The Best Insurance Companies to Work for in the UK |

5-Star Insurance Employers

Jump to winners | Jump to methodology

Facilitating excellence

In today’s market, employees have the advantage of surging demand. Therefore, the best employers are those outstanding firms that stand apart by creating environments where their people can thrive and attract others.

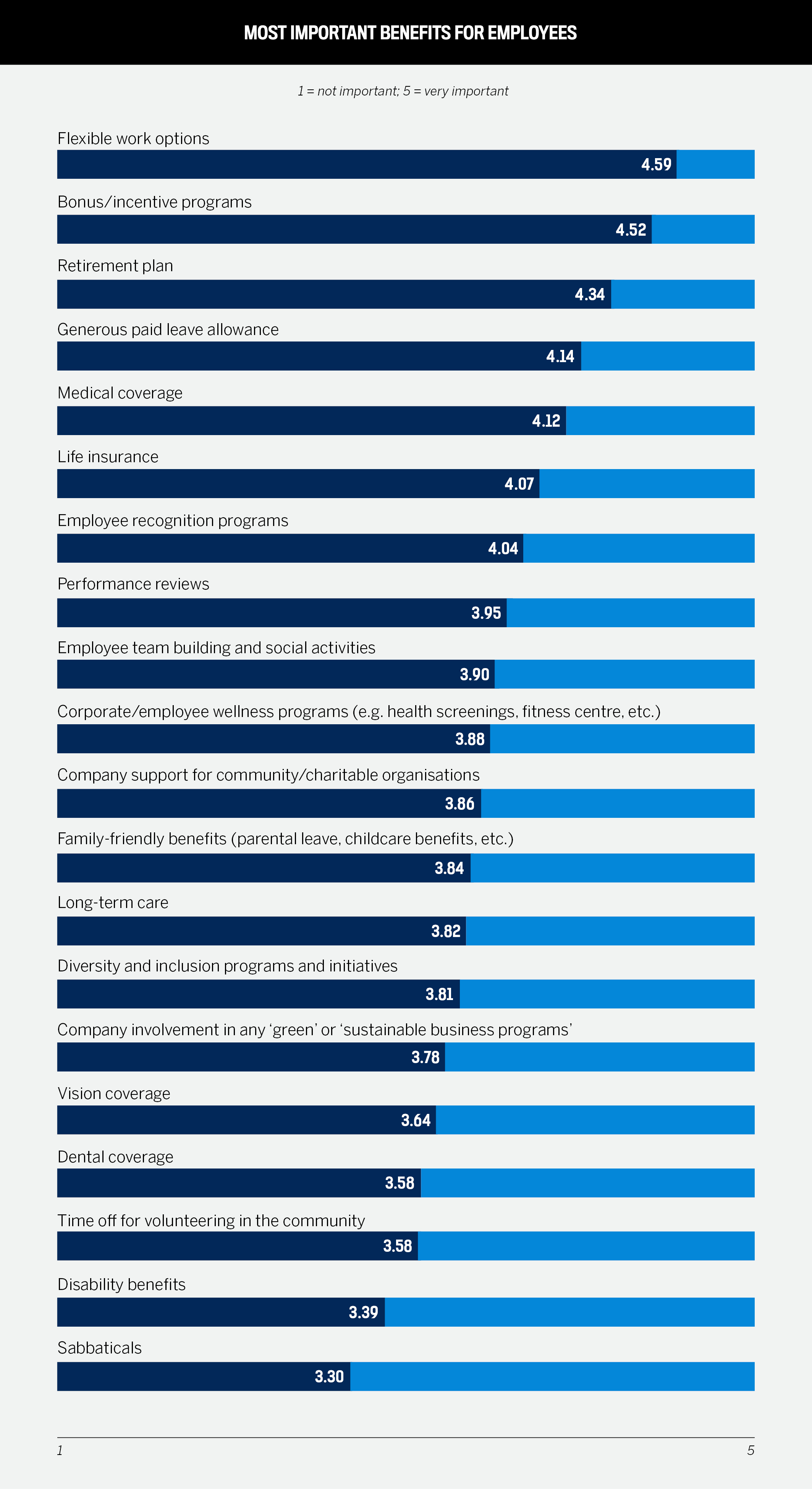

According to industry expert Luke Cahill, business director at Hays, “It’s crucial for employers to have initiatives in place that are properly communicated to employees. The top employers today appreciate that there are several important aspects of a role, including the salary, benefits package, flexible working options and what the team culture is like.”

The Top Insurance Employers have devised and implemented initiatives that have enabled employees to flourish, focusing on:

-

hybrid work models

-

diversity, inclusion and wellbeing

-

career development

-

bonus and incentive programs

"Healthy and happy staff are more likely to be productive and make an even greater contribution to the business as a whole,” says Cahill.

TH March

Diversity, inclusion and wellbeing

TH March has impressively constructed a positive employee environment, stretching across its six branches and 128 staff. Its approach has been focused on equity and removing structural barriers, introducing:

-

an official DE&I policy and forums

-

diversity surveys

-

staff training sessions covering diversity, unconscious bias and inclusion

“Our strategy over the next 12 months is to increase knowledge and awareness of the importance of DE&I education and ensure we continue to raise the bar in being an inclusive employer,” says Jo Morgan, regional director of HR.

