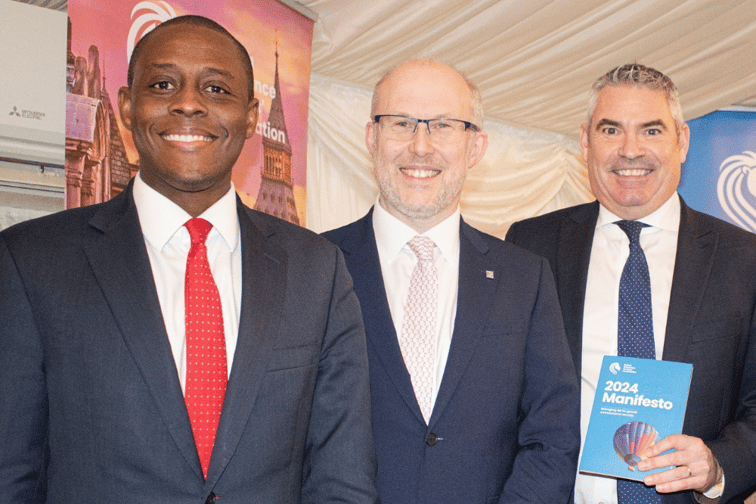

At the launch of the British Insurance Brokers’ Association’s (BIBA) 2024 Manifesto in Parliament, Craig Tracey (pictured right), MP and chair of the APG on Insurance and Financial Services, offered a succinct reminder of the role expert insurance advice plays in making real the theme of the document – ‘Managing risk for growth and economic security‘.

“We do have to remember that insurance can be complicated,” he said. “It’s not a straightforward purchase, so it is always reassuring to have that expertise behind you… to help you to navigate that minefield. What that does is allow individuals and businesses to have the right cover to enable them to live their lives, to innovate, and also to take all the well-calculated risks that we need to drive the country forward. And we should never underestimate the importance of that.”

In the opening remarks of his first Manifesto launch as chief executive officer of BIBA, Graeme Trudgill (pictured centre) noted that it’s a “new era” for the association which is underpinned by its commitment to backing growth and economic security. The broking sector is certainly growing in value, he said, surpassing the £100 billion GWP mark for the first time ever.

“Importantly, our brokers have grown their market share in commercial lines from 80% to a record 83% in the last year, showing the importance and value of their work for UK business,” he said. “We’ve commissioned some new research from Opinium which shows that 62% of SMEs agree that insurance protection enables them to take more risk in order to grow their startups to scale-ups. And, of course, economic security is one of our members’ reasons for being – to help consumers and help businesses mitigate and transfer their risks.”

During the briefing, Trudgill identified that the BIBA Manifesto outlined opportunities for the government to review and reduce the tax burden on policyholders through IPT. He also pinpointed proportional regulation as a key theme running through the manifesto and identified 2024 as a year in which BIBA will work closely and constructively with the FCA to make the most of the latter’s new growth and competitiveness objective.

Regulatory change was also high up on the agenda of Bim Afolami (pictured left), MP and Economic Secretary to the Treasury, who underlined his own longstanding commitment to creating a more pro-growth regulatory environment.

He cited Solvency II reforms as an example of the work going into creating a regulatory regime that promotes growth through the creation of a more tailored and simple regulatory framework that allows capital to be freed up to invest in productive parts of the economy – without compromising the health of insurance. Afolami also touched on the government’s announcement of plans to publish a consultation on the introduction of a new captive insurance regime in the spring and the recently signed financial services agreement between the UK and Switzerland offering British insurance brokers unique access to the Swiss market.

“Returning back to domestic markets, I want to touch on an insurance priority, an important priority… access to insurance,” he said. “There’s no point having a fantastic sector, if people can’t access it. It’s really important that all customers - whether they be individuals or businesses - have access to affordable insurance. And alongside the ABI and others, BIBA has undertaken a considerable amount of work into finding solutions to the challenge of building insurance premiums for multi-occupancy buildings… so I really want to thank you for the work that you’ve done in that regard… and it’s vital that this work comes to fruition as quickly as possible.”

During his closing remarks, Trudgill noted that it’s a year of growth for BIBA internally as well, with the association investing in three new colleagues to bolster its team amid its ongoing commitment to investing in the long-term success of its members. In addition, he said, BIBA will be rolling out three new guides this year – on artificial intelligence, on the Protect Duty, and on the benefits of commission. These are in addition to the three new guides launched earlier this week to enable members to better navigate the claims process for home, motor and travel insurance.

Summarising, he said: “The insurance broking sector really is the jewel in the UK financial services sector and I can’t wait to fire up this new manifesto and work with all of you.”