One of the most common misconceptions about motor insurance is that standard personal vehicle policies provide coverage if you use your car for work-related purposes. The truth is your standard car insurance only covers you if you use your vehicle for commuting and social trips.

If you drive your car for business purposes, you will need a different type of policy. Called company car insurance, this form of coverage works differently and offers a higher level of protection compared to regular car policies.

If you’re among the millions of British drivers who regularly use their vehicles as part of their jobs, this guide can come in handy. Here, we will discuss how company car insurance works, how it differs from other types of motor policies, and what factors impact pricing. Insurance professionals can also share this article with their clients to assist them in finding the best car coverage for their needs. for the insurance professionals who read our site, we encourage you to send this along to any of your clients who feel they do not need this coverage.

Company car insurance, also referred to as business car insurance, is a type of policy that provides coverage for vehicles driven for work-related purposes, excluding commuting, which is covered under standard motor insurance. This means that if “work-related” use of your vehicle is limited to your commute to the same office each day, you do not need to take out a company car policy.

However, if driving is a regular part of your job, then purchasing company car insurance is a must. When picking the right policy for your needs, there are three “classes of use” you can choose from, with each offering different levels of coverage. These are:

If your company owns the business-use vehicle, they are responsible for taking out coverage and paying for the premiums. In the event of a claim, businesses should also shoulder the excess. Some companies, however, incentivise safe driving by shifting the responsibility of paying the excess to the drivers.

For privately owned cars used for work that receive a fixed mileage allowance – also known as grey fleet vehicles – the owners are responsible for purchasing their own insurance. Companies, however, should make sure that these vehicles carry at least the most basic form of coverage required by the law.

Every vehicle in the UK, including those intended for business purposes, is required to have third-party coverage. This is the minimum level of cover required for you to be allowed on the road. In general, drivers can access three types of protection, according to the Association of British Insurers (ABI). These are:

But apart from these standard coverages, company car insurance provides additional protection tailored for business-use vehicles. This includes coverage for:

Company car insurance does not provide coverage for vehicles that are used by businesses for commercial purposes. The table below lists some of these types of vehicles.

For these types of vehicles, you are legally required to take out commercial motor insurance, which we will discuss in detail in the next section.

It is mandatory for all vehicles in the UK to carry insurance before they are allowed to operate on British roads. These include company cars and commercial vehicles. But these types of vehicles require different kinds of policies.

You need company car insurance if you use your vehicle for work-related purposes such as travelling through different work locations or visiting clients. Commercial motor insurance, meanwhile, is designed for vehicles used by businesses for commercial purposes such as those listed in the previous section.

Commercial motor insurance policies come in two main types, namely:

Based on the several price comparison and insurer websites that Insurance Business checked out, the average cost of a fully comprehensive company car insurance policy starts at around £400 and can exceed £600. And just like for standard motor insurance, the premium for your company car may be higher or lower depending on a range of factors, including:

Company car insurance is typically more expensive than standard motor policies as work-related driving involves covering more miles often during busier times and on unfamiliar roads. Due to these factors, car insurers consider drivers of business-use vehicles as riskier to insure.

If you’re a business owner and in search of a company car that wouldn’t cost a fortune to insure, you can check out our list of the cheapest cars to insure in the UK.

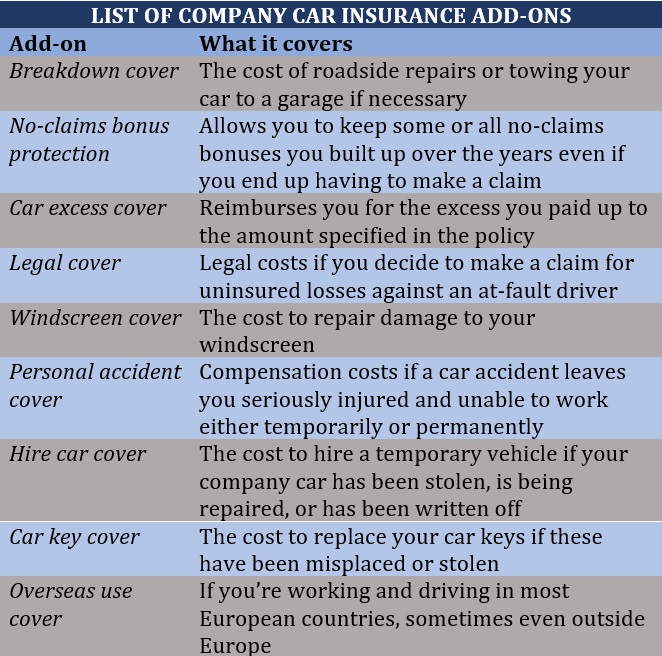

Because each driver has varying needs, sometimes even fully comprehensive motor insurance policies cannot provide complete coverage. That’s why some insurers offer drivers a range of add-ons to enhance the coverage their company car insurance policy provides. The table below lists some of these optional extras.

If your company owns your work vehicle, then you wouldn’t have to worry about paying premiums. But if you’re a business owner or you’re using your personal car for work-related purposes, then you would likely need to purchase company car insurance and pay for coverage yourself. And with the high-cost of insurance premiums for business-use vehicles, it pays to have a plan on how you can minimise the price you pay.

Here are some simple strategies you can take to reduce your company car insurance premiums.

Private drivers have even more options when it comes to lowering the premiums they pay. You can check out our practical guide on finding cheap car insurance in the UK to learn more.

Our Best in Insurance Special Reports page is the place to go if you’re looking for top-of-the-class insurance companies in the UK that offer the best company car insurance policies. The insurers featured in our special reports have been handpicked and nominated by their peers and recognised by our panel of industry experts as respected and dependable market leaders.

Recently, we unveiled our five-star awardees for the Best Commercial Car Insurance providers in the UK. The insurance providers are ranked based on several categories, including claims handling, response time, and underwriting expertise, to secure the coveted spots on our list. Apart from commercial motor insurance, these insurers offer a range of car coverages such as personal and company car insurance to suit the varying needs of British drivers. By partnering with these companies, you can be sure of getting top-notch protection and outstanding customer service.

Are you in search of a company car insurance policy that matches your needs? Did you find our guide helpful? Feel free to tell us what you think in the comments section below.