Lockton has unveiled its Global Parametric Insurance Practice.

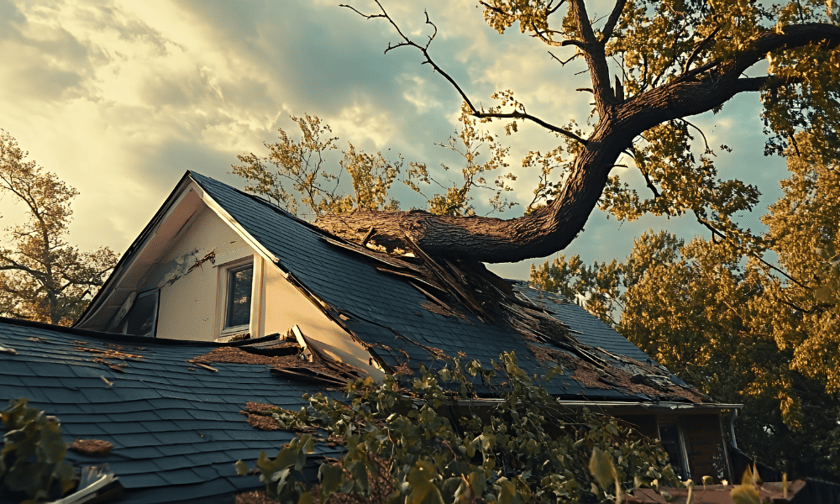

Parametric insurance provides financial protection based on predefined event triggers, such as storm intensity or rainfall levels, rather than actual physical damage. These policies allow for quicker payouts, often within days of a triggering event, reducing the financial strain and operational disruptions businesses face after disasters.

According to Diego Monsalve, the Latin America and Caribbean head of risk practices and international head of parametric solutions, Lockton has increased investments in parametric expertise and resources across the US, Latin America, Europe, and Singapore.

"This global team is uniquely positioned to address our clients' risk management challenges through innovation, delivering the high-caliber solutions they've come to expect from Lockton. We are excited to support our clients as we move forward with this initiative," said Monsalve.

The market for parametric insurance is expanding in response to a rising frequency and severity of natural disasters such as hurricanes and wildfires, as well as emerging risks like cyberattacks and supply chain interruptions.

Global Market Insights estimates the parametric insurance market could reach $39.3 billion by 2032, signaling growing demand for alternatives to conventional property insurance.

Peter Rapciewicz, executive vice president and practice leader of Alternative Risk Solutions and US head of parametric solutions, noted that these offers cater to businesses seeking efficient and cost-effective risk management.

"Lockton's investment in a global parametric insurance practice underscores our commitment to delivering resilient solutions that not only provide financial protection but also empower businesses to continue operations seamlessly despite challenges," said Rapciewicz.

Lockton’s new practice will leverage advanced analytics and data-driven insights to perform detailed risk assessments for clients. The team will work to identify specific triggers that align with clients’ potential losses, providing customized coverage to address gaps in traditional policies. This approach is expected to serve as a complementary option for businesses seeking to safeguard against a broader range of risks.

What do you think of the growing role of parametric insurance in modern risk management? Share your thoughts below.