Updated 16 August 2024

During the rebound after the global financial crisis in 2009, art sales surged around the world. Since then, the global art community has been growing, driving the need for specialist art insurance policies.

Fine art insurance is one of these specialist policies. This type of coverage protects collectors financially if any of their artworks are damaged, lost, or stolen.

Insurance Business digs deeper into this form of protection in this guide. We will explain how fine art insurance works, what it covers, and what factors impact premiums. We will also give you a snapshot of what the future holds for this type of policy.

Insurance agents and brokers can share this article with private and institutional art collectors who may be searching for the right coverage for the prized possessions. Read on and gain a deeper understanding of this specialised form of coverage.

Fine art insurance is a specialised type of policy designed to provide collectors with financial protection in the event an art is damaged or lost due to a covered peril. It is based on the premise that art owners want to preserve objects or collections for future generations of their family or community. Most policies offer all-risk coverage that goes beyond what a typical homeowners’ personal property policy provides.

Fine art insurance comes in two main types:

This type of policy is targeted at private collectors and their art collections. It provides coverage for prized artworks owned by individuals, families, and estates. Private fine art insurance can also cover prized pieces on loan or temporarily stored in another place.

This form of fine art insurance is designed for galleries, museums, auction houses, and art organisations. It offers coverage for artworks owned by institutions or those entrusted to them by private collectors. Institutional fine art insurance pays for damage that occurs during exhibitions, or while the item is on loan or in transit.

In addition, policyholders can choose between two levels of coverage, which come with their own pros and cons:

In this policy, the amount to be paid is pre-determined or agreed upon by the policyholder and the carrier. The covered items are listed separately, with the coverage amount for each specific artwork also indicated.

The main benefit of this type of policy is that the insured amount remains the same even if market prices fall. If the value of the artwork goes up, however, the insurer will only pay the scheduled amount.

Policyholders must also report any additions or changes to their art collection, so that these can be included in their policies. Only items listed or scheduled on their policies will be covered by fine art insurance.

This policy assigns a single policy limit for all insured artworks. Because of this, there are no scheduled items and individual amounts listed in the policy. The insurer will also pay for the damaged or lost items for their current market value. This means that the coverage amount can increase or decrease, depending on the market conditions. Another benefit of choosing blanket coverage is that all artworks owned by a collector are covered up to the policy limit with no per item maximum.

Learn more about the sustainability efforts within the fine art insurance space in this article.

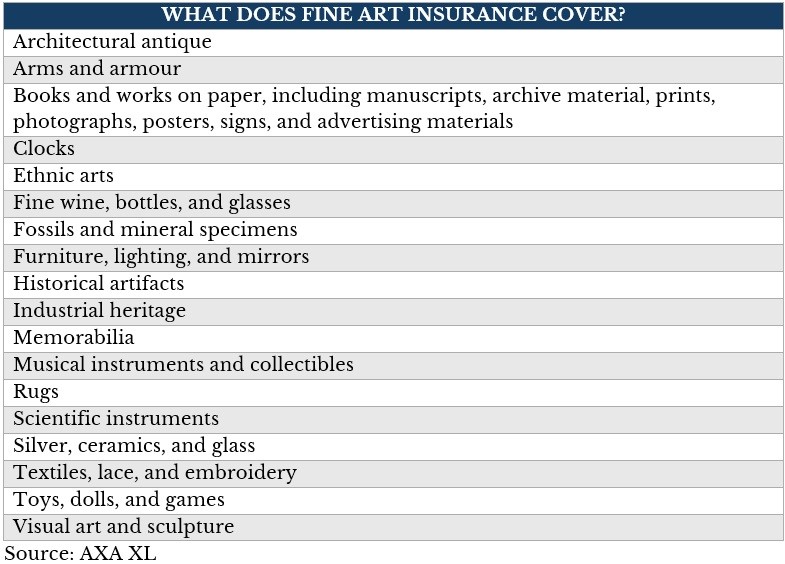

Fine art insurance covers a wide range of items, but it often depends on the risk appetite of each individual carrier, according to AXA XL’s Introduction to Fine Art Insurance.

“Art and objects worth insuring under a fine art policy come in many descriptions,” the guide explained. “They may be snuff boxes and coins, or vast canvasses and monumental sculptures. They may be made of precious metals, precious stones or everyday materials, like paper or clay. They can be stone, metal, or even liquid. Some are ancient, and others are the work of living artists.”

According to the insurer, the one thing all the qualifying objects have in common is that their value “goes well beyond an ordinary function or material.” While this may be subjective in the world of art, a collector might need a fine art policy if they have:

a unique item that will be difficult or impossible to replace

a collection of objects whose value would drop if one piece was damaged or lost

artworks that they lend to museums or exhibitions

valuable items held in storage

fragile, delicate or very old, original items

Here’s a list of items fine art insurance can cover, according to the carrier.

Most fine art policies will cover “all risks” which is a slightly misguided term because there are almost always coverage exclusions. Art insurance provides coverage against perils like fire and theft, while also compensating for loss of value and accidental damages. Most policies cover the cost to restore damaged artwork to its original condition. Some provide liability coverage for damage caused to third parties during the exhibition or transportation of the artwork.

