5-Star MGAs

Jump to winners | Jump to methodology | View PDF

THE UNIQUE APPEAL OF MGAs

THE INSURANCE industry is all about personal relationships. And in the MGA world, those relationships depend on being able to deliver the right coverage for niche markets – everything from terrorism to cyber to high-value yachts. Faced with COVID-19 lockdowns and remote work mandates, as well as a hardening market, MGAs were well positioned to adapt quickly to the crisis.

“The very nature of the UK MGAs, in terms of their innovative, agile approach, enabled them to very, very quickly move to a sort of a home operating model for their staff to main-tain service standards, especially to their brokers,” says Mike Keating, CEO of the Managing General Agents’ Association (MGAA). “And this was evidenced insofar as most MGAs, if not all, increased their retention rates, and they also found far more increasing new business activity because they were able to adapt far quicker than the very large insurers, who really are like big tankers that take a while to turn around.”

It’s a sentiment echoed by Charles Manchester, chairman of the MGAA and founder, chairman, and CEO of Manchester Underwriting Management (MUM), one of this year’s 5-Star MGAs. Manchester says MGAs have provided service levels that are second to none throughout the crisis – although not without their fair share of challenges.

“Some MGAs have been badly affected by COVID-19, particularly those operating in the travel insurance, hospitality and contingency markets,” Manchester says. “Others have been caught up in the Supreme Court [business interruption] case, directly or indirectly, but many have seen business grow due to rate movements and service levels.”

“Most MGAs, if not all, increased their retention rates [during the pandemic], and they also found far more increasing new business activity”

-Michael Keating, Managing General Agents’ Association

What’s next for MGAs?

In general, there are two schools of thought on where the MGA market in the UK is today and where it’s going. One is that limited capacity, less commission and stricter terms from insurers will cause many MGAs to struggle going forward. The other is that now a critical time for MGAs to shine – which is the position Keating takes.

“For our members, this hard market ... is a watershed moment, one where MGAs that really know their stuff, and are not just opportunist links in the chain to market, will not only survive, but blossom, while those that do not add any value will wilt away,” Keating wrote in a recent editorial for IBUK.

Manchester notes that “insurers generally have toughened up over the last two or three years, particularly in specialty lines such as those MUM writes, and this affects their appetite for supporting MGAs. Those MGAs that don’t add real value will struggle to get quality capacity support in this market. Good MGAs will thrive into the rest of 2021 and 2022. The model works well when the right partners get together.”

As more and more people get vaccinated and lockdown restrictions ease, the question lingers: should insurers and MGAs revert to pre-COVID-19 work environments or stick with new technologies relied upon during the tough times? Keating believes the new work-place will likely be a hybrid setting where employees work from home a couple days a week and in the office the other days, leveraging the best of both worlds.

“You can’t get away from the importance of face-to-face relationships in our industry,” he says. “But I think they’ll use technology such as Microsoft Teams and Zoom to create an opportunity and savings for organisations, insurers and MGAs. I think what you’ll find is that they will use technology to add value and to be complementary to those traditional ways of working. I think it will be a hybrid of online and face-to-face.”

Going forward, Manchester says he expects “more insurers to enter the market as the MGA model is proven. Maybe they’ll be less naïve than some of them have been in the past, though.”

