Top Young Insurance Professionals in Australia |

Rising Stars

This generation of young insurance professionals is equipping its employers with a competitive edge, balancing digital savviness with strong client relationships built on trust and expertise.

“Standing out from the crowd needs to be done not only in person but also through their online presence, so their branding needs to be successful,” says Kirsty Dowell, director at Stellar Insurance Brokers.

The industry expert further highlights that today’s tech-driven young insurance professionals enjoy the benefit of their online upbringing, making their digital brand building less challenging than doing the same task in person.

“They need to have the ability to shine through in both aspects, which is something past generations have never had to navigate,” Dowell adds.

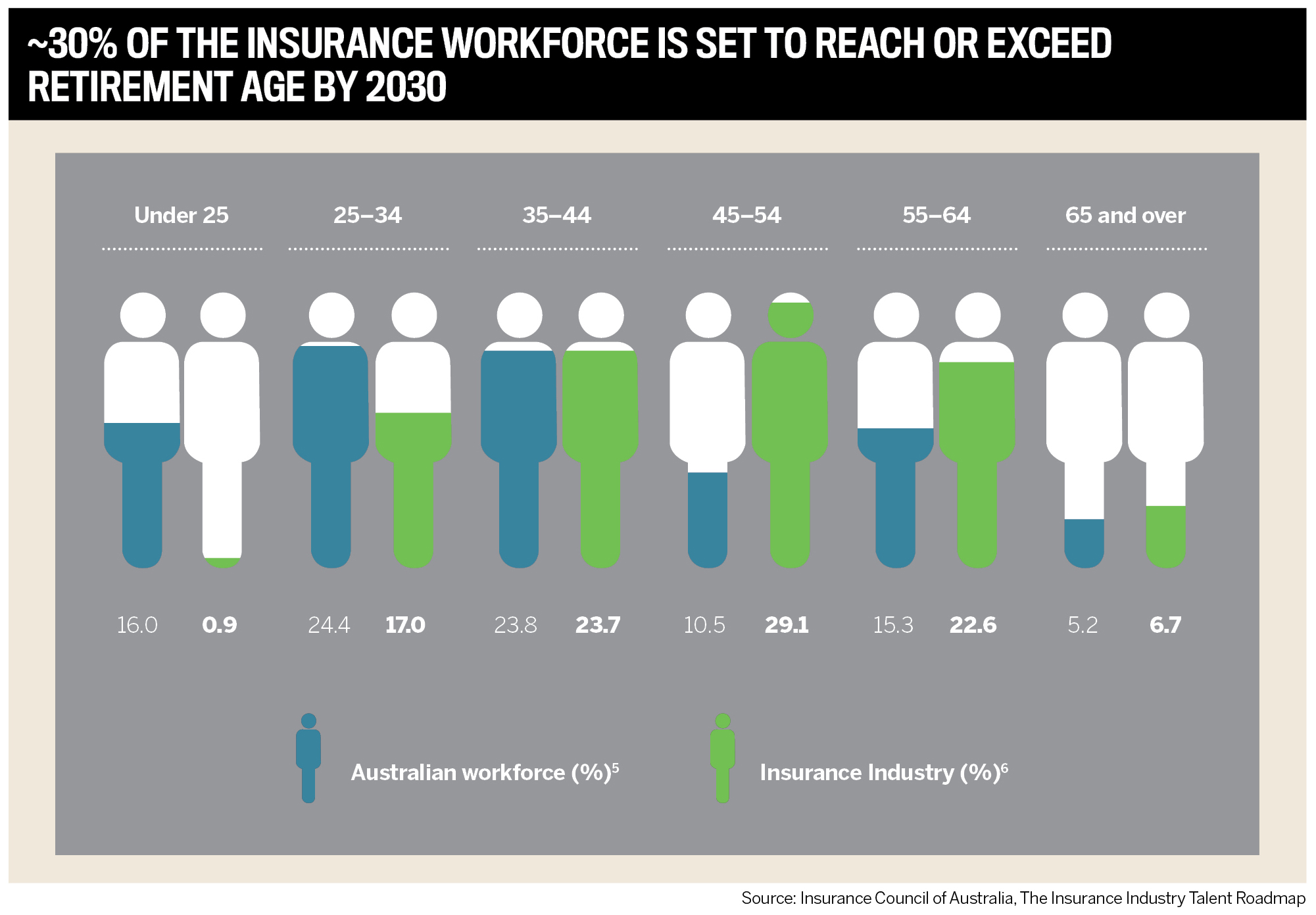

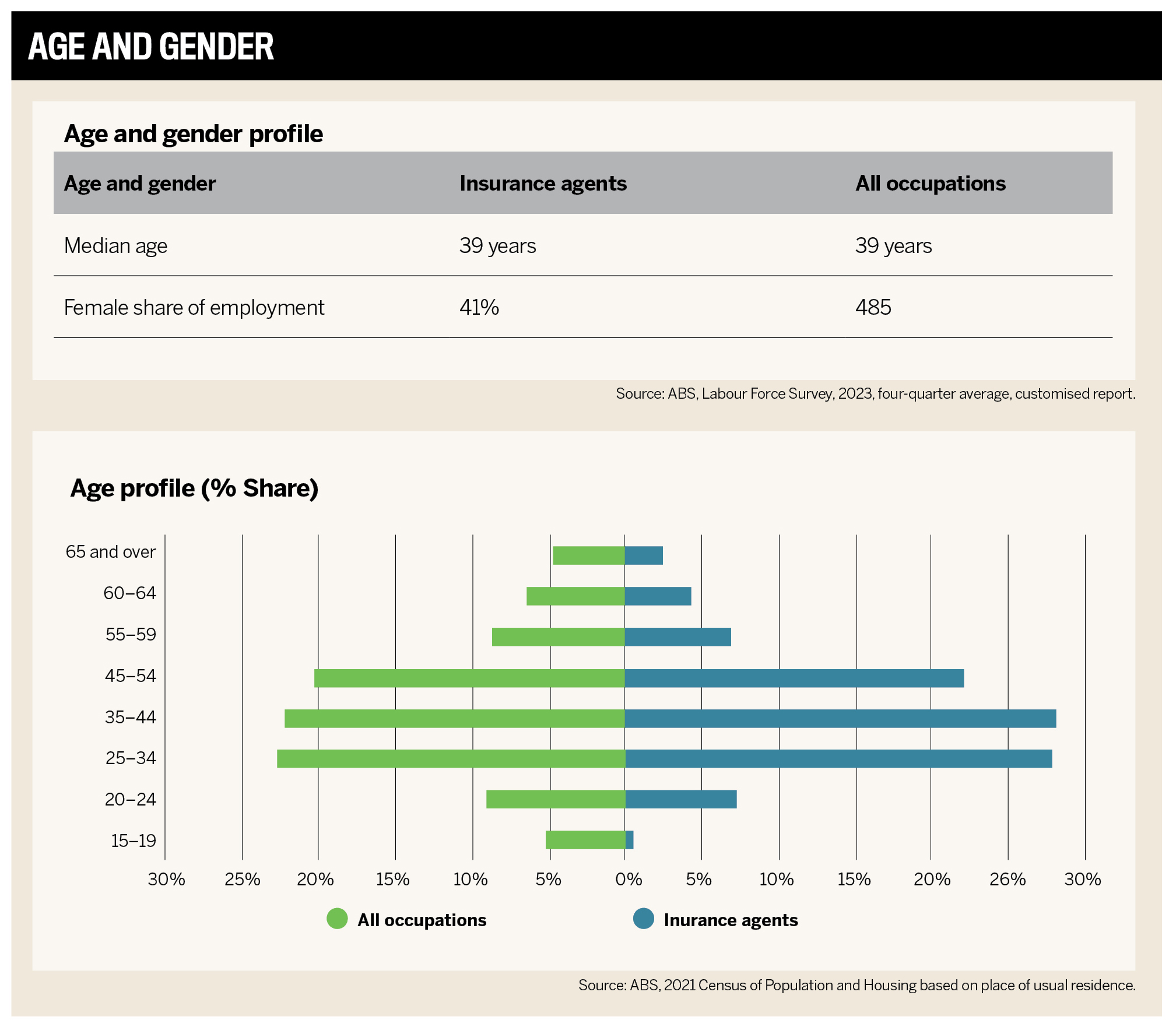

Given that nearly one-third of Australia’s insurance workforce is set to reach or exceed retirement age by 2030, Insurance Business’ Rising Stars of 2024 have demonstrated their potential to play an important role in leading the industry’s transformation, particularly with respect to leveraging advanced technologies.

