“The way the pandemic unfolded, from our perspective, was almost like watching a car crash in slow motion. You could see it coming, which gave you a little bit of time to prepare, but the impact and the uncertainty it caused really unsettled our business and unsettled our people.”

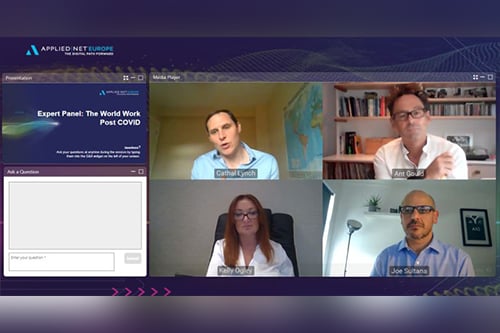

Those were the words of chief information officer for RSA Group Ireland, Cathal Lynch, as he shone a light on the impact the COVID-19 pandemic had on work and life. Discussing ‘The World of Work Post COVID’ at the recent Applied Net Europe event, a panel of senior insurance leaders revealed how the crisis had impacted themselves, their staff and their technology investment strategies.

Find out more: Learn everything you need to know about Applied Systems here

Moderator, Ant Gould, director at Full Circle Comms, emphasised how the technology theme shapes any conversation surrounding work during and post-COVID and questioned the impact of the crisis on investment plans. Offering a broker’s perspective, Kelly Ogley, chief operating officer at A-Plan, highlighted how the onset of the pandemic accelerated the implementation of the business’s strategic roadmap.

She cited her agreement with the words of fellow panellist Adam Khalifa, head of EMEA financial services at Google, that, “in terms of digitisation, over the last seven months, we’ve really seen the equivalent of seven years of the change that we’d get in normal circumstances, both from the consumer and the business side.”

Ogley highlighted that the strategic roadmap of A-Plan hasn’t changed, it has just been reprioritised to ensure that remote working was made possible for all the team. Thankfully, she said, the business rolled out its broker management system Applied Epic a few years previously, which meant it had the right platform in place to support the people in all its branches.

“Now everything in the background continues as normal, [since] we got people up and running and over the hurdle of bedding down… We’re investing in broking technology and we’ve continued doing mergers and acquisitions,” she said. “We actually completed a deal as we went into lockdown, so it was the first time we had to onboard clients remotely. We’ve since done three others and, since then, Howden acquired A-Plan. So, from an investment factor, it’s been generally business as usual.”

Gould then turned the question to Lynch to field a perspective from the insurer’s side, discussing how investment in technology has been impacted and whether or not it is possible to develop new products in a virtual environment. Lynch noted that a technology investment plan, like any other plan, is a reminder of the Mike Tyson quote that, “everyone has a plan until they get punched in the mouth.”

For the first six months of the year, RSA Ireland focused on redirecting some of its investments to improve cybersecurity, he said, but COVID led to a reprioritisation to focus on security infrastructure and remote working.

“One thing I’ve found is that remote working helps an organisation be more focused and be more targeted because our interactions tend to be more transactional. Video calls don’t really lend themselves to lots of chitchat, when you get on the call you have a meeting and a specific agenda to get through. So, we found that we actually got quite clinical, quite surgical in terms of what we need to invest in.

“Back in April/May we looked at our investment plan for the remainder of this year, and also looked into further years and we quickly coalesced our priorities and we’ve gone at them quite hard over the last few months. And in insurance, like other industries, you’ve got three areas to invest in. You’ve got your strategic initiatives, you’ve got your BAU and then you’ve got the regulatory agenda.”

The regulatory agenda has not changed during COVID, Lynch said, and still needs to be met - but what he has found is that people are now looking at the BAU agenda and the regulatory agenda through a digital lens. The question for businesses is how they can future proof their investments and make sure these align with overall strategic objectives.

COVID has made it easier to secure investment for digital capabilities as it has convinced people of the need for this investment, Lynch said. RSA Ireland already has a number of programmes lined up with Applied and other digital service providers to enable the full digitisation of the business and, in the current environment, it is finding that these are moving faster than originally anticipated. The pandemic, he believes, is giving people who are open to new opportunities a sense of confidence in their digital capabilities which they did not necessarily have before.