Condominium living has become increasingly popular for families in Canada’s biggest cities – and for several good reasons. Unlike in suburban houses, living in condos entails fewer repair and maintenance responsibilities. It also gives you access to on-site amenities, including swimming pools and saunas, that you might not otherwise be able to afford. Condominiums are often located close to public amenities, such as malls, hospitals, schools, and even your workplace, so convenience can also be a motivating factor.

And as preference for this kind of lifestyle grows, insurance companies have likewise stepped-up their efforts to provide coverage that suits the unique needs of the country’s rising population of condo dwellers.

But condo insurance providers offer varying levels of protection, and determining which one delivers the best coverage is largely dependent on the specific needs of the unit’s residents. Because of this, there isn’t a clear-cut choice as to which insurer is number one. We decided to arrange this list alphabetically instead and give you a rundown of the top condo insurance providers in Canada and what types of policies they offer.

As the name suggests, Allstate Canada is the Canadian subsidiary of American insurance giant Allstate. The Markham-headquartered property and casualty (P&C) insurer offers a range of auto and home insurance policies – including condo insurance – to customers in Ontario, Québec, Alberta, Nova Scotia, and New Brunswick.

Allstate’s condo insurance policy provides coverage for the unit, and your personal belongings and liability. It protects against a range of perils, including:

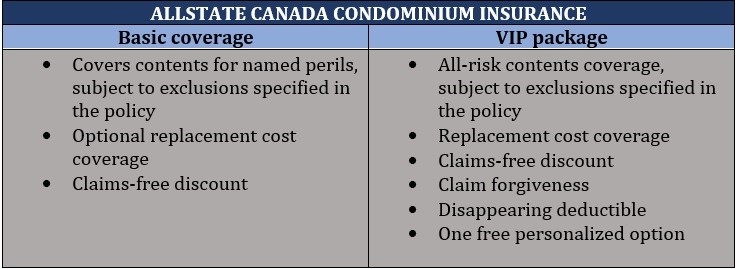

Condo dwellers can also choose among two levels of protection, with the features and inclusions listed below:

Allstate Canada clients can access their condo insurance policy through the myAllstate app. This includes paying their monthly or yearly premiums and updating personal and policy details.

Aviva Canada is among the largest P&C insurers in the country, providing a range of home, auto, personal, and commercial insurance to about 2.4 million customers. The Markham-headquartered company is a subsidiary of UK-based insurance giant Aviva Plc.

Aviva Canada’s condo insurance policy has the following standard inclusions:

Policyholders can also customize their plans with the following add-ons:

Belairdirect offers car and home insurance policies in Québec, Alberta, Ontario, New Brunswick, Nova Scotia, and Prince Edward Island. British Columbia residents can only access the company’s home insurance, which includes condo coverage. The Montréal-based insurer is a subsidiary of Intact Financial, one of Canada’s largest P&C insurers.

Belairdirect is also among the country’s top condo insurance providers. Its policies offer coverage for the following:

Coverage for water damage, including burst pipes and sewer back-ups, can be purchased as an add-on.

CAA’s insurance arm is a part of the Canadian Automobile Association South Central Ontario (CAA SCO), the largest CAA club in the country. It provides home, auto, and travel insurance, along with a range of services, to its more than six million members.

CAA offers condo insurance as part of its home insurance plan. It covers fire, smoke, and water damage under the standard plan, but policyholders can choose to enhance their coverage with the following add-ons:

Guelph-based Co-operators is a financial services co-operative that offers a range of insurance and investment products. The insurer provides coverage to over 700 Canadian companies, including employer-sponsored groups, professional associations, and affinity organizations.

Co-operators’ condominium insurance policies have coverage limits ranging from $250,000 to $2 million and come with the following features:

Condo dwellers can access two types of policies, which provide different levels of protection. These are:

Coverage for valuable items, including watercraft and jewellery, can also be purchased as an add-on.

CUMIS provides insurance products to credit unions across the country. It is the Canadian arm of US mutual insurer and financial services provider CUNA Mutual Group. It is also a subsidiary of The Co-operators. CUMIS serves around 380 credit unions, with a combined membership exceeding five million.

CUMIS offers condominium insurance under its home insurance umbrella. The company’s condo insurance policies come with the following features:

Desjardins is not only among the top condo insurance providers in the country, it also ranks as one of the largest insurance companies in Canada. The Lévis-based insurance giant also boasts the widest regional presence of any financial institution in Québec and has a strong presence in Ontario. Desjardins offers a range of auto, home, travel, life and health, and credit insurance policies.

Desjardins’ condo owner’s insurance provides coverage for the following:

Policyholders can also enhance the protection they are getting by purchasing endorsements for the following:

Intact Financial is one of the country’s largest providers of property and casualty insurance and a major provider of specialty insurance in North America. The insurance giant boasts a global presence, servicing more than six million clients in Canada, the US, the UK, and Ireland.

