Brokers on Underwriting Agencies 2022

Jump to winners | Jump to methodology

Underwriting Olympics

Sponsored by: The IB Brokers on Underwriting Agencies survey is the Olympics of Australian underwriting. The 29 winners are exemplars of excellence, chosen by hundreds of brokers for the quality of their service, including coverage, overall service level, turnaround times for new business and claims, broker support, premium stability and commission structures. Medals were awarded across one or more of 16 underwriting niches: accident and sickness; commercial motor; construction; cyber and information technology; directors and officers; financial lines; hospitality; management liability; marine; not-for-profit; product liability; professional indemnity; property; public liability; strata cover; and travel.

The IB Brokers on Underwriting Agencies survey is the Olympics of Australian underwriting. The 29 winners are exemplars of excellence, chosen by hundreds of brokers for the quality of their service, including coverage, overall service level, turnaround times for new business and claims, broker support, premium stability and commission structures. Medals were awarded across one or more of 16 underwriting niches: accident and sickness; commercial motor; construction; cyber and information technology; directors and officers; financial lines; hospitality; management liability; marine; not-for-profit; product liability; professional indemnity; property; public liability; strata cover; and travel.

IB’s data shows that 71.55% of brokers have up to 50% of their books underwritten by underwriting agencies. It also reveals that 74.62% of brokers rated the pricing of their underwriting agencies as ‘good’ or ‘very good’, and 91.9% of brokers gave the same ratings for the underwriting agencies’ technical expertise and product knowledge. In addition, the top three criteria, in order of importance, that brokers looked for were coverage, overall service levels and claims turnaround times.

One broker commented, “I consider the support of underwriting agencies imperative; they generally have product specialists and great wordings,” while another said, “Overall, at the moment, the service from UA is equal, if not better, than that from the main insurers, by way of response time on referrals and answering the phone.”

“We are always striving to provide wonderful service to our brokers, and we believe that in the hospitality space, our service is second to none”

Alisa Martins, Pen Underwriting

Experience prevails

“We are thrilled to have won the gold medal in hospitality,” says Alisa Martins, the COO for underwriting operations at Pen Underwriting. “We are always striving to provide wonderful service to our brokers, and we believe that in the hospitality space, our service is second to none.”

Pen has four liability underwriters in Sydney with vast experience. They focus on risks faced by suburban and country hotels with revenue of up to $20m, operations that host bands and dancing, and that frequently close in the early hours of the morning. Internal controls, such as security, are key. Once Pen has the information it needs, it can turn around a quote in 24–48 hours.

Pen also specialises in property insurance for the hospitality industry. It won a silver medal for property and a bronze for product liability and public liability.

“In general, we distinguish ourselves in the marketplace with expertise and the knowledge of our people. We have over 1,000 years of underwriting experience across our team,” says Martins. “Then there’s our service. Our underwriters pick up the phone and genuinely want to help our brokers. And then there are relationships with security. We have a very longstanding and stable relationship with our security providers, meaning our product offerings and service are reliable and consistent.”

For the past three years, Pen has conducted Net Promoter Score surveys to gauge the sentiment of its brokers. In September, it achieved its highest score to date. The company also places a premium on its people and recently scored 85% on an engagement survey – 13 points higher than the global benchmark – and scored exceptionally well in wellbeing, inclusion and retention.

Winning gold in the product liability category was Brooklyn Underwriting, topping the list for the second year in a row.

The Brokers’ Pick medal was also awarded for top products. Winners included AFA Insurance for its personal accident and illness insurance, Woodina Underwriting Agency for professional indemnity, Pen Underwriting for property ISR, and Emergence Insurance Group for its cyber insurance.

Emergence also named as the Best Cyber Insurance Providers in Australia in 5-Star Cyber 2023 special report.

