps escalating. We have integration with Roost telematics that can be installed into a customer’s roof. If the system detects a water leak, it calls into Duck Creek, places a claim and calls a plumber, thereby reducing the severity of the damage.”

Sethu points to global insurer Chub b’s recent introduction of Pay As You Roam (PAYR) travel insurance as one of the “green shoots” of fully digital products. PAYR uses mobile phone roaming data to identify when customers are outside their home country, then activates coverage automatically at a daily premium.

PAYR could be applied to a domestic scenario, too. More of us now work from home, for example, so why not build that reality into an insurance product?

“Imagine if, when you work from home, you pay less premium,” Sethu says. “Your insurance software is connected to your alarm system, so when you arm it, your premium goes up for the period you are out of the house. But you collect loyalty points when you are home. At the end of the year, your insurer says, ‘You’ve got 500 loyalty points; why not use them to buy a new TV on our website?’”

Digitisation is also an opportunity to reach younger consumers who do everything on their phones, Sethu adds.

“Young people aren’t buying big insurance products,” he says. “But they might consider contents, so make it simple. If you just purchased an expensive item on your credit card, a message could pop up on your phone: ‘You just bought a camera; would you like to purchase insurance for it?’ And you answer a simple yes or no.”

So far, so wonderful for the consumer. But what of the broker? What will their role be in this new super-digitised insurance world?

Tandy believes brokers will be more important than ever. They can use these tech tools – whether it’s an IoT device, tracking, a phone or all of the above – to ask a client, “How do I help you mitigate the risk so you can decide whether to insure or self-insure?”

“Similar to many true advisers, they need to consider the company’s balance sheet and risk appetite,” Tandy says. “They can say, ‘Based on the financial position of your company, can you afford to wear the risk if it does eventuate, and how many times a year can you afford to wear that?’ Therefore, the business is making a much more informed decision about risks ceded to underwriters and retained within the business itself.”

“Similar to many true advisers, they need to consider the company’s balance sheet and risk appetite,” Tandy says. “They can say, ‘Based on the financial position of your company, can you afford to wear the risk if it does eventuate, and how many times a year can you afford to wear that?’ Therefore, the business is making a much more informed decision about risks ceded to underwriters and retained within the business itself.”

In this context, Tandy believes brokers will increasingly become highly valued curators of risk management, mitigation and financial modelling.

“Think about travel,” he says. “We can now book directly, but we still go to an agent because it’s a curated experience. That’s what a broker can off er. They can say that based on their experience, this is the combination of insurance you should have.”

Making the shift to this fully digitised experience is about much more than the soft-ware, Sethu points out.

“It’s about a state of mind. Most brokers know their customer well – that’s why customers go to them. So don’t just sell them a policy and move on. Be there for the wider services. We need to rethink insurance, to reimagine it based on the new demographic, the new data sets, the new tech. Make it simple. Make it so simple it becomes second nature.”

Importantly, brokers are in a powerful position to persuade a somewhat reluctant insurance industry to adapt.

“They’re buying products from insurance companies then on-selling to the customer,” Sethu says. “So don’t buy from organisations that sell the vanilla product; buy from carriers that can tailor it to your customer’s needs. Brokers have buyers’ power. They can create a change for good.”