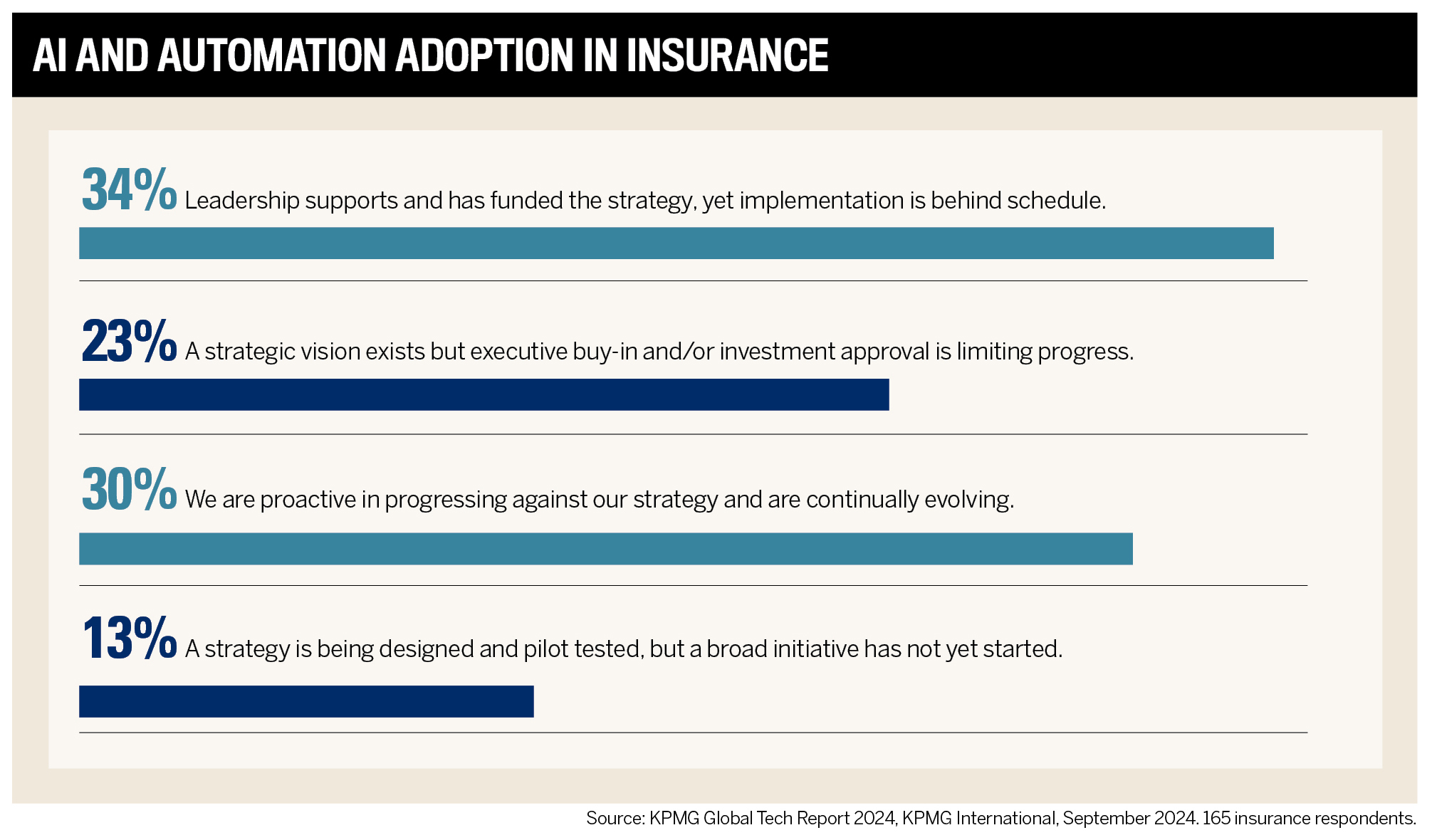

According to KPMG’s international report, Advancing AI across Insurance, organisations are taking a strategic and cautiously optimistic approach to AI transformation.

“We’re seeing significant interest in AI with many insurance organisations trialling proofs of concept within niche areas,” states one of the authors, Caroline Leong, KPMG Australia partner and global insurance claims lead at KPMG International.

“There is still hesitancy around wider deployment, exacerbated by challenges around the speed at which AI is evolving, data quality, bias and regulatory compliance. This has resulted in many businesses taking a measured approach.”

The Advancing AI report also revealed the following:

-

47% of insurance organisations experimenting with AI have set up AI centres of excellence, featuring employees from across the business, compared to the global average of 40%.

-

41% of leaders who are extremely familiar with AI expect to redesign business processes from the ground up with the technology.

-

57% of organisations see AI as the most important technology for achieving their ambitions over the next three years.

-

58% of CEOs said it would take three to five years for Gen AI to provide a return on investment.

-

85% of insurance CEOs believe that Gen AI is a double-edged sword, in that it may not only aid in the detection of cyberattacks but also provide new attack strategies for adversaries.

-

61% of organisations are wary about trusting AI systems, with 84% citing cybersecurity as a top concern.

-

71% of CEOs believe that the lack of current AI regulation within the insurance industry could become a barrier to the organisation’s success.

Dowell points out that the biggest challenge for young insurance professionals over the past 12-18 months has been forging meaningful connections in a post-pandemic world since many started their careers during or after lockdowns.

“The habits and behaviours towards human connection have diminished and changed completely,” she says. “Insurance is a relationship-based industry, with our peers and building rapport and trust with our clients. This can be challenging for young professionals because they either need to step outside their comfort zone to create these relationships or adapt to build meaningful connections with limited or no in-person interactions.”

To identify exceptional young talent for the 10th annual Rising Stars list, IB invited nominations from professionals across the Australian insurance sector. Nominees had to work in roles related to, interacting with, or impacting general insurance and must not have been previously recognised.

