The Best Insurance Brokers in Australia

Jump to winners | Jump to methodology

Brightest in the business

Client feedback is the measure of a broker’s performance and justifies why Insurance Business Australia’s Top Insurance Brokers are the industry’s standout operators leading the charge.

In its second annual search for the best insurance brokers who act in their clients’ interests, IB conducted a rigorous marketing and survey process.

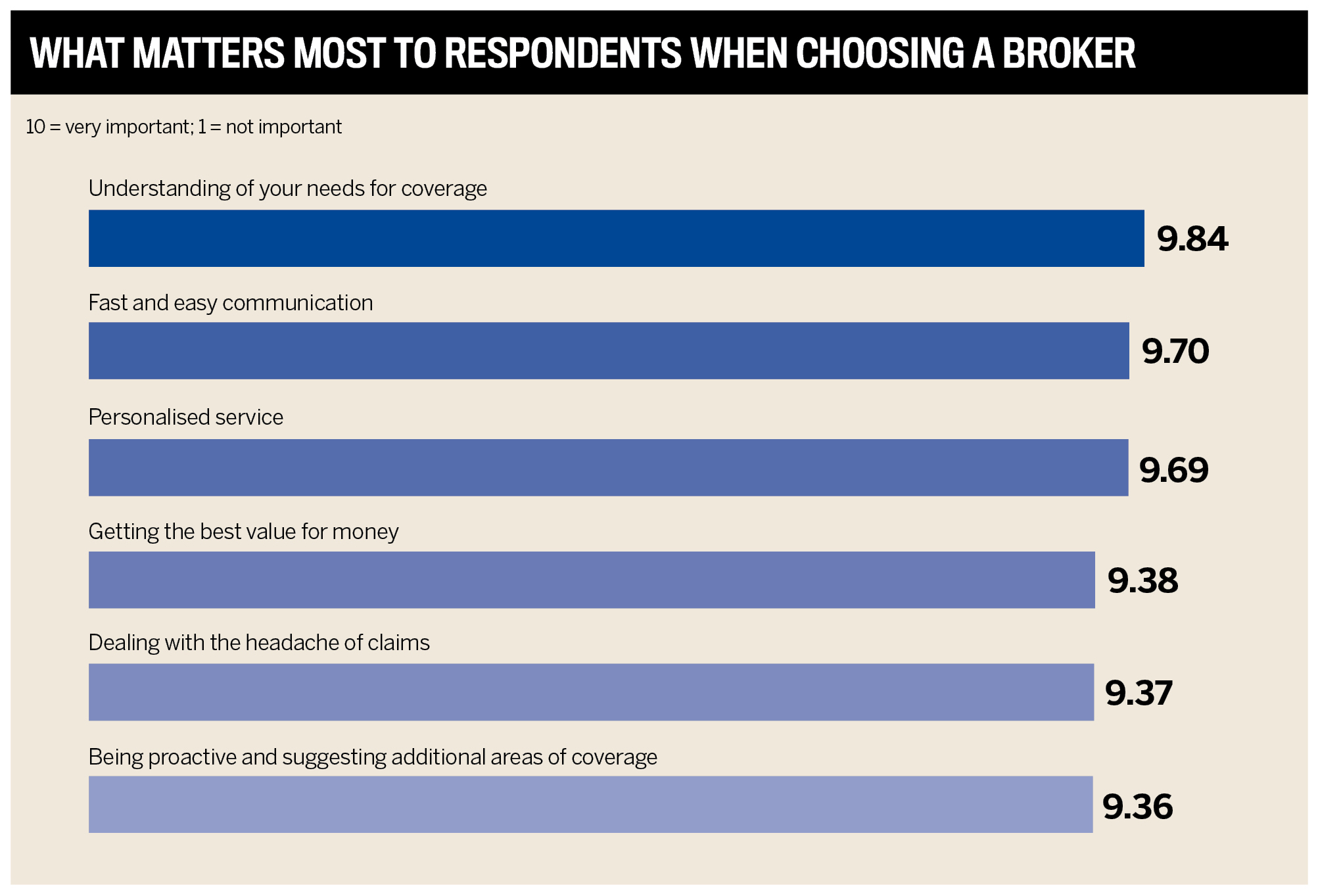

The IB team asked thousands of readers nationwide to nominate their brokers and rate them on six criteria, including personalised service and understanding of coverage needs.

