California has one of the strictest insurance regulations in the US. It’s not surprising that launching an insurance business in the state is no simple feat.

To help you sort things out, Insurance Business will give you a step-by-step walkthrough on how to start an insurance company in California. We will also give you a rundown of the various requirements and the departments you may need to work with.

If you’re up to the challenge of running an insurance business in one of the country’s most tightly regulated states, this guide can help. Read on and find out what it takes to start an insurance company in the Golden State.

The strong growth potential that comes with running an insurance company makes it an appealing venture. But establishing your own insurance business in one of the most restrictive states in the country requires careful planning and preparation.

Here’s a step-by-step guide on how to start an insurance company in California:

Your company name represents your business and your brand, so it must be carefully thought of. Once you’ve settled on one, you must send your name approval request to the Corporate Affairs Bureau of the California Department of Insurance (CDI) to this address: 1901 Harrison Street, 6th Floor, Oakland, California 94612.

You can list up to three names in order of preference. A disclosure of your company’s principals must be submitted along with the request. You will also need to pay a name approval fee of $150. For joint underwriters, the fee is $79.

Once your company name has been approved, you must then file the articles of incorporation with the California Secretary of State. Apart from the business name, you will need to provide the following details:

Filing comes with a corresponding fee depending on your business structure. You can find the complete list of fees and schedules on the Secretary of State’s website. The fastest way to file your articles of incorporation is through the Secretary of State’s Bizfile Online website.

The CDI requires all state-based insurers to apply for an organizational securities permit. According to the state insurance regulation department, “this permit authorizes the sale of stock to obtain the initial capital and surplus.” In layman’s terms, this allows you to raise the necessary capital to start your insurance company in California.

Your application, along with the necessary documents, must be submitted to the CDI. According to the department, the required documentation includes:

The state insurance regulation department prepared this checklist detailing the steps and requirements in getting an organizational securities permit.

The CDI notes that the document is “not presented as an exhaustive list of requirements and the applicant must still comply with all appropriate regulations and statutes.” This means that you may be asked to submit supporting documentation or meet requirements not on the list.

Once all requirements have been submitted, the department will review your application. Once your permit is approved, you can proceed with the next step.

All insurers wanting to do business in California are required to get a certificate of authority before they can operate legally. This time-consuming process consists of three stages, lasting between a week and 60 days:

Duration: One week

The CDI reviews your application to ensure that it has been submitted in the right format. During this period, you will be notified in writing whether your application has been accepted for filing. If accepted, you will be given an “official filing date.” If not, you will be given 10 business days to file the application in the complete format.

If you’re still unable to complete your application within this period, everything you submitted will be returned to you. According to the department, it cannot hold incomplete applications for more than 10 business days due to the sheer volume of submissions it receives.

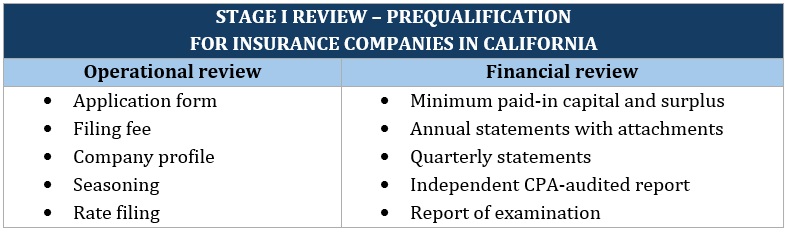

Duration: 30 days

During the prequalification review, the CDI will conduct a preliminary review of your insurance company’s operational and financial status. This is done to determine if you meet California’s minimum statutory requirements for insurance businesses.

Here’s a list of what the insurance regulation department will review during this stage:

The CDI will notify you in writing on or before the 30th day after your filing date whether your business passed the stage one review. If your business qualifies, your application will automatically proceed to the final qualification review.

If your business fails to qualify, you will receive a written notice detailing the reasons and some guidelines to help you meet the requirements if you decide to reapply. Your application will also be withdrawn.

