The Best Young Insurance Professionals Under 35

in Canada | Rising Stars

Jump to winners | Jump to methodology

Tomorrow’s power players

Insurance Business Canada’s Rising Stars of 2024 are shining in their roles and embracing the forward-thinking and inclusive approach that is shaping the industry’s future. Most notably, they are confident enough to share their ideas and take action, with assurance that belies their age, as all are under 35.

These talented young insurance professionals are a vital part of ushering in a new age of insurance. Recent data and research highlight just how key they are:

-

KPMG’s April 2024 study highlights the need for equitable workplaces to attract millennials and Gen Z talent, expected to make up over 60 percent of the global workforce by 2025. IBC’s Rising Stars are leading the way in this transformation, championing diversity, equity, and inclusion in an industry still challenged by representation at the top levels.

-

The Insurance Institute of Canada’s 2022-2023 demographics report of the Canadian P&C workforce emphasizes the importance of work-life balance, continuous education, and career growth, values backed by IBC’s top professionals under 35.

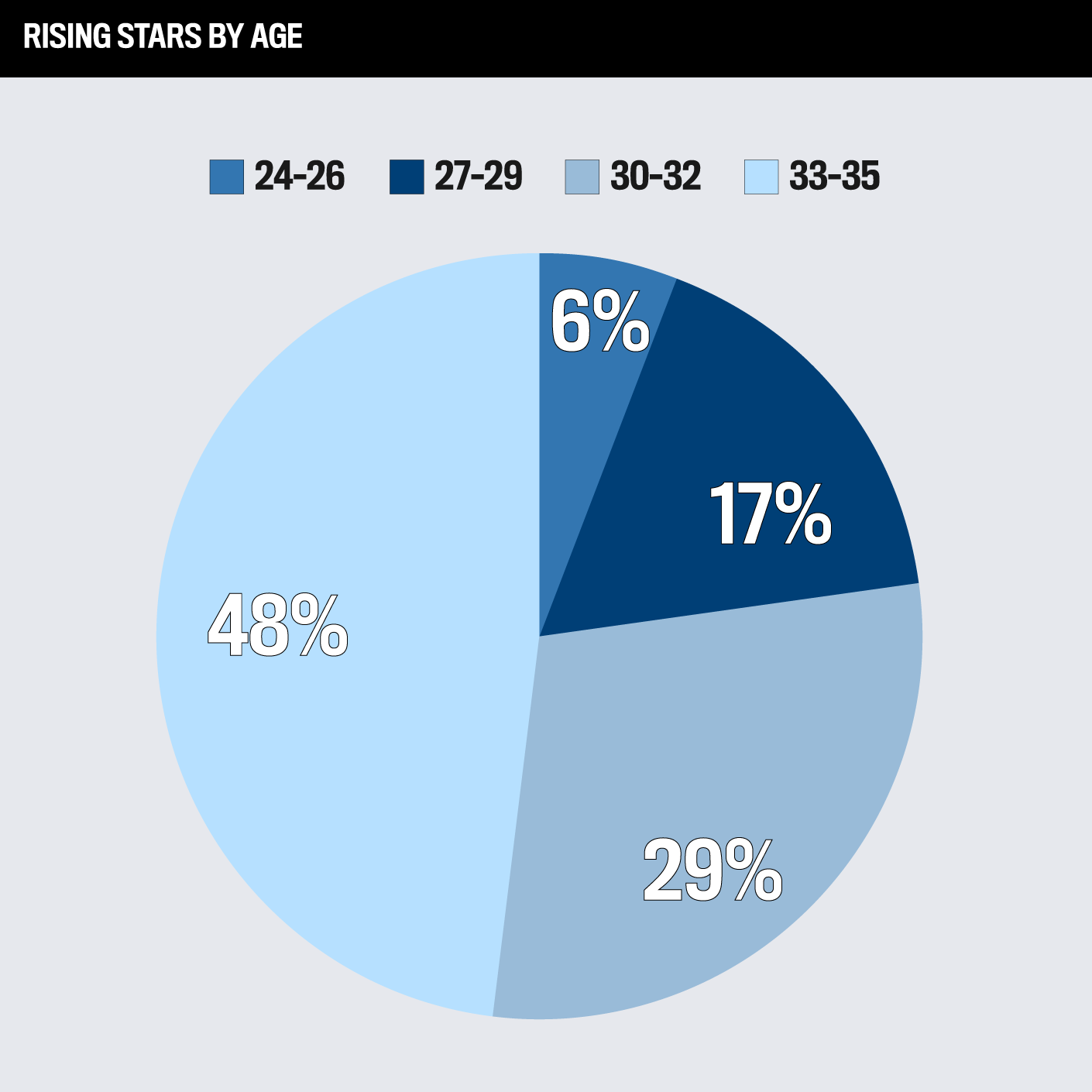

The ninth annual Rising Stars list, compiled by a five-person judging panel, identified the most exceptional young talent nationwide from over 80 distinguished nominees. These awardees represent an influential cohort of insurance professionals adding value to their organizations and contributing to the betterment of the industry despite being so early in their careers.

