Best Insurance MGAs in the UK

Jump to winners | Jump to methodology

Industry dynamos

The broking community has spoken and delivered its verdict. Insurance Business UK proudly celebrates the Brokers on MGAs 2024 winners.

Mario Conde, partner at Bain & Company, says, “Successful MGAs have to deliver an attractive value proposition that’s superior relative to the alternatives available from both the perspective of the capacity provider and from the perspective of the broker or end customer.”

He lists key attributes of the best MGAs:

-

clear focus: defined end customer segment, risk appetite, coverage and geographies that the MGA can differentially serve

-

specialised expertise: product offering and execution with a differentiated approach to risk assessment, the use of data and clearly differentiated production options for the target market segment

“The best MGAs need market-leading speed, broker responsiveness and scalability, including for both quote and bind as well as in the claims arena,” says Conde.

Renovation Underwriting

Ringing up a consecutive hat trick of IBUK Brokers on MGAs awards is even more satisfying since the firm joined Ardonagh Advisory’s stable in September 2023.

“They have contacts far higher up the tree in insurers and in some of our partner brokers. So, it helps to have those higher-level conversations about plans to expand the business and how they’re going to help us implement that,” says managing director Douglas Brown.

There was a resolute desire to maintain the standards Renovation Underwriting is renowned for as an MGA and a broking group in the private client contract works.

“We kissed no end of frogs in the venture capital world; they weren’t bringing anything that would help us do anything faster or better,” Brown says. “Ardonagh was the obvious choice, as they were one of the few who had an MGA and a broking platform.”

Brown completed a management buyout in 2010 when GWP was £2 million and it’s grown to £30 million. The reason for the upsurge is high standards and the honing of skills.

He says, “In all of that time, I’ve fired one person, one retired and one got his dream job in corporate finance. Everybody else has stayed; turnover is incredibly low.”

Douglas BrownRenovation Underwriting

And he underlines how the internal structure is geared for long-term success.

Brown says, “The expertise we’ve built within the team is very high. All of our underwriters have the same underwriting authority, and we don’t have big hierarchical systems. That’s been the backbone of how we’ve done it.”

Part of the reason why the team is so adept at serving brokers comes from the painstaking selection process. Before Brown offers a contract, he issues candidates a full staff list with phone numbers and asks them to pick any two people to call at any time for an honest chat about working at Renovation.

“It’s more important that the person wants to join us than we want to give them a job,” he says. “The fit is more important than the experience because there’s a real team ethos.”

Proving that point, the firm’s three fundamentals are:

-

capability

-

competence

-

conscientiousness

Educating and innovating

Renovation has prioritised its Continuing Professional Development offering and delivered a disproportionate amount relative to its size of approximately 2,000 hours annually.

The firm also has no fiscal targets, as Brown feels that approach has two traps:

-

“If they’re ridiculous, and people view them as ridiculous, they probably won’t try that hard.”

-

“If you’re not ambitious enough, as soon as you approach them, everybody backs off.”

Renovation’s mission is to ensure no one loses their home.

“We don’t want anybody, as far as we can control, to lose their home because their existing insurer had decided that because they were having work, they weren’t going to pay their claim. A lot of the reason for joining Ardonagh was to get us closer to that,” says Brown.

Innovative is one of Renovation’s calling card.

-

Case: Work on a boat house next to the Thames where a nearby railway bridge was too low for a fire engine to pass.

-

Solution: The firm arranged for a pump to be installed for the duration of the works to supply water direct from the Thames to stem any fire long enough for the fire service to arrive.

-

Case: Renovation of a remote thatched roof cottage with a fire station 20 minutes away.

-

Solution: Installing a 10,000-litre polythene water tank on site, which the fire brigade can couple up to.

While Renovation prides itself on its creativity, it has clear demarcation lines.

