5-Star Construction 2022

Jump to winners | Jump to methodology

Effective risk mitigation amidst uncertainty

A key driver of the Canadian economy, the construction industry has had a wild ride recently. While headwinds, such as the COVID-19 pandemic, supply chain problems, and inflation continue to be a drag on the industry, tailwinds such as federal initiatives for housing and a booming housing market keep the industry moving forward. Through the ebb and flow, the construction insurance industry has been there to support nearly all aspects of the construction process on projects of all sizes.

For Insurance Business Canada’s 5-Star Construction awards in 2022, we set out to interview brokers throughout the country on who provides the best service and cover to meet the needs of this complex sector. Those who earned a score high enough in work quality, specialist expertise, and client services in one or more of 14 different categories were granted the awards.

“There’s uncertainty around COVID-19, rising costs of raw materials, rising interest rates, increased fuel costs, skilled labour shortages, supply chain shortages – the list continues to grow”

Jonathan Graham, Northbridge Insurance

A mix of marketing conditions

Uncertainty has characterized the construction industry over the past two years and until today, according to Jonathan Graham, underwriting director of construction and contracting at Northbridge Insurance, a 5-Star Construction award winner in 2022.

“There’s uncertainty around COVID-19, rising costs of raw materials, rising interest rates, increased fuel costs, skilled labour shortages, supply chain shortages – the list continues to grow,” he says.

Meagan Woensdregt agrees and expounds on Graham’s views about COVID. The managing director of Lions Gate Underwriting (LGU) – another 2022 IBC 5-Star Construction award winner – says the pandemic has caused slowdowns and shutdowns, further worsened by provincial lockdowns. General contractors and site managers/developers saw more pressure to attend to on-site risk controls.

“Empathy had to be given to insureds to avoid punishing them for a longer course of construction terms, even though this would traditionally go beyond a contract term,” says Woensdregt. “Most, if not all, insurance carriers in the construction space have been understanding of these unprecedented events.”

As rate increases and a possible recession may cause already high material costs to go even higher, she says it’s important for brokers and carriers to realize that hard cost values will increase, and that capacity should be made available to insureds.

Meanwhile, Hans Choi emphasizes the good news: there’s been an upward trend in the construction market over the past 24 months. The segment manager for construction at Cansure, another 2022 5-Star award winner, attributes this trend to bidding wars for homes, a spike in home prices, and very low interest rates up until a recent rate hike. There’s also been an increase in the number of renovation projects and office building conversions.

“We have seen an upward spike in underutilized commercial space being turned into apartments and condos,” says Choi. “This is seen in cities like Calgary and Edmonton where downtown office high-rises are retrofitted into condo buildings as less and less people are returning to [their offices] as work from home becomes the new normal.”

“Our ability to see a risk, understand it, and underwrite it well and profitably makes us stand out in the industry”

Jamie Ross Dick, Lions Gate Underwriting

Supply chain issues and inflation

Problems with the supply chain highlight weaknesses in globalization and show that worldwide supply networks have been riskier than anticipated, says Graham. As such, industries like construction have had to re-evaluate their ways of sourcing raw materials.

“With more organizations purchasing local and stock piling materials in lieu of ‘just in time’ deliveries, Northbridge stands prepared to support the changing coverage needs of our customers through this period.”

Meanwhile, Choi says that in addition to pandemic-related shutdowns, other factors are at play in the supply chain conundrum. “The ‘Great Resignation’ that has hit a lot of US markets can also be seen rippling into the Canadian construction economy,” he says. “Older workers are opting for retirement, and the construction industry isn’t attracting many of the younger generation… The construction industry is still doing a record volume of work across Canada, something that the current labour market may not be able to support.”

Price increases represent another problem as inflation rose from 7.7% in May to 8.1% in June, according to Statistics Canada. Thus, Graham and Northbridge are working with brokers to help ensure clients’ coverages are adequate despite the rising costs.