The most voted-for brokers that received an average score of eight or higher out of 10 were named Top Insurance Brokers, recognised for their exceptional client service.

IB’s survey data shows that clients value knowledgeable brokers who are quick to respond, proactive and genuinely interested in their wellbeing.

Industry experts: best insurance brokers go the extra mile to build trust

Top-performing brokers forge trusting relationships that make clients feel valued, heard and understood.

“Brokers that still enjoy face-to-face interactions with clients are rarer than ever, and they stand out at interviews,” says Madeleine Martin, Fuse Recruitment’s national manager, insurance and wealth management. “Top-performing brokers are willing to go the extra mile and spend time with their customers to truly understand their businesses and the risks they face as a trusted business advisor.”

Stuart Freeman, director of growth at recruitment firm Kennedy, also mentions that apart from industry qualifications, the best broker candidates have a track record of getting to know their clients well.

“I look for people that are really good listeners, and I think it’s got to be someone passionate about going out and spending time with their clients,” he says . “They get to know their client’s business on an intimate level. It’s about putting yourself in the client’s shoes. As the broker, it’s about putting the client first.”

Vero Insurance’s head of distribution, Anthony Pagano, emphasises that top brokers offer customers a personal, transparent experience by acting in good faith and balancing risk advice with their best interests.

“Going above and beyond and demonstrating knowledge in specific industry segments sets brokers apart,” he says. “They also need to maintain a full-service relationship with their clients, from placement to policy maintenance and claims management.”

Cynthia Yap, managing director at Dynamic Insurance Services, highlights that the best insurance brokers possess strong technical expertise, a client-centric focus, ethical conduct and the following:

-

deep understanding of the insurance products they offer

-

proactive communication with clients, anticipating changes in risk and adjusting coverages as needed

-

integrity and transparency, ensuring clients understand the policies they are purchasing and feel confident in their broker’s recommendations

-

a commitment to continuous learning as the industry constantly evolves with regulatory changes, emerging risks and technological advancements

-

strong negotiation skills to secure the best deals and terms for clients while maintaining profitable relationships with insurers

Kellie D’Arcy, director at Australian Elite Insurance Solutions, points out that fast turnaround time on claims, clear communication, excellent product knowledge and strong insurer/broker relationships are essential for standing out.

IB proudly highlights 24 accomplished insurance brokers for their passion, dedication and commitment. Two of the best share insights into their service philosophy and success.

Personal touch sets best insurance brokers apart

Wilson founded the Horsham, Wimmera brokerage in 2013 to meet local demand among small and medium-sized businesses for enhanced insurance options.

Offering unparalleled client service was of utmost importance, particularly for farmers, about whom she has a soft spot and admiration for the work they do to sustain communities.

Today, Wilson serves clients nationwide, tailoring insurance solutions to their unique business, home and family needs. She regards this as a way of giving back.

“As brokers, we do a lot of what we call pro bono work,” she says. “All our advice and quotations are free of charge with no obligation whatsoever. Even advising others is comforting, knowing that we’ve educated them, opened their eyes to what can happen or helped them protect themselves better.”

Abbie WilsonNational Insurance Brokers

Wilson’s commitment to her clients has led to a record-breaking year in 2024, despite recent industry challenges. She was honoured as one of IB’s Top Insurance Brokers and earned a finalist spot for NIBA’s Broker of the Year award for Victoria and Tasmania. Additionally, she was recognised as IB’s Elite Broker and Elite Woman for two consecutive years.

Wilson attributes her success to her clients’ trust in her qualified advice. An example of her proactive approach came earlier this year when a claim was fully declined.

“Through persistence, investigation and tough conversations with all parties, we got it overturned, and the client was paid,” she says. “It took four months of daily effort and was mentally exhausting. The client admitted they never understood the true value of a broker until that moment, which changed their view of brokers and insurance.”

