AXA, the French insurance giant, has reportedly divested from its remaining investments in Israeli banks that have been implicated in financing settlements in the occupied Palestinian territories, according to a new report from advocacy group Ekō.

The divestment is said to follow sustained pressure from human rights groups and international coalitions, who have accused these banks of complicity in activities denounced by the United Nations and other major human rights organisations.

The report, which is based on data from the independent research organisation Profundo, indicates that as of September 30, 2023, AXA held over 2.5 million shares, valued at more than $20 million, in three Israeli banks—Bank Hapoalim, Israel Discount Bank, and Bank Leumi.

However, by June 24, 2024, the report claims that AXA fully divested from these institutions amid mounting pressure from the global “Stop AXA Assistance to Israeli Apartheid” coalition and widespread public opposition to the situation in the occupied territories.

The report further claims that AXA has not reinvested in Bank Mizrahi-Tefahot or First International Bank of Israel since at least December 31, 2022.

Leili Kashani, a senior campaigner with Ekō, stated that the report demonstrates AXA’s rapid divestment from these banks, which have been targeted by human rights activists.

She also said the divestment was driven by external pressure rather than market conditions, which she said is a conclusion supported by the data showing significant drops in AXA’s holdings despite steady or rising share prices.

Ekō, part of a broader coalition campaigning for AXA’s divestment from Israeli banks and Elbit Systems, Israel’s largest weapons manufacturer, said that it succeeded in getting AXA to divest from Elbit Systems by the end of 2019 and from two other Israeli banks by the end of 2022.

The coalition says that this alleged latest divestment from the remaining three banks signals it has achieved all its original demands.

Ekō says that public support for the campaign against AXA has been significant, with the organisation noting that 175,000 people signed its petition urging the insurer to cease investments in banks financing illegal settlements.

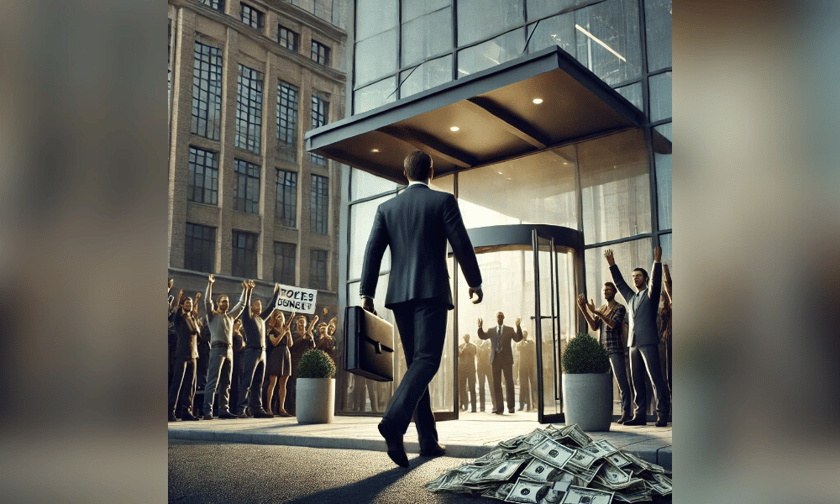

The group says that it also organised protests at AXA’s London headquarters and other locations across Europe, delivering petitions and engaging directly with AXA’s leadership at its annual general meetings.

At the company’s AGM in April 2024, AXA CEO Thomas Buberl acknowledged the pressure over the insurer’s investments, declaring that AXA had no direct or indirect investments in Israeli banks.

Although he did not respond to inquiries from Ekō, the organisation’s report alleges that AXA had indeed divested from all targeted banks by that time.

AXA’s reported divestment was also hailed as a significant development for the Boycott, Divestment, Sanctions (BDS) movement and its allies, who view it as a milestone following years of strategic campaigning. Ekō and other groups have indicated that they will continue to monitor AXA’s investments to ensure compliance with international laws and standards.

Ekō’s report comes shortly after a ruling by the International Court of Justice, which declared that Israeli actions against Palestinians, including its military occupation and annexation of Palestinian territory, are illegal. The ruling reinforces the obligation of states, corporations, and institutions to refrain from enabling such violations of international law.

In response to a request for comment from Insurance Business, a spokesperson from AXA Group highlighted Burberl’s comments at the AXA Group AGM in April, where he said: "AXA does not have any investment in Israeli banks(…)targeted by boycott calls, currently led by some activist groups against several companies.” He further added "This means it's not 200-and-some shares; it's zero shares."

The group also noted that it is “committed to conducting business to the highest ethical standards. AXA’s investments comply with applicable laws and regulations and respect internationally recognised human rights principles. This is the case globally, including AXA’s investment in the Middle East Region. The AXA Group Human Rights Policy can be found on our website.”

AXA added that it aims to avoid any negative impact on human rights that could be associated with its investment activities. The ESG assessment of companies in which the AXA Group has invested, or is considering investing, incorporates the following elements related to human rights: fundamental principles such as those of the United Nations Global Compact, the International Labour Organization, or the OECD, which cover areas such as forced labour, discrimination, inclusion of vulnerable populations, controversial weapons, working conditions, and the reputation and potential controversies surrounding these companies.

What are your thoughts on this story? Please feel free to share your comments below.