“Their combined eagerness and willingness to learn, with respect for experience, while still finding a way to challenge the status quo has been an admirable feat to watch,” says panel member Vinita Jajware-Beatty, president and board chair of the Toronto Insurance Women’s Association.

“Every generation, as they advance within a sector, generally charts a similar course, but this cohort of young professionals under 35 is finding a way to express themselves while maintaining professionalism and respect for their colleagues and how things have been done,” she adds. “The ability to speak up, share ideas, and take action is very strong with this cohort.”

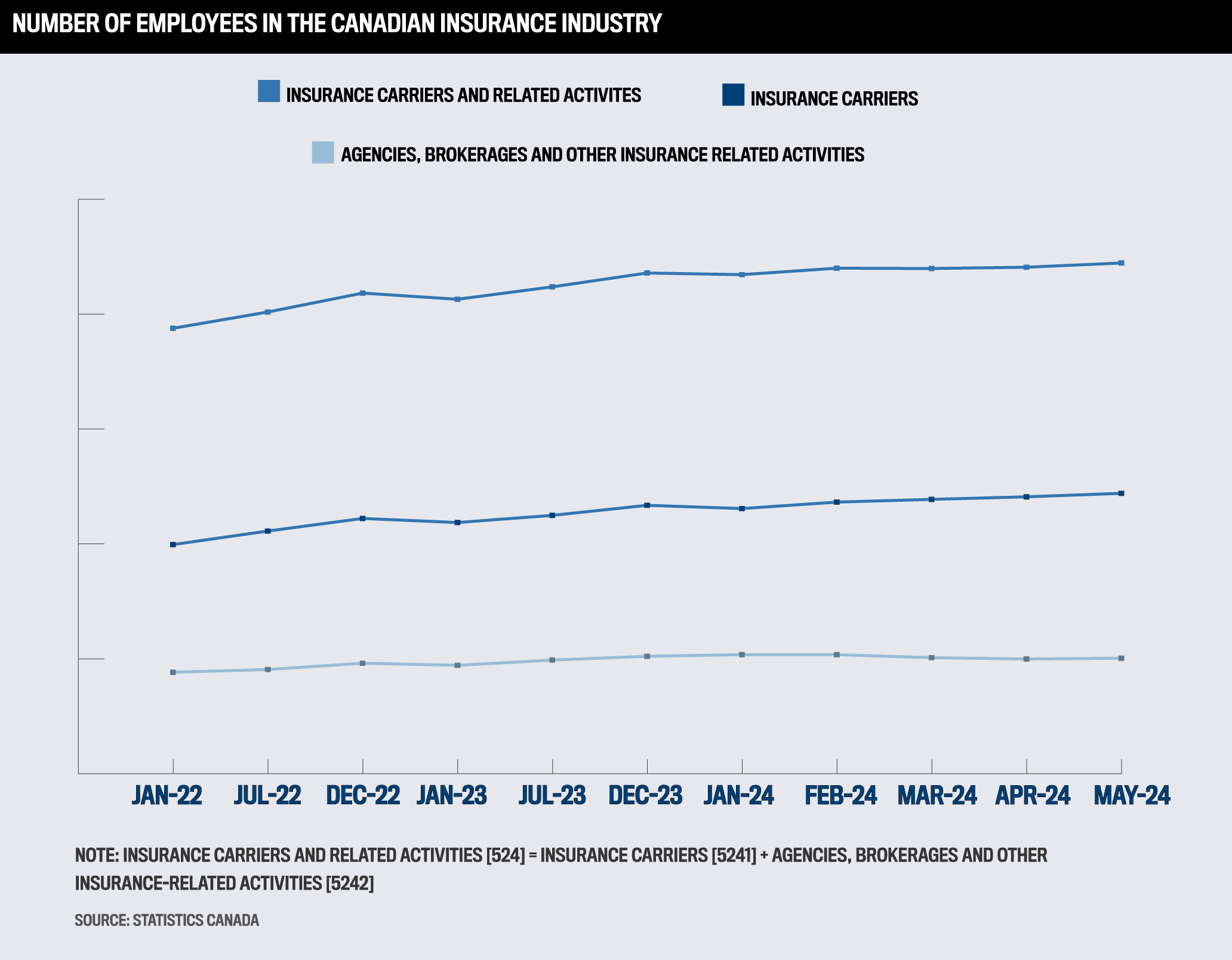

Standing out as future leaders in a crowded talent arena is no easy task, considering the over 1.3 million insurance professionals working in Canada’s vast insurance sector, as of May 2024.