Building better companies

Another winner, MECON Insurance, got the gold for construction for the seventh straight year. “Keeping ahead of our market peers has been more challenging over the past two years than ever before,” says MECON Insurance CEO Glenn Ross. “For most agencies, service standards for brokers make them stand out over mainstream insurers. We have absolutely maintained our focus on this aspect but have also been fortunate to be able to provide consistent coverage rated highly by brokers against our peers.”

The company also looked at initiatives to offset some new client risks during and after the COVID-19 pandemic. It leveraged strengths in delivering broad coverage, offering front-end service in delivering quotes, and providing back-end service with claims processing.

“In general, we distinguish ourselves in the marketplace with high levels of underwriting and claims service,” says Ross. “We also have experienced and accessible staff, and we have broad policy coverage – very focused on the needs of our clients.”

What’s more, over the past three years, the company has undertaken remedial work that has reduced its combined operating ratio by more than 10%, helping ensure strong profitability in the near future.

Recently, MECON Insurance merged with Underwriting Agencies of Australia.

SURA Construction also won a silver medal for construction. How does it differentiate its construction offerings in the marketplace? “We pride ourselves on having knowledgeable underwriters who can assist brokers,” says Blair Arnot, director of SURA Construction and Engineering. “Brokers can directly access decision-makers who can negotiate terms and advise on coverage, and we have a broad risk appetite, from small, low-hazard risks to large and complex construction projects.”

SURA Construction distinguishes itself by having local underwriting representation throughout Australia with authority to write business, as well as an in-house claims team.

The company has grown its GWP by 124% from 2020 to 2022.

“The construction underwriting sector essentially hit a profitability speed bump about three years ago, which saw some insurers and agencies reduce appetite and capacity or withdraw capacity altogether”

Glenn Ross, MECON Insurance

What brokers want

IB’s 2022 winners are delivering outstanding results. But what would encourage them to keep their business with or do even more with their underwriting agencies?

One respondent said, “There is one agency that used to be rated higher by us; however, they have made changes to some of their wording, which makes some of their product offerings less than market standard. The most helpful thing an agency can do is to keep their wordings as similar as possible rather than make lots of changes whenever a new revision comes out.”

Another said, “They took an interest and engaged us multiple times in person and on Zoom to understand our business requirements.”

In the words of one broker: “Premium stability is very important. To win business one year and have the premium increase 30% the next year means I, as a broker, must remarket the policy, which takes away from doing other things, such as getting new clients, because it won’t be just one policy; it is literally costing the brokerage money. So, trying to maintain price stability is a key factor for brokers moving forward in these turbulent times.”

Another said, “Faster turnaround times on new business – clients do not give us a big lead time on new business.”

And on that same issue, a broker replied, “They need to adjust to market conditions more quickly than in the past. In previous hard-to-soft cycles, underwriting agencies quickly fell out of the market when pricing softened. They also need to ensure that the claims process is streamlined. Some do this very well, whilst others leave you like a shag on a rock with a third party claims handling agency.”

“In general, we distinguish ourselves in the marketplace with expertise and the knowledge of our people. We have over 1,000 years of underwriting experience across our team”

Alisa Martins, Pen Underwriting

Changing times

Pen and MECON Insurance also have interesting perspectives on the underwriting market.

“In Australia, the focus is now very much on compliance, dealing with dynamic and consumer-focused legislation, monitoring the requirements and reporting of the various authorities and remediating the long-tail effects of worker-to-worker claims,” explains Ross.

At the same time, Ross says things have been somewhat difficult for his niche. “The construction underwriting sector essentially hit a profitability speed bump about three years ago, which saw some insurers and agencies reduce appetite and capacity or withdraw capacity altogether,” he says. “The past two years have seen a very distinct remediation phase across the market – with a heightened reliance on actuarial analysis to drive underwriting decisions. With high inflation, and the number of catastrophic weather events, the remediation phase is likely to continue until profitability is restored.”

