With its stunning landscapes, diverse communities and rich cultural heritage, Alberta is one of only two landlocked provinces in Canada. Thanks to its large population, natural resources and many urbanized areas, it’s no surprise that many newcomers choose to live there.

If you’re among those considering settling in Alberta, you can find many business and career options on offer. One of the career options with a good potential for stable income is that of an insurance adjuster in Alberta.

That’s why Insurance Business offers this article on how to become an insurance adjuster in Alberta. If you’re keen pursuing this career, this guide can answer important questions you may have. For instance, what is the average salary of an insurance adjuster? How do you get your insurance adjuster licence online? Read on to get the answers to these and more.

Also called a claims adjuster, an insurance adjuster’s role is mainly to investigate insurance claims made by policyholders. They serve as the mediator between the insurance company and the claimant.

These are the main roles and responsibilities of an insurance adjuster:

This is the insurance adjuster’s primary duty. They must assess the validity of a claim, which involves conducting a thorough investigation of the incident that resulted in the claims. To assess coverage and liability of the insurance company, the adjuster must review the details of the claim alongside the conditions of the insurance policy.

For the adjuster, investigating claims can involve:

The investigative process can assure that the claims are substantiated and accurate. These are critical to maintain the integrity of the insurance process.

After completing the investigation, the adjuster can evaluate the damages reported in the claim.

The adjuster quantifies the financial impact of the loss and provides a detailed report. Typically, the adjuster also includes a recommended settlement amount. The resulting amount is usually based on the conditions of the insurance policy and the assessment of the damage.

If it’s a claim on a piece of property, the adjuster includes the cost of repairs or replacement of any damaged structures. Whereas if the claim is for damages or injuries, the adjuster assesses the personal injury or property damage claims arising from third parties.

It’s also the adjuster’s responsibility to negotiate with claimants. Once the adjuster determines that the insurance claim is valid and that the damages are covered by the insurance policy, they present options to the claimant. In most cases, this entails discussing how to make any necessary repairs or simply settle the claim with a direct payment.

After completing negotiations, the adjuster provides a final report to the insurance company with their recommendations for settling the claim. The report typically includes details like estimated costs, findings from the investigation, estimated costs, and the suggested settlement amount.

In this part of the adjuster’s job, they may also help oversee the payout to ensure that the funds are distributed in accordance with the agreed terms of the settlement.

For an aspiring insurance adjuster to be eligible for this role, they must have fulfilled certain eligibility requirements. The most basic requirements for candidates include:

Non-residents can only apply for an Alberta insurance adjuster licence if they can show proof that they have an equivalent adjuster licence without restrictions from another province.

Becoming an insurance adjuster in Alberta is somewhat like becoming an insurance broker in Canada – you must meet similar eligibility requirements and must first pass a Level 1 licensing exam.

For a more specific overview, you can also refer to our guide to becoming an insurance adjuster in Canada.

The process for becoming or transitioning to an insurance adjuster job in Alberta is straightforward. Here are the steps:

Before you apply for an insurance adjuster licence, the minimum educational requirements are that of a high school diploma or GED equivalent. While this is can suffice, candidates can also obtain a college degree if they choose.

Candidates who are applying to become an insurance adjuster for the first time must take courses for the Level 1 insurance adjuster licence. Course providers like the Insurance Institute of Canada offers a self-study kit approved by Alberta Insurance Council (AIC).

Since you will be applying as an insurance adjuster in Alberta for the first time, you need only take and successfully complete the Level 1 licensing exam. Note that a grade of at least 70% is required to pass. You must also apply for the licence within 12 months of passing the exam. Your marks will be invalid after this period elapses.

Adjuster candidates must undergo and pass a thorough background check to ensure that they have no prior offenses or cases of unethical conduct. Take note that the AIC must receive the background check at least three months before receiving a licence application. If your background check or application requires an additional review or clarification, an AIC Licensing Officer will get in touch with you.

You must obtain E&O insurance, also called professional liability insurance, from a reputable and licensed insurer in the area. The E&O policy you choose must comply with the AIC’s requirements for coverage for employees of an adjusting firm or independent adjusting professionals with certificates of authority.

An important requirement of getting your Level 1 insurance adjuster’s licence is to be employed and directly supervised by someone with an Adjuster Level 3 licence. Your employer should be an accredited claims adjusting firm. They must also sponsor your application and provide proof of your ongoing supervision under a Level 3 claims adjuster.

