Best Insurance Brokerages in the UK |

5-Star Brokerages

Jump to winners | Jump to methodology

Setting standards

“Today’s insurance sector is a vibrant ecosystem featuring innovation, agility and a laser focus on understanding the ever-evolving needs of its customers” are the words of Claire Bowler, global head of the insurance sector, in DWF Group’s Insurance Sector Trends 2024 report.

It’s been a successful year for insurance agents and brokers across the UK, as the 2024 market size is estimated to be £20.5 billion, which is an 11.37 percent increase from the previous 12 months.

However, this rise is mirrored with a decrease in the number of brokerages, declining by 0.5 percent per year on average between 2018 and 2023.

This suggests that brokerages are becoming more efficient and increasing revenue with improved operations, as showcased by IBUK’s 5-Star Brokerages of 2024.

Ainsley Mayhew Seers, partner at PwC UK, says, “There is a long list of characteristics – and arguably a growing list – which a 5-Star Brokerage must be able to demonstrate. Adding to the historical requirements of panel strength, product understanding, responsiveness and relationships, customers are increasingly expecting new digital ways of interacting alongside advice around new emerging risks.”

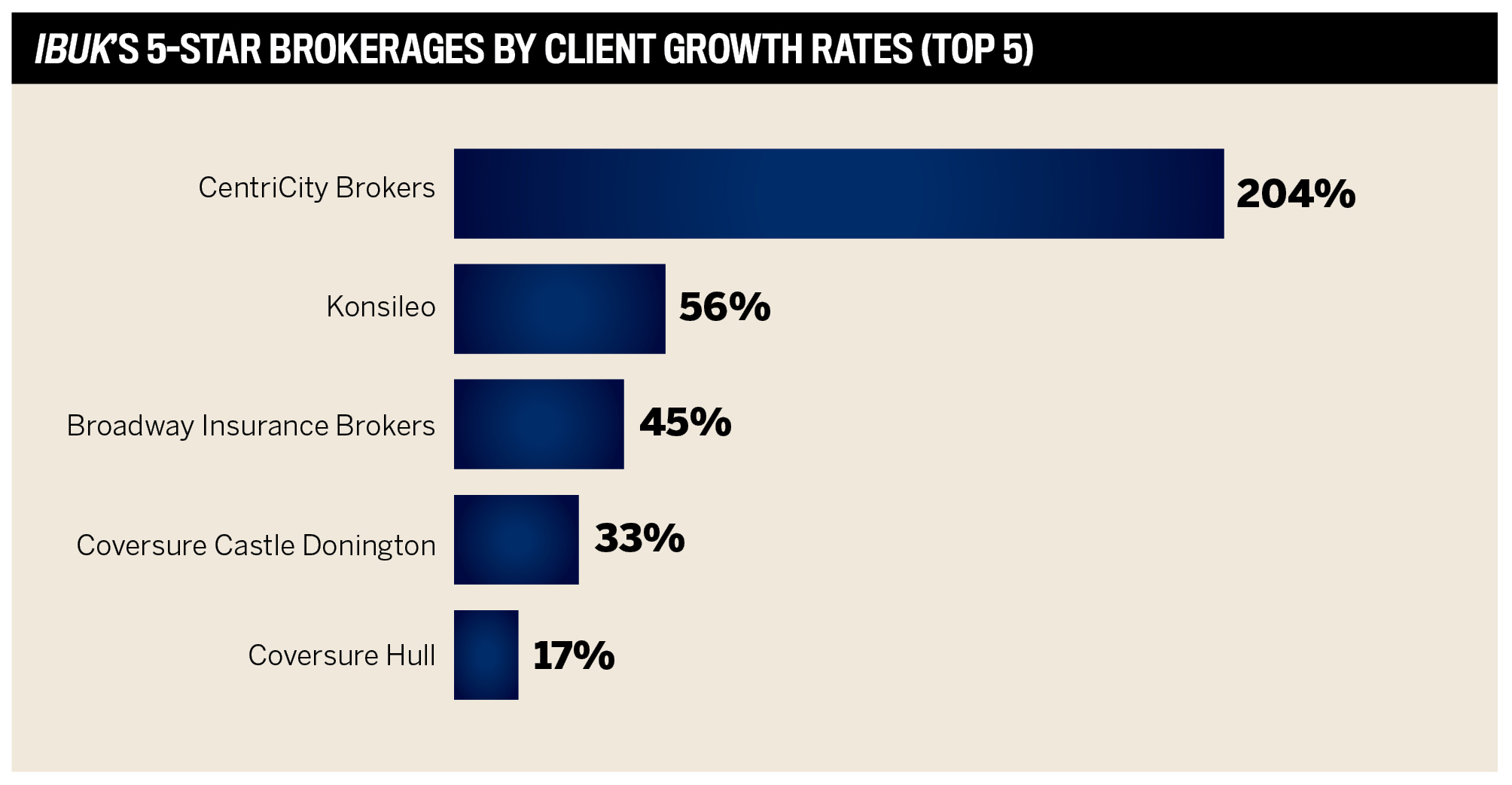

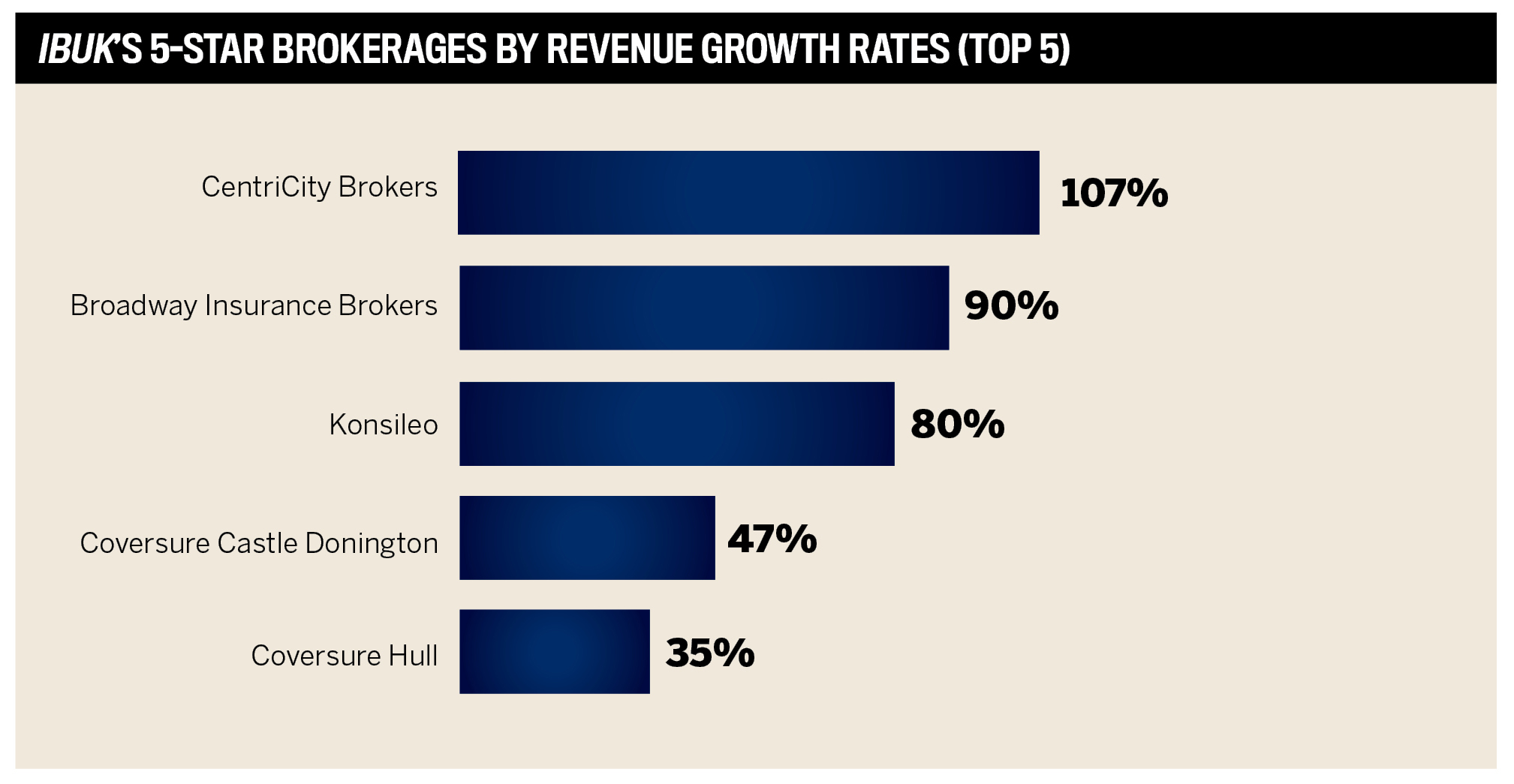

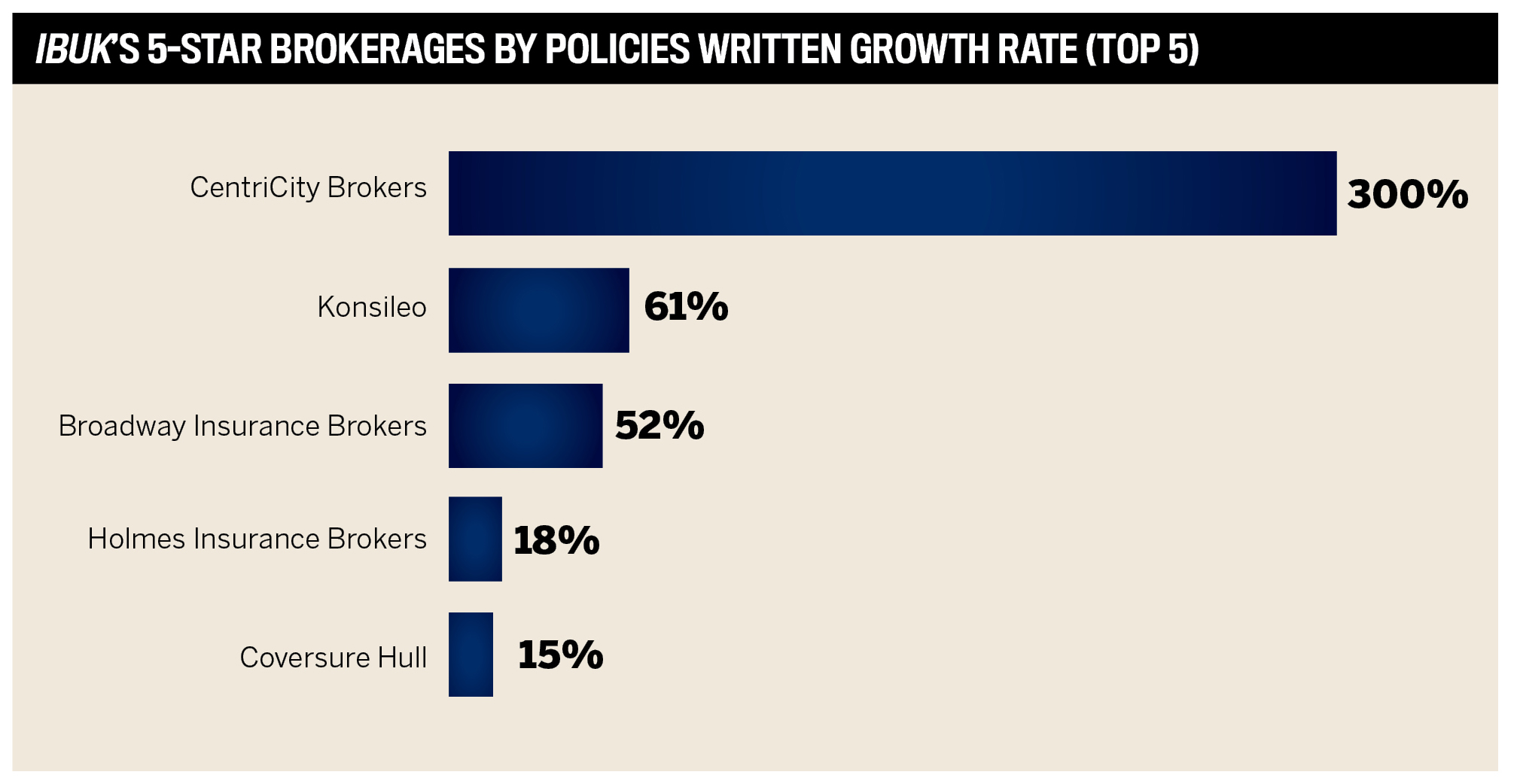

IBUK used five criteria to determine the prestigious list of winners: revenue, revenue growth, policies written growth, client growth and number of new clients. The process rewarded brokerages based on business per broker, ensuring that the very best brokerages are singled out regardless of size.