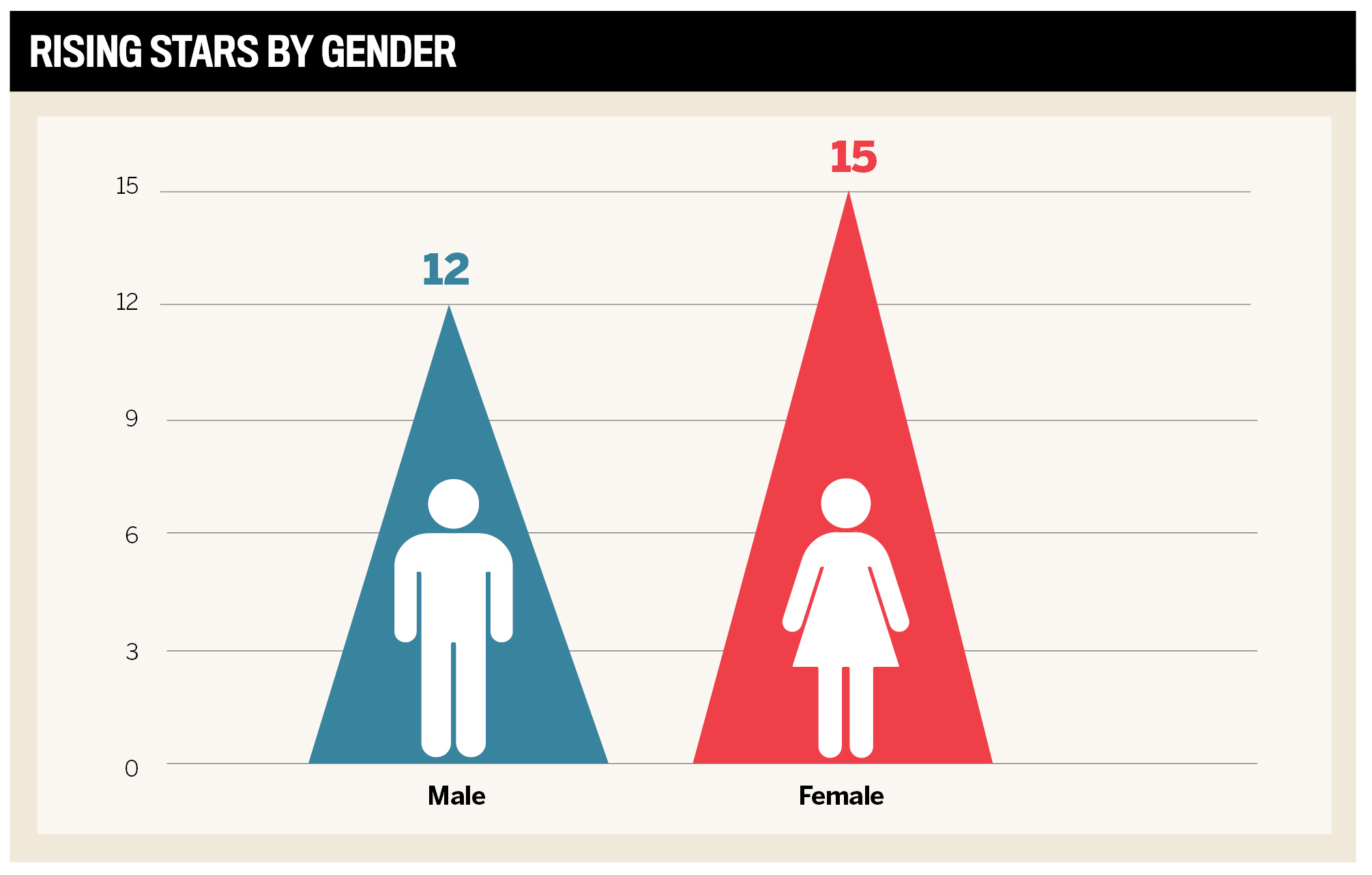

Candidates also needed to be under 35 and committed to a career in insurance with an evident passion for the industry. After reviewing all nominations, the IB team recognised 27 of the sector’s most outstanding young professionals.

2024’s Rising Stars lead insurance evolution

Tech, AI and ESG are becoming increasingly important tools within the insurance industry. IB’s Rising Stars have embraced these trends and incorporated them in their day-to-day operations. Below they offer their insight and how they are leading the future of insurance.

Anita Cheng of Sportscover is actively developing her data analytic skills and participating in projects that integrate AI into their firms’ existing frameworks.

“By contributing to the advancement of AI in our processes, I believe I can play a part in shaping an industry that exceeds customer expectations,” she says. “This change is critical as it will allow insurers to assess risk more accurately, leading to fairer pricing and improved customer satisfaction.”

Arch Insurance Australia’s Nicholas Houseas is another advocate.

He says, “Leveraging data analytics and AI can streamline operations, improve accuracy and enhance the broker and insured experiences. I see myself contributing to this by advocating for adopting innovative technologies within our organisation.”

Also highlighting the importance of Gen AI and how it is rapidly expanding in the industry is QBE/Elders Insurance’s Alisa Louangamart.

“We must ensure that the excitement of this emerging technology is coupled with an understanding of what needs to happen for it to be implemented successfully,” she says. “I see myself contributing to this change by ensuring that customers’ outcomes are central to how we use this and other new tools.”

This is echoed by Leah Giragosian, Arch Insurance Australia, who believes the adoption of AI can enhance customer experiences and streamline claims processing.

“I see myself contributing to this evolution by advocating for and implementing innovative ideas within our processes, ensuring we remain responsive and agile to the needs of our clients in a rapidly changing industry.”

Dismissing any doubts about the adoption of AI, Beau Murphy of Brooklyn Underwriting, underlines how transformative it is.

He says, “The ability to draw from AI to streamline our workloads while still tapping into the subjectivity and analysis that only people can provide is an opportunity that shouldn’t be met with fear or hesitation but a fantastic toolset to build a better foundation for the future. Embracing this change and advocating for the careful adoption of its capabilities is an exciting, near-future change I will continue to champion and believe in.”