TH March has a wellbeing committee comprised of 10 volunteers, with at least one representative from each branch, who meet monthly to discuss important issues and information that can be shared internally to raise awareness.

Morgan says, “They have a very generous budget, and each committee member for their branch can choose how they wish to spend it.”

Jo MorganTH March Group

With 28% of its workforce having been with the company for over 15 years, TH March’s career development prioritisation has been key to retention. The firm received silver accreditation from We Invest for its apprenticeship programs and is one of 19 companies to achieve this UK government-backed recognition.

“The award recognises companies that work hard to train and support those looking to gain qualifications while earning a wage,” says Morgan.

While new employees are required to complete a Cert CII qualification, TH March fully sponsors this training and gives employees designated revision days while paying for the exam costs. Moreover, staff are awarded financial bonuses upon completion of certifications and encouraged to progress further. Employees who earn ACII (level six certification) receive £3,600.

Sedgwick

Opportunities for advancement

Employee respondents were asked by IBUK whether they felt their organisation was dedicated to their career development. Many employees from Sedgwick responded “strongly agree” with additional comments such as:

-

“Our training team is so innovative; there are continuous improvements and updates in investment.”

-

“I receive regular feedback on the quality of my work, and there are mentoring circles I can join to support me.”

-

“Our training and development team has fantastically high standards and has won numerous industry awards each year.”

Sedgwick’s career development strategy consists of:

- increasing new hire engagement: providing enhanced tools and connection points during an employee’s first 12 months

-

career pathways: a program that integrates career conversations with performance reviews

Based on data collected from Hays’ 2024 Salary and Recruiting Trends guide, 93% of employers experienced skills shortages in the last year due to:

-

competition from other employers

-

fewer people entering the insurance market

-

aging workforce

“What we can’t afford to do is become complacent,” says head of colleague resources Vicki Cowell. “If we want to stay market leading, we need to become great. We need to keep moving the dial.”

Vicki CowellSedgwick

Innovative rewards and recognition schemes

Underscoring its Top Insurance Employer status, Sedgwick launched its Props program in 2023, a digital recognition tool allowing employees to reward one another. Each employee is given 2,000 points (renewed quarterly) to bestow on deserving colleagues. They can cash in their points for prizes ranging from gift cards to household appliances.

Employees earn points for:

-

exemplary work

-

assisting other colleagues

-

upholding company values

The scheme also recognises timely recognition, and sending a colleague a virtual high-five results in the recipient receiving five points.

“For us, it’s the in-the-moment recognition and thank you. That’s what we’re really driving, and we’ve seen a lot of traction with it,” says Cowell.

From September to November 2023, the Props program saw:

- 15,233 recognitions, high fives and positive comments

Sedgwick has also introduced Flexible First, allowing employees to spend more time working from home.

Cowell says, “It’s about having that flexibility as a mum to not feel guilty about nipping to the school to pick up your child. We all have different things we must commit to, and being able to drive that flexibility for our people has worked really well.”

Flexible First reflects wider industry trends. According to Hays’ 2024 Salary and Recruiting Trends guide:

-

80% insurance employers allow their staff to work in a hybrid way

-

62% of insurance professionals say they work most productively from home, compared to 31% who say they work better in the office

To remain competitive, Top Insurance Employers like TH March Group offer a hybrid model.

“Before the pandemic, we were an office-based company; however, we have since implemented a hybrid working policy. Managers have the discretion to decide with their departments if they will work on a hybrid basis of two days in the office. This is working well and has proved to be a great benefit when recruiting,” says Morgan.

Fellow Top Insurance Employer Sutcliffe and Co echoes this approach, and although employees prefer to be in office, the firm is understanding of the circumstances.

“Most people want to work in the office, so that’s what we do. But when situations arise, such as sick children or maybe a school play or a sick family member, we let our employees do what they need to do, and we sort it out later,” says director Duncan Sutcliffe.

In addition, Sutcliffe reveals how his firm spotlights its reward and recognition program.

He says, “It’s easy just to get on with the day-to-day grind, but we want to be excellent and provide great service. If we do that for our colleagues, they’ll do that for our clients.”

The Best Insurance Companies to Work for in the UK | 5-Star Insurance Employers

- Addresscloud

- All Medical Professionals t/a All Med Pro & Grow Insurance Partners

- Capsule

- RSA Insurance

- Send Technology

- Sutcliffe & Co

- The Plan Group

Insights

Methodology

To find and recognise the best employers in the insurance industry, IBUK first invited organisations to participate by filling out an employer form, which asked companies to explain their various offerings and practices. Next, employees from nominated companies were asked to fill out an anonymous form evaluating their workplace on a number of metrics, including benefits, compensation, culture, employee development, and commitment to diversity and inclusion.

To be considered, each organisation had to reach a minimum number of employee responses based on overall size. Organisations that achieved an 80% or greater average satisfaction rating from employees were named Top Insurance Employers for 2024.

Keep up with the latest news and events

Join our mailing list, it’s free!