The UK is Europe’s top insurtech hotbed, with almost a quarter of the continent’s insurtech companies based in the country. Globally, the nation trails only the US both in the number of startups and those that have achieved unicorn status, indicating a thriving insurtech space that plays a crucial role in the insurance industry’s evolution.

Insurance Business ranks the 10 biggest insurtech companies in the UK in this article. The list contains a mix of unicorns and “futurecorns” – or those startups capable of crossing the unicorn line – all of which are driving digital transformation and technological innovation within the country’s insurance sector.

If you’re part of an insurance company in search of the sector’s leading “enablers,” this piece can serve as a guide. Read on and learn more about the top insurtech companies in the UK. Here they are ranked based on the total funding raised to date.

Total funding: £411 million

Number of acquisitions: 4

Number of investors: 2

Head office location: London

Founded in 2020, Ki Insurance – pronounced as key – was launched in 2021 and became the largest insurtech startup in the history of Lloyd’s of London, underwriting more than £329 million worth of general and commercial insurance premiums in its first year. The company is also the first fully digital and AI-driven syndicate within the Lloyd’s market. The firm got its £411 million funding from Fairfax Financial and Blackstone.

Ki adopts a proprietary algorithm to underwrite risks. It was built in partnership with Google Cloud with the support of Google’s Octo Labs. The startup also collaborates with the University College London on the first “algorithmic underwriting approach” for specialty insurance, which assesses policies and provides quotes for businesses through the Ki platform. The platform was designed for the specific needs of the London broker and can underwrite 36 classes of business.

Total funding: £398 million

Number of acquisitions: 4

Number of investors: 11

Head office location: London

After achieving unicorn status in 2021, ManyPets rebranded from Bought By Many in 2022, with the goal of bringing its UK business in line with the insurtech company’s global brand. The digital insurer offers pet policies and pet health products to domestic clients, and those in the US and Sweden. The firm is among the top insurtech companies in the UK and is currently valued at £1.6 billion.

ManyPets uses social media and search data to sell insurance policies. It is also the first specialist pet insurer in the country to provide customers with online form-free claims. In 2019, the insurtech startup gave its clients free access to its FirstVet app, which allows them to have direct video calls with veterinarians anytime.

ManyPets offers policies designed using over 40,000 client reviews. This enabled the firm to launch products that boast innovative benefits, while avoiding adding features that customers do not like about other policies.

Total funding: £232 million

Number of acquisitions: 1

Number of investors: 12

Head office location: London

“[T]he problem with traditional insurance is that it holds businesses back,” this is what insurtech unicorn Zego boldly states on its LinkedIn page, adding that conventional insurance is also “too expensive and time consuming, and it no longer suits businesses who use vehicles to earn money.”

Specialist motor insurer Zego is currently valued at £880 million and proudly says that its products address these issues and suit the needs of businesses not just in the UK but also in “Europe and beyond.”

Zego’s portfolio consists of motor, commercial, and professional insurance policies for enterprises of all sizes and types. The insurtech company was established in 2016 and began by offering gig economy workers flexible motorbike insurance, which they can access through its mobile app and website. The firm has since expanded coverage to a range of tech-enabled policies tailored to commercial motor clients. It now insures more than 200,000 vehicles for different types of businesses, including sole traders, fleets, and multinational brands.

"Zego empowers individuals with freedom of choice in the modern world, where traditional insurance no longer provides the cover they need."

— Zego (@Zegocover) March 4, 2019

Our CEO & Co-Founder, Sten Saar, was interviewed on scaling in the insurance industry and gig-economy trends.https://t.co/t1LmnJMcyC

Total funding: about £170 million

Number of investors: 17

Head office location: London

YuLife’s goal is to improve the financial, physical, and mental health and wellbeing of its 550,000 customers worldwide through its portfolio consisting of:

Group life insurance is the insurtech company’s flagship product, which gamifies coverage to inspire policyholders to live healthy lifestyles. The firm’s YuLife app encourages employees to complete daily wellness tasks in exchange for YuCoins, which they can use to reward themselves, family members, or friends with gifts, or do their part to make the world a better place by planting trees or donating to charities.

Apart from staff wellbeing challenges, YuLife’s platform allows employees to access virtual GPs, and mental health and financial protection services.

Total funding: $200.6 million (£165 million)

Number of investors: 7

Head office location: London

BIMA separates itself from the other top insurtech companies in the UK by providing insurance products and health services to clients in traditionally underserved emerging markets through its mobile app. To date, the firm has a global reach spanning more than a dozen countries in Asia, Africa, and Latin America, totalling 31 million subscribers.

The company’s goal is to provide disadvantaged families with affordable health insurance and access to virtual health services. It offers microinsurance, mobile insurance, and insurance administration services to customers who may be unfamiliar with conventional insurance processes. To do this, BIMA collaborates with tech and underwriting firms in these locations.

Total funding: £99 million

Number of investors: 17

Head office location: London

Tractable crossed the unicorn line in 2021 and now has a current market valuation of £820 million. The insurtech company uses AI to support accident and disaster recovery. Tractable uses deep learning to automate visual damage appraisal, enabling it to get an accurate estimate of repair costs just by scanning photos of the damage site.

