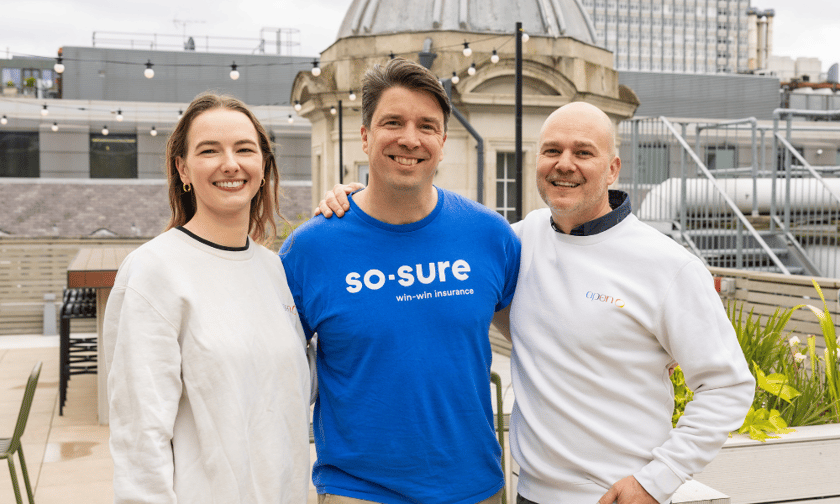

There’s a global ambition rooted at the core of Open, the embedded insurance provider which launched into the UK market via its acquisition of the UK-based insurtech SO-SURE last week. And with a wholly-owned MGA footprint in Australia and New Zealand already, the UK was a natural next step, according to CEO Jason Wilby (pictured right).

The UK is interesting to Open, not only due to its scale, he said, but also the maturity it displays in the affinity and embedded space. Some supermarkets in the UK, for instance, have been selling insurance for about two decades, while mega-giants in the US are now just testing the waters of developing the financial services proposition.

“With that maturity comes opportunity,” he said. “In the UK, there’s a lot of affinity and embedded-style business which, from a technology and a customer experience perspective, is quite underinvested. That’s pretty exciting to us because it means there’s an opportunity for us here.

“There are also newer horizons and models opening up for new embedded insurance products that the market supports here… And from our perspective, it’s a stepping stone into the European market, allowing us to build a base here from which we can expand into further markets as well.”

Identifying where the UK’s maturity around embedded insurance stems from, Wilby highlighted the capability that exists in the market. There’s significant insurance capability, he said, and also regulatory capability.

The insurance capability supports high levels of innovation, he said, while the maturity of the regulatory landscape means there is an advanced understanding of and attention paid to the customer perspective. The regulatory landscape in the UK paints quite a similar picture to Australia, which had its own Consumer Duty moment a few years ago when a host of regulatory changes were driven by a Royal Commission.

“For us, a mature regulatory landscape is very valuable, because we’ve already made investments to be able to operate within those boundaries,” he said. “I think the other thing driving maturity is that a lot of UK brands and retailers have been on the front foot when it comes to embracing opportunities to offer or bundle financial services for their customer base.”

Given the appeal of the UK market, the natural progression of Open’s interest was to find the right partnership and Wilby noted that this was a careful selection process. Acquisitions are always easier said than done, he said, and the team had been looking at potential as a pathway to the UK for quite some time when SO-SURE came along.

Having talked to the SO-SURE team for some time, it soon became clear that their background and origin as a B2C-style business represented a strong alignment.

“What we really liked about them was their focus on the customer, and that there’s a really strong culture fit with Open,” he said. “We’re a B Corp and have been since 2017. We’ve got quite a high bar when it comes to thinking about customer value and consumer value and that aligned really well for us.

“Also, it offered complementary product lines as well, allowing us to get some capability in mobile phone insurance. The device insurance space is also really interesting for us as there are opportunities for us to grow that in the UK, but also to expand that into Australia and some of our other markets as well.”

Looking ahead to 2024, Wilby said building out Open’s presence in the UK market will be a key area of focus. With the acquisition announced, it’s time for the real work to begin on fully integrating SO-SURE to effectively become Open UK – and to start rolling out its proposition and adding some further products in the UK. In addition, Open UK will be announcing some new distribution partners over the course of 2024.

As to what those relationships will look like, he highlighted that Open looks to work with partners who are realistic about what it means to craft a financial services proposition. If they’re not a financial services business, Open looks to provide a lot of support - whether that’s through licencing, products or technology.

As to the future of embedded insurance in the UK, Wilby is feeling very positive - the market is seeing the development of some really interesting new models.

“I think what’s exciting is that the pace of innovation is accelerating,” he said. “So, we’re seeing some really interesting new products, but also new partners and new ways of working with brands to be able to deliver this as well.”