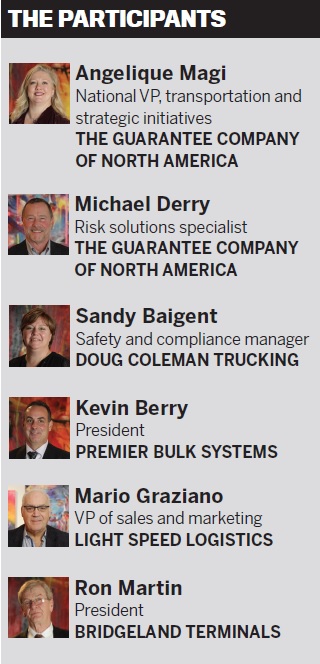

THE PROSPECT of a NAFTA breakup is casting an increasingly large shadow over Canadian businesses, but there are few sectors following the developments as closely as the transportation industry. For decades, the success of many transportation firms has been reliant on sending freight across the border. As Mario Graziano, vice-president of sales and marketing at Light Speed Logistics, puts it, the industry is “holding its breath.”

“We could have a situation where we continue to have the trade, but there will be a cost to it,” Graziano says. “It means you have to be innovative in the type of business you are going to run. In our case, we are focusing more on short haul out of the US into Canada, so that it minimizes the amount of losses in miles our drivers suffer.”

There are 10 million trucks crossing the border annually, so NAFTA plays a central role in how the transportation industry functions and how organizations generate profit. Although there is trepidation around what a dissolution of NAFTA could mean, Kevin Berry, president of Premier Bulk Systems, does believe it’s time for a change.

“NAFTA is 30 years old and needs to be renegotiated and modernized, but at the end of the day, it needs to be fair,” Berry says. “They have to get trucks across the border. What a lot of people don’t realize is that there are 9 million jobs in the US that rely on free trade.”

The current NAFTA uncertainty is creating much confusion, and according to Sandy Baigent, safety and compliance manager at Doug Coleman Trucking, many transportation carriers don’t fully grasp the potential impact of changes to NAFTA and resultant regulation. Transportation companies, Baigent says, are often the last to know.

“Education is key; it is the biggest issue that transportation companies have to deal with,” she says. “If companies don’t know the full details of what changes mean, then dispatchers don’t know and the driver doesn’t know.”

“Technology is coming in waves,” says Ron Martin, president of Bridgeland Terminals. “It’s important for all of us to take a step back. Things are happening so fast that it can be difficult to measure the benefits and return on investment. It’s prudent to pick something that will work for you and be mindful of what’s coming. Don’t chase everything.”

For Angelique Magi, national VP of transportation and strategic initiatives at The Guarantee, the trucking industry’s desire to create efficiency and improve margins is unmatched in any other sector.

“It comes down to working out a goal for what you want the technology to achieve,” Magi says. “Everyone goes through that assessment when they make a change, but there is no ‘one size fits all’ in this industry.”

Berry says he has implemented various types of technology into his company’s operations, including electronic logging devices [ELDs], which have taken the industry by storm but haven’t always been popular with drivers. Berry feels his fleet has now gathered the low-hanging fruit, and ELDs have played a major role in that effort.

“We found that when we implemented ELDs, we didn’t have a drastic reduction in driver capability and productivity – some fleets do; some fleets don’t,” Berry says. “We thought we would lose 15% of our driving force, but we only lost one driver. Quite honestly, when the drivers figure out how to use the ELDs properly, they can be more productive than before.”

“It’s a specialized business, and our ability to hire people with the proper skill set and right attitude is going to dictate growth for our company,” he says. “We have the infrastructure in place to grow substantially, but we won’t grow if we don’t have the right people.”

Baigent believes the industry needs to examine why so many drivers are leaving the business. For example, younger drivers are creating a new culture and are reluctant to be away from home for extended periods of time. “They want to be at home at 6 p.m.,” Baigent says. “So, in order to attract younger drivers, trucking companies need to understand that they need to change. There is a new mindset with younger drivers, and trucking companies need to tighten up.”

Many insurance carriers see younger drivers as being particularly risky, a stance Magi disagrees with, explaining that new training regulations are making the industry safer than it’s ever been.

“With the mandatory entry-level training [MELT] changes that are coming in, companies that embrace training will be well positioned to develop people,” Magi says. “These young drivers are growing company culture and learning as they go.”

Michael Derry, risk solutions specialist at The Guarantee, urges trucking firms to embrace MELT. He believes the industry should take advantage of the changes and set up in-house training programs to further educate drivers.

“If trucking carriers can add to their mentoring processes and create other advantages and benefits for drivers, drivers will be more likely to stay at their company,” Derry says. “It’s all about companies helping themselves out.”