Highlighting IBC’s Rising Stars as instrumental in driving the industry forward, panellist and Insurance Brokers Association of Ontario president Suzanne Pountney says, “These professionals are digital natives and will always be pushing for better and more efficient ways to do our work. We can all benefit from their knowledge and innovation mindset.”

There’s no time like the present, as a March 2024 PwC report shows that the Canadian insurance industry faces significant challenges related to workforce demographics, skills shortages – specifically in attracting younger workers – and the need to adapt to technological and operational changes.

All this points to excelling in the industry being fair game, as noted by 2023 Rising Star Kelsey Hazelton, especially with many experienced professionals retiring and the younger generation needing to step up.

The investigator in the compliance, conduct, and investigations department at the Registered Insurance Brokers of Ontario says young insurance professionals will be well-positioned for senior leadership roles by:

-

embracing technology

-

committing to continuous learning

-

networking

-

developing leadership skills

-

participating in personalized development plans

-

adapting to industry changes

-

bringing innovation and creativity

-

promoting authenticity

Her thoughtful analysis of what it takes to be featured on IBC’s Rising Stars list highlights the significant potential young insurance professionals have to positively shape the future of insurance for customers, brokers, and partners.

“A standout trait of Rising Stars in the insurance industry is their leadership potential,” she says. “They can guide and inspire others toward success, demonstrating their natural talent for motivating and empowering their colleagues. With their adaptability, ambition, and leadership qualities, these Rising Stars are positioning themselves as future industry leaders who will drive positive change and innovation within the insurance sector.”