Brown says, “If a broker won’t take our advice for the client on how to insure a renovation properly, then we’ll walk away. We don’t mind telling people if we think they’re doing it wrong; we make our position clear rather than find a solution, which doesn’t work for anyone.”

The firm also reaches out to architects and project managers about employer-controlled insurance programs to combat the issue of liability being lost among a series of actors.

“We produce a product that means that the client is insured properly; they are in control of the work, the insurance and the liability cover. We make sure that whatever goes wrong, they’re not left in the position of losing their home,” says Brown.

Choice Insurance Agency

To be rated by brokers is particularly pleasing, as the firm makes a conscious effort to back brokers to the maximum.

“We’ve taken a decision that despite all of this technology and AI that’s out there, actually good, old-fashioned service should rule, as brokers’ integrity is on the line every day,” says Chris Clacy, head of sales and marketing. “The insurers don’t get the rap for that; they can take days or weeks sometimes to come back to people, whereas we decide that’s not how we want to trade.”

The firm has exacting response policies:

-

SLA reply time of two hours

-

answer phones in two rings

And Clacy adds, “It’s not segmented; we don’t have tiers where we’ll get back to one broker quicker. No matter how big or small the case, it’s going to be important to that broker.”

Choice can deal with a range of brokers but tends to offer scheme services normally with a £50,000 minimum. Examples include:

-

chemists

-

taxi offices

Chris ClacyChoice Insurance Agency

“We write the products, put them online and they can start trading on them straightaway,” says managing director Mark Williams. “Equally, when they come back with queries about the question set or the wording, we will always look at those. We have management meetings every morning to go through all the responses.”

Despite remaining true to fundamental broking principles, Choice buys cutting-edge technology and adapts it to fit its system where applicable. One such area is flood mapping, where surface water can remain for weeks after a flood.

“We’ve got information from four or five sources at any one point, at the postcode level and then at the address level. We can say at a particular address, ‘Is this likely to have a flood in 100 years, and what is likely in 10 years? And the surface water is going to last for three weeks, depending on the height of the flood,” says Williams. “It maps so many different things: tidal, river flooding and rainwater flooding. It’s just incredible.”

Niche experts

IBUK’s broker respondents rated Choice highly in the charity category. While not an area the firm actively courts, it is a testament to its professionalism and expertise.

Clacy highlights how they step in during trying times for brokers, when renewal hasn’t been invited or the terms have changed, which brokers don’t forget.

He says, “I would imagine it’s kind of a thank you more than anything else. We can write, and we will flex to do what we need to do, but we’re not sitting here as a specialist charity provider.”

The firm’s focus is on niche, bespoke schemes. It has an open-minded approach and will take on anything that adds up.

“Brokers tend to be specialists in areas, so they know the risk probably better than us, and we’ll work with a broker to come up with an appropriate rating guide and appropriate terms,” says Williams.

Referencing the chemist package it created, Choice wrote chemists under two existing products; however, a broker requested a specialist scheme to include:

-

medical malpractice insurance

-

deterioration of drugs

-

dispensing errors

Williams says, “Those extra bits made it a chemist package, as opposed to shoving it onto an existing scheme.”

The reason why Choice stands out as a market leader is that not only does it craft new packages, but it also does so under the correct conditions, estimating it writes around 1 in 3 bespoke requests due to factors such as a lack of business or little profit for insurers.

“We love to consider anything; it doesn’t have to be in our area of expertise,” says Williams. “We’ve worked with some excellent insurers that trust us and are open to our suggestions; if we feel something will work, generally speaking, they’ll go along with it because of our reputation and track record.”

Best Insurance MGAs in the UK

Ability to place niche or emerging risks

- Bspoke Group

- Choice Insurance Agency

- DOA Underwriting

- NBS Underwriting

- Touchstone Underwriting

Compensation (commission, bonuses, profit sharing, etc.)