“For many of our construction customers, inflation has also meant higher borrowing cost, which is contributing to escalating costs,” says Graham. “We expect all of this to have downstream impacts on the cost to build and margins which could ultimately result in further project delays or cancellations if projects become financially unfeasible.”

Choi adds: “Rising interest rates will limit the industry’s ability to borrow and will impact project costs moving forward. For affordable housing projects, it will be interesting to see if government agencies have these reverse of funds set aside to continue these projects. We are already seeing the housing craze cool down in the past month due to the increased interest rates. Developers will have to reconsider what they can spend on projects and pull back on certain budgets because of these rising rates.”

“The construction industry is still doing a record volume of work across Canada, something that the current labour market may not be able to support”

Hans Choi, Cansure

Celebrated for specialization

The categories for the 2022 IBC 5-Star Construction awards were builder’s risk/cause of construction, commercial and contractor general liability, workers’ compensation, environmental liability, third-party liability, auto liability, professional liability, civil contractors, general contractors, specialty/subcontractors, professional construction service firms, developers and owners, heavy construction, and demolition.

LGU won in the builders’ risk/course of construction, commercial and contractor general liability, workers’ comp, environmental liability, third-party liability, and professional liability categories. Regarding builders’ risk/course of construction, Jamie Ross Dick, director of construction at LGU, compliments the company’s construction team for being “incredibly talented and educated in their fields, some even bringing their own personal construction experience prior to entering insurance. Our ability to see a risk, understand it and underwrite it well and profitably makes us stand out in the industry.”

In the area of environmental liability, LGU has been proactively sourcing and acquiring capacity in line with the new Canadian Construction Documents Committee (CCDC) contract change. “As a construction MGA, our goal is to provide full-service solutions for every aspect of a construction project’s lifespan,” he says.

Meanwhile, Northbridge won in the builders’ risk/course of construction, commercial and contractor general liability, environmental liability, third-party liability, auto liability, professional liability, and civil contractors categories. Referring to commercial and contractor general liability, Graham says: “Risks, exposures, and liabilities for contractors have changed over the years, and without the appropriate precautions and coverage, one could be left unprotected if something does go wrong. Northbridge is supportive of the changes introduced by the CCDC requiring contractors to carry increased general liability limits of insurance from $5 million to $10 million.”

Cansure won in the builders’ risk/course of construction, commercial and contractor general liability, third-party liability, professional liability, and civil contractors categories. Regarding builders’ risk/course of construction, Choi cites the features that set the company apart from the competition. “First, at a time when every construction underwriter in the country is burnt out and there is a shortage of experienced construction underwriters, we pride ourselves on having a robust and cohesive team of underwriters that work diligently with our broker partners with an end goal of supporting them in placing their risk. Our experienced senior underwriters also spend time working with our up-and-coming underwriters and coaching them [to help] grow their career within the company.”