Across all 12 winners, the data showed average growth rates of:

-

35 percent in clients

-

38 percent in revenue

-

42 percent in policies written

Describing the key characteristics that distinguish 5-Star Brokerages, Alexander Margolin, managing director of insurance advisory agency Sioma, says, “A culture that puts both clients and employees at their heart. Employees are the ones servicing clients, so happy and well-rewarded teams deliver 5-Star service.

“It’s also about clear timelines, delivering your message clearly and succinctly and most of all, don’t hide behind emails, whenever you can communicate on the phone or in person.”

Brokers and other staff enable a brokerages structure to thrive. Development of staff is something that sets the 5-Star Brokerages apart.

“Employee training is key, as is prioritising and rewarding completion of the CII exams,” says Margolin. “As is skill sharing between senior and junior team members and the ability for employees to work or experience multiple areas of the business.”

Fellow industry expert Paul Davey, managing director for GI at IDEX Consulting, highlights how the top performing brokerages separate functions.

He says, “The clients that we’re working with, who are growing most effectively and retaining the highest proportion of their clients, have got a really well-structured back office to support the salespeople on the frontline, who can focus on developing new clients and not going back to fix problems with existing clients.

“They’ve also got good infrastructure around market placement and client service. They’re also looking into things like AI to enable them to become more efficient and cost effective.”