As a brokerage owner, Meyer takes on multiple roles, including broker, claims manager and advice provider.

She hired a full-time assistant in 2022 to handle back-end processing and administrative tasks, allowing her to focus more on building client relationships.

“I enjoy doing what I do because I get to help people, and insurance is one of those things that’s super complicated, even for brokers to understand sometimes,” she says. “I love talking to clients who have put insurance last on their list because they’ve been dreading the conversation, and, in the end, they thank me and say I’ve made it easy.”

Meyer’s work is driven by a personal family connection to the National Disability Insurance Scheme (NDIS), which fuels her passion for the allied health space.

Laura MeyerMeyerInsure

In addition, she specialises in professional indemnity, management liability, cyber insurance and consultancy coverage, areas where she feels a sense of accomplishment by ensuring the most vulnerable are protected and businesses are set up for success.

Client service and satisfaction remain central to Meyer’s approach, as she continuously improves her knowledge and skills to ensure clients are informed and empowered to make the correct coverage decisions.

“It’s important to me to help educate my clients because getting insurance right is crucial,” she says. “The fact we can be the translator is important, too, and we must be able to communicate well with our clients.”

Meyer’s tenacity and problem-solving skills have significantly impacted her clients.

“Recently, I had a large hail claim where underinsurance was an issue,” she says. “I worked closely with the assessor and the claims handler to find ways to lessen the blow. It took a lot of communication, advocacy and explanation, but we achieved a good outcome.”

Best insurance brokers excel at communication and responsiveness

IB’s survey respondents rated fast and easy communication as a top priority in what they appreciate most in brokers.

Clients shared feedback on what makes a difference, including:

-

“Always responds to emails and phone calls in a timely manner”

-

“Are contactable at all times”

-

“They must be able to translate information in a way we can easily understand what is needed, why, and willingness to help minimise filling out documents”

For Wilson, keeping communication lines open builds trust and ensures clients feel comfortable sharing all the details needed to help them effectively.

“My clients can always reach me; I’m active on social media, and they all have my direct number, knowing that they can contact me 24/7, which is something I stress from the first interaction,” she says. “A broker should be there for you, especially when things go wrong.”

As the face of her business, Meyer leverages various technological tools to make it as easy as possible for clients to reach her, including:

-

an auto-reply on emails confirming receipt and informing the sender their message is being triaged promptly

-

an appointment calendar on the website

“At first, I was a bit concerned that this might make me appear less accessible, but I’ve received good feedback from people, and they can still call me if they need to,” she says.