- Bspoke Group

- Choice Insurance Agency

- DOA Underwriting

- NBS Underwriting

- Touchstone Underwriting

Geographical reach

- Bspoke Group

- Choice Insurance Agency

- DOA Underwriting

- NBS Underwriting

- Touchstone Underwriting

Overall responsiveness

- Bspoke Group

- Choice Insurance Agency

- DOA Underwriting

- NBS Underwriting

- Touchstone Underwriting

Pricing

- Bspoke Group

- Choice Insurance Agency

- DOA Underwriting

- Jensten Underwriting

- NBS Underwriting

- Touchstone Underwriting

Range of products

- Bspoke Group

- Choice Insurance Agency

- DOA Underwriting

- NBS Underwriting

Reputation

- Bspoke Group

- Choice Insurance Agency

- DOA Underwriting

- NBS Underwriting

- Touchstone Underwriting

Technical expertise and product knowledge

- Bspoke Group

- Choice Insurance Agency

- DOA Underwriting

- NBS Underwriting

- Touchstone Underwriting

Technology and automation

- Bspoke Group

- Choice Insurance Agency

- DOA Underwriting

- NBS Underwriting

Specialisation

Accident and health

- SAUA

Gold - Bspoke Group

Silver - Choice Insurance Agency

Bronze

Commercial motor/transport

- Jensten Underwriting

Gold - Amwins

Silver - Choice Insurance Agency

Bronze

Construction (large)