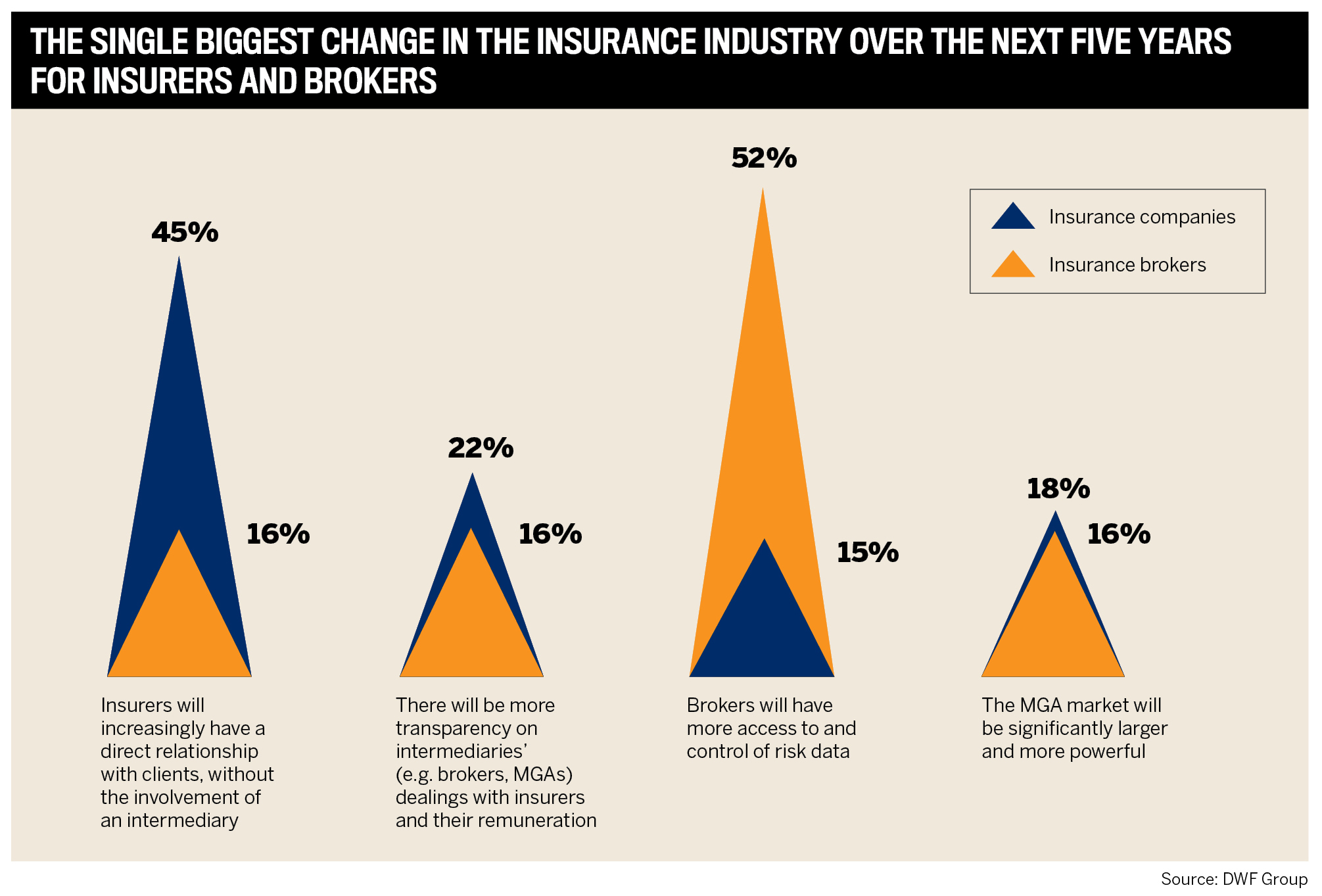

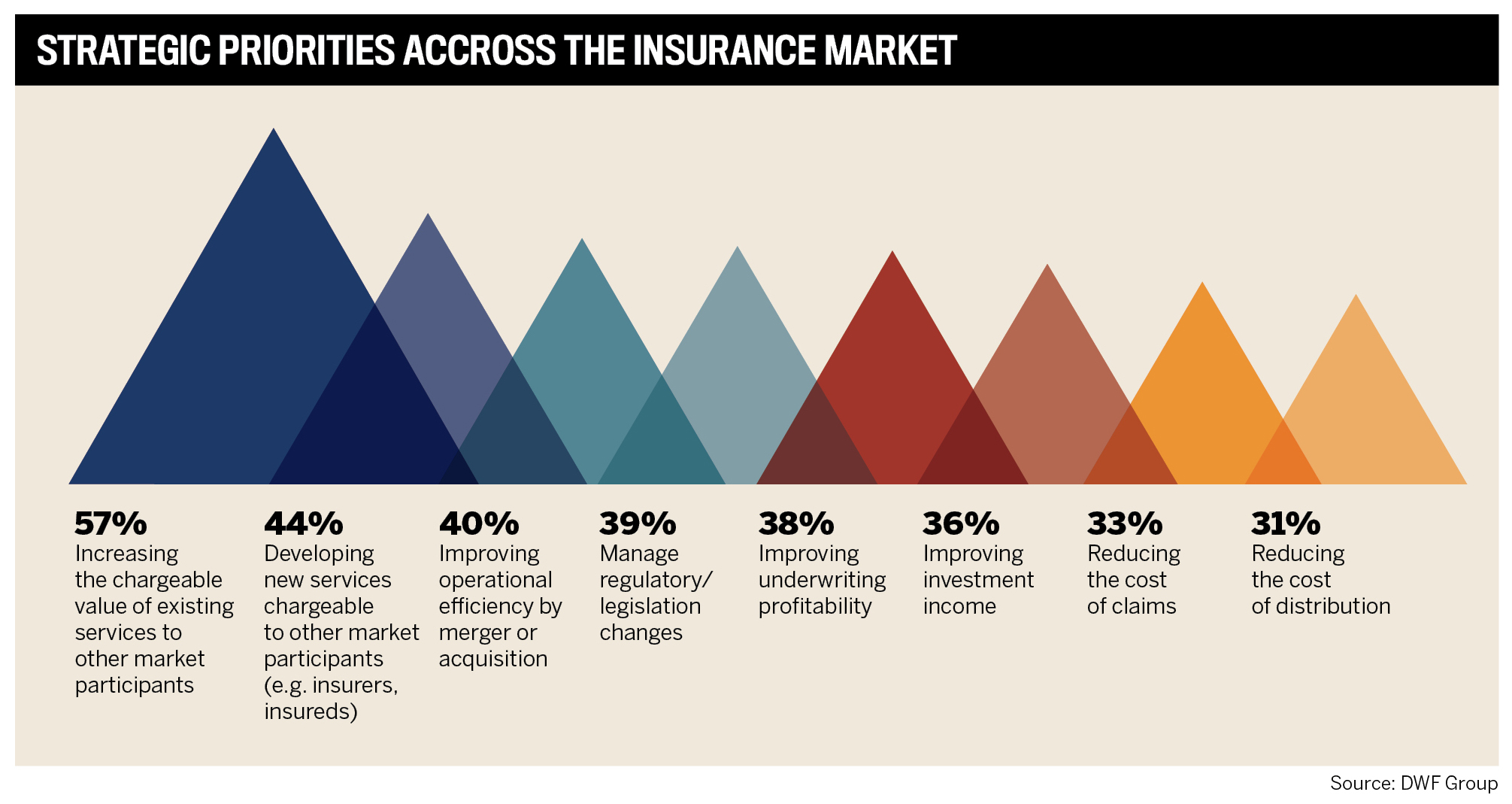

This innovative mindset is further explored in DWF Group’s InsureInsight: Insurance Sector Trends 2024, which reveals 52 percent of brokers see the biggest change in their role as having more access to and control of risk data, while across the industry there is a focus on increasing the value of existing chargeable services and developing new services chargeable to other market participants.

Attracting new clients

5-Star Brokerages 2023 figures

Total: 112,972,000

Average: 10,270

Doing the simple things can be surprisingly effective.

That’s the view of Margolin, who says, “The most basic and most important foundation to growth is client referrals. The more clients you have, the more opportunity there is for a referral. As long as you provide a great service, there is no reason your existing clients shouldn’t be your best asset.”

While referrals are powerful, there is scope to be gained from marketing. This is a largely untapped area that Davey believes brokerages should explore, as it could attract driven professionals who will bring in new clients with their desire and motivation.

“Almost all of the businesses in the insurance sector focus all of their marketing energy on finding clients, and almost none of it on finding talent to help them grow their business,” he says. “The consequence of that is that people who might be interested in working for a business don't understand the reasons that would be beneficial for them to join that business. It’s the stories of success, enablement and empowerment that they’ve got to share for people to realise they can have a successful career with a broking.”

Mayhew Seers highlights three levers to bring in new customers:

-

“Winning more new customers in the market requires a relentless focus on prospecting, new lead generation and conversion.”

-

“Demonstrating exceptional customer service to retain customers.”

-

“Appropriately upselling or cross-selling new products to existing customers and/or maximising share of economics through mutually beneficial work transfer with insurer partners.”