Top priorities for brokers

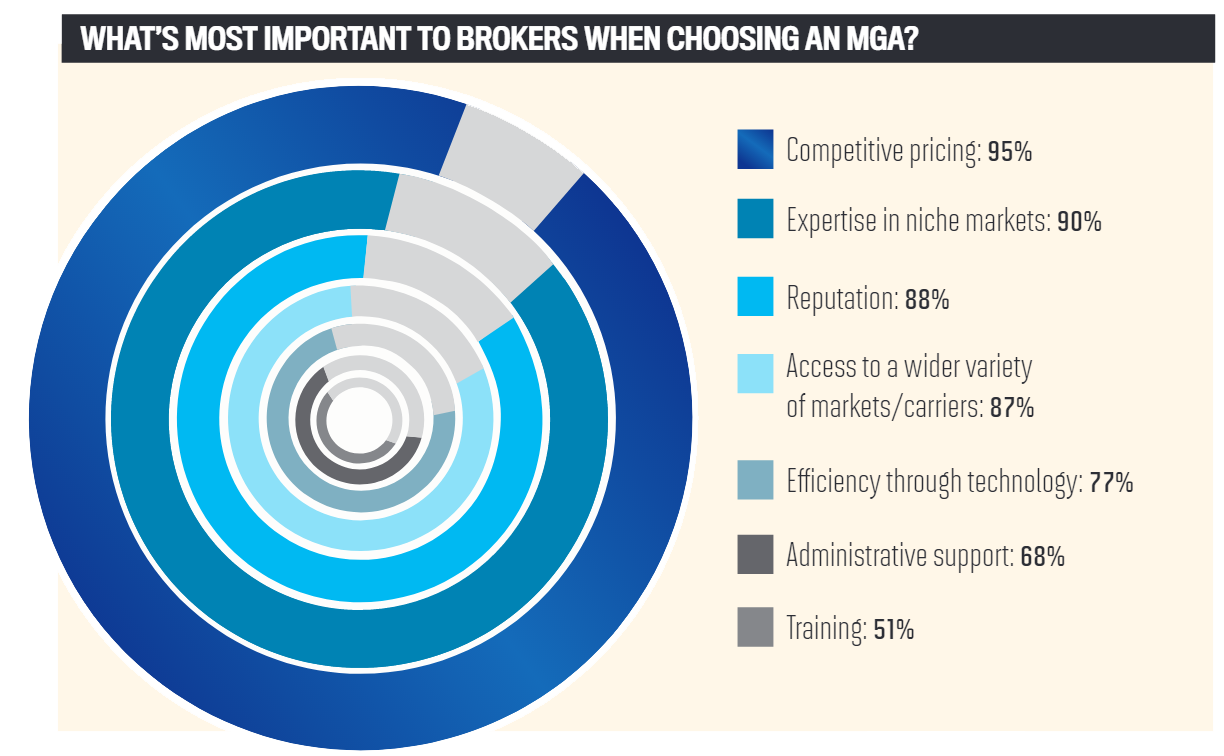

As part of the survey to determine this year’s 5-Star MGAs, IBUK asked brokers what’s most important to them when choosing an MGA. By far, the most critical factor to brokers was competitive pricing – 95% of survey respondents rated pricing as either important or very important when choosing an MGA, and many brokers mentioned competitive rates when asked why they would recommend their top MGA partner. One broker lauded their favourite MGA for “[going] above and beyond to assist with all cases, consistent pricing and great underwriting capability”.

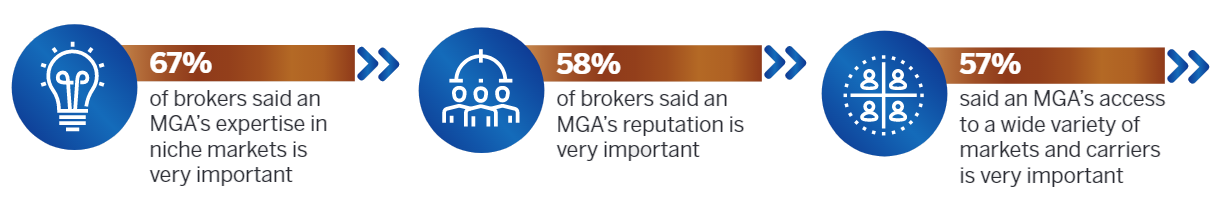

Nearly as important to brokers was an MGA’s expertise in niche markets – 90% of survey respondents said expertise is either important or very important when choosing an MGA. One broker told IBUK they look for “quality markets, long and stable relationships, and niche products”, while another said they seek out MGAs that can provide “bespoke product insurance”. A third broker raved of their favourite MGA: “In a short space of time, they have established themselves and proven to be very helpful on niche placements requiring understanding and expert underwriting.”

Brokers also value MGAs with impeccable reputations (rated as an important quality by 88% brokers) and ones that can give them access to a wide variety of markets and carriers (named an important factor by 87% of brokers). On the latter point, one broker touted their top MGA’s “access to schemes and Lloyd’s”, while several others mentioned a comprehensive product range as a reason why they would recommend their favourite MGA to other brokers.

Somewhat less important to brokers was an MGA’s ability to achieve efficiency through technology; 77% of brokers said technology is an important or very important consideration when choosing an MGA to work with, and several brokers highlighted efficiency as a reason they would recommend their top MGA partner. One broker praised their favourite MGA for its “ability to conclude business efficiently”, while another touted their MGA’s “easy-to-use portal [and] easy access to decision-makers”. Several others commended their top MGAs for quick turnarounds.

While administrative support didn’t rate as highly on brokers’ list of priorities when selecting an MGA (only 68% said it was important or very important), the service brokers receive from MGAs clearly is paramount. Again and again, brokers named excellent service as the reason they choose to work with certain MGAs. One broker noted that their top MGA “will always look to find solutions and are keen to do the right thing by the end client”. Another praised their MGA for “great professional service – refreshing in this market!” A third broker noted that their top MGA’s service “has not changed at all through the pandemic, which has been very much appreciated and has set them apart”.

At the bottom of brokers’ priorities when selecting an MGA was the training provided – only 51% of brokers deemed training an important factor when selecting an MGA, and no brokers mentioned training when asked why they would recommend their top MGA.