Clients highly value personalised service

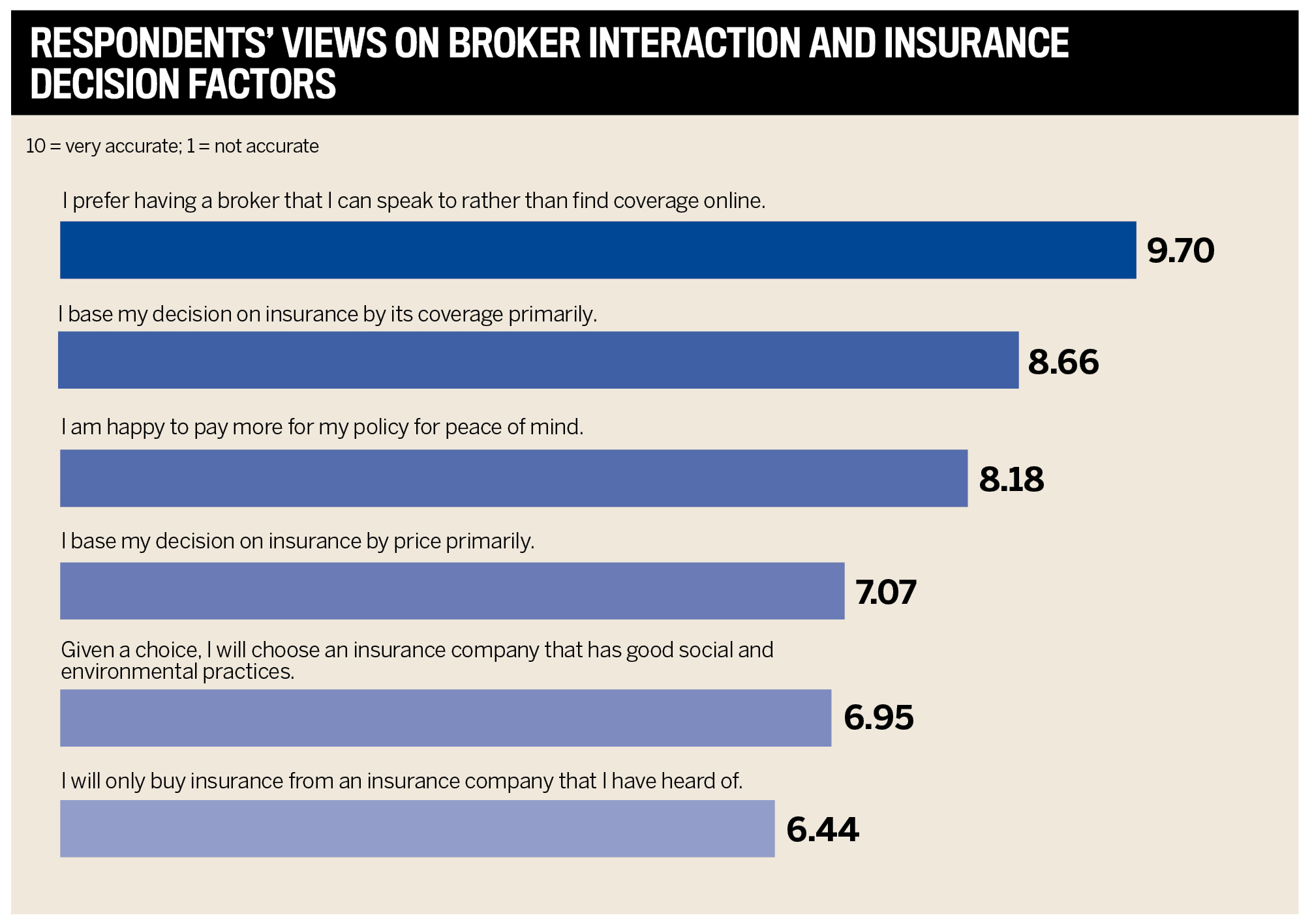

Respondents prioritise personalised service, comprehensive coverage and peace of mind over cost, underscoring brokers’ interaction and guidance in helping clients make insurance choices.

Survey respondents stated:

-

“I want my business broker to treat me like a human being, not a number”

-

“Taking the time to learn and understand my needs and then provide a tailored solution”

In October 2024, Wilson noticed a shift in clients using brokers instead of direct or online insurers. She believes they recognise the value of qualified advice. Her TikTok launch enables her to chat casually with people about life and insurance, which often turn into serious conversations and meetings.

“I don’t criticise online markets, but I do highlight what they can’t offer, and that’s qualified advice,” she says. “I ask people to consider a question: What if something happened yesterday? Would your policy respond? What are your expectations? That’s powerful because it makes them think about real scenarios and seek proper advice.”

Meyer prioritises face-to-face conversations whenever possible, but with clients across Australia, video meetings are the next best thing to put that all-important face to a name.

She says, “It helps to make it personable and to establish a rapport and be friendly with someone. It’s about talking about their business and what and how they’re doing it. This helps me understand their business and approach to risk and risk tolerance.”

Meyer emphasises that listening is just as essential, along with asking good questions and signing up for clients’ newsletters to stay across areas important to them to identify potential gaps or coverage issues.