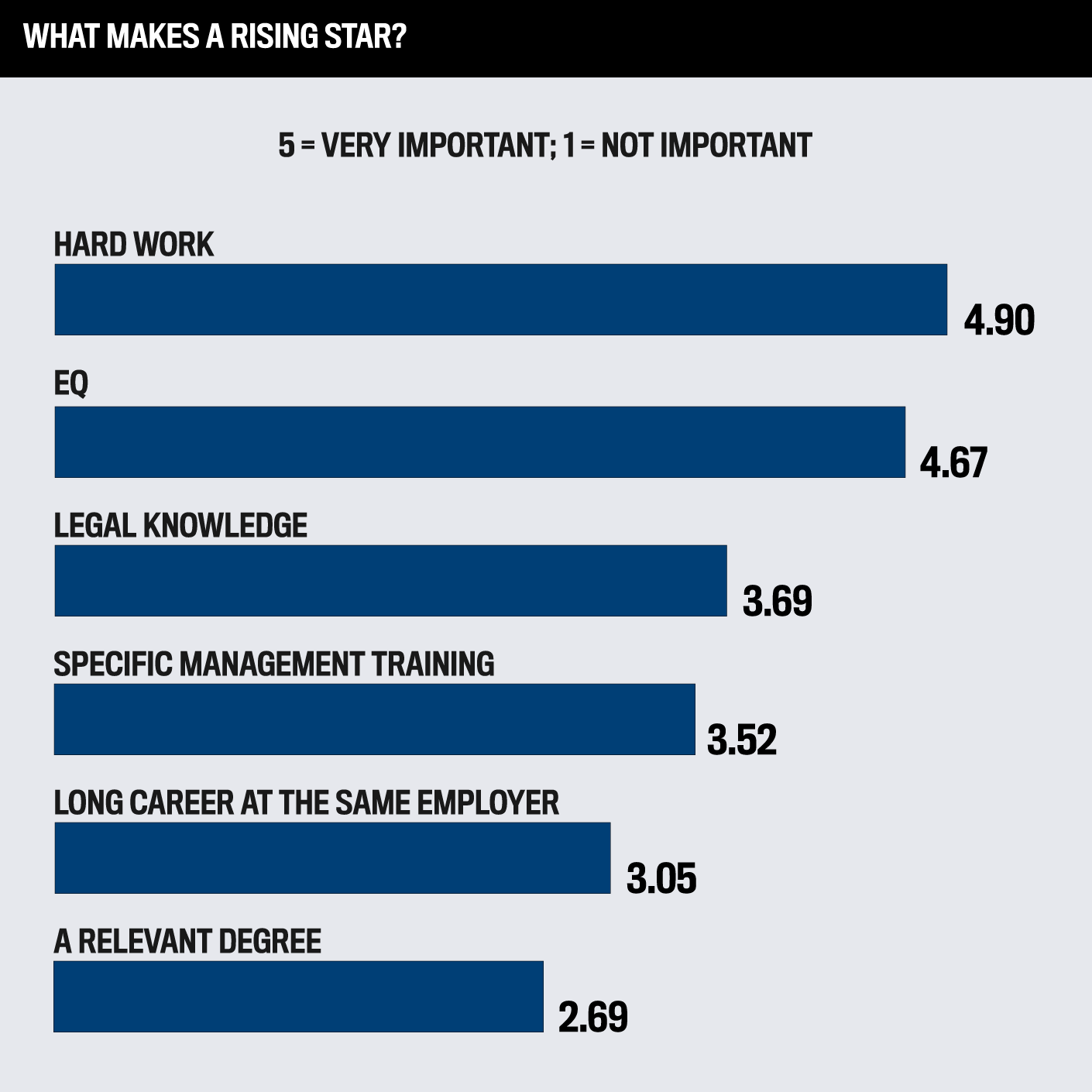

IBC’s survey respondents ranked hard work and EQ as the two major qualities to be a Rising Star in 2024. This suggests the 2024 cohort is having success for reasons beyond their degrees and training, compounding their status as truly outstanding young professionals who are motivated and dedicated to rise above their peer group.

How did the Rising Stars make their name?

Age: 26

Years in the industry: 6

The account executive and recently appointed partner was one of the few university students who realized his interest in insurance early on, influenced and encouraged by mentors.

Waterman landed a Jones DesLauriers summer internship at age 19 and hasn’t looked back, seizing every opportunity to expand his insurance knowledge and technical ability and refine his craft.

“I’m incredibly grateful to Jones DesLauriers and the representatives of the company who have been there every step of the way to ensure my experience was a rewarding one; we have a dedicated focus on organic growth, and I bought into this outlook after my first internship with the company,” he says. “The most rewarding component of my career so far has been the ability to succeed alongside my colleagues as one collective group; we have a philosophy that we only succeed if we truly succeed as a group, and having dedicated more time to this business than anything else in my life, I’m happy to continue doing my part.”

Nick WatermanJones DesLauriers

Waterman’s impressive industry contributions include the following:

-

mentorship and guidance: supports students and young professionals through speaking engagements at the Trisura Youth Mentorship program and Humber College

-

cyber risk management program lead: partnered with some of Canada’s strongest cybersecurity consultants and Navacord cyber practice leaders to ensure customers have offensive cyber threat intelligence and risk management tools to address emerging threats

Admittedly, Waterman notes he’s had a head start on his leadership potential, having joined the industry so young while still maintaining a sense of energy and enthusiasm. His technical knowledge, client confidence, and recognition of the importance of showing up and doing your best evolved over time.

“Everything I’ve achieved ties back to the mentors I’ve had and what I’ve seen them accomplish,” he says. “If I can even do a fraction of what they've instilled in me, I’d consider it a significant achievement in my career. My goal is to remain authentic toward all members of the insurance industry and to lead by example in my growing practice.”

Age: 34

Years in the industry: 10

Pitcher began his career at Arch, where he has steadily advanced from finance analyst to roles in claims operations, business analysis, and underwriting for professional liability, D&O, cyber, and technology.

Now the assistant vice president and head of cyber, Canada, he has been instrumental in helping to grow Arch’s professional liability book, particularly in cyber, where he led the rollout of the company’s cyber product in Canada in early 2022.

“There’s a lot I find rewarding about my current role, but it’s the great relationships we’ve established with our broker partners in the relatively short time since launching cyber here,” he says. “I’m proud of the service and the team’s underwriting standards, which have helped catapult us into a prominent player in the Canadian marketplace.”

Chris PitcherArch Insurance Canada

Nominators identified Pitcher’s outstanding qualities as follows:

-

relationship building: genuinely brings his authentic self to forming relationships and earning trust with brokers and colleagues

-

technical expertise: his highly innovative approach to cyber underwriting has propelled him as a prominent market force, demonstrating his ability to drive significant business outcomes

Pitcher acknowledges his aspiration for more senior leadership roles but emphasizes the importance of focusing on current growth and learning to prepare for future success.

