Brokers on the Top Insurance Carriers | 5-Star Carriers 2023

Jump to winners | Jump to methodology

Accomplished associates

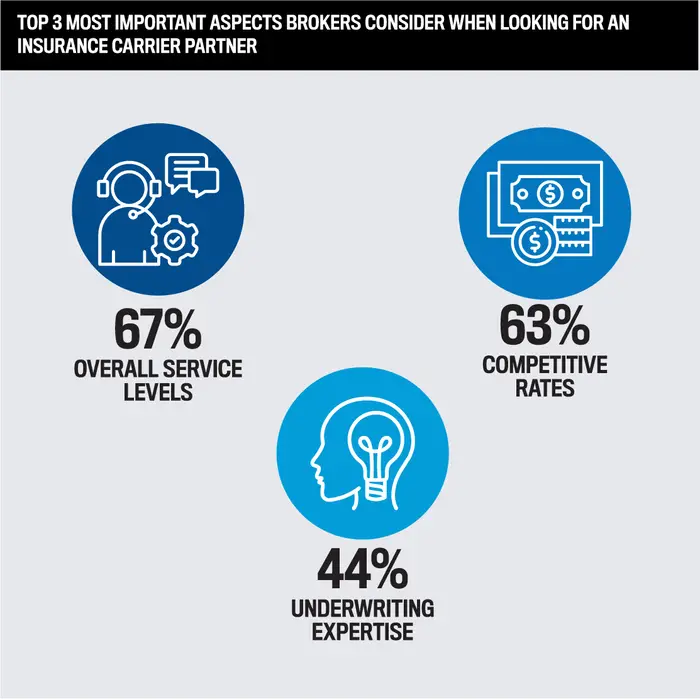

Insurance Business Canada recognizes the 5-Star Carriers of 2023, a coterie of insurance carriers transforming industry standards by prioritizing their broker relationships and the facets considered crucial to ensuring the industry prospers and grows. In this year’s Brokers on Carriers report, industry professionals rated carriers over the past 12 months across 10 key metrics, elevating four of the highest-performing overall to the winner’s circle.

Survey respondents awarded the 5-Star Carriers the highest scores in the following areas:

-

claims processing

-

competitive rates

-

quick quotes

-

product range

-

underwriting

Top insurance carrier Aviva Canada emerges for second year

Repeat winner Aviva Canada continues to outpace its competitors with an overall approach that values the broking community, working with them to build an exceptional customer service experience.

“Brokers are our key partners, so it’s wonderful to have them push us to the top of the podium,” remarks chief distribution officer Ben Isotta-Riches. “It speaks about the trust we’ve built between brokers and Aviva, the strength of our relationships, and our continued commitment toward independent brokers as a meaningful channel in Canada.” For much of 2023, Isotta-Riches travelled the country connecting with brokers, listening to their concerns, and refining the insurance carrier’s strategy based on their feedback. With an emphasis on transparency and honesty, that robust dialogue with brokers has ensured the insurance carrier continues to deliver top-notch claims service, competitive products and pricing, and a streamlined underwriting process.

It’s the kind of personal touch that brokers emphasize as essential, as evidenced by these comments from brokers, dissatisfied by other carriers, about what they would like to see more of:

-

“Be more open to visiting brokers and building relationships.”

-

“Schedule broker visits, events, and lunches to help create better relationships.”

-

“Have an actual launch of innovations; don’t just send a simple memo.”

-

“Pay more attention to personal contact.”

“One of the things that makes us different is that we invest time in building an understanding of brokers’ business so that when there are challenging circumstances, we know we can rely on each other and we know what we need from each other,” says Isotta-Riches.

Ben Isotta-RichesAviva Canada

Brokers’ priorities are difference makers

IBC’s 2023 report provides valuable insights into what insurance carriers can do to improve upon and grow business with them in the future.

Brokers emphasized their desire for the following:

Clear communication

-

“Lack of communication by carriers and adjusters puts an undue burden on the broker to resolve an issue where we have very little input or influence.”

-

“Listen or at least talk to us.”

Flexibility in underwriting

-

“Provide phone numbers and direct access to underwriters so we’re not wasting our time waiting on hold.”

-

“Hire more underwriters to handle the workload so we can get the paperwork to our customers.”

-

“Simplify things; underwriting is getting more complex than it needs to be.”

Responsive customer/claims service

-

“Claims needs to work on customer service; brokers are trying to fill that void along with all of our other duties.”

-

“Claims service is the only thing that matters.”

-

“Fair appraisals of damage and open communication with customers on expected timelines.”

Competitive rates

-

“Take a broader view on all aspects.”

-

“Be flexible and make exceptions for some individuals.”

-

“Maintain rates and be open to doing business.”

-

“I am losing business to direct writers constantly because of the difference in rates.”

Exactly half of participating brokers said they were unlikely or very unlikely to change insurance carrier partners in the next 12 months, suggesting there are opportunities for high-performing carriers to win more business.

If brokers were to jump to a competitor, the top reasons noted by a combined 45% of respondents were poor overall service, claims processing, and uncompetitive pricing.

Top insurance carriers must keep brokers engaged

Offering competitive rates is ongoing and can be complicated in regulated environments. Still, Aviva stays at the forefront by ensuring its business performance remains strong with premium growth continuing.