“Those MGAs that don’t add real value will struggle to get quality capacity support in this market. Good MGAs will thrive into the rest of 2021 and 2022”

-Charles Manchester, Manchester Underwriting Management

5-Star Excellence Awards

- Angel Underwriting

- Aqueous Underwriting Mangement

- Azur

- Beech Underwriting Agencies

- Blagrove

- Capital Insurance Markets

- CFC Underwriting

- Compass

- Ensurance

- First Underwriting

- Footprint

- Glemham Underwriting

- Gresham Underwriting

- Iprism

- Kennco

- Kew Insurance

- Manchester Underwriting Management

- Millstream Underwriting

- Modus Underwriting

- NBS Underwriting

- Nexus Underwriting Ltd

- Omnyy

- One Commercial Security

- Origin UW

- Patrona Underwriting

- PEN Underwriting

- Plum Underwriting

- Policyfast

- Prosure Solutions

- Provego

- R&Q

- Trilogy

- Wrightway Underwriting

- Yachtpod Risk Partners

Winners By Category

Personal Lines

- Capital Insurance Markets

- Ensurance

- First Underwriting

- Footprint

- Kew Insurance

- Patrona Underwriting

- Policyfast

- Wrightway Underwriting

Commercial General Liability

- Compass

- Patrona Underwriting

- Pen Underwriting

- Policyfast

- Trilogy

- Wrightway Underwriting

General Liability

- iprism

- Manchester Underwriting Management

- Policyfast

- Wrightway Underwriting

Terrorism

- Beech Underwriting Agencies

- Ensurance

- Omnyy

Contractors’ All Risks

- Ensurance

- Pen Underwriting

Professional Indemnity

- Angel Underwriting

- Aqueous Underwriting Management

- Glemham Underwriting

- Manchester Underwriting Management

- One Commercial Security

- Prosure Solutions

- Servca

Fleet Aand Commercial Vehicles

- Blagrove

- BUA Underwriting

- KennCo

- Millstream Underwriting

- Policyfast

- Provego

- Wrightway Underwriting

Cyber

- CFC Underwriting

- Ensurance

- Manchester Underwriting Management

Construction

- Ensurance

- Origin UW

High-Net-Worth Home/Vehicle/Yacht

- Azur

- Millstream Underwriting

- YachtPod Risk Partners

Property Owners

- Gresham Underwriting

- Modus Underwriting

- Policyfast

- R&Q

Property

- iprism

- Policyfast

Unoccupied Property

- Plum Underwriting

- Policyfast

Financial Lines

- Manchester Underwriting Management

- Nexus Underwriting

Architects, Engineers and Surveyors

- Ensurance

- Manchester Underwriting Management

Personally Identifiable Information

- CFC Underwriting

- Manchester Underwriting Management

Non-Standard Home/Car

- NBS Underwriting

Methodology

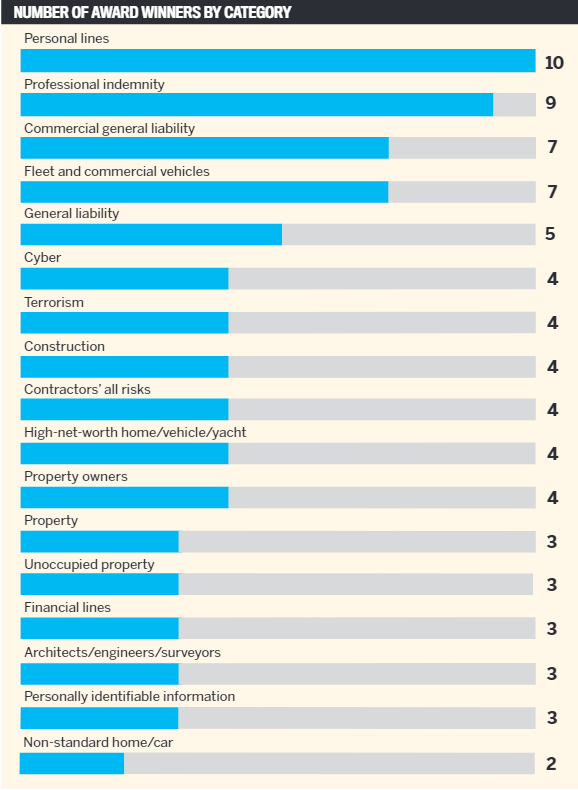

To determine the best MGAs in the UK market, Insurance Business UK sourced feedback from insurance brokers over a 15-week period. IBUK’s research team started by conducting a survey with a wide range of brokers to determine what they value in an MGA. The research team also spoke to hundreds of top brokers across the region by phone, asking them to rate the MGAs they had worked with over the previous 12 months in 17 product categories.

At the end of the research period, the MGAs that received the highest ratings from brokers in terms of work quality, specialist expertise and client service were declared 5-Star MGAs for 2021.

Keep up with the latest news and events

Join our mailing list, it’s free!