Driving revenue

5-Star Brokerages 2023 figures

Total: £123,937,478

Average: £11,267,043

There’s been a need to read the market and identify where the opportunities lie for IBUK’s winning brokerages.

Downturns have occurred in matters related to mergers and acquisitions.

Davey says, “Warranty indemnity insurance has also been more subdued, but we’re expecting that to come back in the next 24 months, as interest rates reduce and pressures around the cost of borrowing reduce, and investors push back into the PE market more.”

While the tech sectors have been vital to driving brokerage revenues.

“The most resilient area of the market, from a specialist point of view, has been probably cyber and technology, because that’s a growing area,” Davey says. “There’s a lot of investment into that from insurance companies and brokerages alike, and we’re also seeing a lot of growth into other tech-based sectors as they are getting bigger and bigger in the UK.”

Styles of success

The UK insurance sector is competitive, but growing revenues prove that the leading brokerages have responded to the challenge.

For Margolin, it’s important to adapt but be aware of the wider picture.

He says, “Although cyber insurance is very different from home insurance, often the customer can be the same person, whether they are acting in a business or personal capacity. So, my advice is not to adapt your style for the line of business but to adapt to the style of your customer. Different customers expect different things – you have to know your customer first.”

Creating a culture of employee engagement with incentives such as employee ownership and a growth mindset can be crucial.

“Equally, new generations of brokers are expecting a higher bar in terms of progress in terms of diversity and inclusion, purpose and other ESG considerations. Brokers showing clearer direction here will ultimately be advantaged in their proposition to attract future broker talent,” says Mayhew Seers.

