Pearson Ham Group’s July premium price index showed a slight drop in home insurance rates, for the first time this year, after a long period of climbing and plateauing rates.

Although the drop was quite small at 0.2% and has no heavy impact on the average home insurance premium, now pegged at £416 (which is 29% higher than this time last year), it indicates a significant change in direction in overall insurance pricing, suggesting that house insurance pricing might start to align with motor insurance premiums which have been consistently falling since the first quarter of the year, the survey noted.

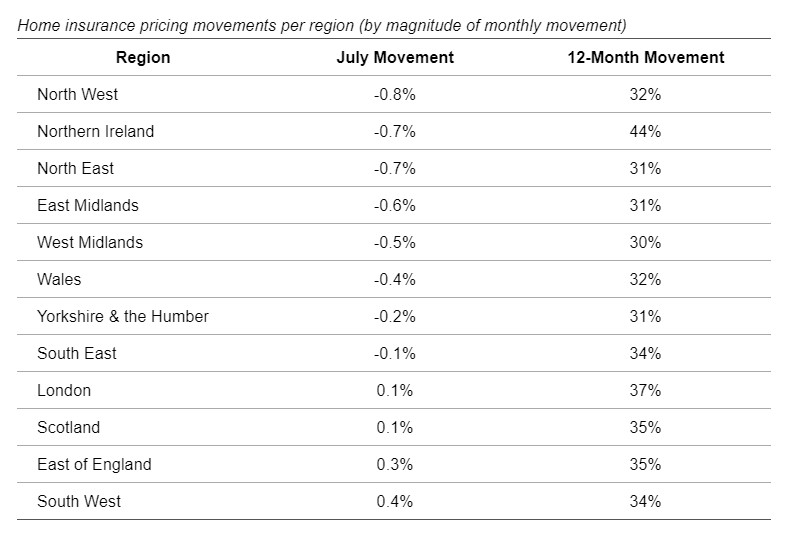

The Pearson Ham Group’s price index noted that the decrease in home insurance pricing was not uniform across the UK. For example, properties in the northwest of England registered a -0.8% drop in home insurance costs, the highest in all of England. It was followed by Northern Ireland and the northeast, which registered a -0.7% decrease in home insurance prices last month.

“These drops are particularly notable as properties in Northern Ireland experienced the largest increase in June with a 1.6% rise, while the North East saw one of the smallest increases in June at 0.3%,” the survey noted.

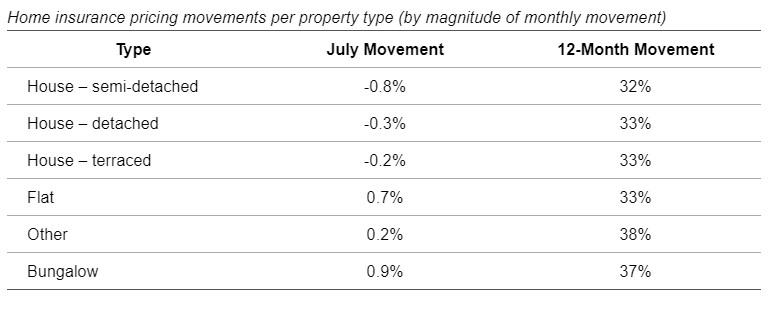

The price index also indicated a notable variation in pricing trends depending on property type. There was a -0.8% reduction in insurance premium rates for semi-detached homes, the most significant decrease in home insurance prices.

“These findings mark a significant shift in the home insurance market, offering a glimmer of hope for homeowners and renters across the UK who have faced escalating premiums,” said Pearson Ham Group director Stephen Kennedy. “While the reduction is modest at -0.2%, it signifies a potential alignment of home insurance pricing trends with those seen in motor insurance, which has been on a consistent decline since the first quarter of the year. This trend could provide much-needed financial relief and stability to policyholders in the coming months.”

The Pearson Ham price index also noted that, since June, motor insurance rates have continued to drop and the trend may continue in the next several months.

June saw a -1.5% drop in the cost of motor insurance prices, with insurance premiums levelling out - now being 3% higher than this time last year, compared to a peak of 47% higher in Q4 2023.

“In terms of which regions and segments saw the largest drops in motor insurance pricing, drivers in Yorkshire and the Humber saw an average decrease of -1.9%, followed closely by drivers in Northern Ireland which saw an average reduction of -1.8%. By age and vehicle type, drivers aged between 51 to 60 benefitted the most with an average reduction of -1.9% as did owners of vehicles with a value in excess of £20,000 who saw an average drop in insurance pricing of -2.1%,” the survey noted.

Have something to say about this story? Leave a comment below.