Arch Insurance Australia’s Mitchel McDonald emphasises how the D&O insurance sector is witnessing a complex and dynamic environment shaped by shifting regulatory requirements and heightened scrutiny of corporate governance, trends reverberating across various lines of insurance.

“Professionals in this space must understand geopolitics, have advanced financial analysis skills and have a legal background applicable in Australia and internationally,” he says. “I want to advocate for enhanced training initiatives that equip professionals with essential skills and instill a genuine interest in insurance. If we embrace innovation and address the complexities of our industry, we can cultivate an engaging environment that excites the next generation, ensuring the future success and resilience of the insurance sector.”

Tech drives efficiency and performance but can also be leveraged to achieve other goals.

“As a part of our ESG team, I have been involved in a commitment to enhance the sustainability of our supply chain and be full-scope carbon neutral by 2030,” adds CHU Underwriting Agencies’ Mia Wilson. “This goal is being achieved through close collaboration with our builders and suppliers to improve practices in waste management, fleet emissions, electricity usage and material usage. I aim to advocate for broader environmental goals and align insurance industry practices by participating in this initiative.”

While Gallagher Bassett’s Michael Charalambous is committed to integrating holistic, inclusive support for injured workers within the company’s return-to-work (RTW) services, ensuring its approach addresses each aspect of an injured worker’s journey back to health and productivity.

“I see myself driving initiatives beyond traditional RTW measures, advocating for policies supporting a more balanced, comprehensive recovery process,” he says. “By championing such initiatives, I aim to set a new standard in the industry that leads to better outcomes for workers and employers.”

Young insurance professionals drive innovation

While 2024’s Rising Stars have made impactful contributions to the insurance sector, IB profiles eight winners across three subsets:

-

client-centric claims and service excellence

-

leadership and team building

-

expertise in underwriting and technical knowledge

Those profiled, along with all the Rising Stars, exemplify the innovation, leadership, and dedication driving the industry forward.

Client-centric claims and service excellence

Age: 24 | Claims consultant

A passion for teamwork and dedication to providing exceptional customer service over and above her daily responsibilities in managing personal accident claims has earned her recognition within the professional community.

Cheng believes emotional intelligence is essential to understanding client needs and building strong relationships, underpinning her success.

“As clients increasingly seek personalised service, my ability to empathise and connect with them will enhance their experience and build a trusting relationship,” she says.

“Strategic thinking is vital, too, as the industry faces rapid changes due to technology and shifting consumer expectations. I’m working on this by participating in workshops and seeking advice from experienced mentors who can provide insights on long-term planning and decision-making.”

By developing leadership qualities, Cheng aims to create a more responsive and sustainable future for the industry, helping her organisation better meet client needs and navigate the fast-moving insurance sector.

“… increased use of AI and data analytics in underwriting and claims processing, as it will allow insurers to assess risk more accurately, offer fairer pricing and improve customer satisfaction”

Anita ChengSportscover

While managing a recent complex personal accident claim involving a claimant athlete being rendered quadriplegic, she assisted the family after hours. That proactive communication with all stakeholders enabled the timely processing of a significant capital benefit payment.

“Maintaining an empathetic approach is important in claims management and especially in insurance because that demonstrates the meaning of insurance and delivering the best help as much as we can,” Cheng adds.

She balances empathy with the complexities of her role, communicating updates and providing straightforward explanations of the claims process to ensure clients feel informed and supported.

“In the recent quadriplegic case, I took the time to understand what this vulnerable family was going through,” she says. “I listened to their concerns and kept them updated regularly.”

Cheng often assumes a mentorship role, sharing her expertise and collaborative approach to guide less experienced colleagues through complex cases that prioritise efficient and accurate claims management and processing.

Age: 32 | Claims handler, accident and health

While managing corporate travel, accident, and health claims, Giragosian’s leadership potential came to light.

“I’m focused on developing several leadership qualities and skills that I believe will be important in shaping the insurance industry’s future,” she says. “Building strong relationships with clients and team members fosters a supportive environment and leads to increased engagement and better communication.”

To understand client needs, Giragosian is committed to enhancing communication to:

-

provide transparent information

-

set realistic expectations

-

improve client satisfaction

She has also been instrumental in creating service-level agreements and is frequently called upon by underwriters to educate brokers on the company’s accident and health claims process and products.

“… the adoption of AI to enhance customer experiences and streamline claims processing”

Leah GiragosianArch Insurance Australia

Giragosian promotes a culture of feedback, encouraging team members to share their ideas and concerns, fostering collaboration and trust.

In addition, she created a flyer to clearly outline Australia’s Medicare legislation and its implications for personal accident and sickness policies, providing clients with crucial information that helps set realistic expectations for claims and facilitates a smoother claims review process. It also minimises potential complaints, fostering better client relationships and customer experience.

Keen to assist new staff in settling into their roles, she also developed a training manual on systems and claims processes.

“The training manual was created to streamline our internal process at Arch and enhance the onboarding experience for new staff members,” she says. “My experience in previous leadership roles inspired me to create these educational resources when starting at Arch. I strive to analyse and refine existing workflows, ensuring efficiency and clarity for all team members’ understanding our internal processes when managing a claim end-to-end and the importance of compliance with claims management procedures.”