5-Star Construction 2022

Builder’s risk/course of construction

- Apollo

- April Canada

- Aviva

- Berkshire Hathaway

- Burns & Wilcox

- Cansure

- CHES Special Risk

- Economical

- Great American

- Intact

- Lloyd’s Underwriters

- Premier

- Red River Mutual

- RSA

- SGI Canada

- Starr Insurance Companies

- Totten Insurance Group

- TruStar Underwriting

- Victor Canada

- Wawanesa

- Wynward

- TriPoint Insurance Underwriting

Commercial and contractor general liability

- Apollo

- April Canada

- Aviva

- Burns & Wilcox

- Cansure

- CHES Special Risk

- CNA Canada

- Economical

- Intact

- Certain Lloyd’s Syndicates

- Portage

- Premier

- Red River

- RSA

- SGI Canada

- Sovereign Insurance

- Totten Insurance Group

- Travelers

- Wawanesa

- Wynward

- TriPoint Insurance Underwriting

Workers’ compensation

- April Canada

- Burns & Wilcox

- CNA Canada

- Intact

- Liberty

- Totten Insurance Group

Environmental liability

- Apollo

- Berkley

- Berkshire

- Burns & Wilcox

- Chubb

- Intact

- Liberty

- Lloyd’s

- Markel

- Premier

- Strategic Underwriting Managers

- Totten Insurance Group

- Victor Canada

- TriPoint Insurance Underwriting

Third-party liability

- Apollo

- April Canada

- Aviva

- Burns & Wilcox

- Cansure

- Economical

- i3 Underwriting

- Intact

- Lloyd’s

- SGI Canada

- Totten Insurance Group

- Travelers

- Victor Canada

- Wawanesa

Auto liability

- Aviva

- Burns & Wilcox

- Definity Financial Corp

- Economical

- Gore

- ICBC

- Intact

- Totten Insurance Group

- Travelers

Professional liability