Internal communication is also another rated as important to how a brokerage delivers success.

Davey highlights a firm that he works with where the CEO hosts monthly calls and invites certain team members to speak up who have been promoted or achieved something.

“What that simple task does is that it reflects out to the rest of the business,” he says. “For example, someone has been promoted, and the other workers try to find out how it’s possible and what they’ve done to make it happen. Then all the people go away and tell their friends about it, and then suddenly you’ve got a message that spreads out into the wider market, that they are a firm where people are given the chance to develop, and it’s a meritocracy.”

And he adds, “The businesses that struggle don’t talk about that stuff and don’t promote it; they don’t necessarily communicate out beyond their own organisation as to how they’ve been able to create a platform for people to be successful.”

This type of messaging can be crucial in the most successful brokerages attracting high-quality professionals interested in joining a vibrant team.

There is also a level of importance in ensuring teams are internally supported, something the 5-Star Brokerages do.

“The non-financial benefits that make an impact are flexibility. Businesses that show flexibility in terms of where people work also have a higher retention rate. The ones that are struggling in the market for retention and attraction of talent are the ones that are expecting people to be in the office five days a week and not showing any flexibility,” says Davey.

Challenges ahead

A hallmark of IBUK’s 5-Star Brokerages is their ability to navigate and adapt to market changes.

PwC UK’s Mayhew Seers agrees there are several challenges on the horizon for brokerages.

“For example, take the future (expectation) of the moderation of the rate of insurance premium; this will likely lead to less shop around behaviour from insureds. though could also improve brokers efforts towards achieving high retention rates of existing customers,” he says. “Consumer Duty represents another important change for many brokers - brokers need to as ever make sure they and the products they offer represent excellent fit and value for customers.”

In the evolving insurance sector, there is an ongoing issue of issues coming into focus.

Margolin says, “The next big challenge for brokerages is commission disclosures. Precedence has been set in the residential property insurance sector, and a move towards transparency and being able to justify earnings to customers based on your value over and above anything else will be a giant step forward for our industry. I believe the 5-Star Brokerages will embrace this and execute with a high level of professionalism.”

Another hurdle is that after a sustained period of wage inflation running high in 2024, this has calmed down but is still rising, albeit at a slower rate.

“Employers spending excessive amounts on new hires are being more considered now. From 2021 to even 2023, almost 100 percent of people who handed their notes in also received a counter offer to convince them to stay. It’s probably running about 60 percent now,” explains Davey. “Brokerages are still battling to keep people, but they’re doing it to a budget because their costs have risen, and they’re still prioritising profit over top-line growth.”

This shift has meant that it’s a good chance for new entrants to join the British insurance industry, as top brokerages look to expand their teams from the bottom up.

“Ironically, it’s probably the best time to join because a number of our clients are now prioritising new entrants because they are a lower cost to hire compared to experienced individuals,” adds Davey. “We’ve got a number of clients who’ve prioritised apprenticeships this year when hiring people, as they are looking to grow and train their own.”

Best Insurance Brokerages in the UK |

5-Star Brokerages

- 1. Konsileo

- 2. Broadway Insurance Brokers

- 3. CentriCity Brokers

- 4. Broadway Insurance Brokers

- 5. C&C Insurance Brokers

- 6. Coversure Hull

- 7. Stanmore Insurance Brokers

- 8. Coversure Castle Donington

- 9. PIB Insurance Brokers

- 10. Holmes Insurance Brokers

- 11. The Plan Group

- 12. Sutcliffe Insurance Brokers

Insights

Methodology

To be considered for Insurance Business UK’s 5 Star Brokerages 2024 list, each brokerage was required to provide key details of its business in 2022 and 2023, including revenue, policies written, number of clients and profit margin. To be eligible, brokerages were required to have two or more brokers and be headquartered in the UK. Each brokerage was then ranked according to five criteria: revenue, revenue growth, policies written growth, client growth and number of new clients.

Brokerages were ranked according to each of the above criteria and all the rankings were then added together. Akin to a golf score, the lowest overall score indicated the highest rankings for the brokerages. IBUK’s ranking system rewards brokerages based on business per broker rather than critical mass, which ensures that the very best brokerages are singled out regardless of size.

Keep up with the latest news and events

Join our mailing list, it’s free!