More than two-thirds of the country’s insurers believe that insurtech companies play a crucial role in helping incumbents achieve digital transformation, a recent survey conducted by the consulting giant EY and industry body Insurtech Australia has revealed. The key is finding the right insurtech partner that shares their “business vision and strategy” by practising “detailed business and technical due diligence.”

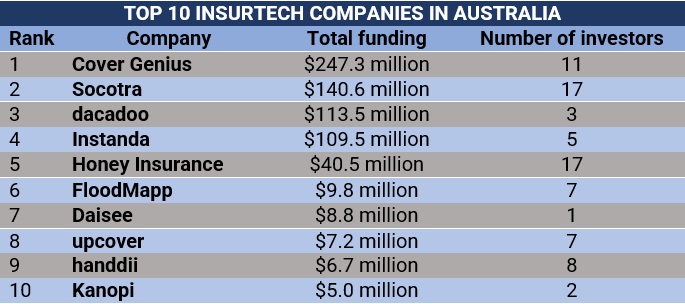

To help narrow down the list, Insurance Business ranks the 10 biggest insurtech companies in this guide. If you’re part of an insurance company that’s on the lookout for the right collaborator to help drive digitalisation and technological innovation, this article can serve as your guide. Read on and learn more about the top insurtech companies in Australia. Here they are ranked based on the total funding raised to date.

1. Cover Genius

1. Cover GeniusTotal funding: US$165.1 million (about $247 million)

Number of investors: 11

Number of acquisitions: 2

Number of investments: 1

Headquarters: Sydney, NSW

Cover Genius has reached its current investment value through six rounds of funding, the latest of which was a Series D held in November 2022. However, it generated the greatest buzz in 2021 when it secured US$100 million (around $149 million) from investors, upping its market valuation to $1 billion, which it said it will use to fund the company’s global expansion.

The insurtech startup gives insurers access to an insurance distribution platform designed to protect customers of the world’s largest digital companies. Among its flagship products are:

Cover Genius has offices in key cities across the world, including San Francisco, New York, London, Amsterdam, Tokyo, Seoul, Singapore, Kuala Lumpur, and Manila. It has a pair of acquisitions – global refund protection specialist Booking Protect in 2022 and embedded warranty provider Clyde Technologies in 2023. The insurtech firm is also an investor for AI-based sales and marketing solutions provider Ensuredit.

2. Socotra

2. SocotraTotal funding: US$93.9 million (about $140 million)

Number of investors: 17

Number of acquisitions: 1

Headquarters: Bondi Junction, NSW

Originally from San Francisco, California, Socotra is among Insurtech Australia’s largest players, offering insurance companies a digital platform that enables them to accelerate product development, save on maintenance costs, and improve customer experience. It has five products, namely:

These cloud-based solutions are designed to unify key industry processes, including:

Socotra recently opened its first international office in Australia and holds a partnership with the nation’s largest general insurer IAG. The insurtech firm acquired insurance software startup Avolanta in 2022, which became Socotra Unified Portal. That same year, Australian insurtech KOBA Insurance migrated its insurance programme onto Socotra’s platform.

3. dacadoo

3. dacadooTotal funding: CHF70 million (about $113.5 million)

Number of investors: 3

Headquarters: Sydney, NSW

Based in Zurich, Switzerland, dacadoo holds its Asia-Pacific headquarters in Sydney. The insurtech company operates and develops a digital health engagement platform designed to help individuals live healthier and more active lifestyles. This is done through a combination of motivational techniques, using the following:

dacadoo’s health engagement platform is available in 15 languages and can be integrated into customer products through its API. The insurtech startup holds partnerships with several health and life insurers, and health and wellness services organisations worldwide.

4. Instanda

4. InstandaTotal funding: US$73.1 million (about $109 million)

Number of investors: 5

Headquarters: Eight Mile Plains, QLD

London-based Instanda offers insurance professionals a no-code platform to create and launch insurance products, with its software-as-a-service (SaaS) policy administration tool. This platform enables insurance providers and brokers to build, distribute, and manage new products in a fraction of the time that it conventionally takes.

Instanda has collaborations with several major property and casualty, and life and health insurers, as well as underwriters and brokers across Australia, Europe, and North and South America.

5. Honey Insurance

5. Honey InsuranceTotal funding: $40.5 million

Number of investors: 17

Headquarters: Surry Hills, NSW

Among the top insurtech in Australia, Honey Insurance offers homeowners, renters, landlords, and contractors coverage against natural and man-made calamities, accidental damage, theft, liability, and property rebuilding, among others.

The company uses smart technology to keep households protected from avoidable accidents. Clients who sign up with Honey’s Smart Home Program are given three smart sensors to help prevent fire, theft, and water damage. These sensors monitor:

In 2021, Honey Insurance received $3 million in funding from Australian energy giant AGL, allowing it to offer smart insurance products to home builders and tenants.

As part of our investment in start-up company @honey_insurance, we’re excited to begin offering smart #insurance products to #customers building a new home or renting.

— AGL (@AGLEnergy) August 24, 2021

Learn more → https://t.co/toqMBzV47Z

6. FloodMapp

6. FloodMappTotal funding: $9.8 million

Number of investors: 7

Headquarters: Brisbane, QLD

Australian insurtech FloodMapp specialises in real-time flood forecasting and flood inundation mapping to provide users with greater warning time and situational awareness that can potentially help save lives, reduce damage, and cut associated financial losses. The startup is among the first in the world to offer this type of predictive flood mapping technology.