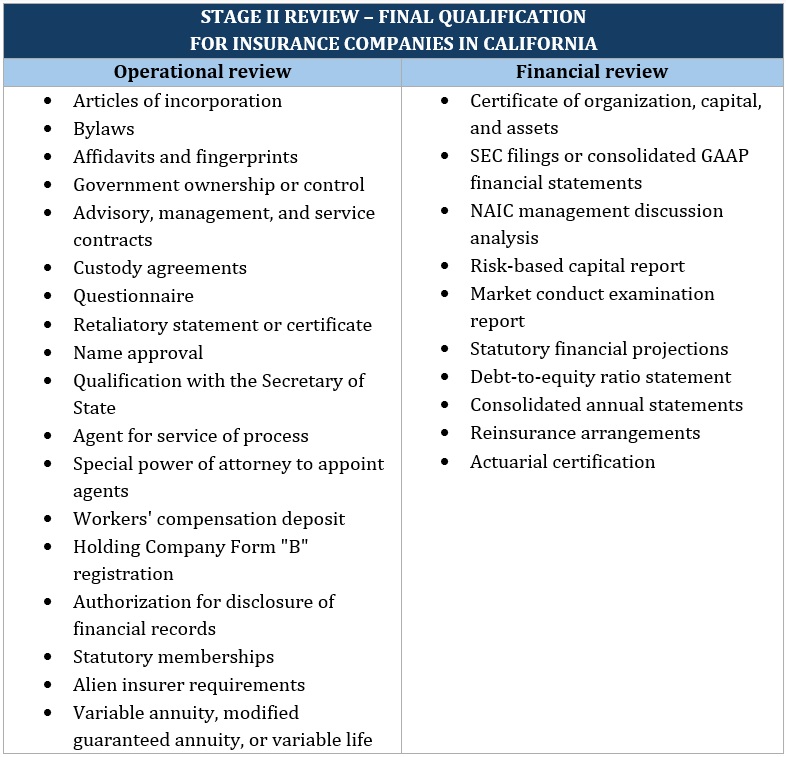

Duration: 60 days

This stage involves the review and approval of additional financial, corporate, and legal requirements. Here’s a list of what the CDI will review in the final qualification phase:

At the end of the review period, you will receive either your certificate of authority or a written notice detailing each item that failed to meet California’s admission requirements. If it’s the latter, you will be given a two-week window to complete all deficiencies. If you’re able to correct all deficiencies, you will receive your certificate of authority within two weeks.

If two weeks is not enough to perfect your application, you may be given an additional 45 days to do so. Once complete, the CDI will review your application within 30 days and either issue you a certificate of authority or notify you that you have failed to meet the admission requirements.

Check out this step-by-step guide on how to start an insurance company if you want to find the general details on how to launch your insurance business.

If your insurance company is involved in selling policies, you need the proper licenses to operate legally. There are two general types of insurance licenses you can take out:

This type of insurance license allows you to sell policies within state lines. It works like a standard insurance agent license but on a business level. This step-by-step guide on how to get an insurance agent license can help if you want to work for an agency as a stepping-stone to opening your own business.

If your insurance company is based outside the state, you will need a non-resident license. The good news is that California has reciprocity agreements with other states. This allows out-of-state insurance agencies and agents to apply for licenses without having to take California’s state licensure exams.

As a business owner, you can choose different insurance lines to specialize in. If you plan on selling policies in more than one line, then you need a license for each. These licenses come with corresponding fees and requirements.

Here are the most common types of insurance licenses in California. The descriptions are based on CDI’s definitions:

This allows your business to provide insurance policies for sickness, bodily injury, and accidental death. You may also be able to offer disability benefits.

This is required if your insurance company provides cargo owners and shippers coverage for the goods they’re carrying.

This lets you provide coverage against legal liability. This includes any action that results in injury, disability, death, and property damage.

This allows your business to offer credit insurance without the need to get a life or property and casualty insurance license.

This lets you offer life insurance policies. Coverage can include accidental dismemberment, annuities, disability benefits, and endowments. Most life insurance agencies also offer accident and health insurance.

This is required for insurance companies that employ analysts who offer advice on life and disability insurance contracts.

This allows your business to sell and negotiate coverage on behalf of an appointing motor club.

Generally taken together with a casualty license, a property insurance license lets you offer policies covering any “direct or consequential” loss or damage to property.

This allows insurance brokers to place the following risks with non-admitted insurers offering coverage for:

This lets insurance brokers place insurance with non-admitted insurers to cover risks other than aircraft and certain marine and transportation risks.

Learn more about the different insurance agency licenses you need to operate in California in this guide.

California legislation requires all businesses involved in providing insurance products and services to get the proper licenses. Running an insurance company without the necessary licenses can result in a felony charge. If your business is caught, you can face severe penalties, including monetary fines and blocked commissions. You also risk having your business license suspended or revoked.

In addition, the CDI may issue cease-and-desist orders to prevent your insurance company from operating. If this happens, you may be required to pay any unsettled insurance claims.

People are always searching for the right coverage – be it when driving their vehicles, operating businesses, buying homes, or seeking medical attention. For this reason, insurance products and services will always be in demand.

The continued growth of the sector presents an enticing opportunity for aspiring insurance entrepreneurs wanting to start their own company. But to earn profits, you must be willing to put in hard work and dedication.

If you’re looking for industry players to model success from, our Best in Insurance Special Reports page is the place to visit. Recently, we revealed the five-star winners of the Fastest-Growing Insurance Companies in the USA awards. Find out how these firms came up with innovative and entrepreneurial processes to grow despite challenging market conditions.

Is starting an insurance company in California a good idea? Share your thoughts in the comments.