Industry stakeholders expect artificial intelligence (AI) to transform the global insurance business model by significantly changing the industry’s skill base and also by facilitating more predictive and less reactive risk management and claims processes.

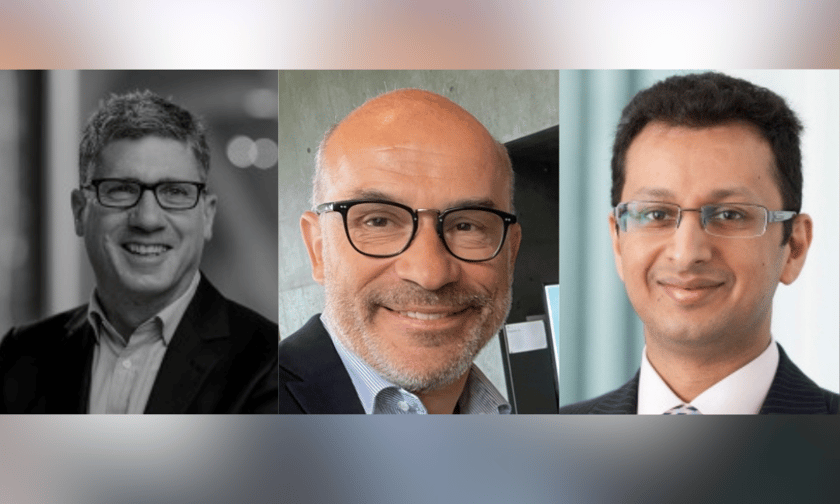

“When we talk about transformation, we could say lots of things around automation,” said Troy Dehmann (main picture, left side), Beazley’s chief operating officer. “I think the biggest transformation that you're going through is around skills.”

Dehmann was taking part in a recent Financial Times (FT) webinar. He was asked by moderator Lee Harris, the FT’s insurance correspondent, for the single biggest insurance industry change Agentic AI and Generative AI (GenAI) would cause in the next five years.

He said every insurance role will be affected in some way. “I think one of the bigger transformations will be skills and how we think about skills in our industry, within financial services more broadly,” said Dehmann.

He expected a “transformation” around education and training.

Co-panellist Michael Föhner (main picture, centre), Swiss Re’s global head of data and AI governance, said the speed at which the industry needs to make this change is “rather frightening.”

“We need to define this upskilling,” he said.

Föhner said one big question is how can insurance firms “get the humans in the loop” to validate AI driven results? He compared the use of AI to driving a very fast car. “You have to be upskilled to manage this fast machine,” he said.

Föhner suggested that the academic and the insurance worlds need to work together to address these issues. “I think our [insurance industry] culture will shift from being what I would call reactive processing to continuous risk and claims management,” said Mohammad Khan (main picture, right), the third panellist. Khan is partner and head of general insurance at PwC UK.

He said Agentic AI will help make insurance decisions and enable insurers to analyse how future risks will impact their current decisions. “I think we'll move far more to being more predictive because the technology, the processing power, will allow us to do that,” said Khan.

The other major AI-inspired change, he said, will impact insurance customers. Khan expected specialty insurers to be custom building products that are better suited to customers’ risks.

Föhner was asked to detail how Swiss Re is currently using the technology.

He said GenAI is like a “magic tool” for dealing with his firm’s unstructured data quickly and efficiently. He said 80% of the data his firm needs to process is unstructured.

Underwriting and claims management are two key areas where this happening, he said. “Reinsurance contracts might be massive, so now, instead of minutes, half hour, one hour, you can have the answer already in seconds,” said Föhner.

He said the firm has rolled out an AI powered underwriting assistant, Life Guide Scout. Underwriters can use a chat function to ask it questions in natural language about how to underwrite certain risks. Previously, he said, the underwriter would have to read articles which have been suggested based on the keywords.

“I have to emphasize, when we use GenAI, the tool is not taking the decision,” said Föhner. “It's still the underwriter, it's still the claims manager taking the decision, but it's a very powerful assistant.” He said this frees up underwriters from having to read “cumbersome” details.

Dehmann agreed. “We're using it for everything from reading, summarizing, extracting data for underwriting, claim submissions,” he said. “I think we've implemented tools across many use cases,” he said.

He said governance and guardrails are an important focus area. The relationship between the underwriter and AI, said Dehmann, was like sparring partners. This technology is not being allowed “to go solo,” he said.

Khan gave a useful definition that explained the difference between GenAI and Agentic AI. “I would define Generative AI as a class of artificial intelligence models capable of creating new content, such as text, images, audio, video, code, etc, by learning patterns from existing data,” he said.

Khan said the key thing is that GenAI “creates.” He described Agentic AI as a sub-class of GenAI that consists of artificial intelligence systems that “possess agency.” “So the capability to act independently, pursue goals, make decisions and interact with the environment around them over time to achieve objectives,” he said.

Traditional AI and GenAI are smart tools that respond to inputs, said Khan, whereas Agentic AI “operates with initiative and autonomy” and is more like a personal assistant. “We're increasingly seeing Agentic AI being used across the insurance industry, but I think it's also fair to say we are in the very early stages,” he said.

How is your firm using GenAI and Agentic AI? What are your challenges and concerns? Please tell us below