At a recent briefing on ‘Global Reinsurance Market Perspectives’, AM Best analysts and industry executives collaborated to provide a discussion on how the COVID-19 pandemic and a higher frequency of natural disasters have dominated recent claims experiences. Providing commentary on the outlook of the global reinsurance sector, Carlos Wong-Fupuy, senior director at the rating agency, noted that AM Best is maintaining its global reinsurance outlook as stable.

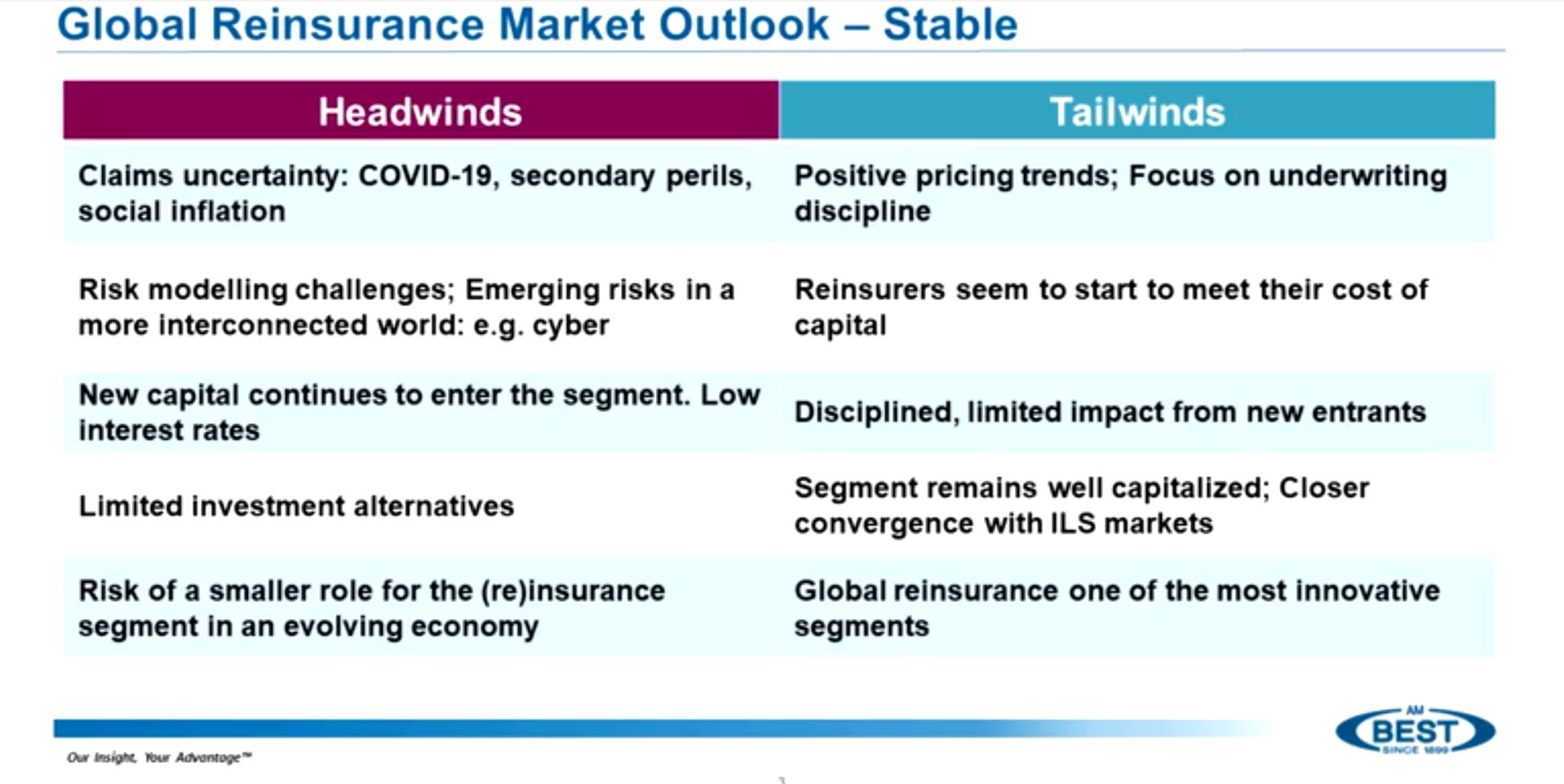

“The reason for this is that we see a number of positive and negative factors, which are in some way offsetting each other,” he said. “Probably the main point here is the level of claims uncertainty that we see in the market. We’re not thinking just about COVID-19, with the high proportion of IBNRs [incurred but not reported claims] which will take several years to develop, we’re talking as well about the higher frequency of extreme weather-related events.