Ensuring clients receive proper coverage hinges on expertise

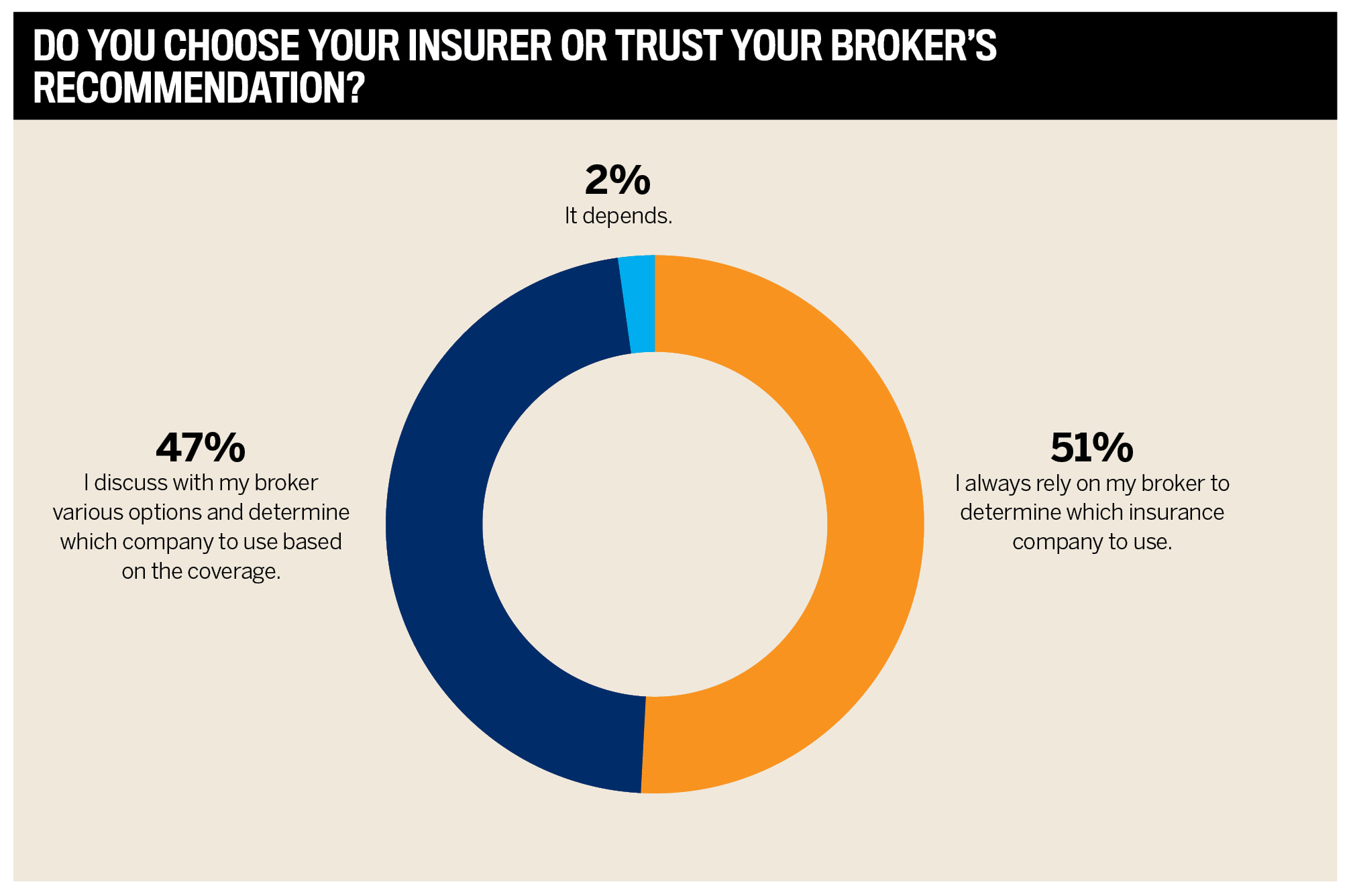

IB’s data shows that a majority of respondents place significant trust in their brokers’ expertise, indicating clients’ reliance on them in choosing the appropriate insurer for their needs.

Survey respondents highlighted:

-

“Helps me find covers for my business ventures and explains the covers required and optional covers that others in my industry also take out; provides me with reports and risk mitigation suggestions to reduce my overall exposure”

-

“Knowing my industry and how else I can protect all my assets without asking”

-

“Helping me save on premiums when times are hard and increasing the scope of cover when times are good”

The best insurance brokers are typically insurance nerds, asserts Wilson. She notes she constantly stays abreast of changes, trends and news risks, such as lithium battery issues on electric vehicles.

