Top Insurance Brokers 2023

Jump to winners | Jump to methodology

Divergent routes to the top

Canada’s Top Insurance Brokers of 2023 are a cohort of dedicated professionals valued and trusted by their clients.

The brokers were judged on criteria that included displaying:

-

passion

-

dedication

-

commitment

While all the 2023 winners are recognized for their excellence, they have achieved this through various methods and approaches.

Karim Chandani

HUB International Insurance Brokers

In the last few years, more brokers have relied on video calling technology to do deals; however, Chandani has his own blueprint. He describes the approach as “borderless” since the pandemic struck.

“My company gave me authorization to travel and I visited any client that was in the office or wanted to touch base. For those that were working from home, I would send them a gift bag or dinner for them and their family that night.”

That enabled Vancouver-based Chandani to solidify relationships when his clients were in a state of uncertainty.

“That loyalty really built up and what transpired from that was constant referrals. I don’t have to go knock on the door because all I’m doing is getting on the phone from a very warm lead that’s come from a very happy client,” he says.

Now, Chandani has never been busier and has thrown himself into a punishing schedule. Up to October 2023, he has spent 114 nights in a hotel room, which doesn’t include stays in Toronto with family.

“When I look at success, we call it borderless, and it doesn’t matter where our client is and where their offices are. We can help them. I got a referral for a hotel in Saint Lucia and now we’re doing that and that’s what we mean by borderless. We just go in, we’ve got the right people, and we work as a team.”

Chandani leads a department consisting of 16 employees, which frees up his time to continue building relationships with clients and brokering new deals. He outlines their fundamental strategy as:

-

protecting the client

-

understanding their needs

-

being in contact

He adds, “This year we are number one in our company in Canada and I think number two in North America and that’s not a small feat, but that happens when you’re working as a team and you’ve got a great client base.”

Despite the operation working so well, it’s a challenging load for Chandani. His experience over the last few years has enabled him to finetune his travelling so he can perform at his peak.

“When I go away, I do almost a week at a time, and it helps me do more, but I don’t jampack my days like I used to. Before, I would be going from morning to night and that wore me out. I’m not seeing five clients in a day; it’s two or three.”

And this is what Chandani regards as the secret to his success.

“As much as the video calls and everything else, nothing replaces breaking bread with a client. It’s that human element and it makes a huge difference,” he explains.

It’s his desire to go the extra mile and fly all over North America that resonates with clients.

“I could just say I will give this to the Toronto office, but the clients are dealing with me for a reason and that’s why we keep those accounts for the long term, it’s building that loyalty.”

Smart time management is of paramount importance due to the amount of travelling Chandani does.

“About 90 percent of the time, there’s Internet on the plane, so it allows me to catch up and prepare and even if there’s no Internet, there’s time to sort of reflect on what’s going to be happening,” he says. “It’s all about being prepared. If you’re going to start preparing for Monday, you’re in trouble.”

There are no signs of Chandani slowing down. Rather, he is prepared to increase the pace if need be and is focused on maintaining his outstanding results.

“I think, as a broker, I need to make an investment in my clients. Everybody’s different and it all comes down to what you are actually willing to invest in your relationship with your clients.”

Feedback from Chandani’s clients is testament to that, with comments such as:

-

“He understands his clients and goes beyond everything to help them.”

-

“Karim is a master of his craft. He has solved more complex coverage requirements than anyone I know. He is the only trusted source for our needs in Canada and globally.”

-

“Karim brings us tremendous value by always suggesting options and new coverages, be it cyber, D&O, etc. It is very important to us to have the right information on our current policies and insuring our properties to the right values.”

Karim ChandaniHUB International Insurance Brokers

Adam Buss

Canaccord Genuity Wealth & Estate Planning

In terms of being technically sound, Buss stands out for his dedication to his craft. His professional designations include:

-

Certified Financial Planner

-

Certified International Wealth Manager

-

Chartered Investment Manager

-

Chartered Life Underwriter

-

Fellow of the Canadian Securities Institute

-

Registered Retirement Consultant

Straight talking and down-to-earth is how Buss conducts himself.

“I wouldn’t consider myself anything special by any stretch of the imagination. I want to get the right coverage and protection in place. Most of my recommendations stem from doing full-blown holistic financial plans and in-depth analysis for people,” he says.

An illustration of his commitment is being the best broker possible even if it hits his bottom line.

“I really want to make sure that I am getting them the right coverage for their situation. I don’t want to shove unnecessary products down their throats. I am brutally honest to the point where I probably sacrifice commissions because of it.”

Part of being an advocate for his clients involves Buss removing complexity. He appreciates the need to give them necessary information without confusing technicalities.

“I don’t want to overwhelm them with the knowledge that I have and all these different things that I think are important but they probably really don’t care about,” he explains. “They just want to know at the end of the day, what do I need? I’ll try to keep it simple and explain those basics.”

Canaccord leans toward the high-net-worth market, but Buss is resolute in treating all clients equally. His approach and way of working doesn’t waver.