“I think we must be doing something right with the pricing to be seeing growth at a strong rate, and we’ve got a consistent track record of strong results,” reflects Isotta-Riches. “We’re seeing enough growth across the board to feel like our prices remain competitive.”

The breadth of Aviva’s products and solutions makes it a unique proposition across personal and commercial lines and, generally, across the business, providing brokers a platform to grow.

The 5-Star Carrier also stands apart for its well-trained and highly skilled underwriters, who genuinely care and embody the organization’s values in their broker relationships. It believes that brokers value authentic relationships more than ever in the dynamic insurance landscape, especially when their carrier partners are willing to work together to find solutions.

“That’s all backed by a solid claims organization with a customer-centric approach that supports them in their time of need; brokers can trust us and feel confident that the customer will be taken care of,” Isotta-Riches explains.

Building strong, trust-based relationships with brokers has emerged as the foundation for long-term success, and respondents offered their opinions on how insurance carriers can boost engagement:

-

“Show their commitment to grow with us.”

-

“Webinars on new products and technology.”

-

“Personal check-ins, events, and contests.”

-

“Act with integrity.”

-

“Be more transparent with premium increases.”

-

“Speak to us, seek input, and implement changes.”

-

“Better service on new business quotes and punctual responses on client files.”

-

“If we have to do all the data input, improve the portal and give us more authority.”

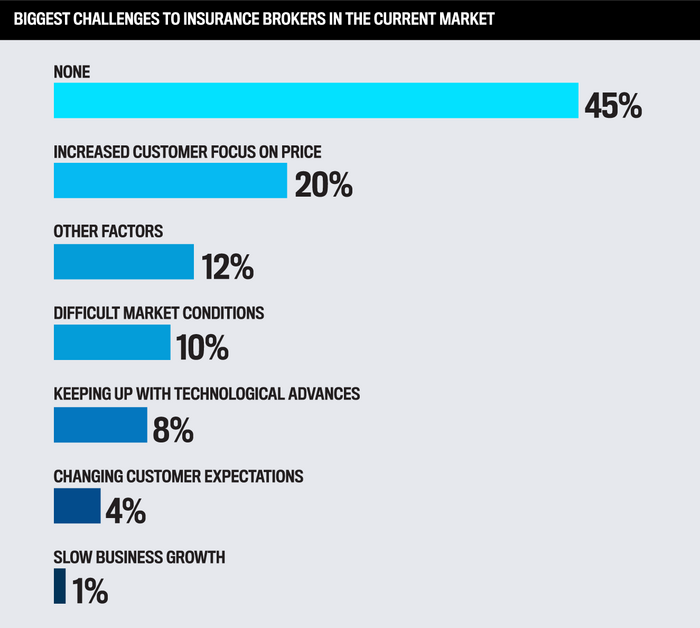

The challenges brokers faced most in placing business with insurance carriers came from changing customer expectations and their increased focus on price, and what they generally viewed as a difficult market.

Other obstacles noted by respondents included:

-

competing directly with insurer-owned brokerages

-

keeping up with technological advances

-

significant reduction in property capacity

-

balancing book growth and insurance market appetites

As Aviva’s approach illustrates, insurance carriers who invest in their broker partners and foster positive relationships will retain their business and set the stage for a brighter future for all.

Brokers on the Top Insurance Carriers |

5-Star Carriers 2023

- Aviva Canada

- Intact Insurance

- SGI Canada

- Wawanesa

Methodology

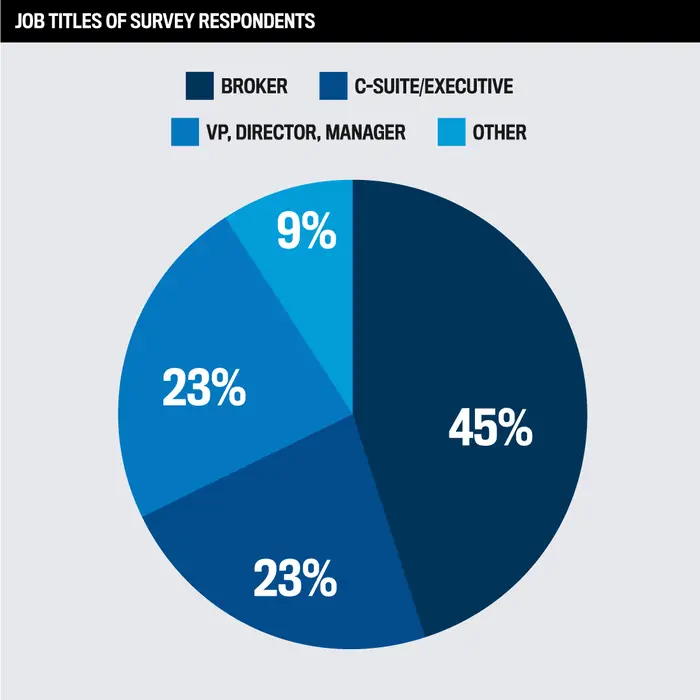

For the seventh year in a row, Insurance Business Canada has extensively surveyed insurance brokers to find out what they look for in the carriers they have worked with over the past 12 months on overall service level, product innovation, claims processing, among many others.

The most voted and highest-rating carriers are awarded five stars. This year, only four different carriers were recognized with one of the industry’s leading awards – IBC 5-Star Carriers.

Keep up with the latest news and events

Join our mailing list, it’s free!