- Bspoke Group

Gold - Jensten Underwriting

Silver - DUAL

Bronze

Contractors

- Bspoke Group

Gold - Jensten Underwriting

Silver - DOA Underwriting

Bronze

Charity

- Q Underwriting

Gold - NBS

Silver - Choice Insurance Agency

Bronze

Cyber

- CFC

Gold - Angel Underwriting

Silver - Coalition

Bronze

Directors and officers

- Angel Underwriting

Gold - CFC

Silver - DOA Underwriting

Bronze

Flood

- Bspoke Group

Gold - NBS

Silver - Choice Insurance Agency

Bronze

General liability

- Bspoke Group

Gold - DOA Underwriting

Silver - Jensten Underwriting

Bronze

Management liability

- Pen Underwriting

Gold - CFC

Silver - Angel Underwriting

Bronze - DOA Underwriting

Bronze

Marine

- Munich Re Specialty - Global Markets, UK

Gold - Provego Underwriting

Silver - Fiducia

Bronze

Professional indemnity

- DOA Underwriting

Gold - NBS

Silver - Jensten Underwriting

Bronze

Property

- Bspoke Group

Gold - DOA Underwriting

Silver - NBS

Bronze

Schemes

- Bspoke Group

Gold - NBS

Silver - Jensten Underwriting

Bronze

SME

- DOA Underwriting

Gold - Jensten Underwriting

Silver - NBS

Bronze

All-Stars

- Bspoke Group

- DOA Underwriting

Brokers’ Pick

- Bspoke Group

Commercial combined - DOA Underwriting

Professional liability - Jensten Underwriting

Property insurance

Insights

Methodology