FloodMapp’s product range consists of:

7. Daisee

7. DaiseeTotal funding: $8.8 million

Number of investors: 1

Headquarters: Sydney, NSW

Daisee uses AI to perform conversational analytics that ranks and rates all client interactions, allowing insurance companies to easily identify points on where to improve customer experience. It gives insurers access to its Programmable Scorecard platform, which replaces traditional paper scorecards with automated digital versions. This online tool can also be set to filter questions based on the type of call or the team to which an agent belongs to ensure that it is assessing quality appropriate to the customer interaction.

8. upcover

8. upcover

Total funding: US$4.8 million (about $7.2 million)

Number of investors: 7

Headquarters: Sydney, NSW

upcover’s API-based platform enables businesses, brands, and marketplaces to distribute affordable commercial insurance to their SME customers and contractor workforce. It covers more than 400 types of businesses, including:

9. handdii

9. handdiiTotal funding: US$4.5 million (about $6.7 million)

Number of investors: 8

Headquarters: Melbourne, VIC

One of the fastest-rising startups in Insurtech Australia’s roster, handdii operates an online marketplace that connects customers directly with an insurance company’s contractor network. This spares them from the often lengthy and frustrating process surrounding small property insurance claims. Through the platform, contractors can easily engage clients and promote their businesses, while insurance companies can reduce claims costs. Policyholders, meanwhile, can get their property repairs done faster and cheaper.

10. Kanopi

10. KanopiTotal funding: $5 million

Number of investors: 2

Headquarters: Melbourne, VIC

Kanopi operates a digital platform consisting of the following that connects insurers to their clients:

Kanopi’s platform uses data-driven insights to analyse customers’ needs, which allows insurance companies to provide clients with insurance products that fit their needs. Among the policies it offers are small business, home and contents, landlord, and invoice protection insurance. Kanopi has offices across Australia, Singapore, and London.

Here’s a summary of the top insurtech companies in Australia based on total funding. To come up with this list, Insurance Business gathered investment data from this website. All insurtech firms included in the list are also members of Insurtech Australia.

The term insurtech is derived from the combination of the words “insurance” and “technology.” It is used to describe a company that uses technological innovation to make the conventional insurance model more efficient. For example, many insurtech companies in Australia take advantage of AI and data analytics to come up with fair and accurate premiums and make claims processing and underwriting faster.

Insurtech in Australia generally come in two categories based on the role they play within the country’s insurance sector. These are:

Australia’s insurtech sector is dominated by enablers that work with insurance companies to make the process more efficient rather than disruptors bent on displacing incumbents. This was what EY’s series of studies on the country’s insurtech has found in recent years. In the most recent edition, the consulting giant reveals that the only way for the insurance industry to advance is to continue with these partnerships.

The report notes, however, these types of collaboration are still relatively low, preventing the insurance industry from “maximising value creation at scale.”

EY worked closely with Insurtech Australia to compile responses from insurtech firms, insurance companies, and other service providers to get their perspective on the state of insurance and insurtech space in the country.

Many of the respondents agreed that it was time to bolster partnerships to take advantage of opportunities in areas that are “ripe for innovation.” These include:

“As the platform economy matures, insurers will move beyond the simple alliance models and develop the infrastructure to support plug-and-play and cross-platform integration capabilities to create true ecosystems,” wrote Andrew Parton, global insurance consulting partner at EY, in his analysis. “One of the key ingredients here is putting the right infrastructure around legacy systems, so insurtech can plug into the enterprise.”

He also noted that “deploying insurtech at scale is the only way to keep up with fast-moving technology developments and satisfy rising consumer expectations.”

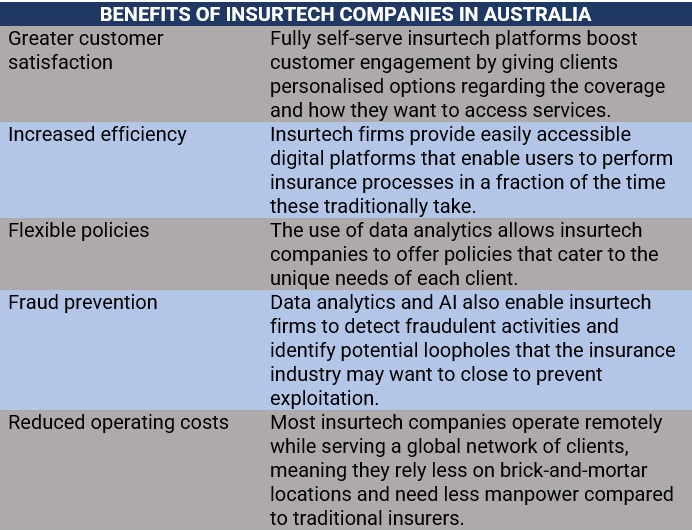

The top insurtech companies in Australia provide several benefits that make them attractive options for both the insurers looking for partners to drive digital transformation and the consumer searching for the right type of cover. These advantages are detailed in the table below:

Among the business lines that are ripe for digital transformation is SME insurance. Find out the impact of insurtech and technological innovation in Australia’s SME space in this article. If you’re hungry for more insurtech news, you can check out our Insurance Technology section for the latest industry updates and breaking news.

To learn more about this year’s winners read our Top Insurtech Companies | Global 5-Star Technology and Software Providers 2023 special report.

What are your thoughts about insurtech in Australia? Which firms do you think have greater roles to play – the enablers or the disruptors? Share your comments below.