To guide and inspire others, he advocates for a culture of continuous learning, which helps him and his team stay ahead of industry trends and enhances operations efficiency through technology and system advancements.

“That all bleeds into keeping up with shifting customer expectations at both the broker and client levels,” he says. “Adapting to changes in the dynamic product space we’re in, especially regarding cyber, is crucial. I aim to lead by being proactive and anticipating how these shifts can help us as a team and a company stay ahead and set us up for more long-term success.”

Age: 33

Years in the industry: 1

While pursuing a psychology degree, the now product owner of digital and business systems learned the basics of underwriting for specialized products as a summer student at HSB Canada.

Sproston then joined full-time after graduation, where she focused on insurance operations and developed an affinity for process improvements.

After a brief stint at an external brokerage , which allowed her to gain a different perspective on various insurance products, she returned to the specialty insurance and IoT services provider with a sharp focus on driving innovation during the company’s transformation journey.

“It is fulfilling to run with innovative solutions and creative ideas to see how we can better serve our clients and enhance their experience,” she says. “It’s exciting being the key contributor in the early stages of our transformation and having a place at the table.”

Robyn SprostonHSB Canada

Working in the male-dominated insurance industry has empowered her to challenge stereotypes, drive innovation, and promote diversity.

Some of her accomplishments highlight her commitment to advancing the industry toward a more inclusive and contemporary future:

-

industry engagement: connects with insurance professionals and contributes to discussions on technology, inclusion, and growth within the sector

-

established a new role: took the initiative to create the product owner and business lead roles to support strategic product development and meet business objectives

On a personal level, she has recently started investing in her leadership brand.

“What I had to do to get to the next step was take a step back and carve that time out for myself to identify my core strengths,” she says. “My number one is inspiring others and helping them identify and grow their talent.”

Age: 28

Years in the industry: 7

A part-time job analyzing insurance data while pursuing a BA in finance sparked Pelletier’s deep interest in the industry.

That passion launched him into a successful career, where he now serves as the regional practice leader for professional, technology, and cyber risks for Eastern Canada and leads a fast-growing four-person team from BFL’s Montreal headquarters.

He didn’t squander the trust his leaders put in him and was instrumental in starting the company’s regional cyber practice two years ago.

“What I like most about my job is what we can deliver for clients,” he says. “I’ve always been super focused on the service level we provide to clients, and when they come back to us with good comments on the work we do and see that we do more than just insurance, it’s always rewarding for me. It makes me feel good and know I’m in the right place.”

Charles PelletierBFL CANADA

Pelletier’s success and strong relationships are built on two key strategies:

-

being frank and fair in all professional relationships, cultivating a personal rapport that fosters trust and loyalty

-

building personal connections by going beyond work-related conversations and treating clients almost as friends to create more genuine relationships

“What I found is that contrary to what I thought at the beginning, it’s better to be authentic in all our relationships,” he says.

Pelletier’s career rise has been an ongoing learning process. He emphasizes the importance of gaining experience and training, mainly through managing his young team of employees. His success has been built on his managers’ guidance and mentorship, and he is committed to giving back.

“I think you need to learn about leadership by doing it,” he says.

Young insurance professionals overcome career challenges

Pelletier found it difficult to be taken seriously by clients when he first started in the industry. He developed a method to explain complex details to clients in a way that resonated with them, always mindful of his audience.

“I made a conscious effort to focus on what my clients cared about, such as financial details for CFOs and the legal side of their exposure to legal counsel,” he says. “This helped me build trust and strong relationships, despite being young, which some of my peers struggle with, especially when dealing with more experienced, older clients.”

For Waterman, young insurance professionals may face challenges on both the personal and industry side. Using cyber as an example, he asserts that failing to keep up the fast pace, such as the definitions of breaches and cyber terrorism, can leave one behind. On a personal level and from the broker side, he stresses the importance of developing a unique brand in dealing with clients, underwriters, and colleagues to maximize long-term success.

“There are a lot of top industry performers here, and they all have their approach to working with clients and members of the insurance industry crafted from 20 to 30 years of experience,” he says. “The goal for any young broker is to take the best elements of the more experienced brokers in your business to better build and tailor your approach with your clients; your best approach is the one that suits you and you alone.”

Keeping up with the industry’s ongoing evolution can be challenging for young professionals, especially as the rate of change is faster than a decade ago, as Sproston notes. She has difficulty convincing colleagues to adapt to new ways of working, particularly concerning client relationships.