“If we can’t prevent a risk entirely, we need to adapt our policies and services to handle it,” she says. “We have to embrace change and prepare for the unknown. There’s always something new around the corner, and we must be ready for it.”

Staying informed is par for the course for Meyer, who adds that maintaining compliance with requirements is an ongoing effort. She attends industry webinars, reads industry-specific newsletters and keeps in touch with insurers and other professionals on social media.

“If something comes across my desk that triggers something about a particular client, I’ll get in touch with them straight away,” she says. “I always have my insurance brain on.”

Honesty and integrity central to client interactions

Clients trust what they deem to be honest brokers, according to comments made by respondents:

-

“He completed the review of the policies and advised me to stay with the current insurer and broker as they were in the right home. He gave an honest opinion and didn’t try to win the business for the sake of himself”

Wilson insists there’s no room for sugarcoating in the industry.

“I always put myself in the client’s shoes and think about what I would expect,” she says. “It keeps me grounded, honest and transparent, resulting in strong integrity.”

Integrity is a core value that Meyer holds dear.

She says, “If I say I’ll do something, I do it. I tend to attract clients who align with my values because they know I’m focused on doing the right thing, even if it means putting in work hours without compensation.”

What does the future look like for the best insurance brokers?

According to leading industry experts, human connection and personalised service in the insurance broking industry will endure even amidst technological advancements.

Pagano: “Brokers are more important than ever, especially regarding advice, because clients do not know what they do not know. They will continue to play an integral role in the support and success of a client’s business to ensure that business assets, people, and livelihoods are protected.”

Yap: “Their ability to combine technology, specialisation and human connection will shape the future of leading brokers. My leadership experience emphasises that brokers who balance innovation, industry expertise and client empathy will remain indispensable in the evolving insurance landscape.”

Martin: “With emerging technologies playing a part in how broking will operate, we still firmly believe that insurance brokers are as valuable as ever. The need for a broker to understand a client’s needs and provide a best-in-market solution hasn’t been replaced by technology. The claims process is also incredibly important to the overall customer experience. While technology can enhance the customer experience, it cannot provide the reassurance of a proactive and empathetic broker during a customer’s time of need.”

Freeman: “I think broking will always have a human element. So, how might that change going forward? I believe accessing information for brokers and consumers now is easier with AI and comparative websites. I think the brokers I see continue to do well year after year; it’s really about the level of intimacy they have with their clients. They don’t take their clients for granted and continue spending a lot of time with them.”