In terms of exclusions, most policies do not cover loss or damage resulting from general wear and tear, war, terrorism, pests, and inherent vice.

Find out what it takes to thrive in the fine art and specie market in this expert interview.

The value of artwork is sometimes quite subjective. Typically, insurers base premium calculation and claim pay outs on several factors, including:

the type and condition of the artwork

the materials used

how the artwork is stored or displayed

the method of transportation and how often the artwork is transported

exposure to natural hazards

quality of security arrangements

the presence of fire detection systems on where the artwork is located

the policyholder’s loss history and previous claims

Other factors that may have an impact on fine art insurance premiums include:

overseas transport, including the risk of damage while in customs control

legality of materials, including ivory and whale bone

how attractive the artwork is to thieves and other criminals

whether the owner is a collector or an investor

whether the artist is living or deceased

the use of contemporary materials or forms

Find out how the emerging threats in the fine art world can impact insurers in this article.

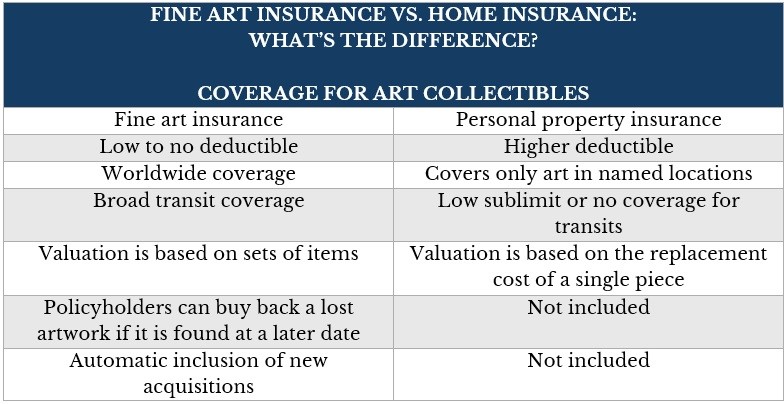

Standard homeowners’ insurance policies provide some coverage for personal property, including artwork. The level of coverage, however, is not as extensive as that of specialist fine art insurance.

High-value items, such as art collectibles, are also handled differently in home insurance policies. Often, the coverage limit is capped at 10% of the total coverage amount. This amount is not enough to provide sufficient coverage for fine art, antiques, and other expensive collectibles.

Here’s a side-by-side comparison of how fine art insurance and the personal property coverage in a standard home insurance policy work when it comes to expensive artworks.

When it comes to specialised art insurance policies, the real value comes with the risk management and mitigation expertise around restoration, transportation, and storage.

“Valuable artwork is most vulnerable when it’s on the move,” according to Huntington T. Block, an operating unit of Aon plc. The Pennsylvania-based insurance agency is also the oldest and largest managing general underwriter of fine art insurance in the US.

Transit losses make up 85% of its claims. “When you think about art, when it’s on a wall on display or in an individual home, the risk of something happening is pretty minuscule. The same cannot be said when an object is in transit,” the agency said.

Andrew Mitchell, fine art underwriter at Hiscox in London, UK, said accidental damage during transit is the most common claim he sees.

“The main driver of fine art claims is accidental damage, rather than any of the sexier crime-based [losses]. And that’s usually something that happens during the course of transit – when you’re moving anything, that’s when you’re at the most risk of dropping, or impact, or loss, or any of those things.

“So, about 50% of our claims come from accidental damage. Unfortunately, that’s just part and parcel of operating in that market with high-value, potentially fragile items.”

What makes art a difficult product to insure is that, by definition, it is always new. Every artist’s mind works differently and therefore every creative product is unique. This exclusivity reveals itself in many ways – through the final product, the materials used, and product placement, just to name a few.

“It is difficult to predict hot trends in the art insurance sector,” said William Fleischer CIC, president of Bernard Fleischer & Sons Inc. “Artists create new art every day, resulting in a constant influx of creative product and the continued growth of the art insurance industry. Artists love working with new materials, and with that comes different risks and exposures.

“These days, a lot of art has moving parts or boards and electronics, so there’s cyber liability to consider. Artwork with electronic parts and Wi-Fi connection could potentially be used as a gateway to a museum cyberattack. Insuring art and technology require thinking outside of the box.”

A great example of a new art trend is AI-generated art. Global auction houses Christie’s and Sotheby’s have both held their inaugural auctions of AI-generated artwork. In fact, Christie’s piece shocked the art world by selling for $432,500, more than 40 times the official estimates.

The AI-generated art trend is creating a lot of interesting questions around the future of art and art insurance.

“Uncertainties around how artwork should be valued, authenticated, and protected are just some of the challenges that art insurers will have to deal with moving forward,” said Claire Marmion, founder and CEO of Haven Art Group.

Our Best in Insurance Special Reports page is the place to go if you’re looking for the top fine art insurance carriers in the country that can provide your clients with top-notch coverage. The companies featured in our special reports have been handpicked by their peers and vetted by our panel of experts as respected and dependable market leaders.

By partnering with these insurers, you can be sure that your clients are financially protected once unexpected disasters occur.

Do you think fine art insurance is worth having? Let us know in the comments.