The aviation sector has retained the dubious honour of being one of the most impacted industries throughout the COVID crisis. Examining the ways in which the pandemic has disrupted the sector, Joe Trotti (pictured), head of aviation and aerospace at McGill and Partners, noted that the largest challenge was that each country responded to the pandemic differently, including on travel conditions.

Find out more: McGill and Partners’ unique aviation insurance proposition

Airlines are large and complex businesses, operating globally and regionally, labour and technology dependant, he highlighted. They have to manage both high fixed and variable costs such as aircraft leasing, fuel, labour and insurance. Understanding the logistics and complexity associated with operating flights and supply chains involved in performing those services, provides a good picture of how COVID has threatened the industry.

In some countries, Trotti said, governments have protected their own airline industries via large loans or other forms of finance, such as the furlough of employees. This created a major disparity in the industry with some governments electing to assist their local carriers while others have had to rely on asset disposals, or commercial loan facilities, or even bankruptcy protection.

“The disruption caused by the pandemic resulted in many airlines with in-force policies paying for exposures/flying which was simply not taking place with no relief until policy expiration,” he said. “We successfully renegotiated mid-term adjustable-rate features aligned with the dramatically reduced exposures, which in turn provided immediate premium/financial relief. It resulted in a premium which was more closely aligned with the actual exposures and provided cash flow relief, at a time when our clients needed it most.”

To support their aerospace manufacturing clients, McGill and Partners also leveraged its risk profiling, analytical, placement and market expertise to differentiate its clients’ risk profiles, demonstrate the dramatically changed historic exposures and future sales downturn and negotiate a premium base that was reflective of its clients’ current risk profiles and immediate needs, which also included a substantial COVID credit. Trotti noted that the pricing level now accurately reflects clients’ current exposures and not those which were standard in the market.

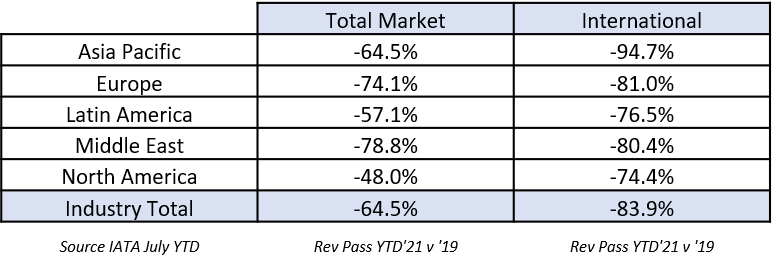

Analysing where the aviation sector currently stands in terms of traffic uptick, Trotti emphasised that recovery has varied by region, with most airlines facing challenges specific to the countries they are based in, or the region they operate within. For example, he said, the US and China, which both have large domestic markets, were initially much quicker to recover compared to South America and Asia more widely - both of which have been struggling to see demand reach 2019 levels.

Figure 1 Source IATA Q3 2021 Chartbook

“However, even for airlines within markets that have recovered quicker, the airline traffic remains volatile, particularly with the emergence of new strains such as the COVID-19 Delta variant,” he said. “The one consistent success story throughout the pandemic has been in the cargo sector. This sector has remained very active, and some passenger airlines have expanded their own footprint into that area as an extra revenue stream.”

The success of the cargo market can be viewed through several statistics, with Trotti noting that, industry-wide, cargo tonne-kilometre (CTK) grew by 24.9% compared to the three months ended July 2019. The strong upward trend in air cargo volumes continued during the three months to July 2021, he said, however, the growth momentum has softened compared to early 2021.

Read more: McGill and Partners expands reach to Bermuda

“The inventory restocking cycle that started at the beginning of the year is still in progress and allows air cargo to overperform global goods’ trade,” he said. “This is likely to continue for some time. While most regions and trade lanes have experienced a strong recovery from the crisis, airlines in Asia-Pacific and Latin America have lost market shares, mostly in favour of North American airlines.”

He highlighted that many drivers of air cargo demand saw a V-shaped recovery after the initial hit from the pandemic. While indicators, such as new export orders and confidence, have stabilised recently, conditions remain supportive.

“In particular,” he said, “trade is still growing, and inventories remain too low compared to sales, encouraging businesses to turn to air. Air cargo prices, although higher than ocean shipping, have become relatively more affordable, providing further incentives.”

As to whether the challenges being faced during COVID are alleviating, Trotti noted that it has been difficult for insurers to react to such a large shift in exposure. Insurers must provide a lot of capital to insure an airline, he said, and many elect to, or must, buy treaty reinsurance protection to make the transaction viable which has an upfront cost that they must bear on their own balance sheets.

In the early days of the pandemic it unexpectedly distorted exposures to a very drastic level, he said. Insurers had to return large amounts of premium where the estimated exposures on which the premium had been charged did not materialise. This reduced the market income and the amount available to pay losses. However, the loss frequency also dropped due to the substantial reduction in activity, which in some ways offset the reduction in premium.

“On renewals throughout 2020 and into 2021 we have seen insurers impose significant rate increases to compensate for the exposure falls,” he said. “They also imposed minimum earned premiums as a means of creating certainty in premium aligned with what insurers believe they must achieve for an individual policy to be profitable.”

The risk of such action is that, in some cases, as and where recovery occurs, the increased rates produce a disproportionately inflated level of premium which burdens the airline as it tries to recover. Trotti highlighted that the same can be said for aerospace manufacturers and service providers where the activity and liability associated with historic sales are down due to lack of activity and passenger demand – not to mention a dramatic reduction in future sales. This misalignment must be corrected.

With respect to the minimums applied, he said, they typically have been set at a high level, and a more pragmatic approach must be taken by insurers, especially where the exposures have not recovered - as those minimums can further undermine a struggling client.

“Overall,” Trotti said, “there seem to be several unintended consequences, and lower (or no) minimums would seem appropriate, as well as a new rating methodology that more accurately reflects a client’s true exposure footprint. Several insurers have embraced the need to innovate and work collaboratively with clients and their brokers to produce tailored solutions at a time of such uncertainty, however it is not representative of a market-wide approach.”

You can find out more about how McGill and Partners supports the aviation sector here