The Best Insurance Brokers in Australia

- Aimee Hendersen

Grace Insurance - Austin Rosier

omnisure - Ben Van der Merwe

omnisure - Charles Tame

Australian Building Services Insurance Brokers - Daniel Webber

Webber Insurance Services - Dean Kennedy

Cruden Read - Frans Du Plessis

Grace Insurance - Heather Coutts

Capstone Insurance Brokers - Jen Bettridge

Clear Insurance - Matt Whitley

PSC Insurance Brokers - Matthew Bates

Bell Partners Insurance - Michael Sims

Marsh - Murray Johnson

Johnson Insurance Brokers (AR of Phoenix Insurance Brokers) - Samer Hamdan

Coverforce - Simon Gray

Planned Cover - Taela Bloemers

Status Insurance Brokers - Teighan Carr

Honan Insurance Group - Tiahna McDonald

Clear Insurance - Yuvi Singh

Global Insurance Solutions - Zoe Evans

Gallagher

Insights

Methodology

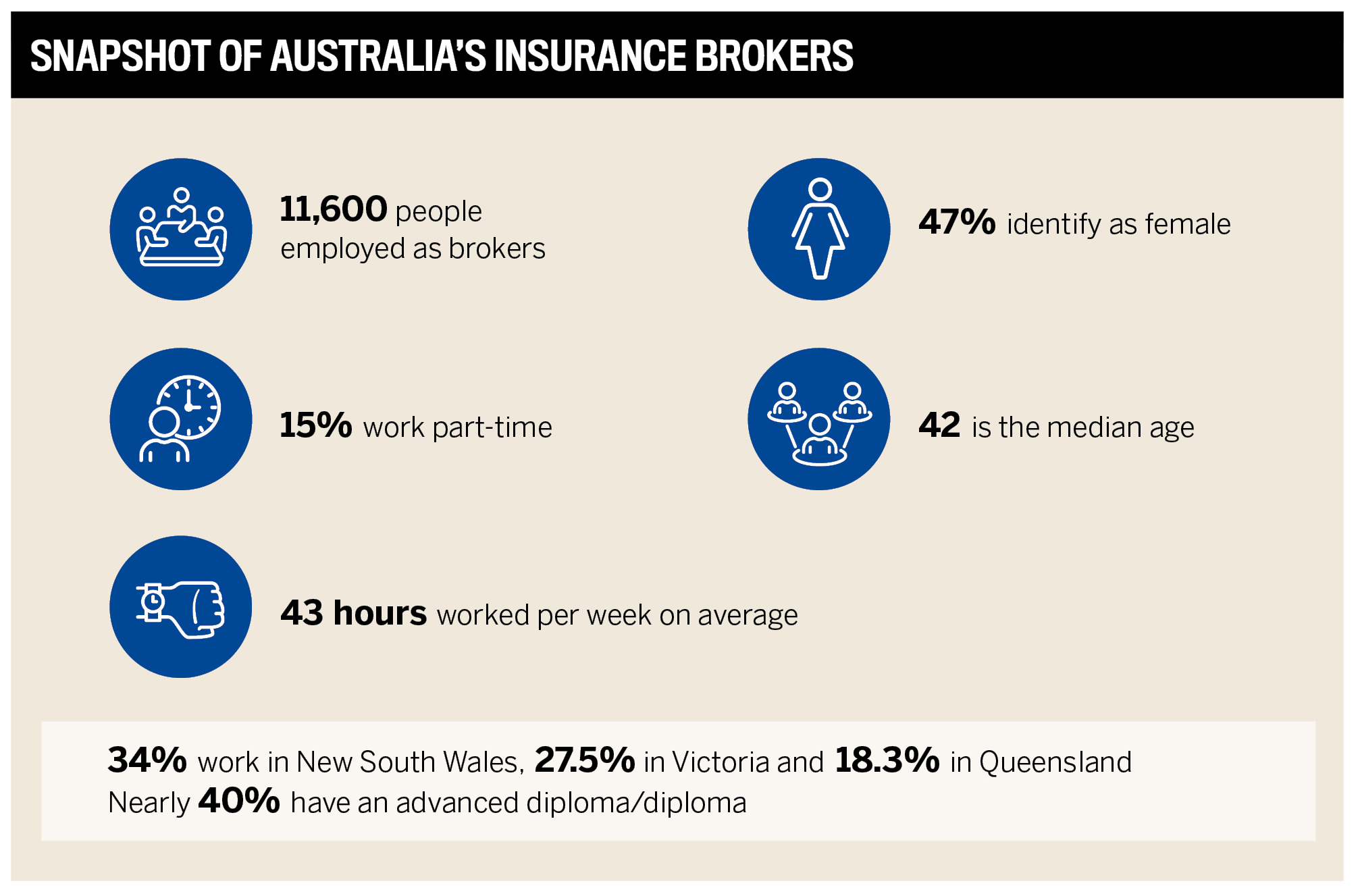

Insurance Business Australia conducted its second annual search for the Top Insurance Brokers to discover the best brokers who act in their clients’ interests. From a diverse cross-section of insurance professionals, the IB team had the opportunity to spotlight remarkable examples of passion, dedication, and commitment.

From 29 July to 23 August, the IB team undertook a rigorous marketing and survey process, leveraging its connections to thousands of readers across the country. Readers were asked to nominate their brokers and rate them on six key criteria.

The most voted-for brokers that received an average score of 8 or higher were named Top Insurance Brokers who were recognised based not on revenue but rather the service provided to their clients.

Keep up with the latest news and events

Join our mailing list, it’s free!