Leadership and team building

Age: 35 | Team manager

Charalambous has stood out for making a positive difference in improving recovery and RTW outcomes for the Victorian Department of Education, one of the region’s largest employers. His inclusive and innovative leadership style promotes teamwork while pushing for better results.

“Balancing team wellbeing with recovery challenges is key to delivering our best to clients,” he says. “My approach centres on clear communication, role clarity and structured development to foster an inclusive, supportive culture that strengthens team morale and our capacity for effective RTW solutions.”

His greatest strength lies in an ability to forge personal connections with people and unite them towards a common goal. Moreover, he actively supports his team’s wellbeing, creating a supportive and welcoming workplace where everyone feels valued.

“… a stronger emphasis on holistic, inclusive support for injured workers, encompassing mental, emotional and physical recovery”

Michael CharalambousGallagher Bassett

This commitment has boosted team morale and retention rates, earning him respect from colleagues and the senior leadership team. As one RTW specialist from the Victorian workers’ compensation team notes, Charalambous’ leadership skills make coming to work enjoyable, illustrating his impact.

He is focused on advancing his stakeholder management and strategic thinking skills, particularly in relation to team performance and client service outcomes.

He says, “These skills are vital for fostering a high-performance culture that resonates with the ‘Gallagher Way’ values. By enhancing these capabilities, I can contribute to a future where our industry leads in operational excellence and client service standards.”

Age: 29 | Direct portfolio team leader

Wilson leads a skilled team of customer service agents and underwriters that serve the company’s direct customer base, motivating her team to excel while overseeing underwriting and risk approvals, ensuring decisions align with the overall risk strategy.

“I’m working through an MBA and focused on enhancing my adaptability and strategic decision-making skills,” she says. “The ability to respond proactively to industry shifts and emerging challenges is essential, so equipping myself with the expertise to make sound and agile decisions is key.”

Acknowledging that ethical standards and accountability are foundational in shaping the industry’s future, she notes that balancing customer-centric innovation with profitability is more important than ever. She fosters innovation by empowering her team to explore breakthrough ideas.

“… the insurance industry embraces sustainability as a core principle, integrating environmental impact into its operations and partnerships”

Mia WilsonCHU Underwriting Agencies

Wilson is also involved in several initiatives vital to how the company will adapt to change in the coming years. One such project taps into her underwriting knowledge and direct customer experience as a subject matter expert in developing a new insurance product addressing the industry-wide concerns of underinsurance and non-insurance.

She led the project from a coverage and risk perspective, providing insights into the wants and needs of potentially vulnerable subsets of communities.

“Through working with lot owners, I saw firsthand that some traditional insurance policies can fall short of the nuanced needs of vulnerable populations,” she says. “Underinsurance in these areas stems from cost barriers and limited access to tailored information and education around coverage options. Vulnerable communities face unique challenges and require unique solutions and cover. However, standard approaches can overlook specific circumstances.”

Her view is that developing more individualised, accessible and affordable insurance options will help mitigate risks by allowing access to adequate cover while also encouraging greater financial resilience for these communities.

Expertise in underwriting and technical knowledge

Age: 25 | Underwriter, executive assurance

A varied background in claims services, financial lines broking and underwriting has given McDonald a broad perspective in finding solutions for his client’s needs.

An insatiable curiosity to understand all aspects of his work has enabled his potential to shine through. He has built a reputation for tackling complex and time-consuming cases, ensuring detailed risk assessments and the best outcomes for brokers and insureds.

“My drive to uncover the ‘why’ behind insurance is rooted in a commitment to professional excellence,” he says. “I ask specific questions to understand how products work, allowing me to make informed decisions. This curiosity enables me to find solutions that benefit clients and my employer.”

“… the elevation of industry standards through comprehensive training and tailored accreditation that align with the evolving global insurance landscape”

Mitchel McDonaldArch Insurance Australia

Collaborating with industry experts and colleagues, as well as staying updated on market trends, has enabled him to look at products through multiple lenses, giving him an edge on identifying opportunities. This makes it easier to anticipate potential challenges.

“Immersing myself in complex risks pushes me out of my comfort zone,” he says. “Having this focus broadens my knowledge and improves my ability to navigate complicated situations. I am also honing my communication skills, particularly in fostering a strong team dynamic and engaging with my colleagues on how I can add value or provide guidance.”

McDonald adds that sharing knowledge encourages collaboration and innovation. His openness to discussing complex risks improves problem-solving and better meets evolving client needs.

Leading by example, he prides himself on being accountable and fosters a culture of continuous learning and ownership as he strives to build a team dynamic that can navigate any challenges.

Age: 32 | Assistant underwriter, property

Managing a diverse portfolio of accounts in the property division has enabled his technical expertise and client-centric focus to come to the forefront. That, along with a commitment to providing positive outcomes for brokers and the company, has earned him a reputation as a trusted professional.

He also serves as the lead contact for general property inquiries from brokers who have acquired accounts through Letters of Authority. His knowledge of property insurance products and straightforward communication have led him to be regarded as a reliable resource.

