Mitch Insurance has appointed two new leaders to help the company achieve its business goals - and both of those individuals have worked for the brokerage in varying capacities before.

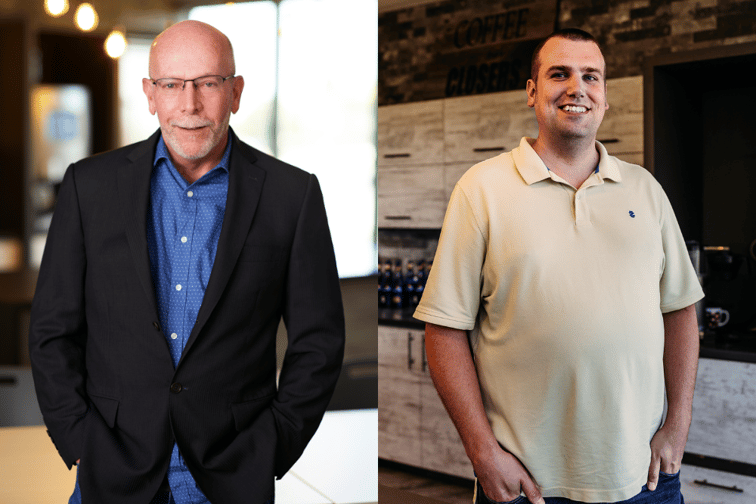

Scott Logan (pictured left), Mitch’s director of personal lines service, has been with the brokerage since 2015 and has worked in the insurance industry at large for over three decades.

“I started out selling just life insurance and then added home and auto license to that work independently. I then joined a few brokerages over my lifetime, before meeting Adam Mitchell in 2014,” Logan said.

“At the time, he had quite a unique problem with acquiring all these leads of potential clients who wanted a quote but did not have a sales team to reach out to them. I joined Adam and have been working with him ever since.”

Meanwhile, Andrew Duncan (pictured), the company’s newest director of sales and lead generation, has had more of a fragmented history with Mitch Insurance.

“I started getting into the industry doing lead generation for brokerages and Adam was one of my clients,” Duncan said. “Prior to that I had experience working in different call centres doing telephone sales, working both as an agent and as a sales coach helping teams improve their conversion rates and building up their sales experience.”

Duncan worked with Mitchell from 2016-2018 and has now returned to work for the team once again and refine the customer experience.

In an interview with Insurance Business, Duncan and Logan spoke about how they plan to help elevate Mitch Insurance’s business, what client retention means for a brokerage right now and what market trends they are keeping an eye on.

By re-joining Mitch Insurance, Duncan’s immediate priorities will involve broadening and diversifying the brokerage’s lead generation channels along with expanding its sales team.

“There’s a few strategic partnerships that we’re exploring with the other businesses where insurance would be relevant for their customers and how we can help provide great coverage solutions for their customers as well,” he said.

“We’re also expanding the different types of digital marketing campaigns that we’re doing, going beyond Google search ads for our sales team.”

Meanwhile, Logan’s focus areas include reimagining the customer journey, setting new service standards, and increasing client retention.

“We want to make it as easy as possible for the clients to work with us,” he said.

“That might include advancing online chat, SMS, telephone communication, whatever mode that they prefer to reach us, we want to be able to accommodate that.”

Client retention is an extremely important business move according to Logan, since the cost to acquire new business is steadily increasing.

To keep satisfaction high, the team at Mitch is looking to decrease call waiting times and enhance its self-serve options.

“I think one of the most important aspects of client retention is always being there for a customer when they need you,” Logan said.

“The customer wants to be able to fully experience the value a brokerage offers, especially with more unique types of coverage, such as right-hand drive coverage, which not many brokers have experience selling like we can.”

For Duncan, working in a brokerage means providing an essential service to customers that can be tailored to their needs, especially as clients want more personalized interactions.

“One of the advantages of dealing with the broker though, is we’re able to match people with the company that’s the right fit for them at that particular point in time,” he said.

“It gives our customers a little bit of isolation from a hard market or rampant rate increases because a good broker can use its resources to find those options for them.”

With the constraints of a hard market and consistently rising rates due to inflation and other social/economic concerns, Duncan is witnessing many customers feeling anxious about their coverage options.

“On the new business side, we do hear a fair bit of price sensitivity and anxiety around the cost of insurance going up, with customers noticing how their existing providers have given them a big increase that they weren’t expecting,” he said.

“This is leading to many looking for new options to find a product that fits within their budget, and that can be distressing.”

As a result, Duncan believes that the onus is on brokerages and their employees to expand their business connections, especially by forming partnerships with various carriers, to be able to provide multiple solutions to these pricing woes.

“You never want to leave a customer feeling stuck,” he said.

On the flip side, there are existing customers who will notice these increases and have many questions, and this is the opportunity for empathetic brokers to allow their industry knowledge to become actionable.

“It’s important to be able to explain these things in a way that makes sense to the customer,” Logan said.

“With relationship building, especially in insurance, clear and concise communication is key. Education is the best thing a broker can offer to clients who mostly do not understand how insurance works.”