“I’m agnostic; it doesn’t matter who’s coming to see me for insurance. I’ll find the right strategy to put in place for them, whether it’s a cheap little deal or some fancy corporate insurance strategy that saves them money on tax and maximizes their estate.”

In turn, Buss keeps in mind the pressures facing clients, such as challenging economic conditions.

“I make sure that we’re having the right conversations and it’s a matter of understanding that everybody’s got different pressures on their financial picture.”

And in typical humble fashion, Buss gives an oversight of what he strives to do.

He adds, “I’m hoping for most people insurance is the biggest waste of money they ever spend in their life because they’ll never actually need it. But if they do need it, they will find significant value.”

This is echoed by clients who offered comments, including:

-

“Beyond his unmatched technical prowess, Adam’s compassionate approach instils trust and confidence in his clients. His keen attention to detail and dedication to achieving their financial goals set him apart.”

-

“Adam Buss has earned a well-deserved reputation as the best insurance broker in Canada. His in-depth knowledge of the insurance industry, coupled with years of experience, allows him to navigate the complexities of insurance policies with remarkable ease.”

-

“His commitment to his clients goes beyond simply finding suitable insurance coverage; he takes the time to understand their unique circumstances, ensuring they receive tailored solutions that provide comprehensive protection.”

Adam BussCanaccord Genuity Wealth & Estate Planning

Top Insurance Brokers 2023

- Amandeep Shahi

Billyard Insurance Group - An Chapman

Beyond Insurance - Andrea King

Surex - Aneeza Ahmad

Kase Insurance - Bobbee Wood

Judy Johnston Insurance - Brian Davidson

Paisley Partners - Chris Sanderson

Maximus Rose - Crissy McKay

Jones & Associates Insurance - David Palermo

Insureit Group - Elena Sylven

Surex - Frank Spidalieri

Insure.It - Gage Miranda

Munn Insurance - Ivan Chia

Billyard Insurance Group - James Clay

JT Insurance Services (Canada) - Jason Peterson

Surex - Jhared Smith

Programmed Insurance Brokers - John Gruninger

Surex - Jorge Escobedo

Primerica - Karim Chandani

HUB International Insurance Brokers - Kellie Van Iderstine

Surex - Laurent Courion

Aon - Matt Frogley

Surex - Megan McCartney

Oracle RMS Insurance Risk Management Services - Nathian Burke

Ai Insurance Organization - Nikki Keith

Wilson M. Beck Insurance Services - Patti Gustafson

Surex - Ron Trecroce

Westland Insurance - Ryan Hall

Surex - Skylar Jardine

Keyes Insurance - Stefania Leone

BrokerLink - Terence D. Cairns

Wilson M. Beck Insurance Services (Alberta) - Teresa Connolly

Keyes Insurance - Tiffany Reider Baird

Westland Insurance - Valerie Riewe

Primerica

Insights

-

Lorie Phair

Lorie Phair

President

Canadian Broker Network -

Diana Feliz

Diana Feliz

Insurance Specialist Consultant

Carte Risk Management -

Kirk Purai

Kirk Purai

CEO and Owner

Carte Risk Management

Methodology

Insurance Business Canada conducted its inaugural search for the Top Insurance Brokers to discover the best brokers who act in their clients’ interests. From a diverse cross-section of insurance professionals, the IBC team had the opportunity to spotlight remarkable examples of passion, dedication, and commitment.

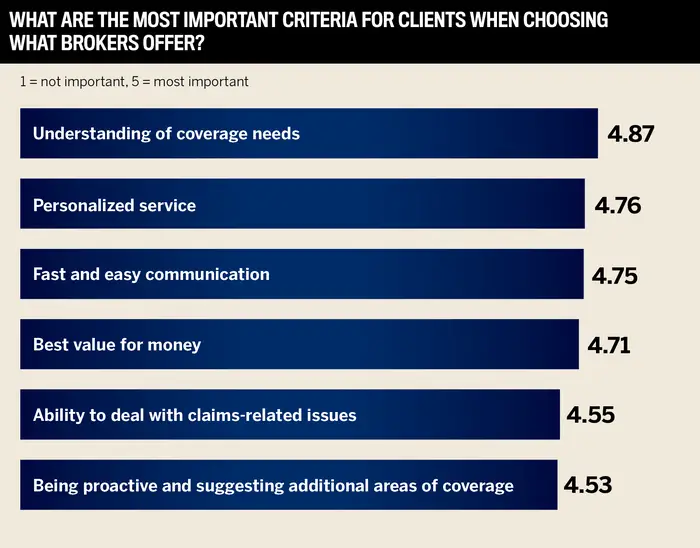

From July 10 to August 4, the IBC team undertook a rigorous marketing and survey process, leveraging its connections to thousands of readers across the country. Readers were asked to nominate their brokers and rate them on six key criteria.

The most voted-for brokers that received an average score of 8 or higher were named Top Insurance Brokers who were recognized based not on revenue but rather the service provided to their clients.

Keep up with the latest news and events

Join our mailing list, it’s free!