“We are thinking about the Texas freeze earlier this year and more recently the European floods. About the higher incidence of secondary perils that, by definition, are less well understood, are more difficult to price and model, and [also] the persistent trend in social inflation, which is affecting US casualty lines.”

Despite this plethora of considerations, Wong-Fupuy highlighted that there is some good news as this environment of higher uncertainty has driven pressures on better underwriting discipline and improving pricing trends. AM Best has seen several companies improving, across the board, their performance on an underlying basis, once the impact of the events related to COVID-19 has been excluded.

These positive trends are welcome, he said, and among them is the emergence of new capital entering the market. Fortunately, that discipline is being maintained, and the impact of new entrants is still limited. At the same time, when a long-term view is taken into account, the rating agency’s team feel that this underwriting discipline has to be balanced with the challenges that an evolving economy and evolving risks are posing to the market.

“And we believe that the sector remains very well positioned not just because of the capital efficiency, because of the strength of their participants but [also] because of the level of innovation that it has shown in the past,” he said. “[The way] the traditional sector works with the ILS capital markets is definitely an advantage, which keeps the sector very well positioned to face these new challenges.”

Leading the conversation, as moderator, Stefan Holzberger, chief rating officer at AM Best, emphasised how understanding the headwinds and tailwinds buffeting the global reinsurance segment is key to understanding how these might progress. In that spirit, he posed the following question to Juan Andrade, CEO of Everest Re Group – “do you feel optimistic about the pricing environment and earnings expectations over the near term?”

Andrade said he is optimistic about what he sees today in the marketplace and sees that continuing into 2022. While this is a well-capitalised industry and there have been some new entrants coming in, the reality is the fundamental dynamics of the reinsurance industry have not changed because of that.

“Most of our competitors, I would say, at this point, are reacting in a very disciplined way to the environment that they see,” he said. “I think most companies recognise that generating an underwriting profit in this environment is critical. In an environment where you have perennially low interest rates, where climate change is definitely increasing the loss cost profile for the industry, and in a pandemic. So I do think that has helped the discipline of the environment with some of our key competitors.

“That being said, I think there’s going to continue to be a bit of a tailwind behind us on terms and conditions and on pricing that I do believe will continue into next year. So I am convinced that there’s stability in the industry right now, I see rational competition in this space and I see much more focus on underwriting profitability than I’ve seen in a number of years.”

Sticking with this macro-view, Holzberger asked Kathleen Reardon, CEO of Hiscox Re, whether there are any particular lines of business or geographic regions that she feels offer the best prospects and whether there are lines or regions which she would encourage her teams to steer clear of. She highlighted that, at the Hiscox Group level, the team is seeing the rating environment overall as very favourable for its three business units – retail, London Market and Hiscox Re & ILS.

Specifically for the big-ticket businesses, being London Market and Re, they saw double-digit rate increases for the first half of the year, Reardon said. Zooming in on reinsurance specifically, the rate improvement has been slower, but still very healthy. Hiscox Re is in its fourth-year of rate increases, she said, and seeing a strong double-digit rate improvement overall.

“Looking at the first half of the year,” she said, “we still had [increases] in many of the property lines, and even marine double-digit increases. Or looking at geographical differences, we see Japan still had mid to high single-digit increases and Florida a good solid 10%. So, we’re in a much-improved position going into the second half of the year and with the 1:1 renewal season coming up.”

Examining the geographies that are interesting to the Hiscox team, Reardon highlighted that Europe is currently “underweight”. Given the comments Wong-Fupuy made earlier, she said, regarding the recent floods, and the COVID losses impact, in conjunction with the good relationships that it has there, the group will be taking a closer look at Europe specifically.

As for lines of business, she said, it is important to note where Hiscox will not be looking to grow its exposure, without taking this to mean that it will necessarily shy away from it. Recently, at the Hiscox Group level, it looked at its cyber exposure and, as a result, meaningfully cut back from certain industries and certain geographies.

“That was a deliberate decision,” Reardon said. “On the reinsurance side, we managed to restructure our position somewhat and non renew the low-attaching layers, partially to remove us away from the increased frequency of ransomware, but also to alleviate some of the premium increases for clients.”