“As the lead contact for property inquiries, maintaining trust and reliability with brokers is paramount, as they are front of mind,” he says. “Taking a proactive approach to broker relationships ensures regular touchpoints that go beyond transactional interactions.”

“… greater use of technology such as data analytics and AI in underwriting and claims processing to enhance the experiences of brokers and insureds”

Nicholas HouseasArch Insurance Australia

That commitment to exceptional service highlights his responsiveness, reliability and solution-oriented mindset when he provides:

-

swift feedback on submissions

-

innovative coverage solutions

-

technical expertise

Houseas is currently focused on enhancing his strategic thinking and emotional intelligence to enable him to anticipate industry trends better and align the company’s initiatives with broader market dynamics, helping to drive innovation.

He says, “These qualities will allow me to lead with vision and empathy and help to shape a more responsive and adaptive industry that meets the evolving needs of clients and partners.”

Innovation and operational improvement

Age: 32 | Risk and compliance specialist

As a team leader in the company’s shift towards a more customer-centric model, Louangamart optimises and simplifies operations.

“I’m grateful to leaders in QBE and Elders Insurance who have given me opportunities to learn and grow within the company, as one of my career goals that will never change is to keep learning from peers and inspiring leaders as everyone brings their own unique style, experience and skills to the table,” she says.

“My focus is on developing strategic thinking skills and understanding risks to better navigate the rapid industry changes. As the industry evolves every day with technology and customer experience in mind, I believe resilience through transformation is essential.”

“… Gen AI streamlines day-to-day tasks across the industry, provided it is properly curated, tested and delivers valid outcomes”

Alisa LouangamartQBE/Elders Insurance

One of her proudest accomplishments was partnering with colleagues to recruit and onboard into her underwriting team individuals from the company’s shared services centre from QBE and Elders’ office in the Philippines and seeing the direct impact they bring.

“The most rewarding aspect is seeing them learn something new and working closely with their people leader and onshore team every day,” she says. “Witnessing these positive changes has reinforced my commitment to a collaborative and inclusive leadership approach, where listening and responding to feedback plays a critical role.”

Louangamart is also credited with improving customer engagement by implementing a real-time chat function within Microsoft Teams, enabling underwriters and operations team members to respond promptly to customer inquiries.

Age: 29 | Underwriter – financial lines

Insurance followed a successful academic journey of an undergraduate degree in international relations and mass communication and a master’s degree in international relations.

His studies also included a dissertation on high-level business relationships between Australia and South America while doing internships around reshaping views on Chinese foreign policy and asset-based community development.

Murphy currently underwrites PI, ML and cyber policies after acquiring work experience with several large insurers.

“Having researched international relations and continually educating myself post-graduation, it has allowed me, as an underwriter in a globalised world, to be conscious of the unimaginably complex tentacles of consequence that every risk has snaking through it,” he says.

“This in-depth research experience has enhanced my underwriting lens with a hyper-sensitive awareness that a domino effect in one region affects another, such as through sanctioned exposures, supply chain woes and cyber interconnectivity.”

“… AI doesn’t have to build the house, but it can be the toolbox from which we all draw. Embracing this change and advocating for its careful adoption is an exciting, near-future change I will continue to champion”

Beau MurphyBrooklyn Underwriting

As a new generation of leaders steps up, Murphy asserts that adaptability is the key trait.

“Every generation has dealt with changes, such as the move to the internet,” he says. “Now, those changes are supercharged with so many issues, from AI and how it will interact with all our roles to how customers interact with us and their expectations. The next generation of leaders will need flexibility and adaptability to roll with these changes for the industry as a whole.”

In a dynamic era marked by rapid change and evolving challenges, the identification and nurturing of exceptional talent have become paramount. We firmly believe that IB’s Rising Stars encapsulate the essence of expertise, visionary leadership and transformative thinking. These qualities not only propel individuals to new heights but also serve as catalysts for the resilience of the entire insurance sector.

The team at AXA XL is excited about the opportunity to play a pivotal role in recognising and supporting the Rising Stars, who are poised to make a significant impact on our industry. We are excited to play a part in encouraging curiosity and propelling their promising careers.