Meanwhile, Martins says the domestic underwriting sector has been disciplined for the past few years, with strong rate movement across most lines and tighter coverage and conditions. “This has been a great opportunity for underwriting agencies to really add value in the areas they specialise in,” she says. “Equally, in some areas it has proved challenging in sourcing and maintaining capacity in the agency space. You really need a proven track record and excellent portfolio management backed up with quality data and actuarial. The outlook we expect is largely a continuation of these conditions for the next 12–24 months at least.”

The Underwriting Agencies Council (UAC) is proud to sponsor the 2022 Brokers on Underwriting Agencies survey. UAC congratulates all its member agencies that have been rated highly by the broking fraternity.

UAC is the peak body for Australian underwriting agencies, which write more than $7.5bn in annual GWP. It serves its members’ interests through professional development events, broker expos to showcase members’ specialist products, sector-specific marketing campaigns and advocacy with government and other industry bodies.

UAC has more than 120 agency members, supported by 64 business service members. Since its formation in 1998, UAC has grown dramatically as the agency sector has developed into a powerhouse in the Australian market.

Brokers appreciate agencies’ specialisations, ability to be nimble and agile in their offerings, and the vast range and variety of products they offer. As niche specialists, underwriting agencies can provide bespoke, tailored coverage for brokers and their insureds.

Congratulations to every award-winning agency for your exceptional service to the broking community.

William Legge

William Legge

General Manager

Underwriting Agencies Council

Brokers on Underwriting Agencies 2022

Accident and Sickness

- AHI Insurance

Silver - DUAL Australia

Bronze

Commercial Motor

- NTI

Silver - Blue Zebra Insurance

Bronze

Construction

- ATC Insurance Solutions

Bronze

Cyber and Information Technology

- Emergence Insurance Group

Gold - DUAL Australia

Silver - 360 Underwriting Solutions

Bronze

Directors and Officers

- DUAL Australia

Gold

- ProRisk (Professional Risk Underwriting)

Bronze

Financial Lines

- DUAL Australia

Gold

Hospitality

- Axis Underwriting Services

Silver - One Underwriting

Bronze

Management Liability

- DUAL Australia

Gold

- ProRisk (Professional Risk Underwriting)

