Canadian insurers are dealing with a massive surge in claims following storms and extreme weather events that rocked the country this summer. The sheer volume of claims has led to payout delays and worries over premium inflation.

Industry experts have shared tips for brokers communicating with clients during this tricky time. In a recent panel on Insurance Business TV, Peter Kennedy, national director of Aon Canada’s real estate practice, stressed the importance of brokers and their clients being proactive in the claims process.

“It’s a tri-party agreement between the broker, the client, and the insurance company, and it’s tested during a crisis like this,” said Kennedy. “All parties need to come together immediately to determine what needs to be done and secure resources quickly, as there’s always pressure on resources in disaster areas.

“The faster everyone aligns, the better the results in terms of mitigating loss and resuming operations.”

Separately, Morgan Roberts, VP of RH Insurance at Ratehub.ca, told Insurance Business that payout delays are inevitable. “Right now, insurers are just trying to get the claims assessed and paid out,” she said. “It is taking the companies a little bit longer to be able to get to everything, but they are going as quickly as possible.”

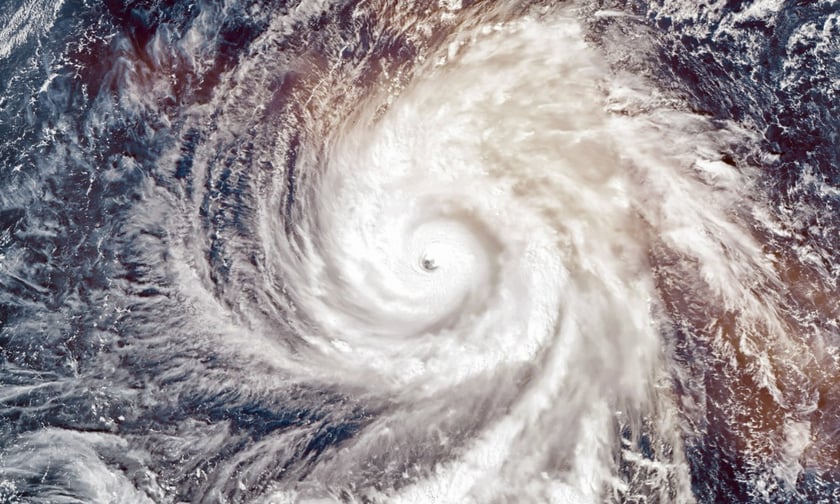

The P&C insurance industry faced the toughest summer in decades due to severe weather across Canada. According to the Insurance Bureau of Canada (IBC), these events led to an estimated 228,000 claims—a 102% jump from last summer’s 113,000 claims in July and August, surpassing the 160,000 claims made in all of 2023.

Four catastrophic weather events this summer – Toronto and Southern Ontario floods, Jasper wildfires, Calgary hailstorm, and Quebec floods – caused a combined total of over $7 billion in insured losses, the IBC said, citing initial estimates from Catastrophe Indices and Quantification Inc.

As the insurance industry grapples with these challenges, one growing among consumers is the potential impact on premiums. Could policyholders who didn’t file a claim this summer still see their rates increase due to the overall rise in claims?

“It’s not guaranteed, and it might not be every company, but there is the potential that carriers will look at raising rates,” said Roberts, who highlighted that inflation could also play a role in future premium increases.

While it’s too early to say for certain whether carriers will adjust their appetite, policies or coverage options to reflect the trend of increasingly frequent natural disasters, Roberts suggested that their long-term strategies may shift.

“Some insurers could raise in areas, but some insurance companies could also offer discounts,” she noted. For instance, homeowners who take steps to reduce their risks, such as clearing brush away from their homes in wildfire zones, might be eligible for discounts on their premiums.

In the Insurance Business TV panel, Ilan Serman, Gallagher Canada’s chief markets officer, echoed this sentiment.

“Insurance companies are starting to take a closer look at these risks, saying they’ll write the policies but may exclude certain risks or raise deductibles on them,” he said. “It’s crucial that brokers fully understand these changes and ensure their clients are aware of them too.”

Serman also noted that in the case of disasters, such as the Calgary hailstorm and Jasper wildfire that impact many insured properties, especially in remote areas, carriers’ resources will be stretched.

“Brokers need to make sure their clients are getting the attention they deserve, from quick claim payouts to efficient rebuilding, as resources like electricians and painters will be in high demand,” he said.

Kevin Lea, president of FUSE Insurance, cautioned brokers against being complacent as insurers grapple with the deluge of claims.

“Too often, when claims happen, some brokers just report it to the insurer and say it’s no longer their problem,” Lea said. “But being there for the client is exactly why they bought insurance from you and not someone else—they trusted you to deliver the right product and support them through the process.

“Yes, the insurer ultimately decides coverage, but it’s the broker’s job to back the client, help them understand the process, and guide them through it. That’s how you prove your worth and build lifelong clients, especially in chaotic situations like catastrophe claims.”

This period is also an opportune time for insureds to review and adjust their coverages.

“The best thing I can say is to ask [a broker] to shop around for you,” Roberts advised policyholders. “If your insurance premium is too expensive, talk to your broker and go over what you are covered for right now and what you are not.”

What are your thoughts on this story? Please share them in the comments.