- Apollo

- April Canada

- Burns & Wilcox

- Cansure

- CFC Underwriting

- Chubb

- CNA Canada

- Intact

- Liberty

- Certain Lloyd's Syndicates

- Markel

- Premier

- QBE

- Special Risk

- Totten Insurance Group

- Trisura

- Victor Canada

Civil contractors

- Apollo

- April Canada

- Aviva

- Burns & Wilcox

- Cansure

- CNA Canada

- Economical

- Intact

- Lloyd’s

- RSA

- Sovereign Insurance

- Totten Insurance Group

- Victor Canada

- Zurich

General contractors

- Apollo

- April Canada

- Aviva

- Burns & Wilcox

- Cansure

- CHES Special Risk

- Economical

- Intact

- Lloyd’s Syndicates

- Red River Mutual

- RSA

- SGI Canada

- Sovereign Insurance

- Totten Insurance Group

Subcontractors

- Apollo

- April Canada

- Aviva

- Burns & Wilcox

- Cansure

- CNA Canada

- Economical

- Gore

- i3 Underwriting

- Intact

- LGU

- Lloyd’s

- Red River

- SGI Canada

- Totten Insurance Group

- Travelers

- TruStar Underwriting

- Unica Insurance

- Wawanesa

Specialty trade contractors

- Apollo

- April Canada

- Aviva

- Burns & Wilcox

- CNA Canada

- CHES Special Risk

- Economical

- i3 Underwriting

- Intact

- Lloyd’s

- Premier

- Totten Insurance Group

- Travelers

- TruStar Underwriting

- Wawanesa

Professional construction service firms

- Apollo

- April Canada

- Aviva

- Burns & Wilcox

- CFC Underwriting

- CNA Canada

- Economical

- LGU

- Lloyd’s

- Premier

- Totten Insurance Group

- Victor Canada

- Wawanesa

Developers and owners

- Apollo

- April Canada

- Aviva

- Burns & Wilcox

- Cansure

- Economical