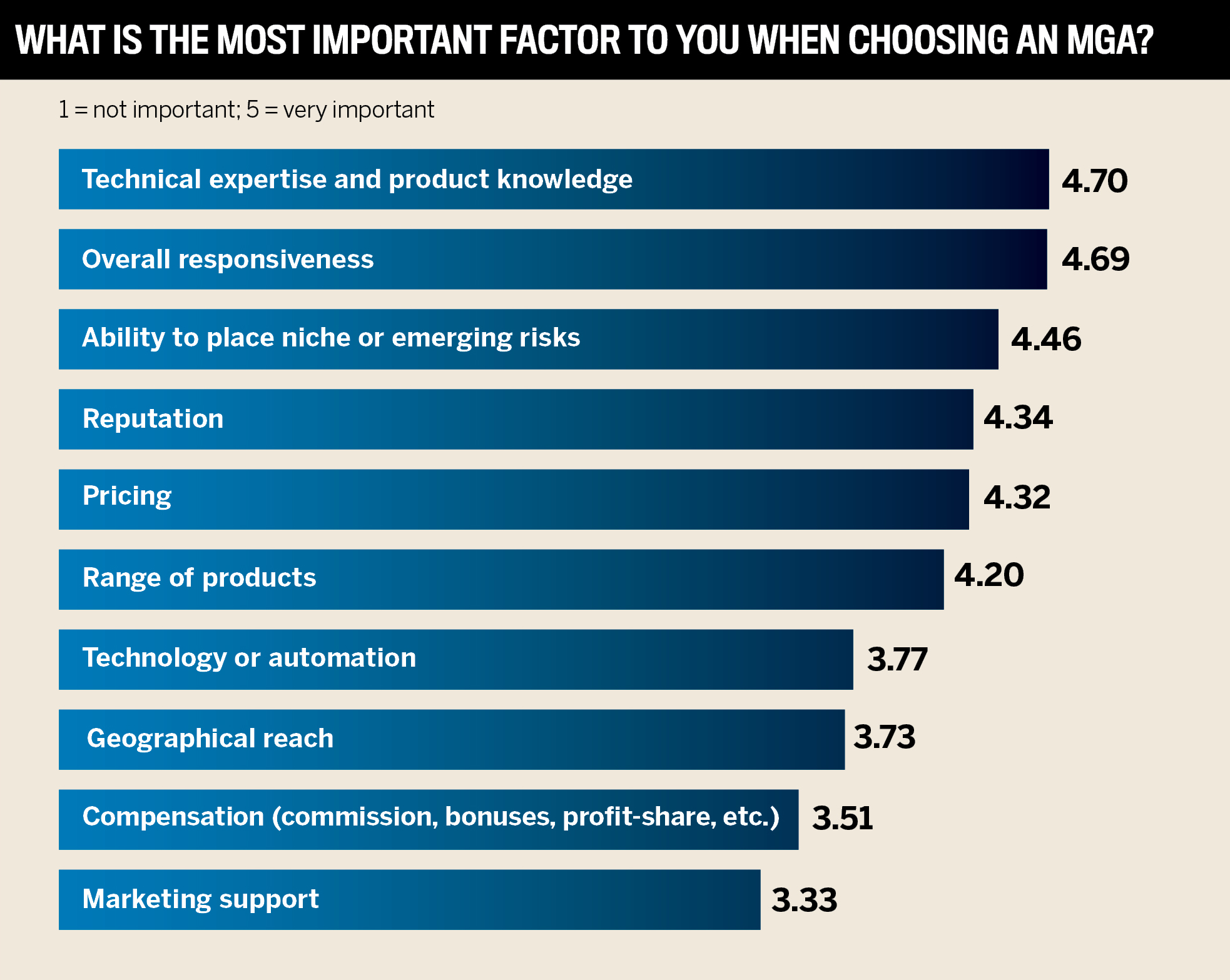

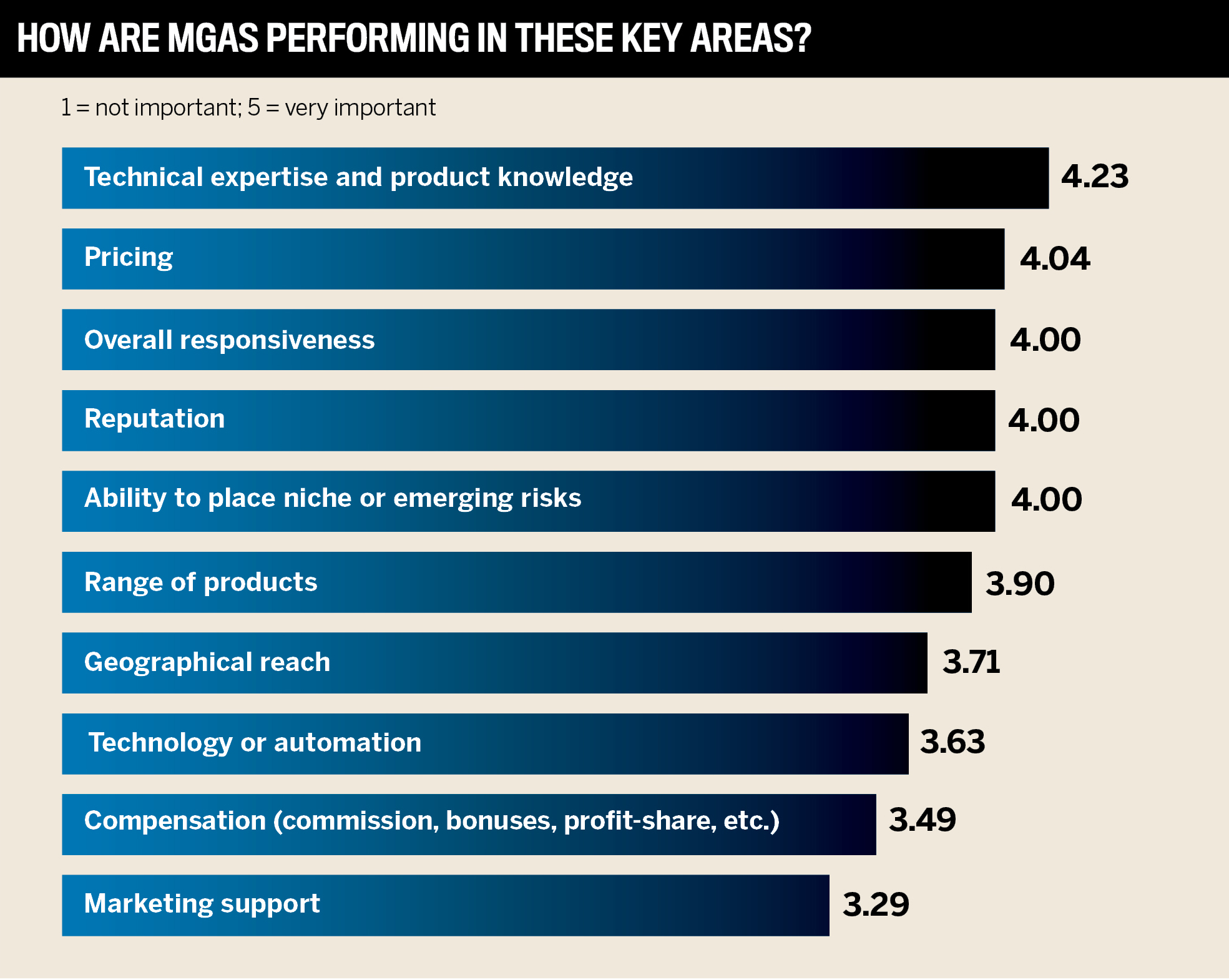

Insurance Business UK conducted a survey of brokers nationwide to determine the best MGA in the business. The survey asked respondents to rate the performance and service of each of their MGA partners on a scale of 1 (poor) to 5 (excellent) against the following 10 criteria: ability to place niche or emerging risks; compensation (commissions, bonuses, profit-sharing, etc.); geographical reach; marketing support; overall responsiveness; pricing; range of products; reputation; technical expertise and product knowledge; and technology and automation. The MGAs that earned an average score of 4 or greater in at least one category were awarded a 5-Star designation. MGAs that received an average score of 4 or greater in all categories received an All-Star designation.

Brokers were also asked to rank their top three MGAs across 16 major types of insurance. Brokers also named the top insurance products offered by an MGA. Based on brokers’ feedback, IB calculated the top three winners for each type of insurance and awarded gold, silver and bronze medals to those MGAs. The three insurance products that received the most votes from brokers were awarded the Brokers’ Pick medal.

Keep up with the latest news and events

Join our mailing list, it’s free!