“It seems like some people aren’t always open to change,” she says. “Being on the reinsurance side, my challenge is to find that perfect balance where we’re still maintaining those strong relationships but finding ways to streamline processes, such as issuing, quoting and binding, and delivering that on time to brokers and client companies.”

Sproston highlights the importance of having a mentor, which has been crucial for her growth as a leader.

From an underwriting and broking perspective, Pitcher believes many young insurance professionals come into the industry with a misunderstanding of those roles and their required skill sets. He notes there are three key components: technical knowledge, product expertise, and strong relationships, with an emphasis on the art of deal-making. But first and foremost, there needs to be an acceptance of being a beginner and embracing learning as a process, requiring hard work, asking questions, and being supported by teammates and mentors.

“Lean on your manager and your company to ultimately set you up for success,” he says. “What underscores any successful person is a strong work ethic, consistency, and a hunger to learn and take on more.”

Meet the judges

The Best Young Insurance Professionals Under 35 in Canada | Rising Stars

- Alison Sanelli

Underwriter, Ontario Personal Lines

Burns & Wilcox Canada - Alyssa Anderson

Financial Security Advisor

Desjardins Financial Security Independent Network - Alyssa Keyes

Operations Manager

Keyes Real Estate & Insurance - Andrew Boateng

Commercial Lines Manager

Aviva Canada - Andrew Chudley

Vice President and Account Executive, Commercial Risk

Aon - Ayla Louttit

Team Lead, Partner Success

The Mutual Fire Insurance Company of British Columbia - Celina Lucchitti

Associate Director

RAISE Underwriting - Eric Griffi

Claims Manager

Crawford & Company (Canada) - Finn Magee

National Sales Representative

Crawford & Company (Canada) - Frederick Pratt Jr.

Ceritified Financial Planner

Desjardins Financial Security Independent Network - Jashandeep Singh Brar

Senior Executive Director

Experior Financial Group - Katie Dallas

Vice President of Underwriting

Special Risk Insurance Managers - Kelly McGuinness

Cyber, Tech, and PI Development Leader – Canada

CFC - Leanne Taylor

Director, Underwriting and Programs, Commercial

RMA - Lisa Campbell

Senior Underwriter

Burns & Wilcox - Maddie Livingston

Marketing and Communications Manager

Markel Canada - Maddie Pedersen

Commerical Account Executive and Operations Support

Wilson M. Beck Insurance Alberta - Marc-Anthony Manion

Senior Commercial Underwriter

Burns & Wilcox Canada - Mark Orlecki

Director, Business Development

Excess Underwriting - Megan Peters

Underwriting Specialist, Commercial Lines

Sovereign Insurance - Mitch Clarke

Director, Risk Management and Corporate Services

Saskatchewan Blue Cross - Nando D'Oria

Vice President, Commercial Insurance

Gallagher - Nick Waterman

Account Executive

Jones DesLauriers - Nitnoor Brar

Commercial Manager

Armour Insurance Brokers - Sebastian Rybarczyk

Manager, Home Product

Co-operators - Steven Owen

President

Owen & Associates - Tapfuma Garabga

Underwriting Associate

Zurich North America - Trevor George

Senior Underwriter

Ridge Canada Cyber Solutions - Yasser Chtaini

Assistant Vice President, National Claims | Surety and National Home Warranty

Aviva Canada - Zvikomborero Barikano

Commercial Lines Manager

KASE Insurance

Insights

Methodology

Starting in April, Insurance Business Canada invited insurance professionals across the country to nominate their most exceptional young talent for the ninth annual Rising Stars list.

Nominees had to be aged 35 or under (as of September 1, 2024) and be committed to a career in insurance with a clear passion for the industry. To maintain a focus on new talent, only nominees who hadn’t been previously recognized as a Rising Star (or Young Gun) were considered. Nominees were asked about their current role, key achievements, and career goals, as well as the contributions they’ve made to shaping the industry.

Recommendations from managers and senior industry professionals were also taken into account.

The Rising Stars were determined by an independent panel of industry leaders composed of the following:

Dionne Bowers

Canadian Association of Black Insurance Professionals

Jonathan Weekes

HUB International Canada

Jurenda Landry

Insurance Brokers of Toronto Region

Suzanne Pountney

Insurance Brokers Association of Ontario

Vinita Jajware-Beatty

Toronto Insurance Women’s Association

Keep up with the latest news and events

Join our mailing list, it’s free!