Insurers that have plotted going public will be weighing up their options after a stalled start to a hotly hyped 2024 initial public offering (IPO) season.

On Wednesday, specialty insurer Fortegra pulled back from listing plans. Underscoring company nerves and market-wide investor caution, Fortegra’s pivot may be seen as a bad sign by other insurance businesses that have eyed public debuts.

At least one other insurer appears to have been hedging its bets in a buyer’s market, after two out of three specialty insurers that listed last year failed to hit the mark.

One IPO researcher pointed to recent speculation around a potential Apollo-backed Aspen reverse merger with SiriusPoint.

Aspen, which declined to comment, has filed IPO paperwork but a deal with NYSE-listed SiriusPoint would offer it a different route to market.

“That could be a sign that Apollo recognises that the public market is not as receptive as it would like, and it might be good to have an alternative in mind,” Nick Einhorn, Renaissance Capital VP, research, told Insurance Business. “Fortegra’s postponements and the poor performance of those two deals late last year is a sign that the market is not especially strong for insurance IPOs, but I don’t think it means that investors wouldn’t be interested in a good company coming at an attractive valuation.”

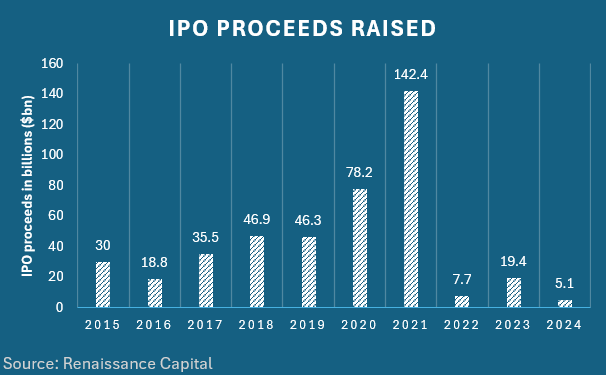

After two slow years for IPOs, 2024 has been slated to be a comparable hotbed of activity. With $5.1 billion total proceeds raised so far across industries, 2024 is well on track to beat 2022’s full year $7.7 billion slump.

In addition to Aspen, Slide Insurance and Accelerant have reportedly signalled public intent. Outside of insurance, hotly tipped names to watch include Stripe, Reddit, and Shein.

Investor hype has, though, yet to reach the “unbridled enthusiasm” seen in 2020 and 2021, Einhorn said.

In its Wednesday IPO withdrawal announcement, Fortegra cited “prevailing market conditions”. The insurer further flagged the “high value” placed on the business by owners Tiptree and Warburg Pincus.

With 18 million in shares on offer at $15 to $18 each, Fortegra’s owners had sought a $1.5 billion market capitalisation (market cap) for the specialty insurer. Tiptree, which owns more than half of Fortegra, had a market cap of just over $700 million on Wednesday.

Tiptree’s share price took a more than 12% hit on news the IPO was off, suggesting its backers had held high hopes for the listing. The Fortegra majority owner’s market cap sat at $605 million on Thursday afternoon.

“If you look at where the IPO was being pitched, Tiptree’s ownership, and Tiptree’s own market cap, it’s pretty clear that the proposed equity valuation was higher than what it was being valued at within Tiptree,” Einhorn said.

Fortegra’s model of doing business largely through managing general agents (MGAs) may have been a driver of public investor skepticism.

“That kind of distribution model doesn’t seem to be especially well liked by investors, and the company was trying to convince investors that they manage this model well, that they’ve had success with it and that they were good at identifying the right partners to bring on to their distribution platform,” Einhorn said.

The change in direction marks the second time that Fortegra has rethought public plans. In 2021, the insurer set terms and then pulled the plug.

Fortegra went on to raise $200 million from Warburg Pincus in exchange for a 24% stake in the business.

It is unclear whether Fortegra will have another crack at listing later this year. The specialty insurer declined to comment further when approached by Insurance Business.

The three specialty insurers that underwent IPOs in 2023 were Fidelis Insurance (Fidelis), Hamilton Insurance Group (Hamilton), and Skyward Specialty.

Together, they have averaged a 30% return from offer, according to Renaissance Capital, propelled by Skyward Specialty’s performance. Both Hamilton and Fidelis have been trading at or below offer price.

Fidelis’ structure as a balance sheet company transacting with its main underwriting company may have left investors feeling cold, Einhorn said. Meanwhile, Hamilton’s “riskier” investment strategy may not have hit the mark with public shareholders.

Skyward Specialty may offer a ray of hope for would-be listing insurers.

The insurer was the first business to launch a US IPO last year. Since then, it has traded 100% above its IPO price of $15.

Further Skyward Specialty bragging rights include having undergone the most successful US financial services IPO of the year and the third most successful IPO of any company.

|

Company |

Sector |

Deal value ($m) |

Pro forma market cap ($m) |

After-market performance – Offer / 1 day |

After-market performance – often / ‘23 Y.E |

|---|---|---|---|---|---|

|

RayzeBio Inc |

Healthcare |

357.7 |

1,094.2 |

33.3 |

245.5 |

|

Structure Therapeutics Inc |

Healthcare |

185.3 |

573.0 |

73.3 |

171.7 |

|

Skyward Specialty Insurance Group Inc |

Financials/Fintech |

154.4 |

564.0 |

27.3 |

125.9 |

|

Cava Group Inc |

Dining & lodging |

365.4 |

2,498.2 |

99.0 |

95.4 |

|

Nextracker Inc |

Technology |

734.2 |

3,553.5 |

26.9 |

95.2 |

Source: Keefe, Bruyette & Woods

Skyward Specialty CEO Andrew Robinson told Insurance Business he remains bullish on insurance public listings into 2024, with some “great names” among IPO candidates.

Robinson outlined Skyward Specialty’s “formula for success” as delivering on results promises and telling a compelling story on technology, talent, and diversification.

“We want to see more people replicate what we did – it certainly helps when you have good performing companies in the public market, we want to be compared against good performing companies,” Robinson said. “It’s certainly something I hope for, but it’s hard to know, because with every company you have your market backdrop and then every company has its own story.”

Got a view on what Fortegra’s IPO cancellation means for insurance? Leave a comment below.