Bronze

Marine

- NTI

Gold - AM&T

Silver - NM Insurance

Bronze

Not-for-Profit

- Community Underwriting Agency

Gold - DUAL Australia

Silver - ASR Underwriting Agencies

Bronze

Product Liability

- High Street Underwriting Agency

Silver

Professional Indemnity

- DUAL Australia

Gold - Woodina Underwriting Agency

Silver

Property

- Axis Underwriting Services

Gold

Public Liability

- High Street Underwriting Agency

Gold

Strata Cover

- Strata Unit Underwriters

Silver - Strata Community Insurance

Bronze

Travel

- AHI Insurance

Gold

Brokers’ Pick

- Woodina Underwriting Agency

Professional Indemnity

- Emergence Insurance Group

Cyber

Methodology

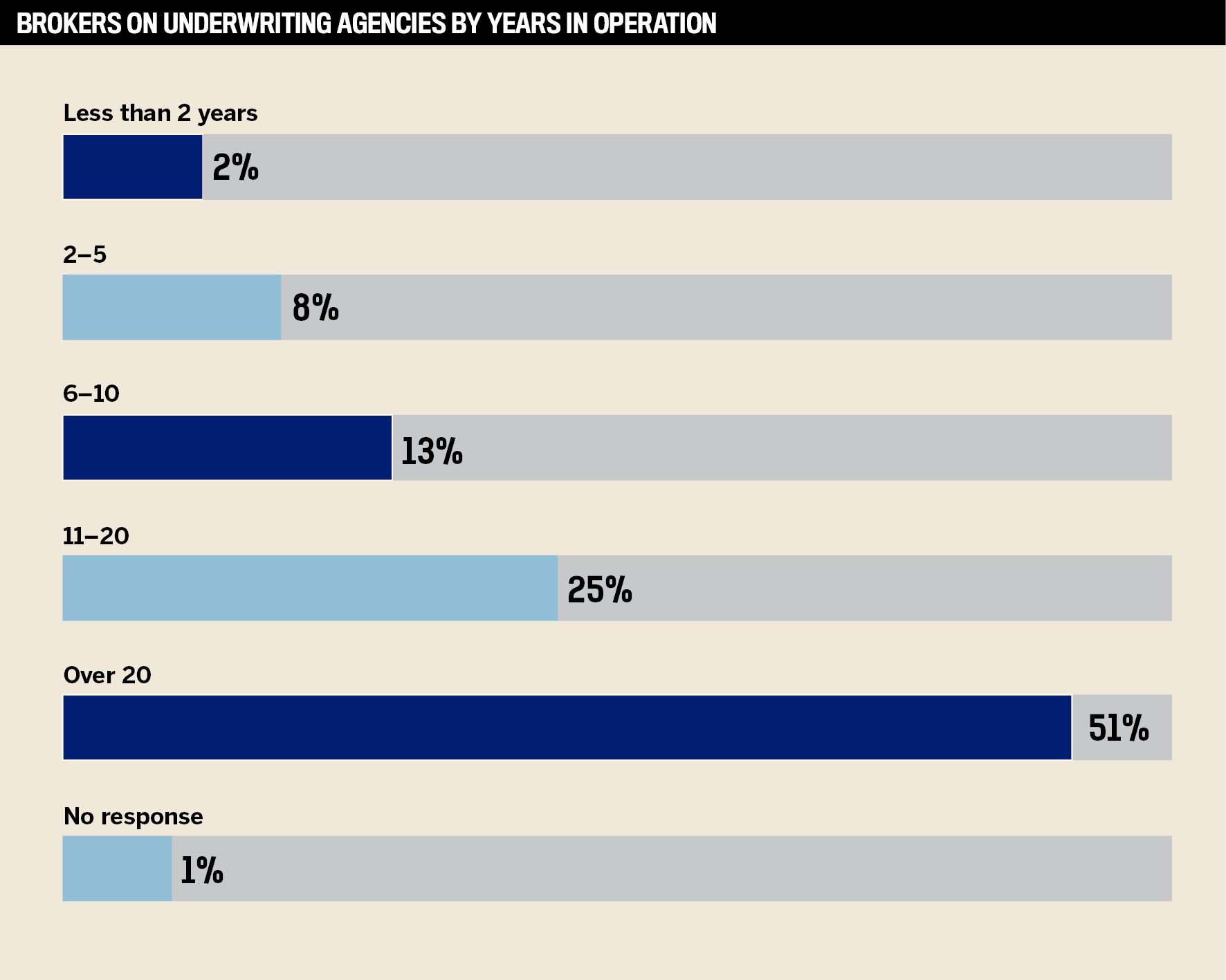

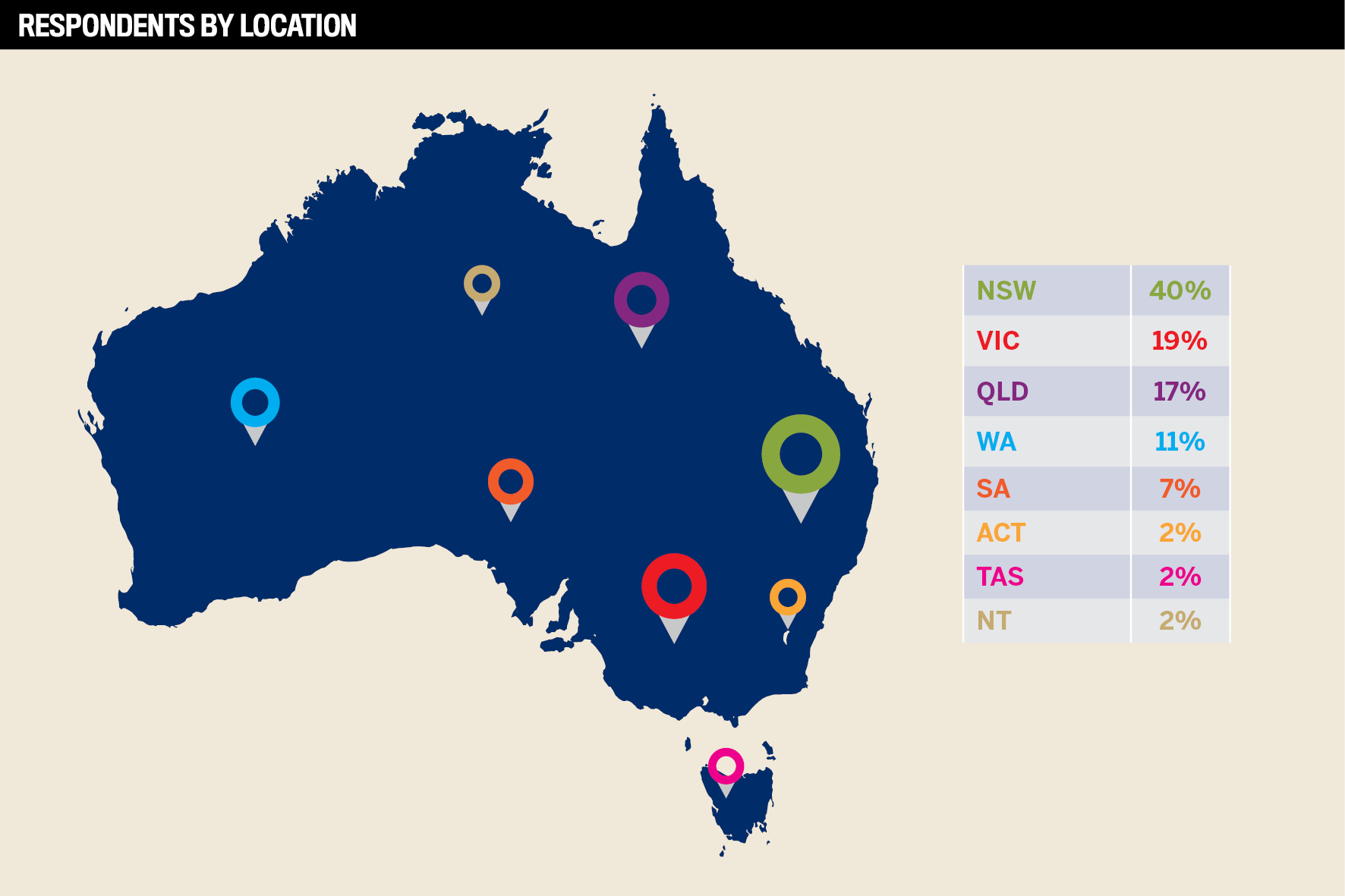

To uncover the best underwriting agencies in the Australian insurance market, Insurance Business reached out to brokers via social media and IB’s online newsletter. Five hundred brokers participated in the survey, ranking their top three underwriting agencies across 16 major types of insurance. Brokers also named the top insurance products offered by underwriting agencies and weighed in on whether turnaround times, product ranges and pricing had improved or worsened over the past year.

To better understand their priorities when selecting an underwriting agency, IB also asked brokers to rank the importance of seven different aspects of underwriting agencies’ service: coverage, overall service level, turnaround times for new business and claims, broker support, premium stability and commission structures.

Based on brokers’ feedback, IB calculated the top three winners for each type of insurance and awarded gold, silver and bronze medals to those underwriting agencies. The four insurance products that received the most votes from brokers were awarded the Brokers’ Pick medal.

This special report is proudly sponsored by the Underwriting Agencies Council.

Keep up with the latest news and events

Join our mailing list, it’s free!