An industry enabler, Tractable provides insurance companies access to its AI Review and AI Estimating tools to help them improve their claims-processing systems, and produce live, end-to-end estimates of the damage. These platforms also deliver vehicle and property damage appraisals in minutes.

Tractable holds a partnership with some of the insurance industry’s global brands, including:

Total funding: £96 million

Number of investors: 8

Head office location: London

In 2021, specialist motor insurtech company raised £70 million in a funding round, which upped its market valuation to £1 billion, making the firm one of the first British Black-owned unicorn.

Marshmallow was established in 2017, originally to provide affordable car insurance for UK expats. The startup has since expanded into a digital-only insurer focusing on offering clients “cheaper, faster, and fairer insurance” through its machine learning technology.

Now among the top insurtech companies in the UK, Marshmallow uses this proprietary pricing algorithm to provide affordable coverage for customers spurned by traditional car insurance providers, including:

The firm also made it its mission to help improve the financial health of these demographics by offering them cheaper premiums. To do this, Marshmallow says it invests in technology to cut operating costs and passes those savings on to its more than 100,000 members.

Total funding: £66 million

Number of investors: 12

Head office location: London

Originally founded in 2015 as Digital Risks – named after the type of coverage it offers – the insurtech company rebranded to Superscript in 2020 to reflect the “evolution of the business” as it expanded its offerings to other forms of risks businesses face.

Superscript now provides a range of insurance products designed for small and mid-sized enterprises (SMEs) and high-growth tech firms. The policies are subscription-based and tailored to suit the unique needs of each business. Superscript gives clients access to a fully self-serve online platform where they can purchase coverage and manage their policies in a matter of minutes. The company also offers advisory and broking services through its SuperscriptQ platform.

Total funding: $73.1 million (about £60 million)

Number of investors: 5

Head office location: London

Instanda provides insurance professionals with a no-code platform to build and launch insurance products. The insurtech company’s software-as-a-service (SaaS) policy administration tool allows insurance providers and brokers to create, distribute, and manage new products in a fraction of the time that it traditionally takes.

Instanda holds partnerships with several major insurers in the property and casualty, and life and health space, as well as brokers and underwriters in Europe, Australia, and North and Latin America.

Total funding: £34 million

Number of investors: 15

Head office location: London

Cytora was established by a team of data engineers and machine learning scientists, so it is not surprising that its configurable risk management platform is being used by some of the world’s leading insurers and MGAs, including QBE, AXA XL, and Starr. The insurtech company’s Risk Engine technology has become a popular tool for commercial insurers to target and price risks, allowing them to underwrite accurately and slash frictional costs.

Cytora has the backing of several leading venture capitalists and holds partnerships with some of the world’s top tech firms.

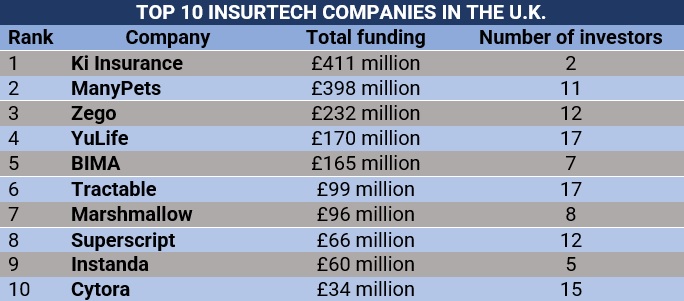

Here’s a summary of the top insurtech companies in the UK based on total funding. To come up with this list, we gathered investment data from this website.

Derived from the words “insurance” and “technology,” the term insurtech is used to describe a company that uses technological innovation to make the traditional insurance model more efficient. This includes using artificial intelligence and data analytics to offer fair and accurate premiums and make underwriting and claims processing faster.

The insurtech sector generally consists of two types of companies based on the role they play in the industry:

The top insurtech companies in the UK are also grouped into four categories:

The UK is home to at least 200 insurtech startups, and accounts for almost a quarter of Europe’s insurtech sector, according to the Institute for Financial Services Zug (IFZ). The country also places a distant second to the US when it comes to the number of insurtech companies, and a notch ahead of Germany.

What benefits do the top insurtech companies in the UK bring?

The biggest Insurtech companies in the UK bring several benefits that make them attractive options for both the consumers and insurance providers. These include:

However, there are still some incumbents that are hesitant to collaborate with insurtech companies. The main reason is regulatory. The insurance industry is highly regulated with a lot of jurisdictional legal layers that companies need to deal with. This makes it quite risky for insurers to work with startups that may operate on a separate legal boundary.

The country is not only home to the second-largest insurtech market, it also hosts several of the industry’s unicorns. Find out the UK’s top insurtech unicorns in our latest rankings. Want the latest insurtech news? Click here to visit our Insurance Technology news section.

What are your thoughts about the top insurtech companies in the UK? Are they here to enable or disrupt the insurance industry? Share your comments below.