Catherine Carlyon

Catherine Carlyon Country Manager, Australia

AXA XL

Top Young Insurance Professionals in Australia | Rising Stars

- Adriana Rey

Growth Marketing Specialist

BizCover for Brokers - Christie Lappin

Chartered Loss Adjuster

Crawford and Company - Claire Finch

Regional Manager – Sydney Metro

Aon Australia - Claire Lees

Senior Loss adjuster

McLarens - Dilasha Kumar

Executive Advisor

Hollard Insurance Australia - Dion Owens

Senior Account Executive, Energy and Power

Marsh - Gareth Downie

Account Manager

PSC Insurance Brokers - Jasmine Miller

Director

Saltwater Insurance Solutions - Kirsty Macleod

General Manager

Knightsbridge Insurance Group - Michelle Morrissey

National Claims Manager

Underwriting Agencies of Australia - Mitchell Campbell-Grey

State Claims Operations Manager – Victoria and Tasmania

Underwriting Agencies of Australia - Nikola Hrnciarova

Financial Lines Underwriter

DUAL Australia - Rachel Hardy

Claims Specialist – Casualty

AXA XL - Richard Davies

National Manager – AR Network and Partnerships

McLardy McShane Insurance Brokers - Sam Rich

Technical Specialist

Allianz Australia - Stephen Christie

Loss Adjuster

McLarens - Steven Rickert

IT Operations Manager

BizCover - Travis Saxby

Manager, Claims

TIO MAC - Tristen van Rhoon

Risk Adviser

omnisure

Insights

Methodology

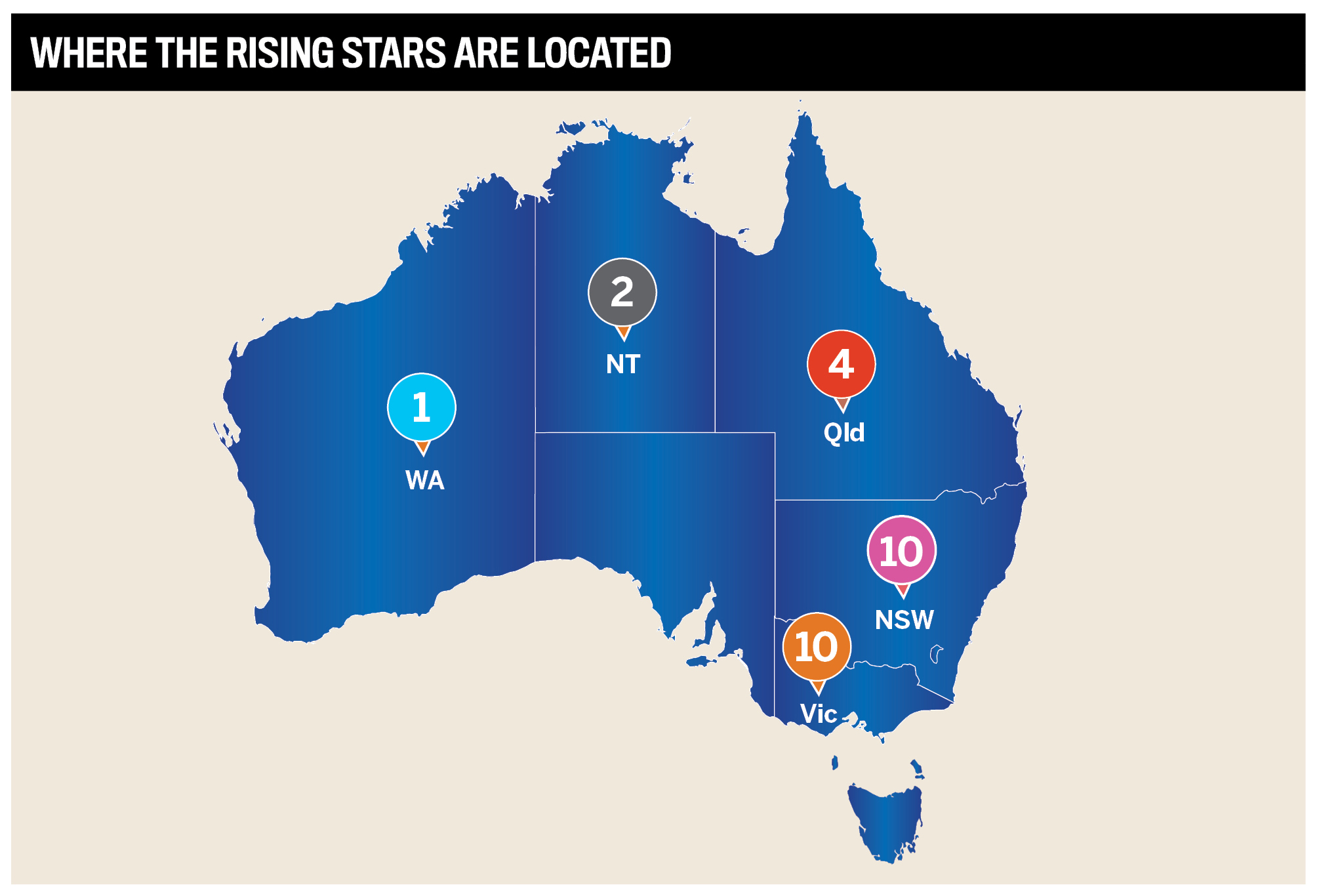

In July, Insurance Business invited professionals from across the Australian insurance sector to nominate their most exceptional young talent for the tenth annual Rising Stars list. Nominees had to be age 35 or under (as of 31 October 2024) and working in a role that related to, interacted with, or impacted the general insurance industry, and have never been previously recognised as Rising Stars or Young Guns. Nominees must have committed to a career in insurance with a clear passion for the industry.

Nominees were asked about their current role, key achievements, career goals and contributions to the shaping of the industry. Recommendations from managers and senior industry professionals were also considered. The Insurance Business team reviewed all nominations, narrowing the list down to 27 of the sector’s most outstanding young professionals.

The 2024 Rising Stars report is proudly sponsored by AXA XL.

Keep up with the latest news and events

Join our mailing list, it’s free!