- Intact

- Lloyd’s

- Premier

- Red River

- RSA

- Totten Insurance Group

- Zurich

Heavy construction

- Apollo

- April Canada

- Aviva

- Burns & Wilcox

- Cansure

- CNA Canada

- Economical

- Intact

- Sovereign Insurance

- Totten Insurance Group

- Travelers

- Zurich

Demolition

- Apollo

- April Canada

- Aviva

- Burns & Wilcox

- Intact

- Lloyd’s

- Starr Insurance Companies

- Totten Insurance Group

- Victor Canada

Methodology

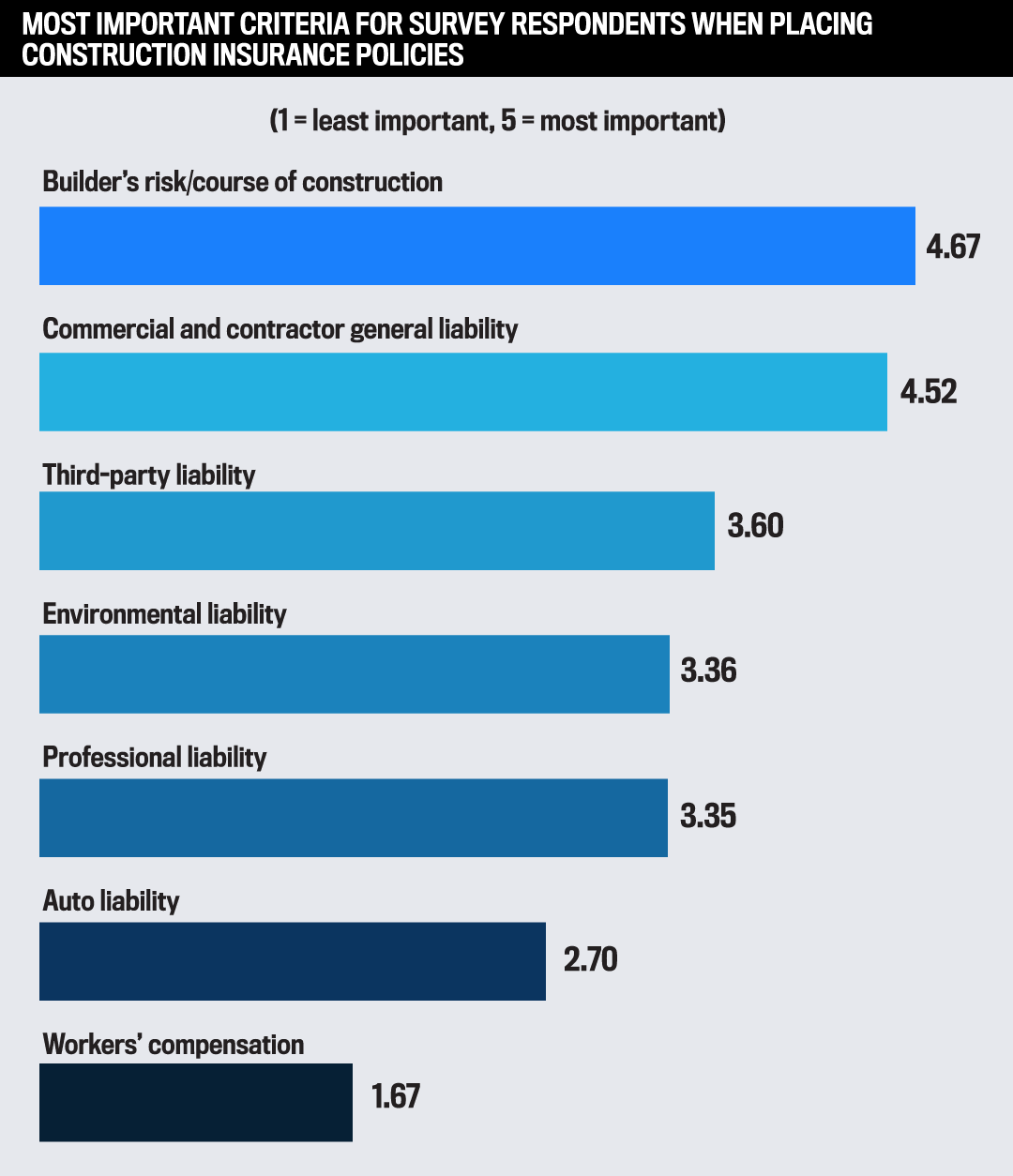

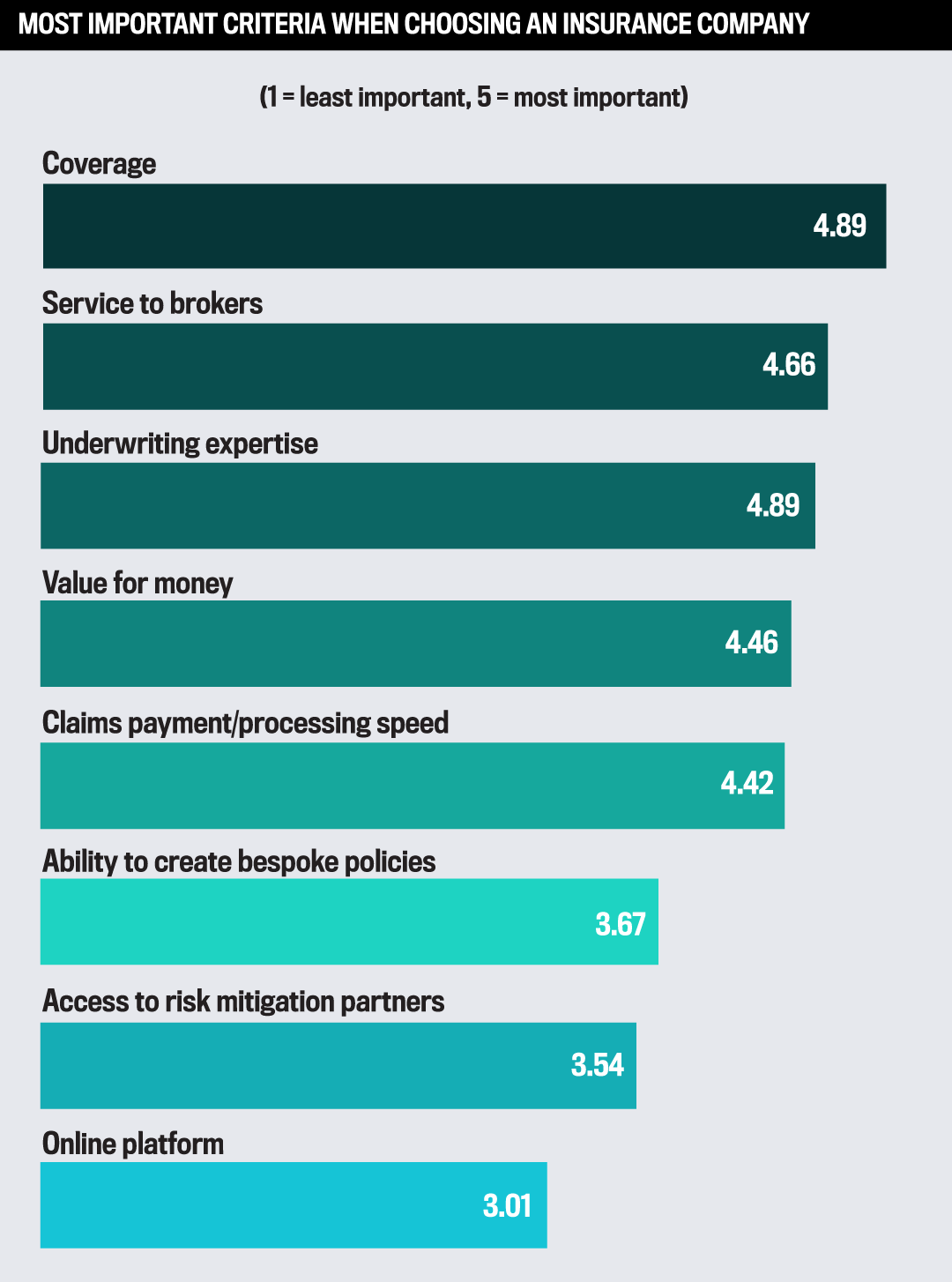

To select the best construction insurance providers for 2022, Insurance Business Canada sourced feedback from insurance brokers. IBC’s research team began by conducting a survey with a wide range of brokerages to determine what brokers value in a construction insurer. The team also spoke to hundreds of brokers across the country, asking them to rate the construction insurers they had worked with over the past 12 months.

The in-depth information gathered enabled the research team to assign weighted values to each criterion being rated by brokers. At the end of the research period, the insurance providers that received the highest rankings in terms of work quality, specialist expertise, and client service were named 5-Star Award winners in construction insurance.

$2.34 million is the brokers' average total premium volume in 2021

76% of brokers expect their construction insurance volume to increase in 2022

53% of survey respondents are based in Ontario

Keep up with the latest news and events

Join our mailing list, it’s free!