Lloyd’s has announced the launch of a disaster resilience vehicle in partnership with the United Nations Capital Development Fund (UNCDF) to deliver disaster risk financing to Small Island Developing States (SIDS) in the Pacific.

The initiative, developed with Aon and supported by members of Lloyd’s Disaster Risk Facility, is part of the Sustainable Markets Initiative (SMI) Insurance Task Force’s commitment made at COP26 to enhance the resilience of climate-vulnerable nations.

The Global Disaster Resilience Vehicle aims to improve recovery efforts and strengthen resilience by utilising the global reinsurance market as a capacity provider. It will leverage donor funds committed to the Pacific region and local networks to provide exposure-based payments to communities affected by natural disasters.

Lloyd’s announced that it will work closely with the local industry to determine their resilience needs and secure the necessary reinsurance capacity. In some cases, this may double the insured amount per policyholder, from $1,000 to $2,000 per year, with compensation reaching up to 100% per event.

Initially, the vehicle will cover Fiji, Papua New Guinea, and Samoa, targeting disasters caused by tropical cyclones, earthquakes, tsunamis, and floods. The long-term goal is to scale the initiative throughout the Pacific region and expand into other vulnerable areas, including the Caribbean, Asia, and Africa.

The project also builds on a Memorandum of Understanding (MoU) signed by Lloyd’s and the UNCDF in September 2023, which outlined commitments to close the protection gap for Pacific Island populations.

The announcement was made during the Commonwealth Heads of Government Meeting (CHOGM) in Samoa, where leaders from the private sector gathered to discuss sustainability and resilience challenges facing Commonwealth countries.

Lloyd’s will present the initiative to His Majesty King Charles III, founder of the SMI, as part of efforts to advance lighthouse project initiatives focused on resilience building.

Lloyd’s CEO, John Neal, said the insurance industry has long played a role in disaster risk finance.

“Establishing this new vehicle reinforces the crucial role Lloyd’s and the re/insurance industry plays in supporting communities within the Pacific Islands to respond and recover quicker from disaster,” he said.

Dominic Christian, global chairman of Aon Reinsurance Solutions, also highlighted the importance of providing access to risk capital to bolster UNCDF’s work, particularly in light of the increasing threats posed by climate change.

“Working with the UNCDF, Lloyd’s, and the DRF represents an exciting collaboration, and underpins our belief that combining our resources and expertise is the most efficient and effective way to develop an ecosystem for disaster risk financing that can benefit the countries and communities that need it most,” Christian said.

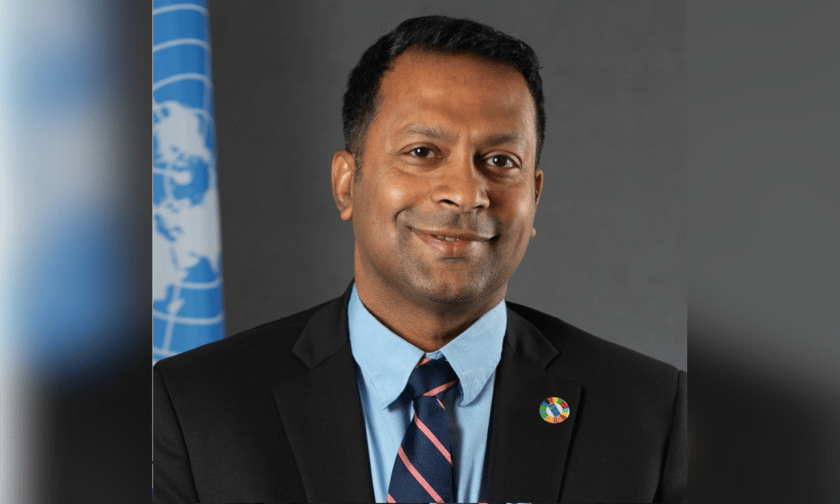

Pradeep Kurukulasuriya (pictured above), executive secretary of UNCDF, stated that UNCDF’s mandate includes providing financing instruments to address development challenges in climate-vulnerable SIDS.

“We are committed to working with the insurance and reinsurance industry to establish this investment vehicle that will be tested in the Pacific, replicated and scaled to other markets,” Kurukulasuriya said.

What are your thoughts on this story? Please feel free to share your comments below.