In Canada, residents and owners can take out condo insurance with the following standard inclusions:

As for additional protections, policyholders can purchase these endorsements:

TD Insurance is a general insurer operating under the TD Bank Group, one of Canada’s largest financial institutions. It is among the leading providers of personal insurance in the country, which includes its home, condo, and auto policies. The insurer also offers a range of business coverages.

TD’s condo insurance provides the following coverages:

Policyholders can also opt for the following add-ons for extended protection:

Winnipeg-headquartered mutual company Wawanesa is among the country’s largest P&C insurers. It is also one of the leading condo insurance providers in Canada. Wawanesa owns three subsidiaries:

Wawanesa offers condo insurance with the following features:

It also allows policyholders to customize their condo insurance with a range of add-ons, covering expensive jewellery, watercraft, cottages, and home-based businesses.

Condo insurance is a type of home insurance policy that protects the condominium owners against damages to their unit’s interior and the contents inside it. It also frees them from the financial liability for injuries that occur within their units. In British Columbia, where the portion of households living in condos are the highest based on the latest census, this kind of coverage is also called strata insurance.

Condo insurance or condo owner’s insurance varies from another from of coverage called condominium corporation insurance, which covers the building’s structure outside of the unit. This includes common areas like hallways, elevators, stairwells, and lobbies.

Condo residents typically pay for common area coverage through their condominium fees. Personal condo coverage, meanwhile, is something that they need to purchase themselves. This type of coverage is designed to fill the gap that condominium corporation policies leave.

If you’re renting a condo unit, however, you will need to take out a different type of policy called tenant insurance. To know more about this form of coverage, you can check out our comprehensive guide to tenant insurance in Canada.

Most policies from the top condo insurance providers cover the unit’s interior, along with personal belongings. It also pays for damages to other units caused by incidents from your unit such as fire and water leakage.

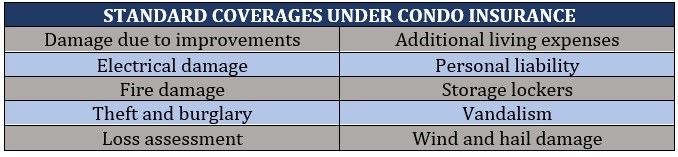

The table below lists some of the standard inclusions in a condo insurance policy.

Some policies also provide coverage for certain forms of water damage, including those resulting from burst pipes and leaky appliances from a neighbouring unit. Through endorsements, this can be extended to include sewer back-up, overland flooding, and heavy rainfall. Coverage for identity theft and expensive possessions such as artworks and jewellery can also be purchased as an add-on.

Condo insurance does not usually cover damages due to normal wear and tear, as well as those caused by animals, and those resulting from war and terrorism. Some policies do not provide flood cover if the building is located in a flood-prone area. Intentional losses and those arising from criminal activities are also not covered.

How much does condo insurance cost?

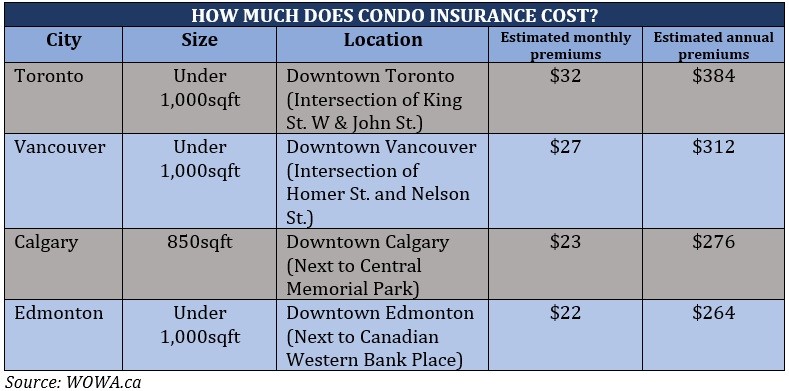

The table below shows a sample calculation of how much coverage costs for a two-bedroom condo in four of Canada’s major cities. To come up with the figure, this website compiled premiums from various condo insurance providers.

Condo insurance providers calculate premiums based on a range of factors, reflecting the unit owner’s likelihood of making a claim. These include:

If you want to find out Canada’s top condo insurance providers from our previous listing, feel free to click on the link.

You can find the best insurance companies that provide quality coverage on our Best in Insurance Special Reports page, where we feature the industry’s most trusted and dependable leaders. These include property insurers that offer top-of-the class condo insurance. By choosing policies from these insurance providers, you can be sure that you can access the right coverage when the need arises.

Also, if you’re following the latest developments in the home and condo insurance market, be sure to visit and bookmark our Property Insurance section, where you can find breaking news and industry updates.

What do you think of the top condo insurance providers on our list? Is taking out condo insurance worth the cost? Let us know your thoughts in the comments section below.