Once you’ve successfully completed the Level 1 adjuster exams, done your background check, and secured employment and sponsorship, it’s time to apply for the Level 1 licence. Get your Canadian Insurance Participant Registry (CIPR) and log in at the AIC portal to start your licence application.

To some extent, a bachelor’s degree can help prepare you for the AIC adjuster’s exam Level 1, but it is not required. However, some adjuster firms may prefer for candidates with bachelor’s degrees, so they can be beneficial in this aspect.

Securing employment at an adjuster firm is a critical part of the Level 1 licensing process.

One of the bottom-line reasons for choosing to become an insurance adjuster in Alberta is if it can provide a substantial income. This is especially important, considering that food, rent, and utilities can be quite costly there, even if there is no provincial state taxes and housing costs are comparatively low.

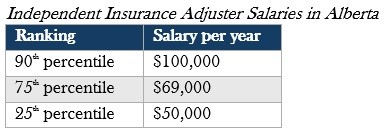

So how do insurance adjuster salaries measure up there? As of early 2025, the average annual salary of an insurance adjuster in Alberta is $63,000 based on data from this website. This amounts to $5,250 a month or $30.29 an hour. Here are the salary rankings of insurance adjusters in the province:

If you’re looking for higher salaries, note also that the average insurance adjuster salary varies and depends on your location and level of experience. An entry-level claims adjuster would certainly earn significantly less than an adjuster with a career that spans decades.

Typically, those who wish to start out as insurance adjusters or shift from another role must begin with a Level 1 adjuster licence. Those who want to further their adjuster careers can then advance to the higher levels. In Alberta and most every other province, there are three licence levels. Here's what they require:

Adjuster level 1 – this is the licence that new adjusters must have to practice. They must pass the level 1 licensing exams and submit their approved and paid application within 12 months of passing.

Adjuster level 2 – adjusters must have the level 1 licence or proof of passing the level 1 exam. This is required, along with proof of having practiced claims adjusting for a minimum of 24 consecutive months.

Adjuster level 3 – applicants for this licence must hold a level 2 licence and pass some courses from the Insurance Institute of Canada. They must also have 60 months’ worth of claims adjusting experience within the last 10 years.

To keep their adjuster licence current, adjusters must complete 15 hours of Continuing Education (CE) credits every year. This is apart from:

The educational requirements and licences are the essentials for becoming an insurance adjuster, but these do not guarantee a successful career. An individual adjuster must apply their knowledge and develop a specific set of skills, which can include:

Being able to explain insurance procedures, insurance policies and their terms and conditions to clients in simple language is crucial. When investigating claims, adjusters must know how to talk and interview different kinds of people to gather important information.

Finally, adjusters must also be skilled at negotiation to secure reasonable settlements for their clients from insurance company representatives.

Some claims may have a time limit, depending on the claims and circumstances. Personal injury claims, small claims, and maritime claims need to be addressed before a time limit lapses and the claims are extinguished.

Adjusters may also have to handle several claims at a time, putting pressure on them to investigate and negotiate efficiently. This makes time management essential to maximize profits and avoid losing business.

New adjusters nowadays are fortunate to have insurance technology companies that provide software tools to help speed up parts of the claims process. For instance, claims investigation can be automated with the help of Artificial Intelligence nowadays. But to speed up the work of adjusters and claims processes, they must have some technical knowledge and an openness for integrating these tech tools.

Claims adjusters must be meticulous in their profession. They should be able to spot small but important details that can affect claims, such as minor damage in vehicle or home inspections. Having a strong attention to detail can also ensure that the claims adjuster does not make inaccurate settlements.

An excellent claims adjuster must have a good bedside manner and know how to make clients feel at ease. Clients who are happy and satisfied with their experience with an adjuster can mean repeat business and referrals.

As with most other insurance careers in other provinces, being an insurance claims adjuster in Alberta has its share of pros and cons. Whether this career is the best path to success and happiness depends on the personal circumstances and choice of the individual.

If you’re considering an insurance adjuster career in this province, be sure to weigh the benefits and drawbacks before deciding.

Did you find this guide on how to become an insurance claims adjuster in Alberta helpful to your career decision? Share your thoughts in the comments.